| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

First Tech Credit Union is out with an easy checking account bonus that just requires $1,000 a month in direct deposits for 3 months to earn, with no other account minimums or fees. I had missed this one when Doctor of Credit posted it a few weeks ago and I was actually planning to close my existing First Tech account until I noticed an email from them advertising this deal. I think they just bought themselves two customers in my household for a little while longer as my wife and I will probably both do this bonus for an easy six hundred bucks between the two of us.

The Deal

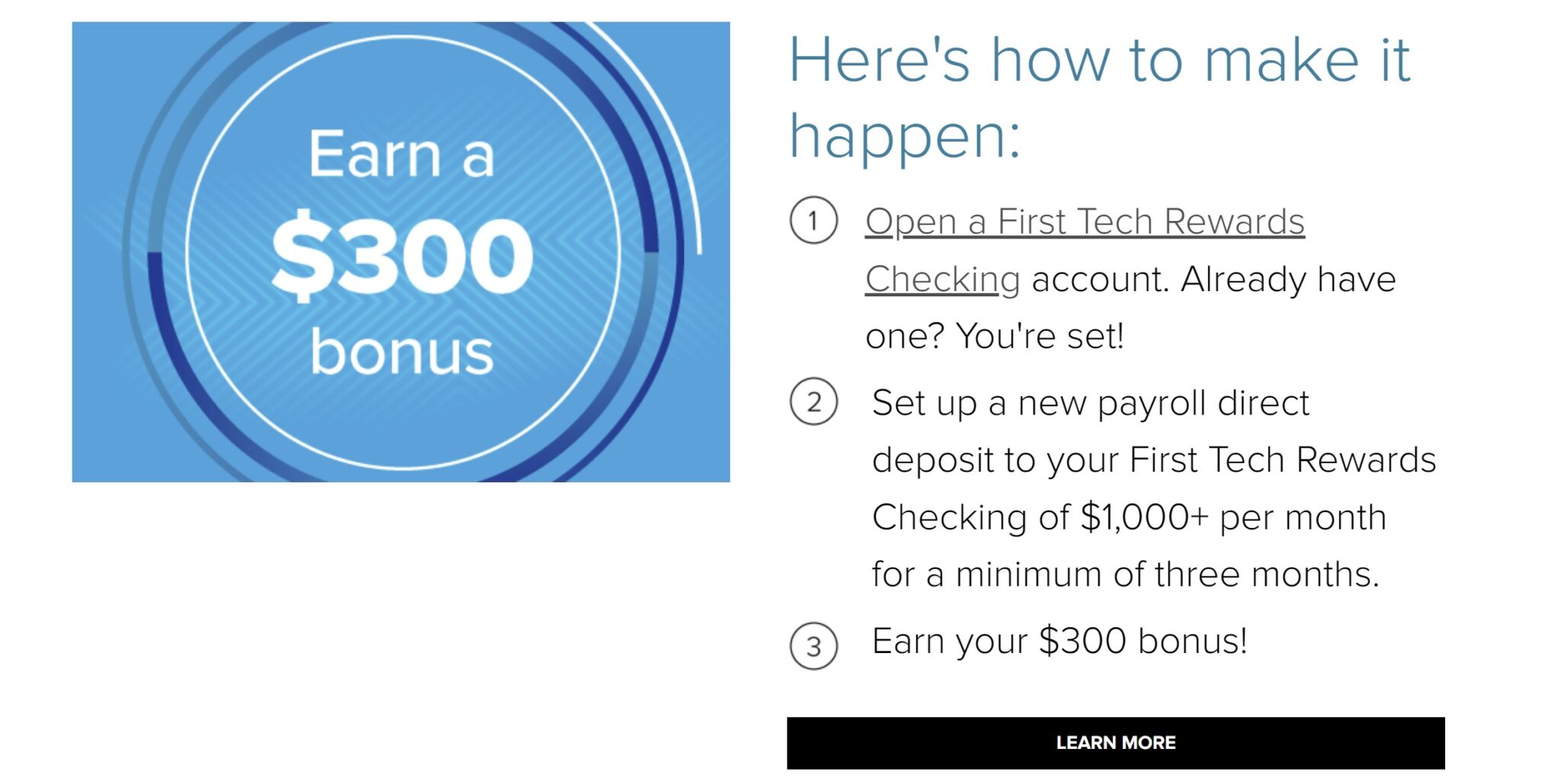

- First Tech Federal Credit Union is offering a $300 checking bonus when you open a First Tech Rewards Checking account and set up a new payroll direct deposit of $1,000+ per month for a minimum of three months

- Direct link to this deal

Key Terms

- No minimum balance requirements

- No monthly account maintenance fees

- Surcharge-free access at nearly 30,000 CO-OP network ATMs nationwide

- Free checking

- Offer valid for enrollment between February 26, 2024 and June 30, 2024 for members without an existing direct deposit.

- Members with existing direct deposits or who are already enrolled in a First Tech direct deposit campaign are not eligible.

- Participant is defined as 18 years of age or older and the primary account owner on a First Tech Rewards Checking (FTRC) account.

- Direct deposits are considered new if there has been no direct deposit activity in the Participant’s share accounts on which they are the Primary Owner within the previous 18 months.

- Membership is required and is subject to approval. Fees could reduce earnings on the account. FTRC accounts must be personal accounts. Fiduciary, trust, business, or organization accounts are not eligible.

- Participant will be enrolled in the promotion upon receipt of new direct deposit transaction into the FTRC account (“Enrollment”). In order to receive any bonus payout, in addition to satisfying the payout conditions set forth in this disclosure, the Membership Savings account must be in good standing (not in default, closed, inactive, or otherwise not in good standing) during the period of time commencing with Enrollment and ending with the applicable date of payout. Any inquiries or disputes must be received by January 31, 2025.

- New Direct Deposit Offer: New direct deposit must occur at least once per calendar month from the Participant’s employer payroll into the First Tech Rewards Checking (FTRC) account of which the Participant is the primary account owner.

- Direct deposits from a non-employer payroll source do not qualify.

- The monthly aggregate amount of all qualifying direct deposits must equal to at least $1,000 to earn the $300 bonus.

- Enrollment is the date of the initial direct deposit transaction. During the period of time commencing with Enrollment and ending 120 calendar days after Enrollment (“Enrollment Period”), at least one direct deposit transaction must occur each calendar month starting with the initial direct deposit transaction.

- A minimum of three direct deposit transactions must be received during the Enrollment Period. (EXAMPLE: If a member’s initial direct deposit is March 1, 2024, additional required direct deposits must occur at least once in each subsequent calendar month following the month in which the initial direct deposit is made, the last direct deposit must be received by June 29, 2024.)

- Any qualifying bonus will be deposited to the Participant’s Membership Savings account the first week following the Enrollment Period.

- Bonuses will be considered dividends and may be reported on IRS form 1099-INT.

Quick Thoughts

This seems like a very easy checking account bonus given the simple requirement of $1,000 a month in direct deposits for 3 months, with no further account minimums or other hoops to jump through. Doctor of Credit is light on data points as to what counts as a direct deposit, but I think the ease of the win here might just make it worth diverting $1K of actual direct deposit money to First Tech.

My wife and I both have existing First Tech accounts, but I think we’ll probably both open rewards checking accounts under this offer given the relative ease of meeting the requirements. A combined six hundred bucks between the two of us for very little effort seems like an easy win.

I should note that I was surprised that this bonus is available to existing First Tech customers so long as you don’t already have direct deposit set up, but we each got an email about opening the account as existing customers — so you can do this one whether or not you’re new to First Tech.

I should also mention that while this credit union is called “First tech”, you may be surprised at how low-tech their website seems. Everything functions well enough, but don’t let the name fool you — this isn’t a cutting-edge banking experience. Still, I’ll use it a while longer for $300 x 2.

![(EXPIRED) [Targeted?] TD Bank: $400 checking bonus, up to $600 savings bonus (up to $1K total) a hand holding a fan of money](https://frequentmiler.com/wp-content/uploads/2020/08/hand-full-of-money-refund-cash-218x150.jpg)

Is this churnable? IE if we had a first tech fed account in the past, are we eligible?

Hi. I thought it was simple too, until I called FirstTech. The representative said there is a number 4 – at least 20 debit card transactions. I suggested that if that is really correct she should communicate the confusion to her management as there are going to be alot of unhappy customers in three months who didn’t know about the debit card requirements.

I sent a message and got an answer I like better:

“Thank you for taking the time to reach out about the promotions for your new First Tech Rewards account.

The $300 bonus requires the direct deposit only for a minimum of three months.

The 20 debit transactions, eStatements and $1,000+ Direct deposit are monthly qualifiers that have to be met in order to earn the higher APY in your account.

You can click the link below to learn more about the two different tiers of requirements.

https://www.firsttechfed.com/pages/depp/direct-deposit“

I know it can be tempting to call and talk to a customer service agent to verify details of a promotion, but any time you do that you may as well go buy a Magic 8-ball and ask the same question because the reliability of the answer in most cases is not different (and to be clear, my point here is more that you shouldn’t rely on a customer service agent’s word for it on most things, not that you should buy a magic 8-ball and trust that). Most customer service representatives are well-intentioned, but they don’t obsess over the terms of offers like these and they frequently don’t accurately understand their employer’s products as well as people who do obsess over those details. I am not one iota surprised that a phone rep told you the wrong thing here.

Are the qualifications listed:

required to earn interest on the account, or for the bonus?

I thought it was pretty clear — it has those requirements under one column and explains under the other column what you get. That “what you get” column is the 5% APY and stuff. It doesn’t say anything about the $300 bonus in that section. Those requirements are clearly for the 5% APY, the extra credit card earnings, etc.

See the screen shot at the top of the post — the section about the bonus has three steps to get the bonus — 1) open and account 2) meet the direct deposit requirement 3) get $300.

And the FAQs go on to note that there are no account minimums or anything. That stuff you’re citing is just for the APY and whatnot.

I work for myself. I don’t know if a transfer from my business bank account will code as payroll. Should I do it or will I be wasting my time?

If you can set up ACH transfers on your business bank account then it would be a better chance of working. Mine charges 1% of the ACH so the bonus drops to $270. Still not too bad for < an hour of work

Thanks, applied.