NOTICE: This post references card features that have changed, expired, or are not currently available

US Bank’s FlexPerks program offers several options for getting better than 1 cent per point value from your FlexPerks points. The details, though, can be hard to find. So, I thought it would be helpful to assemble FlexPerks award charts all in one place…

US Bank’s FlexPerks program offers several options for getting better than 1 cent per point value from your FlexPerks points. The details, though, can be hard to find. So, I thought it would be helpful to assemble FlexPerks award charts all in one place…

Overview

You can redeem FlexPerks points for merchandise, but that’s usually a bad idea. Better value can be had by redeeming points for travel rewards (especially flights) or to pay the card’s annual fee. Since FlexPoints can be redeemed for cash at a penny per point, you would generally be better off doing so and then using a points earning credit card to buy whatever you want with that money (after clicking through a cash back portal, finding coupons & deals, etc.)

Annual Fee Redemptions

The per point value of using points to pay your annual fee is different for different FlexPerks cards:

- Annual fee for FlexPerks Gold American Express card (Redeem 5000 points to offset $85): 1.7 cents per point

- Annual fee for FlexPerks Travel Rewards Visa (Redeem 3500 points to offset $49): 1.4 cents per point

FlexPerks Travel Rewards

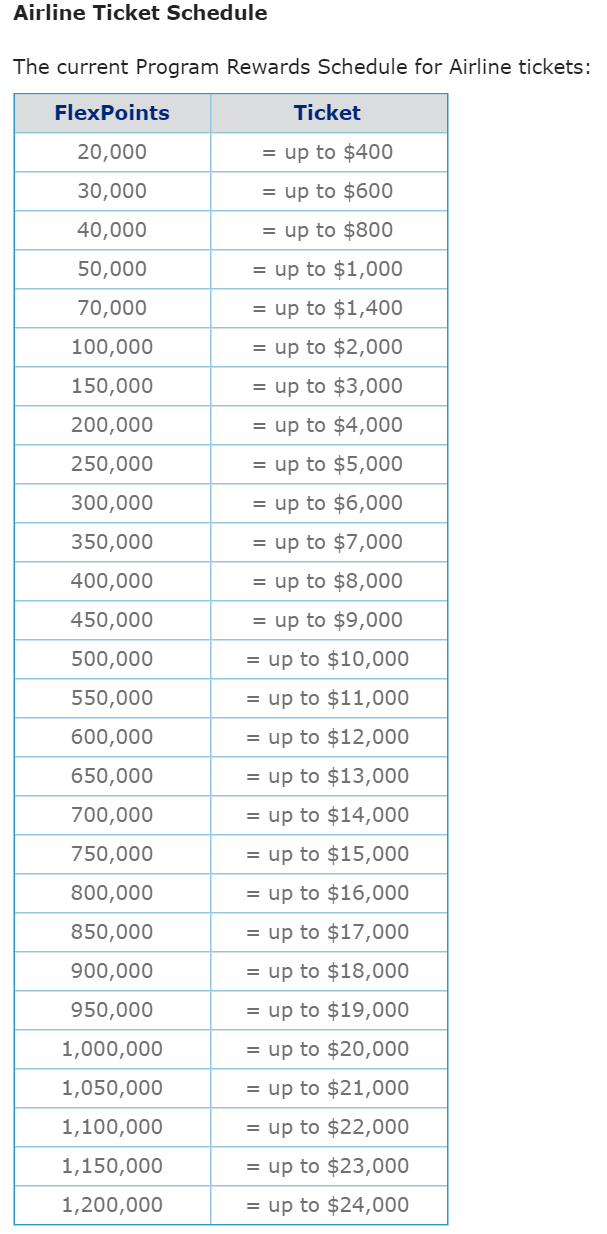

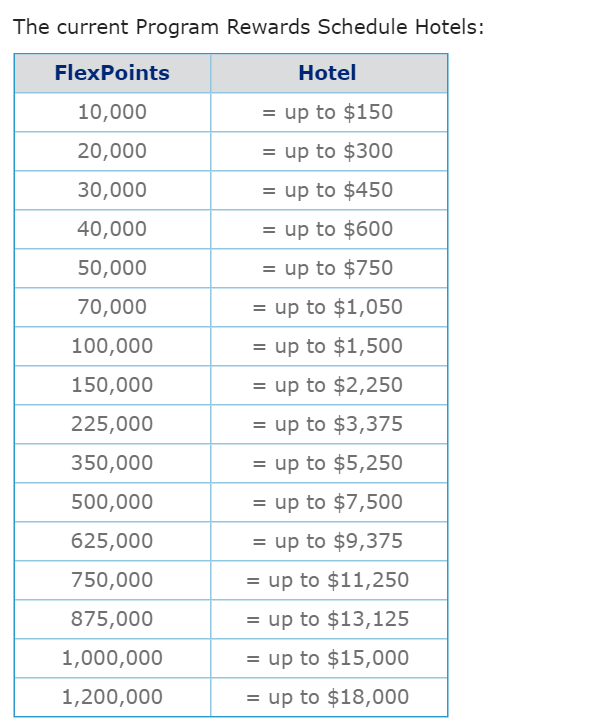

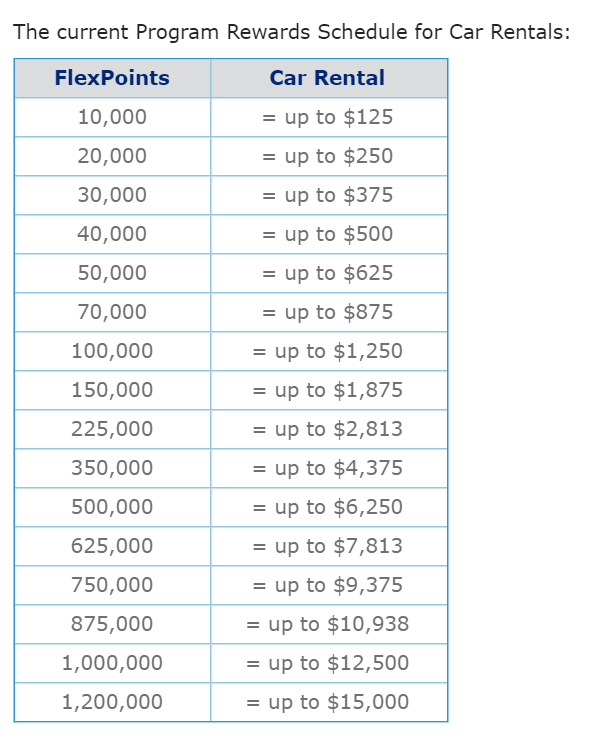

FlexPerks travel reward charts are setup as price ranges. For example, you can redeem 30,000 FlexPoints for flights that cost between $400.0 and $600. In that example, points can be worth as little as 1.33 cents each (for flights costing $400.01) or as much as 2 cents each. Here are the maximum values possible and expected values* from each type of travel reward:

| Type of award | Max Value per Point | Expected Value per Point* |

|---|---|---|

| Airline Tickets | 2.0 cents** | 1.7 cents |

| Hotel Nights | 1.5 cents | 1.3 cents |

| Car Rentals | 1.25 cents | 1.1 cents |

* Expected Value was computed by looking at the 2nd cheapest through the 7th cheapest redemption option for each reward type, and assuming that paid prices would average out to the mid-point of each range. I then computed the average (mean) of the 6 calculated Expected Values.

** With airline tickets, it is theoretically possible to get slightly better than 2 cents per point value by taking advantage of a $25 airline allowance available with each flight redemption. For example, if you use 20,000 FlexPoints to book a flight worth exactly $400 and you get the $25 airline allowance (perhaps by buying a $25 gift card from the airline you fly on the day of travel), you would get $425 worth of travel for 20,000 points. This results in a theoretical max point value of 2.125 cents per point.

FlexPerks Award Charts

Full award charts follow:

Editor’s note about airline ticket redemptions: if you book an award for multiple people, each person’s ticket is calculated separately. So, even though two $195 tickets would price together at less than $400, FlexPerks will still charge 20,000 points, per ticket, for a total of 40,000 points.

$25 Airline Allowance

[The following is copied directly from US Bank’s FlexPerks Program Rules]

Cardmembers redeeming FlexPoints for Award Travel (a ticket paid using FlexPoints) are eligible to receive the airline allowance credit up to $25 per each award ticket. Qualifying Purchases must be made using a FlexPerks Reserve, FlexPerks Travel Rewards or FlexPerks Business Travel card on the Award Travel dates. Qualifying Purchases must be through the airline carrier which is inclusive of a checked baggage fee, on-board food or beverage purchases and airline lounge memberships. U.S. Bank does not have the ability to control how a merchant chooses to classify their business and reserves the right to determine which purchases qualify for the allowance. You may redeem allowance for Qualified Purchases only if the outstanding balance of your account is below its revolve limit and if your account is open and in good standing under the terms of your Cardmember Agreement. Once you or we close your account for any reason, your allowance may be forfeited.

Example: If points are used to redeem for two airline award tickets on a FlexPerks Travel account, the Cardmember may earn the amount of two airline allowances (up to $50 in airline allowance credit).

Cardmember is required to contact Cardmember Service within 90 days after travel to request the airline allowance which is credited to the FlexPerks account and will appear on the statement within 4-6 weeks (or a notification regarding a decline will be sent). The airline allowance is only eligible for FlexPerks Reserve, FlexPerks Travel Rewards Cards and FlexPerks Business Travel Card products.

Do you qualify for the $25 credit for each leg of the trip – ie, if it is a roundtrip ticket, do you get a $25 credit for both your outbound and return flight? Or is it just $25 per redemption (ie, if you book round trip, you only get one credit – but if you were to book 2 one way flights, you’d get two)?

THANKS

No, the $25 credit is per redemption. So, yes, if you book 2 one way flights you’d get two. This works best when the one-way flights cost near the top of a range (e.g. $399 each way).

I just transferred a little more than 37K points from my husband’s Business Flexperks to my Personal Flexperks. Easily done by calling the Rewards Center; he did have to get on the phone to authorize it. With AFs coming due soon (we got the cards during the Olympics promo) my plan is to close his and keep mine, hopefully using 70K towards a $1400 ticket. Having done little other than the required spend for the promo, we have roughly 75K, so I am considering using 3500 flexperks to pay my AF, given the current chart tier is 70K for a $1400 ticket. Always hate to see orphan points!

Great idea. Thanks for sharing.

[…] FlexPerks points are worth up to 2 cents each for airfare, up to 1.5 cents each for hotels, and up t…. The best use of these points has been to try to snag flights at the top of each price band in […]

HI, Is this chart still valid? I found no economy flights to Brussels under 150k points.

Yes. If you use Google Flights or Kayak, do you find flights under $3,000? If so, and if FlexPerks doesn’t show those flights, you’ll have to call to book

Thanks for reply and info Greg!

[…] US Bank FlexPerks Cards: Up to 2 cents per point value towards flights […]

How do you see the price of the flight in dollars on Flexperks website? I can only see how many points I need to pay.

I use a tool like Google Flights to find flight prices and then try to find the same flights on the US Bank site. Once you select a particular flight and go through the steps to book it, it displays the price at some point (it’s been a while since I booked one, so this is going from hazy memory and may not be exactly right)

[…] US Bank’s FlexPerks program, flight awards usually offer the best value (see: FlexPerks award charts for flights, hotels, car rentals, and annual fees). And, it has been possible to maximize value from flight awards by selective use of multi-city […]

FlexPerks is capped at 140k a yr in earnings in the T&Cs

Not exactly. I think you’re referring to the fact that earnings are reduced after $120K spend/year? If so, here are the terms:

If during the calendar year, Net Purchases exceed $120,000, all FlexPoints for the remainder of the calendar year are earned at a rate of one FlexPoint for every $2. Exemption: FlexPerks AutoPay Cardmembers who select the full payment option on the first available payment date after their statement date.

So, heavy spenders just need to setup AutoPay as described above

Is there any way to combine Flexpoints from two cards (e.g. Flexperks Visa and Flexperks Amex)?

I assume that there is a way to do so, but I only have one account so have never tried. You can move points from one account to another (even to other people) but that functionality is capped at, I think, 20K points per year.

They are automatically combined unless you provided a different FlexPoints Number at the time of application for additional cards (and even then, I would imagine USB would catch this and combine them for you rather than creating a new account). When viewing Points History, you can choose to do so by Account Level or Household Level.

Exactly. Same here. We combine them all. It’s great – we have two amex FlexPerks and one Visa.

Key message. Take the new Elan (US Bank) issued Fidelity Reward Visa and redeem all points for a 2% reward straight to a Fidelity Checking account. Auto redemption after $50+ earnings in a billing cycle. No hassles, no tiers, no sub 2% value.

Seems like such a PIA for $25 but they probably do it that way so most people will skip it instead of automatically crediting it.