In the post “Plans for rebuilding my point fortune,” I wrote about my 5/24 status and my desire to build up points in the following programs: Bilt Rewards, AA, Alaska, and Marriott. In that post I also wrote: “it makes sense for me to grab a couple of consumer cards ASAP. The sooner those new accounts hit my credit report, the sooner they’ll drop off as being more than 24 months old.” So, following my own advice, I signed up for two new consumer cards this week.

The Bilt adventure

Bilt’s unbelievable 1-day up-to-150% transfer bonus to Virgin finally pushed me over the edge. I decided that I needed this card sooner rather than later so that I can be in position to take advantage of deals like that in the future.

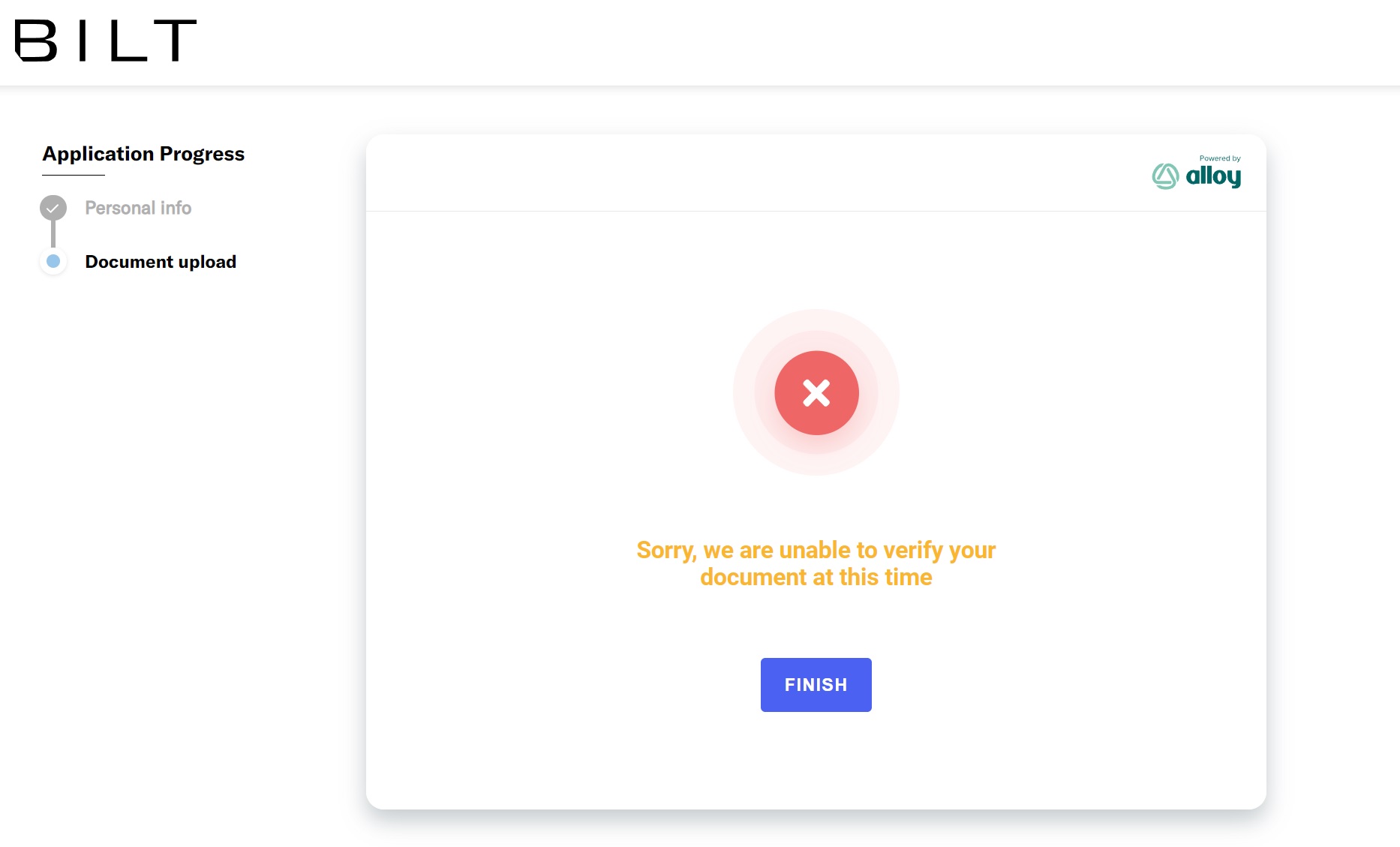

I started the application on August 1, but I quickly hit a snag. The system wanted to verify my identity by having me take photos of my ID (license or passport) and a selfie. I tried first on my laptop, but the system rejected my photos without explanation. It gave me the option to complete the ID verification on my phone, so I tried that. I went through the process twice more, but each time it rejected my photos without telling me what was wrong. Finally, it gave up on me altogether. I couldn’t proceed with the application. When I tried to restart the whole process, it told me to pound sand (not really: it told me to contact support).

I’ve been told that most applicants don’t go through this type of “step-up” ID verification. I was just one of the lucky ones. Further, I’ve been told that about 75% of those who do step-up verification get through it without trouble. Again, I was “lucky.” Apparently, those who fail this step, like I did, get put into a queue for manual verification. As things stand today, that can take up to a month, but Bilt is actively working on a solution that will remove that delay for everyone and, I’ve been told, that should be in place within a couple of weeks. In my case, thanks to having friends in high places at Bilt, they were able to clear my ID check in about 24 hours.

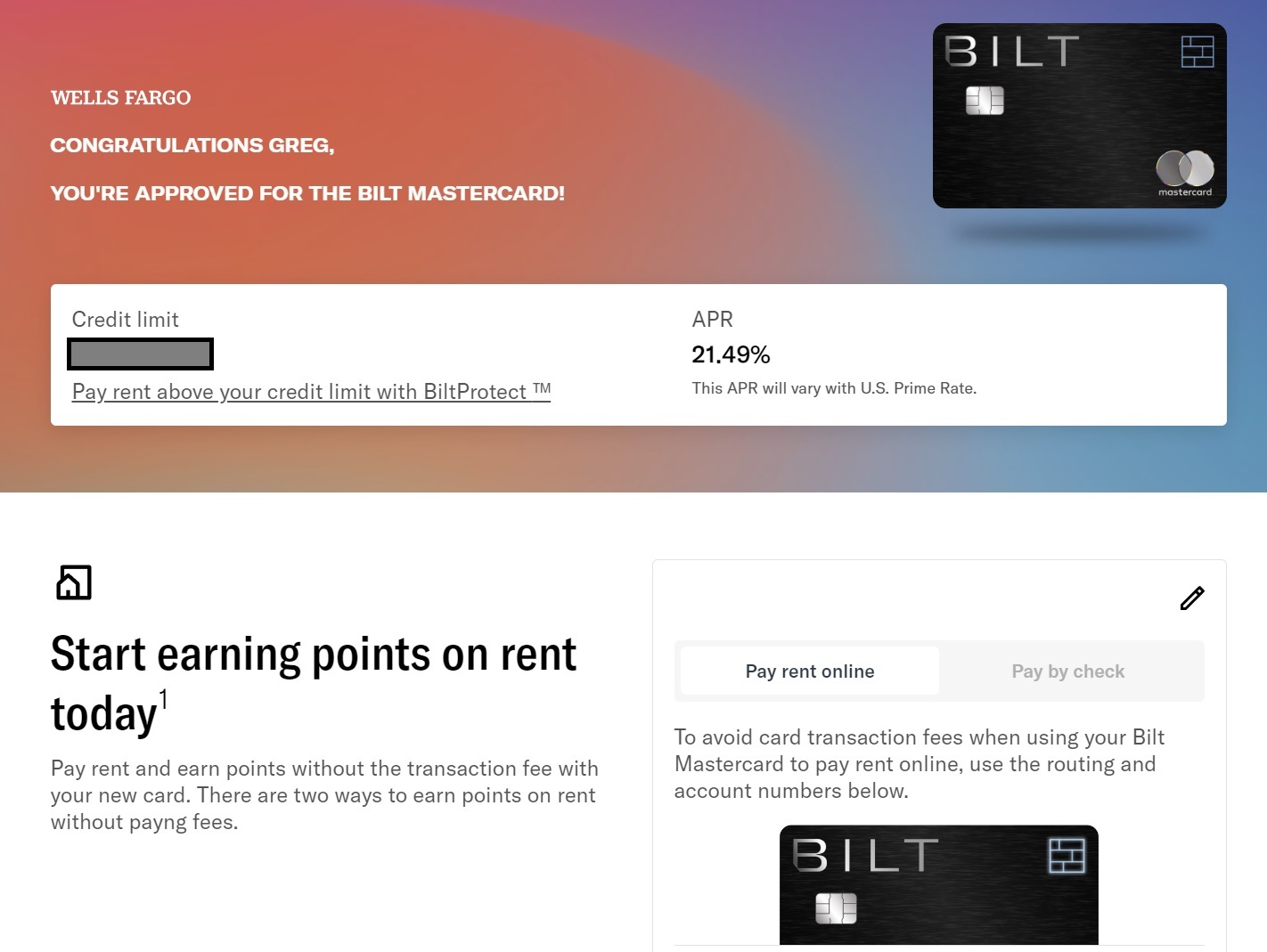

The next day, I clicked to continue the application and I was instantly approved for the card. Fortunately for those who get stuck at ID verification, there was no hard inquiry to my credit report until this final step.

I’ll do a follow-up post with thoughts about how I plan to earn rewards and elite status with this card.

AA Executive Card

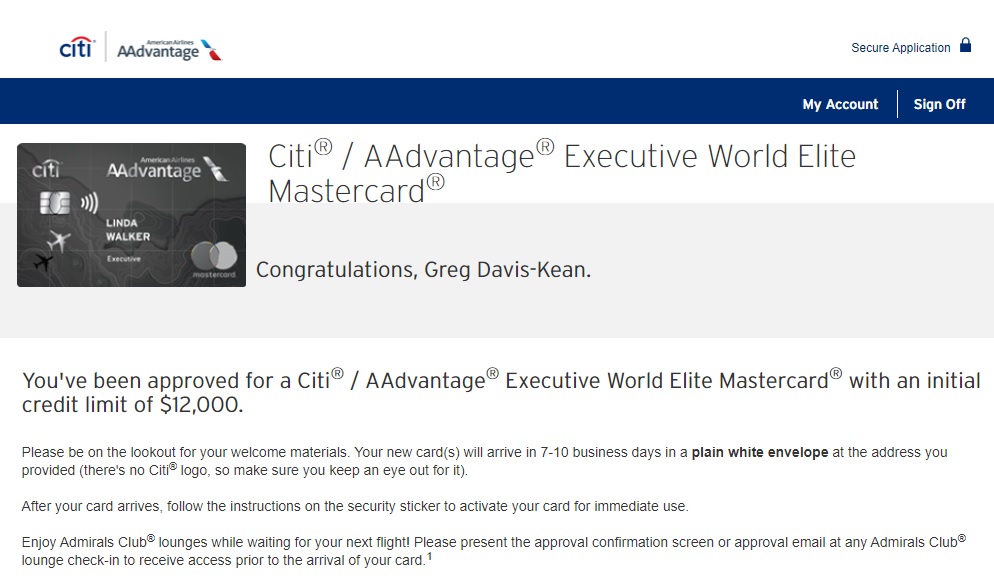

In order to build up my AA points, I applied for the Citi AAdvantage Executive card. My application was automatically approved.

At the time of this writing, the offer for that card is for 100K miles after $10,000 spend in first 3 months. In case you’re reading this after that offer has expired, here’s the current offer for this card:

| Card Offer and Details |

|---|

100K miles ⓘ Non-Affiliate 100K miles after $10,000 spend in first 3 months$595 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Good choice for those who need Admirals Club® access and those who value the Loyalty Points boosts at 50K and 90K Loyalty Points earned. Plus, it offers the usual collection of perks for flying AA (free checked bag, priority boarding, etc.) and some handy credits for Avis or Budget rentals and GrubHub. Earning rate: 4X AA ✦ 10X hotels booked through AA.com/Hotels ✦ 10X car rentals booked through AA.com/Cars ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: ✦ First Checked Bag Free ✦ Admirals Club® access for both primary and authorized users ✦ Up to $120 in statement credits per calendar year for car rentals booked directly with Avis or Budget ✦ Up to $120 per 12 monthly billing cycles for GrubHub purchases (up to $10 per monthly billing cycle) ✦ $10 monthly Lyft credit after you take 3 Lyft rides that calendar month ✦ 10K bonus Loyaty Points after earning 50K Loyalty points through all channels and another 10K bonus Loyalty Points after earning 90K Loyalty Points through all channels ✦ 25% savings on eligible in-flight purchases on American Airlines flights ✦ Up to $100 Global Entry or TSA PreCheck application fee credit every 4 years |

Bottom Line

Obtaining the Bilt and AA Executive cards is just the first step towards building up the points I want. With AA, I need to meet the hefty minimum spend requirements. With Bilt, I’m hoping to get the 5x everywhere for 5 days offer that most new cardholders get. If so, of course I’ll want to spend big during those 5x days. Beyond that, I’ll look to maximize spend on the first of each month (when Bilt doubles reward earnings).

Why not drop some money into the mileage account at Bask Bank? They have a bonus right now as well until the end of August.

I’m considering it.

Greg, has Citi announced when the 100k offer will end?

Yes, it should be available through Sept. 6

[…] Source […]

[…] Source […]

Will paying taxes count for the 5x everywhere initial 5-day bonus spend?

I don’t see why not. 5x is limited to $10K spend I believe so a single $10K payment should get a person to 50K points and half way to top tier elite status.

I’m loving my Bilt card. The extra bonuses have been great. Plus the ability to pay my HOA fees and earn points. Win! Win!

Bilt Bilt Bilt, I’m sure your being paid well.

Yes, we are being well paid… by other card issuers.. but far less by Bilt. Revenue from Bilt isn’t enough to even factor in at all in our financial planning. It’s exhausting having commenters imply that we publish articles like this for the purpose of earning commissions. We do not. We go out of our way to separate the business of the blog from the content of the blog and never, ever, ever consider commissions when we write articles. Further, we always ONLY show the best available offer for each card even when that means we get no commission at all. If there was a Bilt card link that offered even a tiny welcome bonus to readers but paid us $0 commission, we would display that link instead of our affiliate link. But the job of swapping that out is 100% separate from the job of writing articles so when we write articles, we have no idea if an affiliate link will even be on our site at all by the time the article publishes or by the time anyone reads it.

One of the great things about Frequent Miler is that you mostly avoid the trashy comments sections that so many other blogs have — even blogs with good content in the blog itself. You do that in part by never publishing the kind of click-baity articles that other blogs use (Fight On Spirit Airlines! Watch Video Now!), by providing well-reasoned, clear-eyed, honest analysis, and (to be honest) by publishing articles of such complexity and length that most short-attention-span keyboard warriors are deterred from taking part.

But for some reason, even here Bilt out some of the worst commenters. Not only are the mean-spirited “comments” like the one you’re replying to unnecessary and based on false premises, they also serve to expose the ignorance of the poster. They have an opinion (to which, of course, they’re entitled), you have a different one. Great.

Oddly enough, although I enjoy the Bilt content a lot, my personal opinion is generally in-line with the nasties — I don’t have the organic spend, interest in manufactured spend, or the personal bandwidth to manage a Bilt card for substantial earnings. But that doesn’t mean that plenty of other people can’t make it work for them. And my personal calculations will change substantially if a project I’m working on takes off and I add a few hundred thousand dollars of travel spend each year.

I thought the same thing when I first noticed the Bilt card. But after I learned they take HOA and maintenance fees as a “rent related” expense for the 1/month ACH transaction, it became really clear that the card was special for someone like me. I can clear 15k points/yr toward AA or Hyatt with an application and a 2 minute change to my autopay routing numbers for my monthly coop maintenance charges. That’s probably the most valuable change to a CC setup I can make. Bilt has a clear target audience — it is not for everyone. It is clearly focused on HCOL urban centers. Those people pay a lot of rent and buy a lot of restaurant food.

Also, the dining program at Bilt is outstanding — that was not something I expected when I applied. When I looked at the restaurant list, it quickly covered 50+% of our organic spend eating in Manhattan (when we go for the evening). Clearly, the dining program wants to shape spend as well (otherwise what is the value added for the program partners), and it will do some of that. But it was nice to have a list of things I actually wanted to eat (as opposed to the AA dining program, where we just happen on occasion to eat somewhere that nets a few miles). The program is limited, obviously, but if you live in a place covered by the Bilt dining program, that alone can be worth it.

I personally have received a grand total of $0 from Bilt and expect to continue that $0 well into the future – and I’m happy to recommend them to my New York and LA co-workers who pay quite a bit of rent.

So any chance if you time your card to be in hand on the first of the month and get the 5x on everything and the 2x for first of month they would stack to a higher rate 10x maybe?

Great question. I doubt that would work, but I’d love to hear from anyone who has tried it.

Nope – specifically not gonna work in the T&Cs. Welcome to the Bilt Club, Greg, I know you are gonna love racking up AA/Hyatt fast!

Enough with Bilt already. Without SUBs, how much do you need to spend to generate a meaningful amounts of Bilt points to take advantage of transfers? Don’t forget you also need to be Bilt Platinum to take advantage of higher transfer ratio. It’s also comical that after all the hype, it needs to validate who you are by taking a picture. What is this? Applying for Global Entry?

Well, if you spend $24,000 on the card at an average of 3x you’d earn enough AA points to redeem Qatar to Doha in best-of-class buiness. That’s $2,000 a month. You’d have to spend a reasonable percentage of that on dining and travel on the first of the month but with the Curve card (which I’m pretty sure Greg has) or some modest gift card spend that should be easy. That same spend could get you a week’s accommodation at some quite reasonable Hyatt locations as well.

WIth the introduction of the enhanced Platinum benefits, however, I assume Greg will be spending $50k on the card each year. At an average of 3x that would be 150,000 points transferrable to American, United, or Hyatt (plus others).

Just get one (or two or three!) AMEX gold (4xdinner) with a nice SUB and you are way ahead. Yes, life works pretty well without AAdvantage points…….. and the only unique feature can sometimes be cheap economy awards on AA (earning MR at a higher rate of sets higher partner award prices). Unless you take a bunch of clients out for dinner all the time, the average family will spend far from $24k on restaurants using a MC.

Well, I know people who spend well over that on restaurants. It wouldn’t surprise me if Greg’s family spends, say, $1,000 on restaurant dining a month. The rest he could make up with travel spend.

Sure, if you aren’t particularly interested in Bilt’s partners there are good earning opportunities elsewhere. Bilt isn’t the only card you should get. But Greg’s laid out exactly why he wants to restore his balance of AAdvantage points and this seems like a reasonable way to go about it.

In any event, my point was simply to answer Rober’s question about how much do you actually have to spend to get a meaningful number of Bilt points. The number (for my arbitrary definition of “meaningful”) is $24,000. For some people that will seem like a lot of money. For some (and I think Greg is in this category) it will seem like chump change.

I didn’t get this card for the AA miles. I got it because I want to participate in the occasional amazing Rent Day deals they have. On our Current Transfer Bonus page, we also show Expired bonuses and there you can see that Bilt has offered an incredible transfer bonus once every 3 months for the past year. If the trend continues, we should see another great one in Nov or Dec

75% to 150% transfer bonus from Bilt to Virgin (AUG 1 ONLY) 08/01/23

100% Transfer Bonus To Air France/KLM Flying Blue 05/01/23

100% transfer bonus to Hawaiian Airlines 02/01/23

100% transfer bonus from Bilt to IHG One Rewards 12/01/22

And, yes, one can always do better with a series of welcome bonuses, but it’s possible to do the welcome bonuses AND earn from spend. It doesn’t have to be either/or if you can do enough spend.

Greg, most (if not all) of the Bilt naysayers are narrow-minded. I’ve had the card since it went public in April 2022, and have earned over 40,000 points just using it to fill holes in my spending that were otherwise earning 0 or 1 ppd. I quickly turned that into 80,000 points with the 100% transfer bonuses to Flying Blue and Virgin, not to mention the ancillary benefits of earning an extra 3x with Lyft, getting Hyatt Explorist, United Silver, holding Avis Preferred and National Executive (through Mastercard World Elite program), and more, all for $0 annual fee. No headache of using coupon book credits for spending I wouldn’t do, vis a vis Amex. The card works for people who can think outside of a box and took a moment to read its strengths and weaknesses. The 100% bonuses every quarter came about well after I became a Bilter; it’s upside was the 1x on rent.

I use the card for rent, Rent Day 2x on utilities/charities/Costco gift cards, and it’s my default go-to for dining (over the Amex Green and Sapphire Preferred in my wallet). That card raised my floor from 1.5x to 2x, hands down, and I got Silver status without even thinking about it.

I’m over 5/24, and don’t have the organic spend or MS to even bother with most business cards’ spending requirements, which is the case for the overwhelming majority of people, so that “hype” about SUBs is simply irrelevant. Not everyone is willing or able to do that. (I don’t pay quarterly taxes, I don’t own a home/pay for renovations, and am debt free and wish to stay that way for some time) I have 26+ credit cards, so I’ve played the game, but am gardening for the moment, and focused on maximizing what I already have. Totally agree, it’s not an either/or situation. Most people don’t seem to grasp the concept that no SUB also means no spending requirement. I was still chasing bonuses at the same time I got this card (Amex Green 50k Resy bonus simultaneously).

The Bilt card is an elegant solution catering to semi-normal people who prefer a fun, easy-to-use program without hoops and low fees. If it doesn’t work for you, good for you. Don’t complain about a Camry’s V6 when you need and can afford a Suburban to haul your overpriced boat. A lot of people will do just fine with the Camry around town, as the Suburban is expensive overkill. Different products marketed to different people.

If you think the Bilt card is weak, then go get 10 Ink Cash cards or Business Platinums and have a cookie. With milk.

Great info! I am also considering Bilt, but may I Know how you get Hyatt explorist, United silver through it?

How difficult is it to get approved for the Bilt card?

Sorry, I don’t know. I do know one guy who applied for it as his first ever credit card after college, but he was denied. He then got an Amex Gold card. My guess is that if he applied now, a year later, he’d get approved, but that’s just a guess.

Loving the Bilt card. Took advantage of the 100% Air France and my 125% Virgin transfers! To maximize points, I get 6x gift cards on rent day. I earned 50k points on my 5 day 5x on everything offer. Losing my rent earning next year but with no annual fee its a keeper.

Greg, I have AA Platinum status for life – it used to be the top tier when I got it – hah that has devalued !!

Which Citi card or cards would be best for me to try to upgrade that status and why would I want that upgraded status if I travel only business class unless it’s local (where I use Southwest). I have a big stash of AA miles but it’s P2 that has (and keeps) Hyatt Globalist status if that makes any difference.

Perhaps I should just go for whatever new CC bonuses I can get …? P2 and I are both under 5/24 and have businesses.

Any suggestions would be most welcome.

In your circumstance it certainly doesn’t seem to make sense to chase additional AA status. Go for cc bonuses.

I agree. Thanks.

Is there any problem paying the IRS with a Citi card?

I had no problems with the double cash recently, but I did it just to max the rewards+ 10% back with a 30% Qatar transfer bonus for a specific Iberia redemption. I haven’t done it for a sign up bonus and wouldn’t recommend what I did speculatively. But see no reason for it to be a problem.

I paid my 2023 taxes in April with my Citi AA Biz card with no issues.

Thanks.

Don’t the fees offset any benefit?

No, it was well worth it for the benefit of the sign up bonus. I paid 1.85% processing fee, but I’ve been averaging over four cents per point on my redemptions of the AA miles.

For “regular” spend you’re probably right. But for meeting a sign-up bonus or, in some cases, a “high spend” award level, it can be worthwhile. Some people use it to boost their American Airlines elite status to the next level, for instance.

Good idea. I’m not an AA guy, but I may use that strategy to bump up my status with United.

When you say $120 in statement credit, or 2x for car rentals in other cases, surely that’s normally worth nothing as one would want to use a card with primary insurance?

Yes that’s a downside of the $120 credit. In some cases you can swap out your payment card when you return a car so it might be possible to book the car with the Sapphire Reserve (for example), but then when returning the car without problem, use the AA Exec. Or, just hope that you won’t need the better coverage for one rental per year.

Trouble with that is they can still come back demanding repairs later. I had that happen in NZ with Avis – a month after returning they sent a bill for windshield damage, I contested, but they hounded me for a year then the “debt” was bought by a company in LA who sent me threats which I ignored until the 3 year limit passed and I am now free of the harassment. But still, it was annoying.

OMG!!! What are you thinking? Bilt doesn’t have a SUB!!! It clearly must be worthless!!!

Forgive the sarcasm.

The Amex Business Platinum and Bilt are the two most valuable cards in my wallet.

Why?

must be a thick wallet with all those amex coupons!

PS – The third is the AA Executive Card.

Can you explain how you’re getting that much value out of Bilt? Doing massive spend in bonus categories on Rent day?