Years ago, I wrote a post about Hilton’s funny math (which isn’t necessarily about Hilton being bad at math as much as it is showing how playing with the length of your stay can help you identify how to save points). Lately, in the planning phases of my 100K Vacay trip, I’ve stumbled on another bit of Hilton math fun: the static-but-dynamic way that cash & points stays are priced can make a difference in your bottom line.

Hilton “Points & Money” vs other cash & points programs

Like most other chain hotel programs, Hilton offers a way to pay partly with points and partly with cash. Whereas that option is sometimes available with Hyatt and Wyndham, and rarely available with Marriott, it is always available with Hilton, IHG, and Choice Privileges.

It is important to understand that there are differences between how programs handle their cash & points stays. For instance, with IHG and Choice Privileges, you are essentially buying the points in the background; your card is charged immediately. If you book a cash & points stay with one of those programs and you later change your mind and cancel, you’ll get back points, not cash.

However, with Hilton (and also Hyatt), a cash & points reservation is postpaid (which is to say that you pay the cash component at checkout). The points will be deducted from your account immediately, but the cash portion gets paid directly to the hotel. If you cancel a Hilton Points & Money award by the cancellation deadline, you’ll get the points portion back. The “cash” portion will not yet have been charged, so you get neither points nor money back for that part. This is not directly relevant to the main point of this post, but it is worth understanding that when reserving through Hilton with Points & Money, you are not buying the points (in other words, for clarity, this is not a trick to buy points more cheaply).

Hilton does the math to price Points & Money stays

When you book a Points & Money stay with Hilton, they essentially do the math for you to figure out how many cents you’re getting per point, given the current room and award rate. They calculate the cents per point you’d get with a full points redemption and then keep that value constant when you move the slider down to use fewer points, increasing your cash cost based on that cents-per-point value.

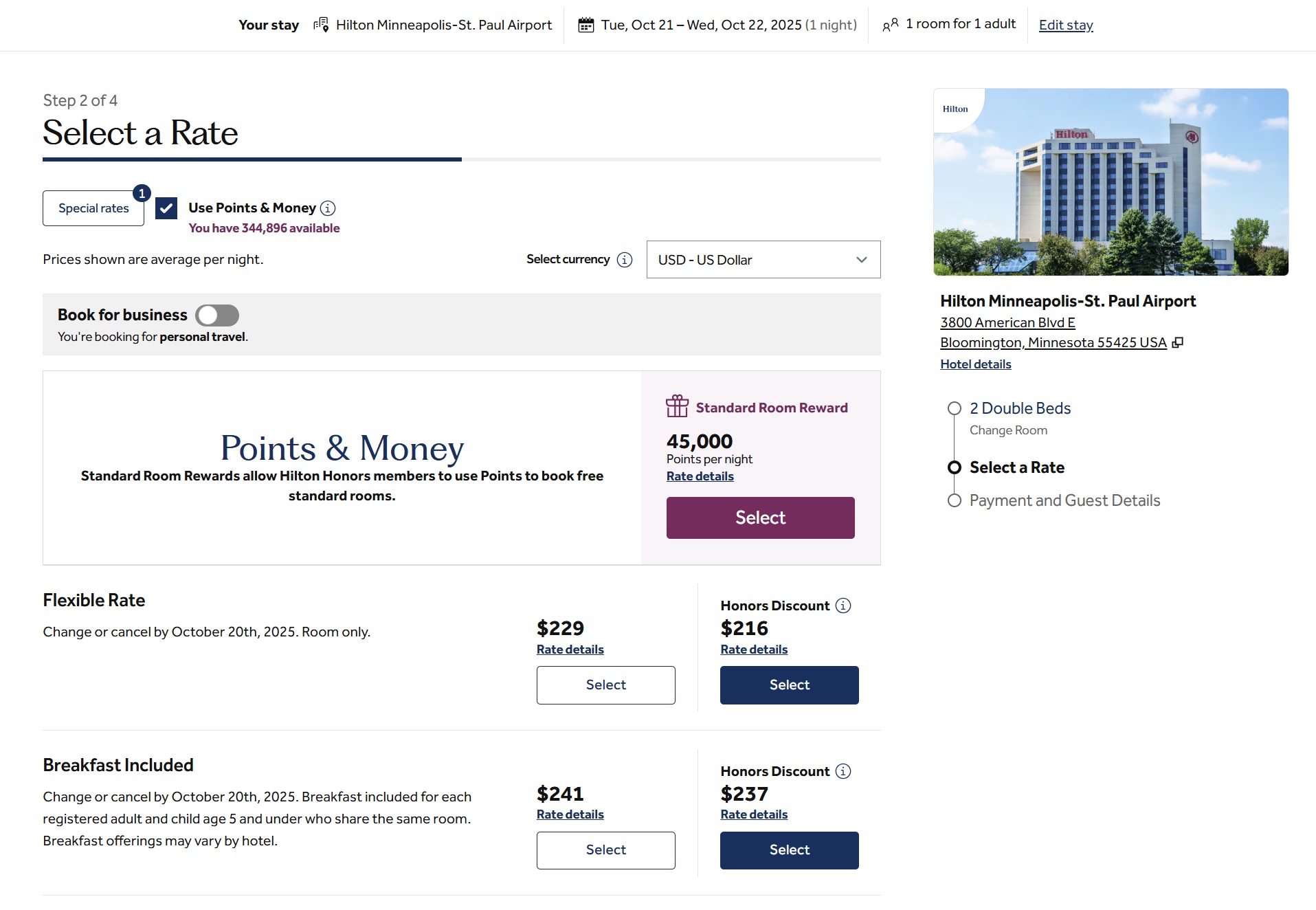

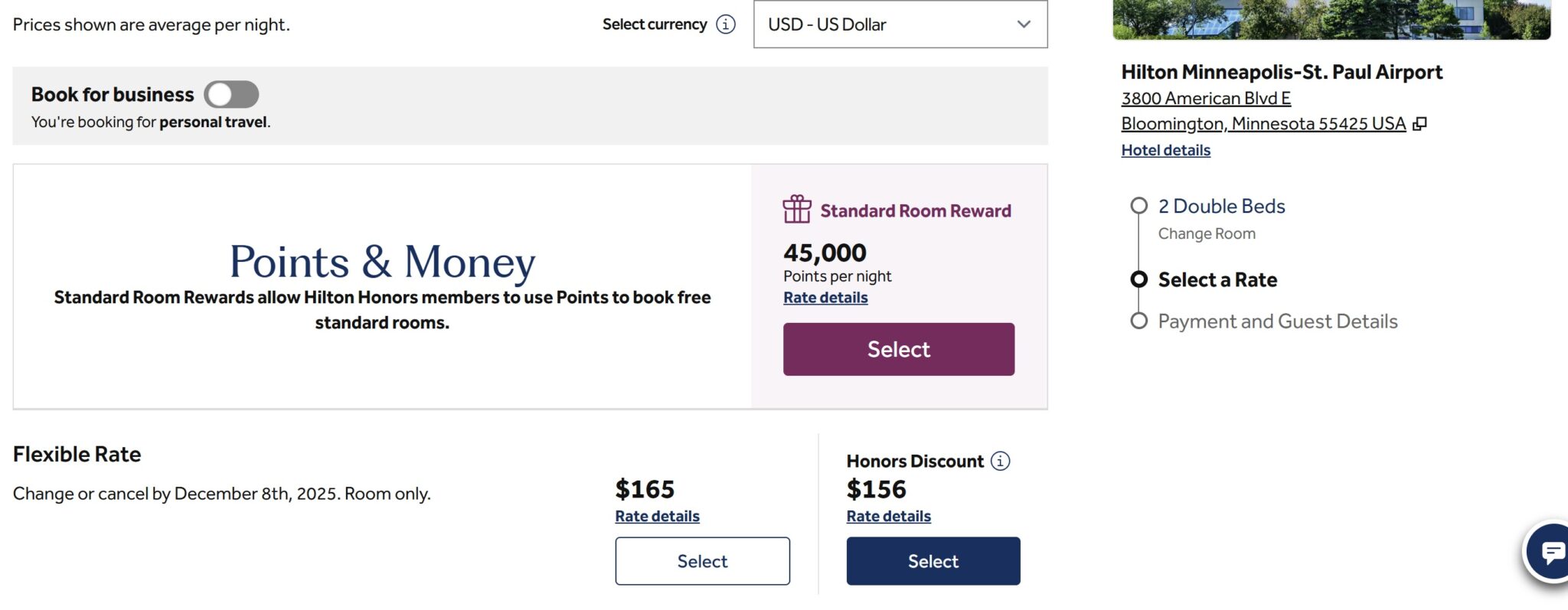

For instance, let’s say you needed a hotel by Minneapolis-Saint Paul Airport for one night. The Hilton Honors member rate on a sample date in October is $216 + tax. Alternatively, you could pay 45,000 points.

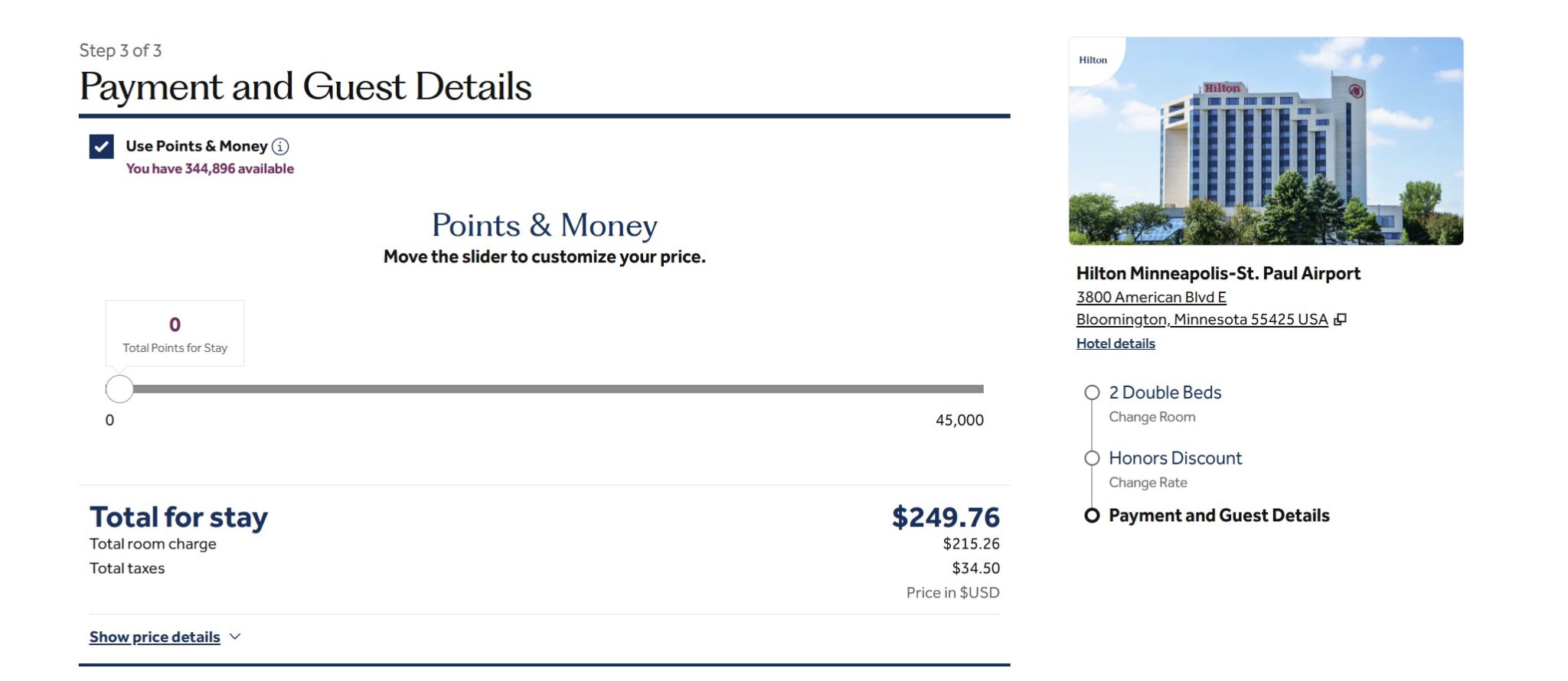

The member rate shown above is before tax. The all-in price with tax is just shy of $250.

In this instance, the cash price of $249.76 divided by 45,000 points means you’d be getting about 0.55c per point if you used points.

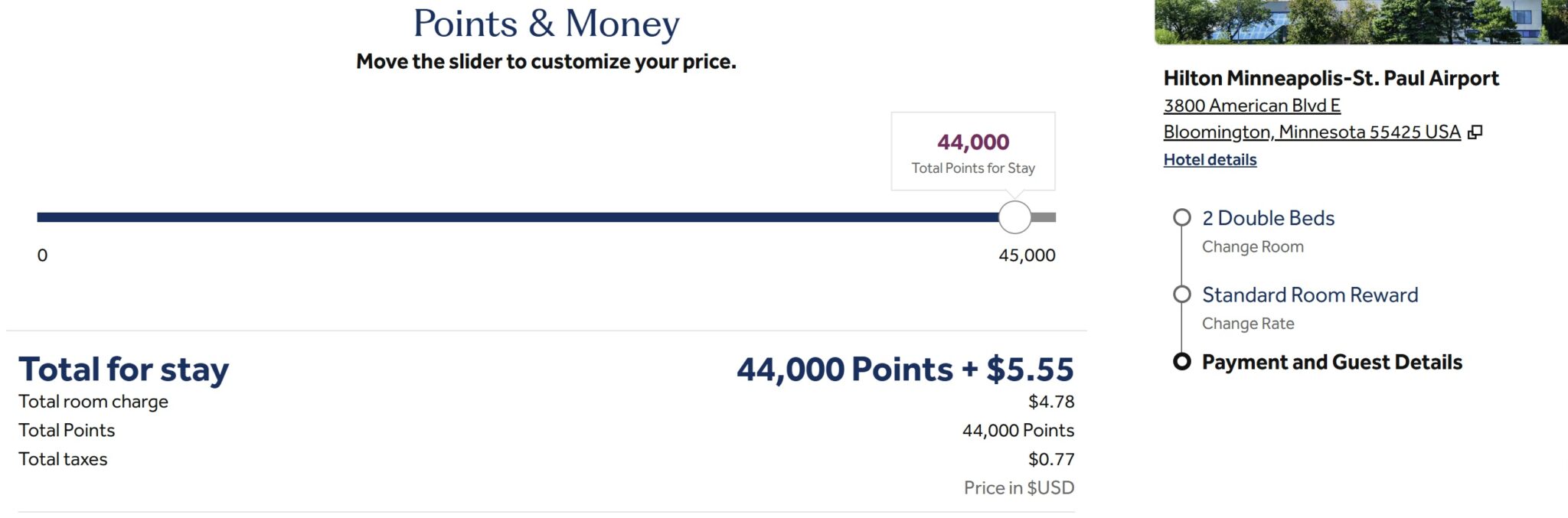

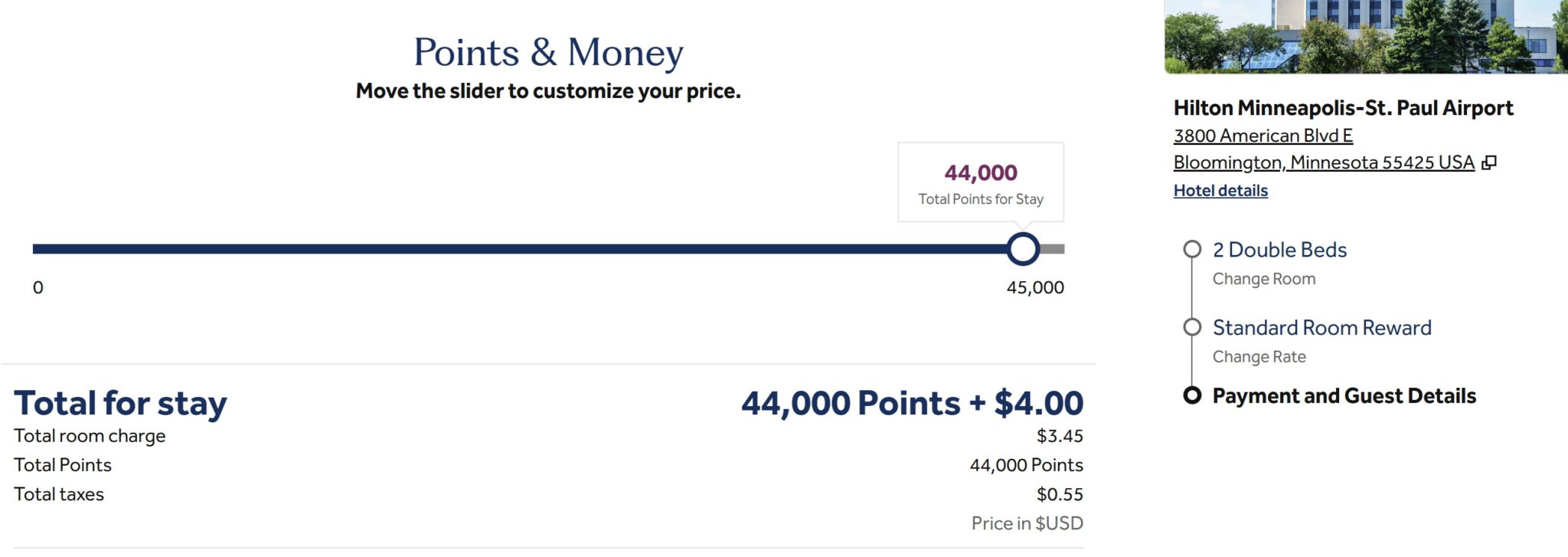

If you choose to use Points & Money and move the slider down to use fewer than 45,000 points, you’ll notice that every 1,000 points fewer that you pay for the stay moves the cash component up about $5.55. For instance, you could pay 44,000 points and $5.55.

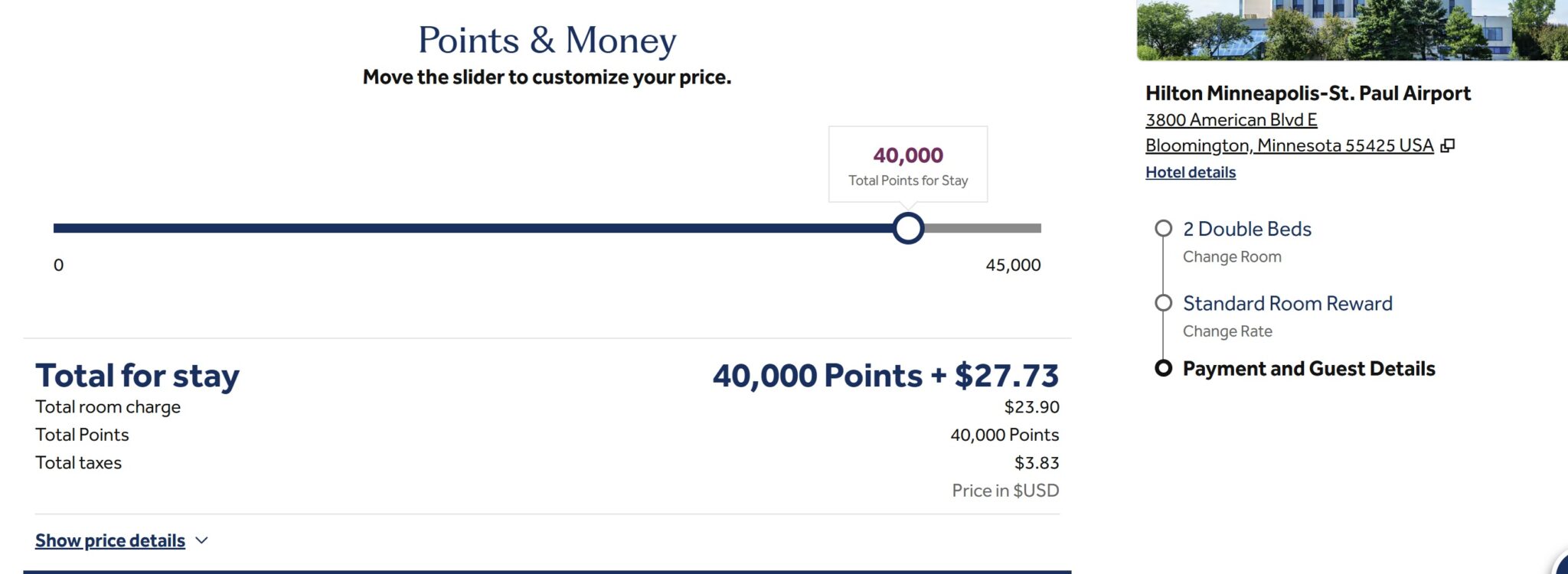

If you only paid 40,000 points (saving 5,000 points), the cash component would be 5,000 x 0.0055c (just over half a cent per point), which would be about $27.50, though I was simplifying the math above with some rounding, so after accounting for more decimal places, the cash component is $27.73. “Saving” 5,000 points will cost you $27.73.

However, the 0.55c per point value of Hilton points shown above is not static. Our Reasonable Redemption Value for Hilton points is 0.41, though our most recent analysis shows that the true value ranges from 0.19c to 1.27c per Hilton point.

On a different date in December, the same property could be booked for 45,000 points or a rate of $156 before tax, which comes to $179.95 all-in.

This presents a value of about 0.4c per point ($179.95 / 45,000). So, in this example, moving the points slider to save 1,000 points will only cost you $4.00.

If I dropped the slider to use 40K points, I would expect the cash co-pay to be about $20, etc.

To be clear, the cash component is lower here because the value you are receiving in exchange for your Hilton points is lower. In this case, 45K points would buy you a room that is selling for $179.95 in December. In the previous example, 45K points would buy you a room that is selling for $249.76 in October. While the October redemption is a better “deal” in exchange for your Hilton points, it means that using fewer than the full award cost of 45K Hilton points on that October stay will cost you more cash out of pocket.

Use Hilton Points & Money carefully

Why does the above matter? The situation where it may be particularly important for you is when your finite pile of points doesn’t quite cover your lodging needs and you need to decide where to use cash & points for your trip.

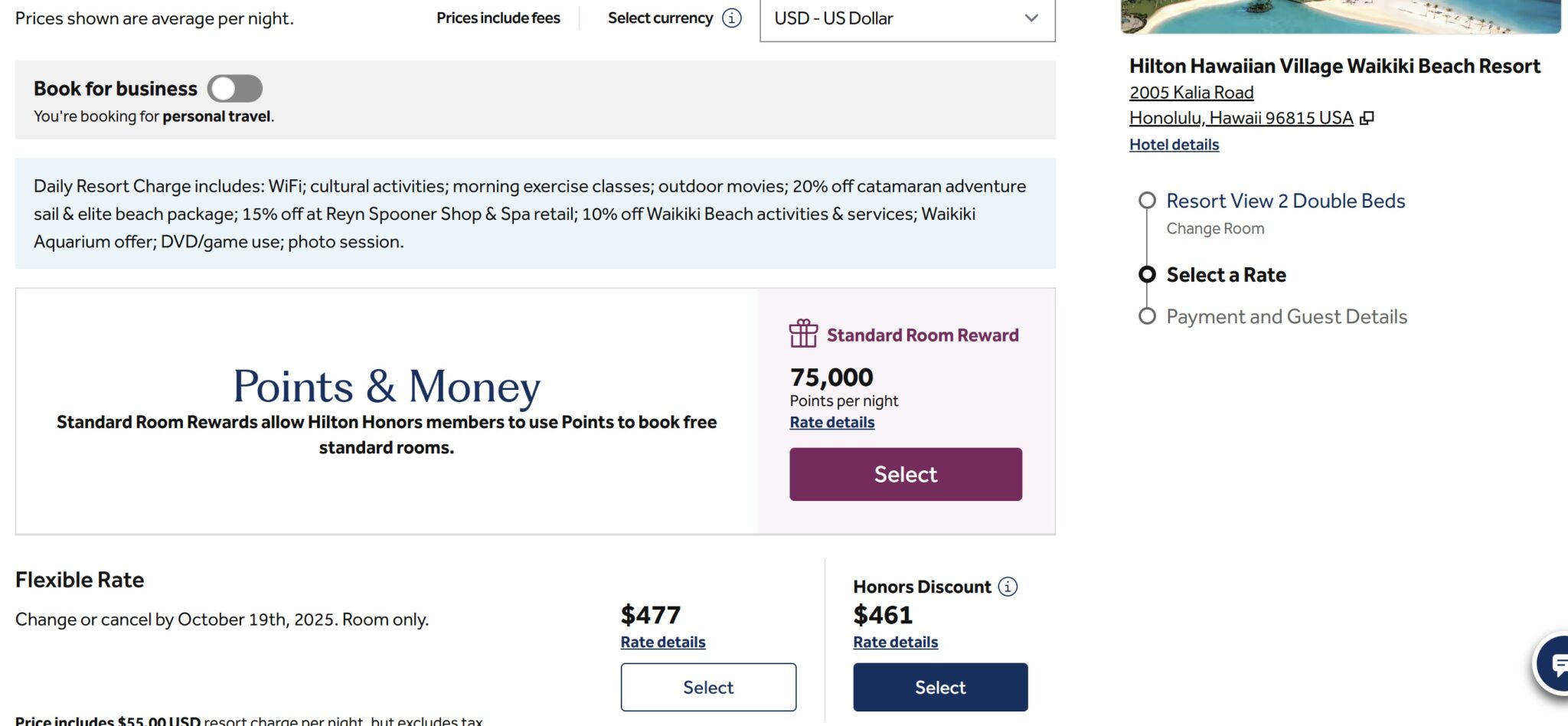

For instance, let’s imagine that you were spending that night at the Minneapolis-Saint Paul airport in December on the night before a trip to Hawaii, where you planned to spend a night at the Hilton Hawaiian Village Waikiki Beach upon arrival. On a sample night in December, that hotel costs 75,000 points or $461 plus tax, which comes to $543.70 all-in.

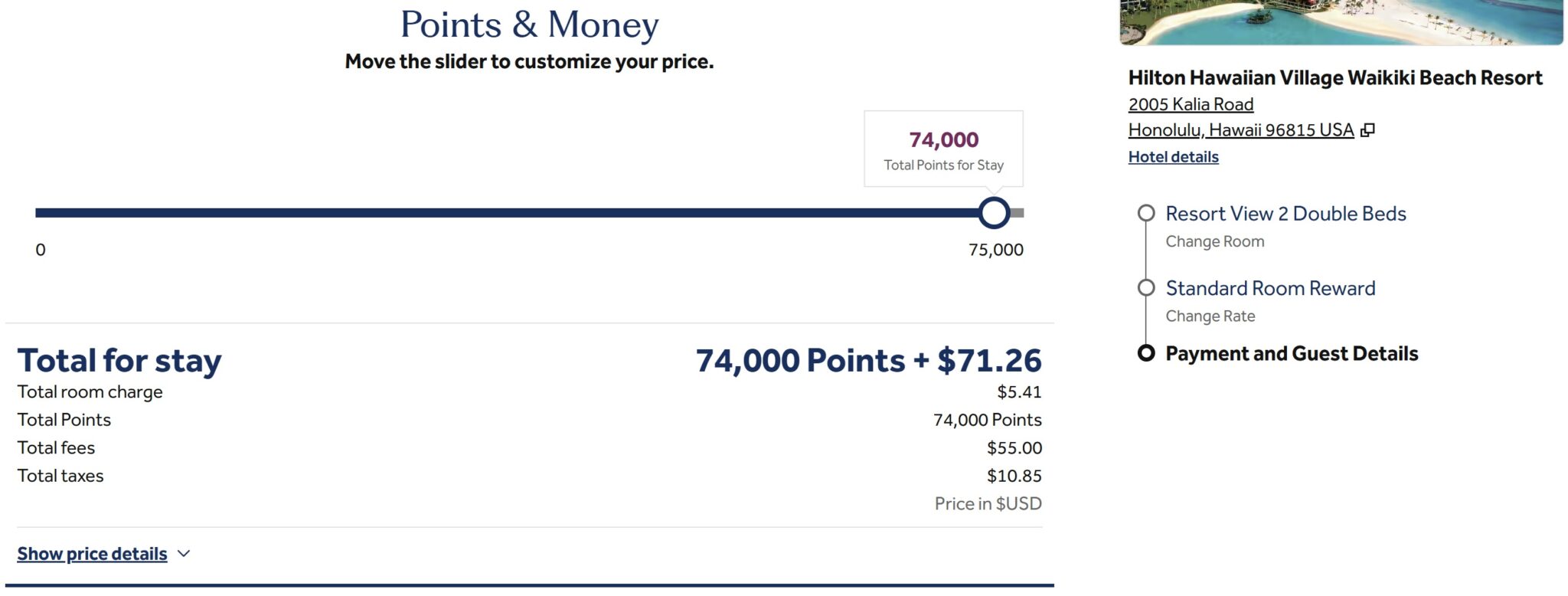

This property is yielding a higher value per point at 0.72c per Hilton point ($543.70 / 75,000). In this case, every thousand points you peel off the award price via Points & Money will cost you more than $7 out of pocket (and, as pointed out by many commenters, using points & money here subjects you to the $55 resort fee, which you would otherwise save when redeeming 75,000 points).

Now let’s suppose that you wanted to book the night at Minneapolis airport in December (45,000 points) and the night on Waikiki Beach (75,000 points). That would cost a total of 120,000 points.

However, further suppose that you only have 100,000 points in your Hilton account, so you are 20,000 points short of being able to book both as pure award stays.

Should you:

- Use points & Money on the Honolulu reservation, paying 55,000 points + cash (and cover MSP in full with your remaining 45,000 points)

- Use Points & Money on the Minneapolis reservation, paying 25,000 points + cash (and cover Honolulu in full with your remaining 75,000 points)

- Buy the additional 20,000 points to book both award stays, taking advantage of the current points sale (Hilton is selling points for 0.5c per point), paying $100 for the 20K points you need.

One choice is clearly better than the others.

If you chose Option 1 to use Points & Money on the Honolulu reservation to reduce your cost by 20,000 points, you’d pay 55,000 points and $192.51. The Minneapolis reservation would be “free” (covered by your remaining 45,000 points).

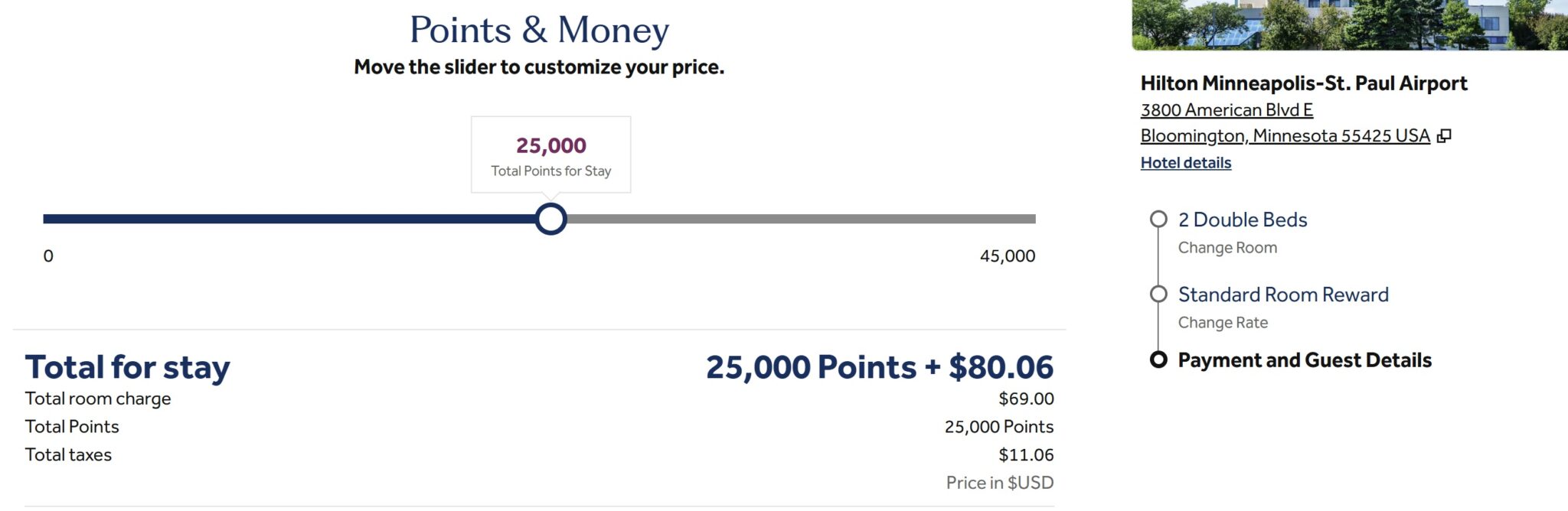

If you chose Option 2 to Use Points & Money on the December Minneapolis reservation to reduce your cost by 20,000 points, you would pay 25,000 points and $80.06 for that Minneapolis stay. The Honolulu reservation would be “free” (covered by your remaining 75,000 points).

If you chose Option 3, you would buy 20,000 points for $100 to boost your points balance to 120,000 total points so you could cover both reservations in full with points.

In this scenario, you would be best with Option 2! You would save $110 by using Points & Money on the Minneapolis reservation, where your points are buying the room at fewer cents per point, over using Points & Money on the Honolulu reservation, where your points have more purchasing power (and therefore a higher cost when you drag the slider to use fewer points). And you’d only be paying $80 out of pocket, which is a better deal than buying the necessary points to cover both for $100 out of your pocket.

However, I want to re-emphasize that the answer here isn’t static.

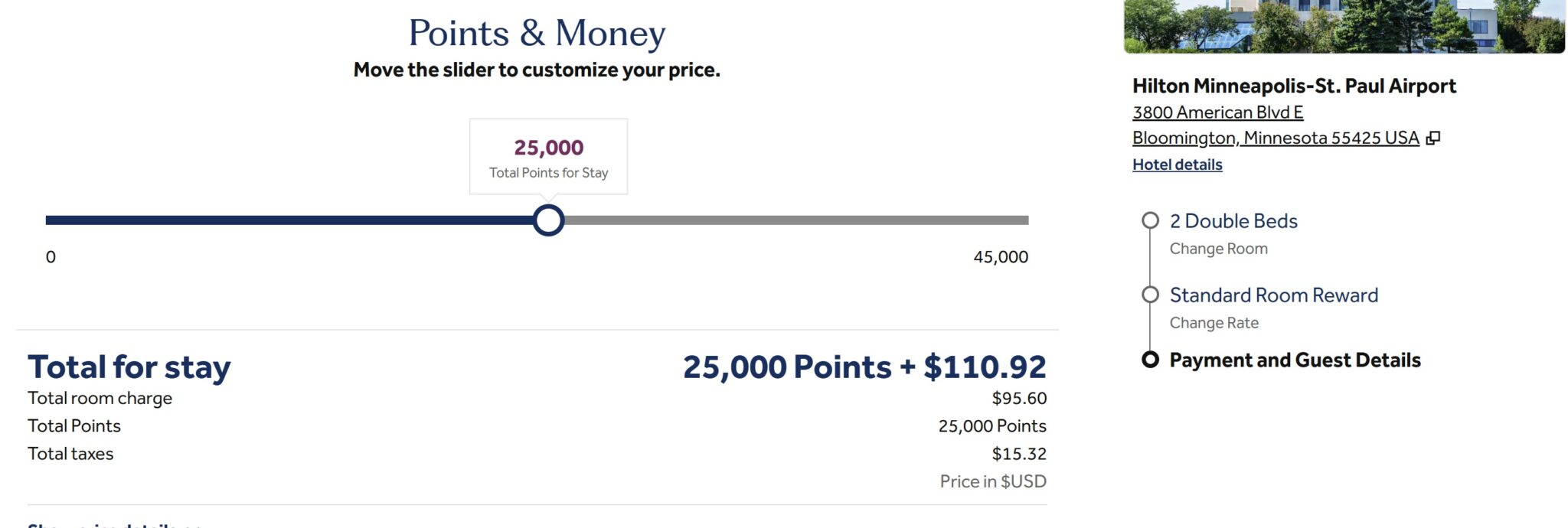

Let’s suppose your trip were in October, when you were getting 0.55c per point in Minneapolis (and let’s imagine Hawaii had the same value as in December). When the points are worth more against the cash rate, you’ll pay more out of pocket to replace the buying power of the points. In October, you’d need 25K points plus $110.92 for the Minneapolis hotel.

In that case, your options would be:

- Book Hawaii using 55K Hilton points + $192 and use 45K points to get Minneapolis “for free”

- Book Minneapolis using 25K Hilton points + $110.92 and use 75K points to get Hawaii “for free”

- Buy 20K Hilton points for $100 and use your 120,000 points to get both hotels fully covered (75K + 45K = 120K).

In that scenario, you would be better off buying the points in the current sale for $100.

The takeaway

If you have a limited number of Hilton points and you can not fully cover your lodging needs for an upcoming trip, you really need to take out a calculator and compare your options. It will sometimes make sense to buy the points to bridge the gap, but other times you will be better off using Points & Money.

Ironically, while we train ourselves to seek out high-value redemptions, your best use of Points & Money is when you’re getting lower value per point toward the cost of a room. I hate a suboptimal redemption as much as anyone, but this came into play for me as I was making a reservation earlier today where I wanted to use Points & Money on one stay or the other. I realized that I was far better off using Points & Money on the lower-value stay (which is to say the stay where the points price was high and the cash price was low) than using Points & Money on a stay where I’m getting stellar value per Hilton point.

Depending on how sharp you need to make the pencil, you might even check whether the cash rate is different for one person versus two people. I noticed a situation yesterday where the cash rate for 1 adult was $20 less than the cash rate for 2 adults, so using Points & Money would cost less if booking for 1 adult (note that I am not suggesting you book for one and show up with two, just that if you are traveling alone, it can be worth checking the Points & Money rate for a different number of guests).

Bottom line

Hilton’s math is actually spot on when it comes to Points & Money reservations, but that means you’ll prefer buying the points you need if you are short on points for a high-value redemption, whereas you’ll be better off using Points & Money to book (instead of buying points) when you’re making a redemption at lower value per point. And if you have to choose between a couple of upcoming reservations to decide where to consider using Points & Money, you’ll want to use a cash component on the stay where the points are worth less. And keep in mind that if you have a credit card that gets a quarterly Hilton credit, that might be a good one to use for that cash component.

Would you mind sharing some of the “worst value” hotels for Hilton points. So we can be sure avoid them? Or at least pointing vaguely in their direction?

thank you for the work here and leaving out selfies today

Does Hilton always use the Hilton Honors member rate, even if you have other rates available to you?

No, this should also work with most other discounted rates that may be available to you. Honors Member Rate is just the default selection when you’re logged in with an Honors account.

Just FYI, a Pinterest ad popped up on my cell phone while trying to read this article and it completely blocked the entire iPhone screen and there was no “x” anywhere to get out of it. I had to hit the back browser and return to the article again.

Actually, it seems like the big takeaway here is that points+money is a great way to use the various credits on hilton Amex cards in some useful way.

With all due respect unless you are broke NEVER redeem points or miles for a value less than replacement cost. If points can be purchased for a half cent each NEVER use them if you dont get that value or more — use cash.

And you need to include in the math the points you earn when using cash.

Sorry Nick but the advice you gave makes little sense. Use cash in MSP is better. ALWAYS

The minimum example in the post is 0.4cpp, which is of negligible difference as compared to 0.41c per point (our Reasonable Redemption Value, which is the value you can reasonably expect to get when redeeming). That’s the median redemption, so telling people to never use Hilton points at less than half a cent is telling them to never use them at more than 50% of the Hilton hotels in the world. That’s a narrow vision of the way people redeem that just doesn’t fit the breadth of reality.

Most folks don’t have an unlimited number of points, nor do they have an unlimited reserve of cash, so there are times when they might use one or the other at what you may deem as a suboptimal use, particularly if their travels frequently take them to the more-than-50% of Hilton properties where they’ll get less than half a cent per point.

I also tend to think that in some situations folks may use a welcome bonus at what you may consider to be suboptimal value. For instance, if someone opens a card with a 100K Hilton point bonus to cover a specific hotel stay that otherwise costs $400, I don’t think it is entirely unreasonable for them to keep $400 in their pocket rather than spend the $400 holding out for a time when they hit a Hilton property that offers them $500 worth of value — which may or may not happen this year or next year or wahtever.

But the point of this post isn’t to argue all of that. The point of the post is to bring awareness to the fact that if you don’t have enough points to fully cover your award stay (a situation that is probably relatable for the vast majority of people), you need to be strategic about how you choose between Points & Money and/or buying points because it can make a pretty sizable difference from one stay to another.

To be clear, I don’t personally make a habit of redeeming Hilton points for less than half a cent each, but I recognize that my personal circumstances and habits aren’t universally applicable — and regardless, the point here wasn’t to tell people how to redeem but rather how to compare.

Nick, I think you may be off by a decimal place here:

“In this case, every thousand points you peel off the award price via Points & Money will cost you more than $71 out of pocket.”

Shouldn’t it be every TEN thousand…?

It should be $7.10 to reflect the one thousand point increments of the slider.

Nick we’re begging you to put your drafts into ChatGPT for accuracy, clarity, simplicity, and grammar.

It hurts the FM brand when the numbers are wrong and the examples are unnecessarily convoluted (Just pick one property on two different dates with different cpp value to illustrate the [very good] point). Include important caveats like resort fees and 5th night free.

You are too good not to be better!!!

Actually, my mistake there was that the $55 resort fee was included in the Points & Money total (so it really was $71.XX when taking 1,000 points off of the price, but you guys are correct that only ~$7.20 of that is from Points & Money and the other $55 is from the resort fee). Not sure ChatCPT would have caught that, but thanks for the suggestion. Resort fee was a great point I should have added, but I didn’t want to get into the weeds with the million other variables (maybe you have an Amex Offer for Hilton, maybe you’re targeted for 30% back on Hilton via Capital One Shopping, maybe you have quarterly Hilton credits to use, etc) but rather illustrate the need to look at the cents per point being yielded when using Points & Money. That should be the takeaway. If you never use Points & Money, then this post probably wasn’t written for you. Personally, I haven’t used it before, so I hadn’t paid attention to the difference and thought it may help to point it out for those who do use it.

I mean the bottom line is why would one redeem points via Hilton at less than 0.5 cents? Unless these points came from a sweepstakes that’s just points murder.

I think it’s reasonable to use a welcome bonus at our Reasonable Redemption Value — that is the value at which our first-year values that appear on card pages and the best offers page are calculated. I prefer redeeming Hilton points for higher value, but since 0.41c is the median value, I think it is probably very, very likely that many readers have redeemed Hilton points from a welcome bonus at somewhere between 0.41c per point and 0.5c per point.

Furthermore, with a current 25% transfer bonus, a stay that yields 0.45c per point is giving you a reutrn of 1.125c per Amex point. Is that the value at which I want to redeem my Amex points? Absolutely not. But do people redeem for Schwab deposits at 1.1c per point? They absolutely do. Hard to call the transfer to Hilton in that situation entirely unreasonable. It isn’t a trade that I would take, but if you’re going to take a trade like that, you need to know how to not overspend on filling the difference with Points & Money.

The points & money reservations are usually how I use my Hilton Surpass & Biz plat $50 quarterly Hilton credits. If I don’t have a way to use my credits one quarter I will email the hotel I’m staying at the next quarter to see if I can go ahead and pay $50 or $100 of the cash portion.

This is the move that was really the impetus for the post.

Great insightful post Nick!

Another factor to consider when staying 5 nights, the 5th night free only works with points only, not points and money. So it would always be better to do option 3 in that case. Buy points in order to be able to cover it fully with points.

Another consideration is that the destination fee or resort fee, if it exists, can be waived on an all-points stay.

good point

Cash on an all cash stay

divided by

points on an all points stay

equals

the “normal” redemption value per point we think of.

(Cash on an all cash stay – cash on a points-plus-cash stay)

divided by

(Points on an all points stay – points on a points-plus-cash stay)

equals

Redemption value per point on a points-plus-cash stay

Which booking offers the better redemption value per point?

Best of luck.

You will probably get it intuitively when a similar situation arises for yourself. Nick delves into the nitty gritty and I enjoy reading the analysis. For myself, I just think of points as a different type of currency. Sometimes it’s worth it to pay in points and sometimes it’s not. If possible, I try to save my points for 5th night free situations because then I know I’m getting my money’s worth.

Hilton often sells points directly for $5 per 1,000.

With Points & Money slider, you’re effectively buying points from Hilton at whatever rate the slider implies (Determined by the CPP rate for a given property).

If the slider price is less than $5 per 1,000 points, you’re buying points cheaper than Hilton itself sells them. Redeeming those discounted points is arbitrage—you come out ahead.

If the slider price is more than $5 per 1,000 points, you’re overpaying compared to Hilton’s own sale price. That’s a bad trade.

Crucial caveat: with all-points bookings, Hilton waives resort fees. With slider bookings, those fees come back onto the bill. So even if the math looks good, the extra fees can wipe out the advantage.

I would have framed this article as Hilton’s Slider Hack: How to Stretch Your Points Further or whatever hooks the algorithm these days haha.