NOTICE: This post references card features that have changed, expired, or are not currently available

For years I’ve regularly paid for Kiva microloans with my FlexPerks Visa card. The US Bank FlexPerks Visa card has long offered 3 points per dollar for charitable donations. Even though Kiva loans are not technically charitable donations, the credit card coded them as if they were. And, considering that FlexPerks points have been worth up to 2 cents per point towards airfare, this has been a fantastic way to earn up to 6% back while helping others (and hopefully getting your money back as well!). You can read more about Kiva loans here: Manufacture Spend (and do good) with Kiva and Kivalens.

As previously reported, US Bank has already announced changes that made the FlexPerks Kiva connection less valuable. For one, starting January 1 2018, the FlexPerks card will offer only 2X for charity. And, beginning December 31st, points will be worth a fixed 1.5 cents per point towards travel rather than “up to” 2 cents per point for airfare. Taken together, these changes meant that the FlexPerks Kiva combo would earn at most 3% back towards travel rather than up to 6%.

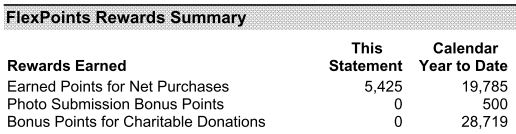

Now, the final axe has fallen. As reported by several readers and confirmed on my own most recent credit card statement, US Bank is no longer coding Kiva as a charity. Kiva loans are now earning only 1 point per dollar. This has been verified with both the consumer and business versions of the card.

Fortunately, there are still many great options for funding Kiva loans, but the FlexPerks Visa is no longer one of them. As long as you can float the money long term and are willing to accept some risk, the following may make sense for funding Kiva loans:

- Fund Kiva loans in order to meet minimum spend requirements when signing up for the Best Credit Card Offers.

- Fund Kiva loans with cards that offer the best rewards for everyday spend.

- Fund Kiva loans with cards where your are trying to earn big spend bonuses.

- Fund Kiva loans with Visa, MasterCard, Discover, or Amex gift cards that you bought for 5X rewards and or at a discount.

If you are interested in learning more about funding Kiva loans by credit card, please see: Manufacture Spend (and do good) with Kiva and Kivalens.

[…] Update: I completely forgot that Kiva has not generated 3x on FlexPerks card since July 2017 (frequentmiler). […]

[…] Preparing for US Bank FlexPerks changes next year and FlexPerks kills Kiva 3x. […]

What are the best cards to use for Kiva now?

1. Any where you are working towards meeting spend requirements for a bonus

2. Amex Blue Business Plus (2X everywhere)

MSing seems to be an unwise financial decision with this unless you are really getting 6% everytime. If the average time it takes to be paid back fully is 12 months, you are losing about 6 months of interest on your average money (see amortization) Throw in an average loss ratio of 1%, and you net 5% (max). This is a poor investment unless you are utilizing a sign-up bonus. One thing most MSers fail to ever do is recognize the power of investments (like stocks) and overlook them because of their narrow vision, such as this example.

Some really inaccurate assumptions in your comment here.

I’ve always focused on loans that are 5-7 months long, preferably that have been “pre-disbursed” in the month or two before I made them. I’d say my average repayment time, using these methods, has been 4 months. Add to that the fact that I’m often not actually “paying” for the loan until 5-6 weeks after it’s made (if done early in credit card cycle, and waiting until final due date to pay off statement), and the money is out of pocket for only about 3 months (with the first repayments having been received even before my CC statement was due).

(A few times, I found the holy grail — high quality borrower, 4 month loans, predisbursed a month prior, at the beginning of my CC cycle, leaving me “out of pocket” for no more than 6 weeks).

Anyway, I could easily cycle the same $30k about 4 times per year (reaching the $120k annual max 3x/charity on the Flexperks Visa card).

Over the years, I’ve “lent” about $425k, with total combined losses of $385 (0.09% — less than a 10th of a percent) in defaults and currency exchange loss.

In short, this has been a goldmine, yielding in excess of 20% annualized returns. This is a big big loss.

The only silver lining is that I now longer have to deal with GCs and money orders and other time consuming nonsense to meet minimum spends. I’ll now just redirect all that spending to Kiva.

[…] FlexPerks kills Kiva 3X by Frequent Miler. RIP Kiva. I wonder what percentage of loans were being funded by MSers doing this. […]

Based on my latest statement, it looks like any transactions that posted after 30 Jun only got 1x points. Had a couple 30 Jun transactions that posted 3 Jul that didn’t get the charity bonus.

Wish I’d read your comment before I spent tons on Kiva via FP last month. Did your FP spending on Kiva ever adjust to 3x on your July 3 spend? Hoping it was just a delay.

Any DP on the (discontinued) FP Amex? I know, be the DP you want to see. 🙂

I never received 3x for KIVA on this card. Other charities did code, but not KIVA.

Thanks. I’ve found the FP Visa to be more reliable for charity coding in general. Had never tried the Amex for Kiva.

What was your % loss? I assume you were slightly paying for these points right?

My all-time default rate is 0.93%. I think I would have done better if I had always filtered to safe loans as I recommend in the linked article, but as long as I’m under 1% I can live with that.

I’ve always done better loaning to female borrowers… they seem to default less and I like giving more oppprtunity to places where female entrepreneurs may not have as many opportunities as their male counterparts

Kiva, as a platform, tends to have more female borrowers. I don’t filter my loans by gender, and have experienced equal default rates so far. My loans happen to be distributed ~85/15 F/M right now.

5k a month? Why bother with that small an amount?

Hopefully your comment facetious.

Not everyone can afford to float or risk $5k per month. Those that can and are aware of this method, probably do.

5k a month seems like a low amount to bother with.

I guess that depends considerably on your financial fitness and level of desires to increase your balances. With GC’s I now see it as an opportunity to earn 25,750 – 25,868 UR every few months. It’s possible to even make a small profit if they are purchased during promos

Had no idea about funding with GC’s. Next time an Office Supply store has an offer I’ll load up.

I’ve been dumping $200 or less VGC to Kiva for some time – I withdraw my “Kiva dividend” every month and fund the subsequent pile of GCs the next month.

Ugh. Thought I had another 5 months.