Delta elite status is shockingly easy to earn this year. It was true last year too, but we figured that Delta would make things tougher in 2025. They didn’t. Here’s what you need to know…

Delta Elite Status Overview

| SILVER | GOLD | PLATINUM | DIAMOND | |

|---|---|---|---|---|

| Miles per dollar earned on paid flights | 7 | 8 | 9 | 11 |

| Free domestic upgrades to 1st Class | Begins 24 hours before departure | Begins 72 hours before departure | Begins 120 hours before departure | Begins 120 hours before departure |

| Free domestic upgrades to Comfort+ | 24 hours before departure | 72 hours before departure | Shortly after ticketing | Shortly after ticketing |

| CLEAR® Plus membership discount price | $159 | $159 | $159 | Free |

| Dedicated phone line | Priority | High Priority | Higher Priority | VIP Line |

| Free companion upgrades | ✔ | ✔ | ✔ | ✔ |

| Free preferred seat selection | ✔ | ✔ | ✔ | ✔ |

| Waived bag fees | ✔ | ✔ | ✔ | ✔ |

| Waived same day confirmed or standby change fees | ✔ | ✔ | ✔ | |

| Sky Priority boarding | ✔ | ✔ | ✔ | |

| Sky Priority expedited checked bags | ✔ | ✔ | ✔ | |

| Sky Team lounge access on international flights | ✔ | ✔ | ✔ | |

| Hertz elite status | Five Star | Five Star | President's Circle | President's Circle |

| Waived change & cancellation fees regardless of route | ✔ | ✔ | ||

| Choice Benefits | Choose 1: | Choose 3: | ||

| Upgrade certificates | 4 Regional | 4 Global (or 8 Regional or 2 Global & 4 Regional) | ||

| Statement Credits (for Delta Platinum and Reserve Cardholders) | $400 | $700 | ||

| Starbucks® Rewards Stars | 6,000 Stars | 6,000 Stars | ||

| Delta Sky Club® Individual Membership | N/A | Requires 2 Choices | ||

| Delta Sky Club® Executive Membership | N/A | Requires 3 Choices | ||

| MQD Accelerator | $1,000 MQDs | $2,000 MQDs | ||

| Gift medallion status | 2 Silver | 2 Gold | ||

| Bonus miles | 30K | 35K | ||

| Delta Vacations Flight + Hotel Cert | $400 | $500 | ||

| Sustainable Aviation Fuel Contribution | $250 | $250 | ||

| Delta Travel Voucher | $300 | $350 | ||

| Wheels up flight credit | $1,500 | $2,000 |

- Unlimited complimentary upgrades (when available, upgrade from coach to first class on domestic flights). Higher status leads to better chance of upgrades.

- Waived same-day confirmed fees and waived same-day standby fees (switch to different flight on same day as ticketed flight). Requires Gold or higher. Info about getting value from same day changes can be found here: Leveraging Delta’s Same Day Flight Changes.

- Complementary Preferred seat selection (choose exit row seats with lots of legroom)

- Complementary Comfort+ Seats (more leg room, free drinks, better snacks).

- Regional upgrade certificates. While these rarely confirm before the flight, waitlisting a regional upgrade puts you to the front of the line for upgrading at the gate. This is great to use for flights where upgrades are most important to you. For example, I use these for flights of about 3 hours or longer. This is a choice benefit for Platinum and Diamond status. Upgrade certificates can be applied to both paid and award tickets.

- Global upgrade certificates. Use these to upgrade from economy to Premium Select, or from Premium Select to business class on any flight when upgrade space is available. When you upgrade from economy to Premium Select, Delta will put you on the business class (Delta One) upgrade list 24 hours before your flight. This is a choice benefit for Diamond status only. Upgrade certificates can be applied to both paid and award tickets.

- Free award changes and cancellations. This used to be huge, but now all awards originating in North America are free to change or cancel for all members. With Platinum and Diamond status, that benefit extends to flights originating elsewhere. Requires Platinum or higher for free changes on awards originating outside of North America.

- Statement Credits (for Delta Platinum and Reserve Cardholders). Getting $700 cash back as a Diamond Choice Benefit is a really nice reward!

- 4 Regional Upgrade Certificates (RUCs)

- 2 Global Upgrade Certificates (GUCs)

- $5,000 MQD Accelerator at the start of the next qualification year (i.e. at the time of publishing, this would be awarded at the start of 2026 for the 2027 Medallion year)

- 50,000 bonus SkyMiles (these can be credited to your own account or gifted/donated)

- Platinum status to gift to 2 other SkyMiles members

- Diamond status to gift to 1 other SkyMiles member (this can only be selected if you reach $100,000 MQDs)

2025 Elite Requirements

Delta elite status is be based entirely on MQDs (Medallion Qualifying Dollars). MQDs are defined primarily as dollars spent on Delta flights and Delta Vacations (MQDs are earned once you actually travel, not when you purchase the travel), but they can also be earned through holding certain credit cards, spend on certain credit cards, and as Choice Benefits for Platinum and Diamond elite members.

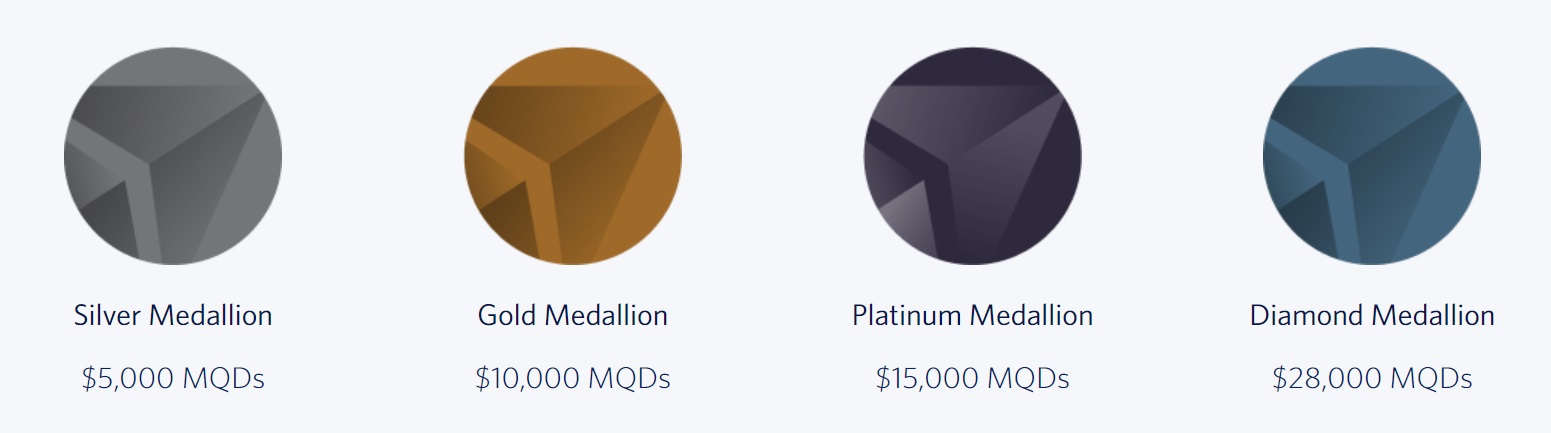

In 2025, the following MQD amounts are required to earn each level of elite status for the 2026 Medallion year. Once the thresholds are met, you get elite status immediately, and it will last through the rest of 2025, all of 2026, and through January of 2027:

- Silver Medallion: $5,000 MQDs

- Gold Medallion: $10,000 MQDs

- Platinum Medallion: $15,000 MQDs

- Diamond Medallion: $28,000 MQDs

Shortcuts to Delta Medallion status

In addition to earning MQDs through spend on Delta (and partner) flights and vacations, the following options are available: MQD Headstarts, MQDs from spend, promotional MQDs, and MQD Accelerator Choice Benefits. Each is described below…

MQD Headstarts

For each of the following cards, you get $2,500 MQDs towards Medallion elite status:

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Platinum Business American Express Card

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

It’s possible to have all four of the above cards and to therefore get $10,000 MQDs (enough for Gold status) automatically. Note though that these are credit cards and Amex limits each person to 5 or 6 credit cards total (charge cards, or what Amex likes to call “Pay over Time” cards, like the Amex Gold Card and Green Card do not count towards this total). Due to the credit card limit, it can be difficult to get all four qualifying Delta cards. More about Amex credit card limits can be found here.

MQDs from Spend

You can earn MQDs with spend as follows:

- Delta SkyMiles® Reserve American Express Card: Earn $1 MQD per $10

- Delta SkyMiles® Reserve Business American Express Card: Earn $1 MQD per $10

- Delta SkyMiles® Platinum American Express Card: Earn $1 MQD per $20

- Delta SkyMiles® Platinum Business American Express Card: Earn $1 MQD per $20

If you’re interested in earning MQDs from spend, the Delta Reserve cards are a much better option than the SkyMiles Platinum cards since they earn twice as many MQDs for the same amount of spend. Plus, that spend counts towards the $75K needed to get unlimited Delta Sky Club® visits.

Promotional MQDs

Delta periodically runs promotions where you can earn MQDs from things like purchasing hotel stays or car rentals through Delta, buying things from a Delta store, etc.

MQD Accelerator Choice Benefits

Each year, Platinum and Diamond Medallion members get to pick Choice Benefits. Platinum members can select one Platinum Choice Benefit. Diamond members can select one Platinum Choice Benefit and 3 Diamond Choice Benefits. One option at each level is to select an MQD Accelerator:

- MQD Accelerator Platinum Choice Benefit: $1,000 MQDs

- MQD Accelerator Diamond Choice Benefit: $2,000 MQDs

A member who achieves Diamond status could select both the $1,000 MQDs for their Platinum Choice Benefit plus $2,000 MQDs for the Diamond Choice Benefit. Additionally, they can use all three of their Diamond Choice Benefits this way for a total of up to $7,000 MQDs.

The MQDs earned this way, apply towards achieving the following year’s elite status. For example, if you earned Diamond status in 2024, that status is referred to as 2025 Diamond status (because status earned in 2024 applies to the entire 2025 year). Then, if you pick an MQD Accelerator as one of your 2025 Choice Benefits, the MQDs would apply to your account now (in 2025) to help you earn 2026 status.

An Easy Path to Status

Step 1: Get both Delta SkyMiles Platinum Cards

Make sure to get both of these $350 cards:

- Delta SkyMiles® Platinum American Express Card

- Delta SkyMiles® Platinum Business American Express Card

As long as you haven’t had the above cards or the consumer Delta Reserve card before, you should be able to qualify for the current welcome bonus for each card. That should more than make up for the first year annual fee for each card. Then, in subsequent years, perks like the annual companion ticket, discounted awards, and hotel rebates can make up for the annual fee.

In order to apply for a business credit card, you must have a business. That said, it’s common for people to have businesses without realizing it. For example, if you sell items at a yard sale or on eBay, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship and you can apply for a business credit card using your own name as the business name, and your Social Security Number as your business Tax ID (also known as EIN).

Once you get the two SkyMiles Platinum cards, you will be given two $2,500 MQD “Headstarts.” $2,500 MQDs + $2,500 MQDs = $5,000 MQDs = Silver status. Boom. You now have Silver Medallion status!

Step 2: Get both Delta Reserve cards

If you have enough credit card “slots” (i.e. you currently have no more than 3 Amex credit cards), then you can apply for each of the $650 Delta Reserve cards:

- Delta SkyMiles® Reserve American Express Card

- Delta SkyMiles® Reserve Business American Express Card

As long as you haven’t had these cards before, you should be able to qualify for the welcome bonuses which will go a long way towards making up for the first year annual fees. For subsequent years, the card perks like Sky Club access, companion tickets, etc. may make up for the annual fees.

Once you have both Delta Reserve cards, you will be credited with another $5,000 MQDs for a total of $10,000 MQDs. Boom. You’ll then have Gold Medallion status!

Step 3: Spend towards higher level status

If you never set foot on a Delta flight, the above steps will get you to Gold Medallion status. You can then put spend on one of your Delta Reserve cards to earn additional MQDs towards higher level status. This is true for the Delta Platinum cards too, but at half the MQD earning rate.

In fact, any spend you do in order to earn welcome bonuses will add to your MQD count. As a reminder, the Delta cards earn MQDs at the following rates:

- Delta SkyMiles® Platinum American Express Card: Earn $1 MQD per $20

- Delta SkyMiles® Platinum Business American Express Card: Earn $1 MQD per $20

- Delta SkyMiles® Reserve American Express Card: Earn $1 MQD per $10

- Delta SkyMiles® Reserve Business American Express Card: Earn $1 MQD per $10

Example: If you have $10,000 MQDs from the MQD Headstarts and you want to get to Platinum status (which requires 15,000 MQDs), you can get the extra 5,000 MQDs with $50,000 spend on Delta Reserve cards.

The Status Match Option

If you have status in another airline, you can apply for a Delta status match. If accepted, you’ll get Delta elite status for a 3 month trial period. Then, if you earn the target number of MQDs during the trial period, you’ll get to keep that status through January 2027.

Full details can be found here: Delta’s excellent status match (status for up to 2 years).

Conclusion

If you’re willing and able to apply for a number of pricey Amex cards, you can earn up to Delta Gold elite status without stepping foot on a plane and without even putting any spend on those cards. If you want to earn a higher level of status, that can be done through spend on your Delta Reserve cards.

Of course, earning elite status isn’t worth much if you don’t fly Delta often so I don’t recommend doing this if you’re not going to fly Delta. If you do fly Delta a fair amount, you’ll earn additional MQDs from flying. Even when redeeming SkyMiles you’ll earn MQDs (at a rate of $1 MQD per 100 Sky Miles spent). So you’ll potentially reach an even higher level of status through the combination of credit card MQDs and flight MQDs.

Overall, Delta elite status is really easy to earn in 2025. That may change next year. As I write this, we don’t yet know to what extent Delta may increase elite requirements in 2026. Stay tuned.

@ Greg — If you received the 2,500 MQD headstart for a Reserve card that you’d held for a few years on Feb 1, 2025 and then closed that card on March 20, 2025, will you lose the 2,500 headstart MQD? I know the T&C say that DL reserves the right to reverse them, but I was wondering if you’ve heard of anyone actually losing these?

My bet is that you would keep the MQD‘s but I don’t have any data points to confirm that

The Japanese AMEX Delta cards provide even faster ways to get status, you can just spend your way to silver or gold medallion instantly and the amount needed is not very high! I suppose they have to do that to compete with the ANA and JAL cards which will let you keep your status for as long as you hold the card and pay the annual fee.

What benefit does tier status provide that a premium cabin ticket doesn’t? For IRROPS, I’ll rely on lounge angels. If I solely fly on points, I don’t need the earn rate. And, who needs the headache of coupon clipping to justify the cards?

For cash payers, take the $2000 in annual fees and pay for upgrades.

For most people this is true but I do get it if you are going to reach Diamond/1K/Executive Platinum with the systemwide upgrades, which Greg obviously does. $2000 won’t pay for long-haul upgrades (except maybe a few routes like NYC-HNL or LHR off-peak where the supply of J seats might be greater than year-round demand), but a GUC/SWU can (and then some).

Easy Peasy! Just get 4 different credit cards with annual fees totalling $2000 and also spend 50k on one of the cards! I appreciate the update but I think “shockingly easy” is a bit of a stretch.

With Delta selling 90+ percent of first class directly or via discounted cash upgrades, complimentary upgrades seem challenging. Another blogger has noted that upgrade certificates are harder and harder to use. Hmmm.

Shhh don’t let facts get in the way of shameless attempts to tout credit card affiliate signups.

I believe you’re confusing FM with TPG…

The above was not from me. Someone is impersonating me.

That said Delta has all but killed upgrade so…

Is there any word on Delta extending the status match into 2025? AS 75k and I have a J fare on Virgin Atlantic that should get me Gold with one round trip. If I can get status through Jan 2027, I’d like to wait to apply for the match in 2025. Assuming that is an option?

Hey Greg if you earn silver for 2025 in 2025 will the Reserve Biz card’s 2500 boost be added bringing you closer to Gold or is it just helping you qualify for Silver first as if you started with no status?

It adds to your status just like qualifying flights do. So yes it would help you get to Gold

How long does it take to for the MQD HeadStart to show up if I sign up for a card? I’ll be close to $2500 short of DM and may sign up for another card if it gets me into Diamond.

Delta needs to make hotel portal MQDs permanent.

The Amex Delta Reserve’s earning structure needs to parallel that of the Citi AA Executive.

Nit pick: the AF on the Delta Platinum cards is $350, it’s being shown as $250 above.

Great article!

Thanks! Fixed

What makes you say this: “…Delta is very likely to drastically increase their elite requirements next year.”? I would be surprised if they changed the requirements again this soon, but your ear is closer to the ground than mine!

In 2023 they first rolled out much, much higher requirements for 2024 but then after a big outcry they reduced them to what they are now. But they hinted that the higher requirements were still coming, just not in 2024. It’s certainly possible that they’ll raise requirements a little each year rather than in one fell swoop. We’ll see!

It should be noted that step 2B is not an option. I’ve been waiting for it to kick in for a couple months, but I now realize it won’t. Deep in the terms it says:

Card Members who upgrade from an Eligible Platinum or Platinum Business Card to an Eligible Reserve or Reserve Business Card will not be awarded an additional $2,500 MQD deposit for the Reserve or Reserve Business Card, and Card Members who downgrade from an Eligible Reserve or Reserve Business Card to an Eligible Platinum or Platinum Business Card will not be awarded an additional $2,500 MQD deposit for the Platinum or Platinum Business Card.

Thanks for this! I’ll update the post.

great post! I would like to upgrade my delta Amex platinum to reserve to get the 10:1 conversion rate of my annual spend (60k). Delta rep told me I need to upgrade by Jan 10th to get the boost benefit. I didn’t ask if I get 2 headstarts if I have 2 credi cards. I would rather not pay 2 fees. Do you think I could get the boost only if I apply by the 10th if Jan? I know the conversions starts Feb 1 but I am not sure if I need to hurry to upgrade. Thaoughts? Platinum medallion in 2024 if that makes a difference.

There’s nothing in the terms about the Headstarts that suggests that you need to get the card by Jan 6. In fact, there are specific terms about how long it may take to get credited with the Headstart if you get a card after Feb 1. So, no need to hurry in my opinion.

I am $102 short on MQD for Platinum this year with 3 weeks to go. Short of travel, is there anything I can buy with Delta that will get me the MQD? I don’t have their credit cards

A flight !

I have around 102K excess MQMs and will start 2024 as platinum. I anticipate getting to Diamond in late 2024. Will I be able to apply my 100K MQMs as a Diamond earned in 2024 to extend the Diamond level in 2025.

I think this question is slightly different than some of the other questions in that I will start 2024 as platinum and then earn diamond in 2024 and I want to extend my newly earned diamond status in 2024 to 2025…. Thanks

Great question. Unfortunately no. Unless details change, you will only be able to extend 2024 status earned in 2023

???? If someone starts 2024 as a Platinum and earns Diamond status during 2024, doesn’t that status start immediately and extend through 2025 (or actually Jan 31st 2026)?

Yes that’s correct but the question was about exchanging rollover MQMs for extra years of status. If Dirk could do that (he can’t) he’d have Diamond through Jan 2027