| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

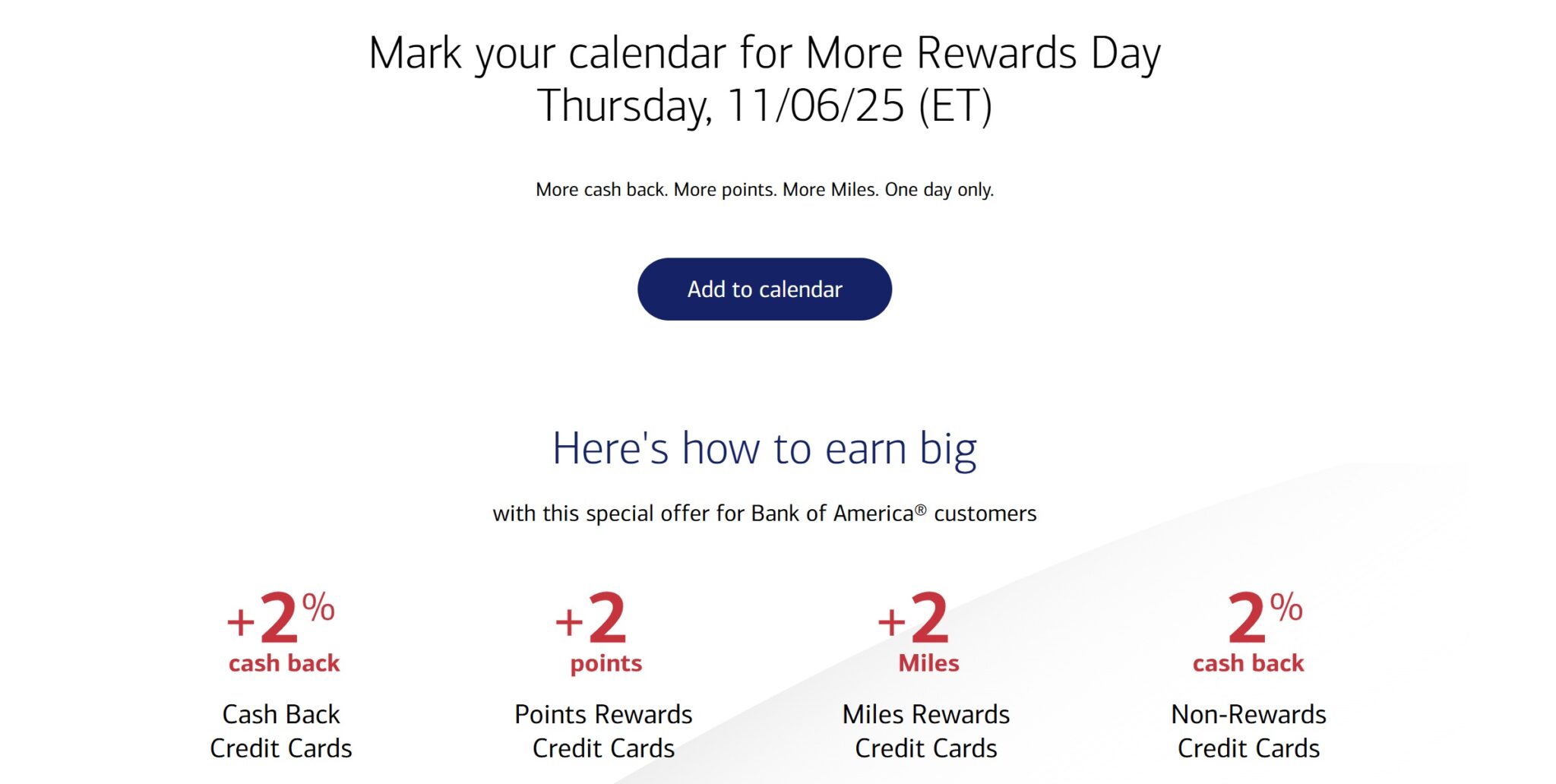

Bank of America is bringing back its annual “More Rewards Day” on Thursday, November 6, 2025. For one day only, you can earn an extra 2% back / 2x on Bank of America credit cards on up to $2,500 in purchases per card.

The Deal

- Bank of America is offering an extra 2% back or extra 2 points/miles per dollar spent on all Bank of America business and consumer credit cards on 11/6/25. You can earn the additional rewards on up to $2,500 in spend on each card.

- Direct link to this deal

Key Terms

- Credit card accounts in rewards programs will earn an additional 2% cash back, 2 points, or 2 Miles per $1 spent on the first $2,500 of Purchase transactions, up to a maximum of $50 in cash rewards, 5,000 points, or 5,000 Miles per unique Consumer credit card account or unique Business Banking company.

- Purchase transactions must post to the unique credit card account and have a transaction date of 11/06/2025 ET.

- Business Banking Company level rewards earning: all rewards earned on individual company cards accumulate at the corporate account level. There will be one bonus earn for the company with a maximum of $50 in cash rewards or 5,000 points.

- Business Banking Individual level rewards earning: rewards earned on each card will accumulate on each individual account. Each individual account may earn one bonus with a maximum of $50 in cash rewards or 5,000 points.

- Rewards type is dependent on the credit card account you are using. See your current Program Rules for any rewards program details.

- Bank of America Non-Rewards credit card accounts will be issued a statement credit equal to 2% of the first $2,500 of Purchase transactions, up to a maximum of $50 per unique Consumer credit card account or unique Business Banking company. P

- urchase transactions must post to the account and have a transaction date of 11/06/2025 ET.

- For Consumer credit cards without rewards, the statement credit will generally be applied to your existing balance with the highest APR before being applied to any balances with lower APRs.

- For Business Banking credit cards without rewards, the statement credit will generally be applied to your existing Purchase balance.

- Merchants provide the transaction date, which may be on or after the date you authorized the transaction (including because of a difference in time zones between you and the merchant), or before the date the transaction posts to your account.

- The following transaction types are not purchases and will not count towards this promotional offer: Balance Transfers; Cash Advances; fees and interest charges.

- Limit one bonus rewards offer per unique credit card account.

- Allow up to two billing cycles after the promotion ends for the promotional cash rewards, points, Miles, or statement credit to be added to your account.

- Receipt of this bonus reward does not affect your responsibility to pay your Minimum Payment Due shown on each statement you receive from us.

- The value of this reward may constitute taxable income to you. You may be issued an Internal Revenue Service Form 1099 (or other appropriate form) that reflects the value of such reward. Please consult your tax advisor, as neither we, nor our affiliates, provide tax advice.

- See landing page for full terms

Quick Thoughts

Bank of America has run this offer for the past couple of years (see the 2024 version here). The offer had no limit the first year, but we’ve seen this limit of up to $2500 in purchases per card for the past couple of years.

Nonetheless, this can be a nice way to amp up earnings if you have large purchases that you can plan for November 6th. Keep in mind that the bonus should apply to all active Bank of America consumer and business credit cards. For instance, if you have an Alaska Atmos Rewards credit card, you’d earn 3 miles per dollar on up to $2,500 in purchases on November 6th; if you have a Bank of America Premium Rewards card, you’d ordinarily earn 1.5% bank on most purchases, but you’ll earn 3.5% on up to $2,500 on November 6th. If you have Preferred Rewards status, this bonus comes on top of that — so if you have Platinum Honors status and therefore earn 2.625% on otherwise unbonused purchases, you’ll earn 4.625% with this bonus. The same concept applies across various Bank of America cards.

Keep in mind that the transaction date for any qualifying transactions must show 11/6/25. I would therefore be looking to use this bonus for in-person purchases or those for services which are likely to finalize the charge immediately (like perhaps insurance or tax payments, tuition fees, etc). If you order merchandise online, many merchants will not finalize the transaction until they ship your order. As such, the transaction date may end up being a day or two after you place the order, and it wouldn’t count for this promotion if the merchant finalizes the transaction on a different date.

This is nonetheless a great opportunity to earn a great return on spend. If you’re already spending toward things like an Alaska companion certificate or you’re working on welcome bonus spend, it makes sense to stack with this promotion if you can.

Regarding: Keep in mind that the transaction date for any qualifying transactions must show 11/6/25.

Often I see the transaction date the day I do the charge, click a link and pay etc but the POSTING date is 2 days or later.

But it does show the Transaction date as the day I charge, so thats what we need correct?

Is the Sonesta card eligible for this?

The Atmos business card is not listed as one of the eligible cards but then at the bottom it says “ Please note that all Bank of America Consumer and Business credit card accounts that are open with active charging privileges are eligible to earn promotional rewards on 11/06/2025 ET. The credit card accounts listed above are only a representative sample of eligible card accounts.”.

It sounds to me like it would be eligible. What do y’all think?

If they are issuing 1099s, how will that work out for an Alaska miles card? Any clues from prior years?

Though the terms say it could be taxable, its return on spend so it shouldn’t be taxable.

Woohoo! Just checked and my Atmos spending deadline is not until end of November. Looks like I will be maxing out the reward on 11/6.

For those with the customized cash card and set online shopping as your 3% category, remember to buy those gift cards early in the day. Last year, I waited until 11pm and the transactions posted the next day even though I received the gift cards almost immediately. Getting 5% back on certain gift cards that are never discounted anywhere is a nice little bonus.

I have an additional 3% cash back (up to $75) targeted offer on one of my BoA cards. Does anyone have experience with stacking this offer with a targeted offer? If it works, it would be a 6.5% total cash back on 2.5k in spend. Might just pre-pay taxes and get almost 5% back after the fees.

I’m checking out of a resort in Mexico 11/6. I had planned to use CSR for 4x, but it sounds like I could get 5x on Atmos Summit (3x foreign transaction + 2x)? Anyone see any issue here?

Does buying points make sense for this or even work?

anybody looking to pay rent with the new atmos cards on Nov 6th? 5.3x reward if you have a bank account with BOA as well

How do you get to 5.3x? Isn’t Atmos only 1 mile per $ to start?

Rent is 3x through bilt. Plus the extra 2x from boa