NOTICE: This post references card features that have changed, expired, or are not currently available

Amex has quietly rolled out a new benefit to many Delta cardmembers: “Fly Now. Earn Later.” This new benefit lets you borrow Delta miles. To find the benefit, log into your Amex account, select your Delta SkyMiles card, and click the Benefits tab.

If you then see the Fly Now, Earn Later option, then you have the benefit:

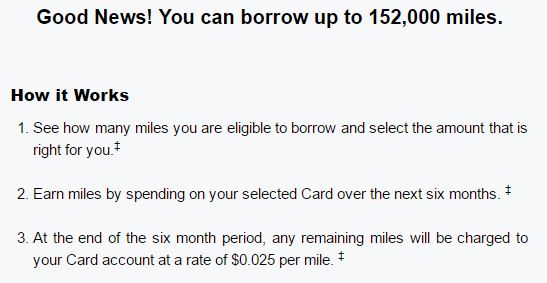

If you click the “Request Fly Now, Earn Later” button, you’ll see how much you’re allowed to borrow. This is most likely dependent upon your past spending history with the card.

Details

This benefit lets you borrow Delta SkyMiles. As long as you earn back those miles within 6 months, you won’t be charged for borrowing those miles. If you fail to earn any back, you will be charged 2.5 cents per mile for each of the miles you haven’t paid back.

Here are additional details from the terms (parsed into bullet points):

- You may have only one (1) Fly Now, Earn Later Balance outstanding at any time.

- The Fly Now, Earn Later Start Date is defined as the date that borrowed miles are posted to your Delta SkyMiles account.

- The Fly Now, Earn Later End Date is defined as the last day of the sixth full billing period following the Start Date.

- If, on the End Date, there are miles remaining in your Fly Now, Earn Later Balance, then your Card account will be charged for those remaining miles at a rate of $0.025 per mile.

- If you do not see the borrowed miles posted to your Delta SkyMiles account immediately, please allow up to 72 hours. Any miles borrowed cannot be returned or transferred…

- When you activate Fly Now, Earn Later on your Card, your Fly Now, Earn Later Balance is equal to the total number of miles borrowed.

- As you earn, receive, or are awarded miles on your Card, those miles are automatically applied to your Fly Now, Earn Later Balance and will decrease the Fly Now, Earn Later Balance amount.

- Miles applied to your Fly Now, Earn Later Balance include (1) miles earned through spending on eligible purchases on your Card, (2) Bonus miles that may be awarded through Miles Boost or other promotions, and (3) miles that may be received from goodwill adjustments or reinstatements.

- Eligible purchases mean purchases for goods and services minus returns and other credits. Eligible purchases do NOT include fees or interest charges, balance transfers (balance transfers are not available on Delta SkyMiles Business Credit Cards), cash advances, purchases or reloading of prepaid cards, or purchases of other cash equivalents.

- Only miles earned, awarded, or received on the Card you selected for Fly Now, Earn Later will be applied to your Fly Now, Earn Later Balance.

- Your Fly Now, Earn Later Balance will be updated each billing period to reflect miles earned, awarded, and received during that billing period.

- You can view your Fly Now, Earn Later Balance online.

- If, on the End Date, the miles earned, received or awarded to your Fly Now, Earn Later Balance equal or exceed the number of miles borrowed, there will be no charge for borrowed miles. If, on the End Date, there are miles remaining in your Fly Now, Earn Later Balance, your Card account will be charged for those remaining miles at a rate of $0.025 per mile. You will not earn miles on this charge.

- If your Card account is cancelled anytime between the Start Date and the End Date, any miles remaining in your Fly Now, Earn Later Balance at the time of cancellation will be charged to your Card account at a rate of $0.025 per mile.

- If your Card Account enters bankruptcy status or hardship status anytime between the Start Date and the End Date, any miles remaining in your Fly Now, Earn Later Balance at that time will be charged to the Card account at a rate of $0.025 per mile.

Analysis

Overall, this sounds like a great way to get miles when you need them (perhaps you’d like to try out the new A350 Delta One Suite, for example). You then have 6 months to earn those miles in order to avoid paying for them.

The problem is that you have to earn back those miles on the same card in which you borrowed the miles. If you earn Delta miles from flying; or by transferring from Membership Rewards, SPG, or Marriott; or from the Delta SkyMiles shopping portal; or even from other Delta SkyMiles cards you have, those miles will not pay back the miles you borrowed. You could still get stuck paying 2.5 cents per mile.

The obvious solution to this problem is to make sure to spend enough on your Delta card over the next 6 months to earn back the borrowed miles. Unfortunately, this means spending less on more lucrative cards such as the Blue Business Plus which earns 2X Membership Rewards per dollar, or SPG which earns 1 point per dollar. Membership Rewards can be transferred to Delta 1 to 1 (with a very small fee), and SPG points can be transferred to Delta 20,000 to 25,000. Both are better than the Delta Gold card for earning Delta SkyMiles, but neither will help you “Earn Later.”

If you really need to borrow miles, though, the best choice is to use a Delta Platinum or Delta Reserve card. Both offer bonus miles and bonus MQMs (elite qualifying miles) with high spend:

- Delta Platinum: Spend $25,000 within a calendar year and earn 10,000 bonus miles and 10,000 MQMs. Spend $25,000 more within the same calendar year and earn another 10,000 bonus miles and 10,000 MQMs.

- Delta Reserve: Spend $30,000 within a calendar year and earn 15,000 bonus miles and 15,000 MQMs. Spend $30,000 more within the same calendar year and earn another 15,000 bonus miles and 15,000 MQMs.

To increase spend, you can use a service like Plastiq to pay your rent, mortgage, or other bills that can’t normally be paid by credit card. The service charges 2.5%, but if you earn bonus miles as shown above, the cost per mile will end up being significantly less than the 2.5 cents per mile charged by Amex.

For example, let’s take a mythical scenario where you borrow 90,000 miles with the Delta Reserve card and you don’t have any spend planned for that card. You could then make mortgage (or whatever) payments through Plastiq totaling $58,540. With Plastiq’s fees, you’d charge a total of $60,003.50 to your Delta Reserve card. You would earn 60,004 base miles and 30,000 bonus miles (thanks to hitting $30K and $60K of spend), plus you’d earn 30,000 MQMs (more than enough for Delta Silver status). Your cost per mile in this scenario would be $1463.5 / 90,004 = 1.6 cents per mile. I wouldn’t normally want to buy Delta SkyMiles at that price, but it is way better than getting stuck with a charge of 2.5 cents per mile. Plus, if you’re interested in Delta elite status, the MQMs make it all worthwhile.

Even better than Plastiq bill payments would be to pay federal taxes at a rate of 1.89%. For more ideas about ways to increase credit card spend, see: Manufactured Spending Complete Guide. But, be careful. The terms of this offer clearly state that purchases of prepaid cards (i.e. gift cards) are not eligible purchases. I doubt they’ll enforce this restriction, but there’s always a chance that they will. That’s why I prefer options such as Plastiq and tax payments if you do not have enough regular spend to earn back the miles.

Help me out here. I’ll be buying Delta tickets to Hawaii in the next couple of months. Should cost in the neighborhood of $4,000 – $4,500, which I will pay with my Gold SkyMiles card. Currently, I have 60K miles accrued, so could reduce this cost by $600.

I’m only eligible for a relatively small number of advance miles. But even if I only got 5K advance miles, I’d reduce my airfare by another $50 and would easily spend enough in six months.

Is there a downside to this?

I don’t see a downside to that as long as you’re comfortable with getting only 1 cent per point value from your miles. It is sometimes possible to get substantially more value by using miles to book award flights rather than using them to reduce the cost of flights.

Living on borrowed time/money is the American dream, don’t ruin it for people!

Hey Greg

That restriction is written in the T&C of all amex cards as far as what kind of purchases earn points. They never seem to enforce outside of recently for those people who MS’d the sign up bonus for MR cards. They clawed those sign up bonuses back. Other than that I think it’s just a formality

Haha. That made me laugh cost of 2.5 cents per mile!!!

Thank you for the excellent, thorough analysis. Actually, I think that this is, ironically like carrying a “reverse balance” on your card, which seems contrary to everything about this points and miles game. Just like you should not spend money you don’t have, you should probably not spend miles you do not have.

@ joE, you are so right.

BTW, we busted out laughing with the “Skypesos Logo” on the original email…