| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

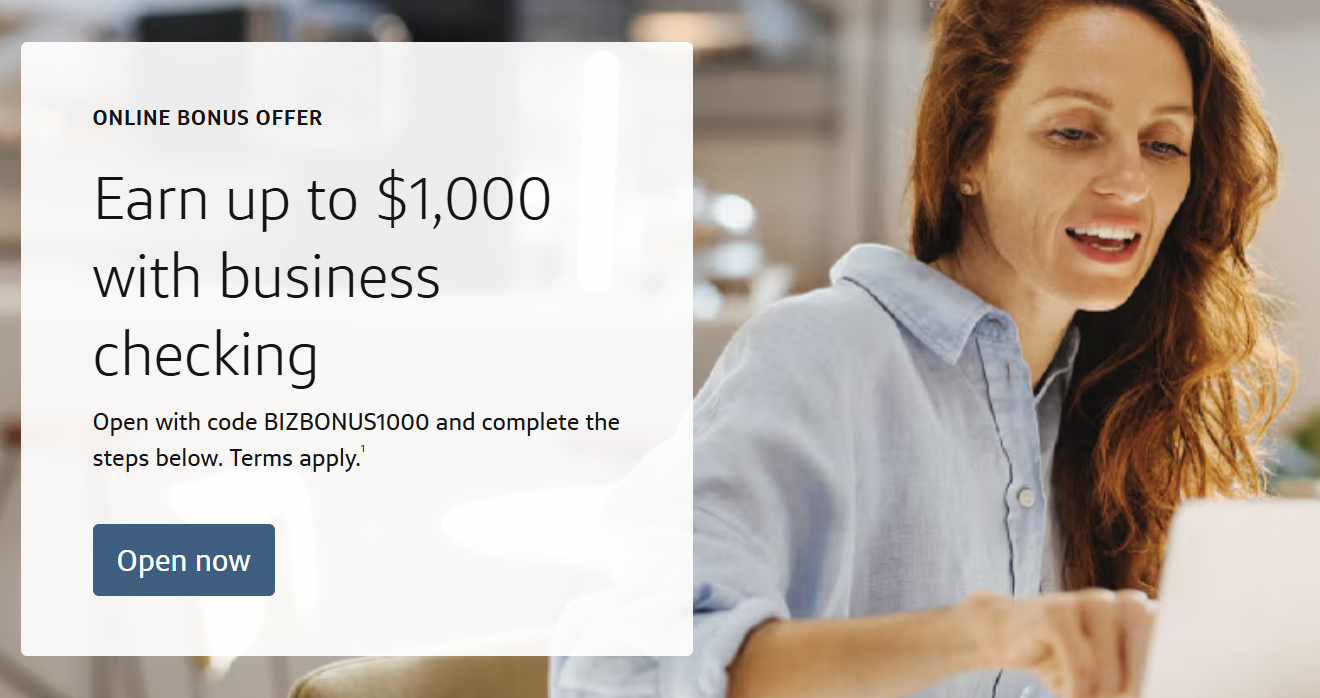

Capital One is currently offering a $500 or $1,000 bonus when you open a new business checking account, deposit either $5,000 or $30,000 within 30 days, leave the funds in the account for 60 days, and then make at least 10 qualifying transactions (like a remote check deposit or ACH transfer).

If you have the cash, that’s a pretty easy return without having to worry about any direct deposit requirements. This bonus is available nationwide.

The Deal

- Capital One is offering either a $500 or $1000 bonus when you open a new business checking account, deposit the required amount within 30 days, keep the funds in the account for at least 60 days, and make at least 10 qualifying transactions.

- The $500 bonus requires $5,000 in deposits.

- The $1000 bonus requires $30,000 in deposits.

- Must use the promo code BIZBONUS1000 when opening the account.

How to earn the bonus

- Open a new Basic or Enhanced Business Checking account with promo code BIZBONUS1000.

- Deposit required balance from non-Capital One accounts within 30 days of account opening. ($5,000 for the $500 bonus; $30,000 for the $1,000 bonus).

- Maintain the minimum required end-of-day balance for at least 60 days during the first 90 days of account opening.

- Make 10 qualifying electronic transactions within 90 days of account opening. Qualifying transactions include electronic wire, electronic ACH, and remote check deposit.

- Basic Checking account incurs a $15 monthly service fee, which can be waived with a minimum balance of $2,000. Enhanced Checking account incurs a $35 monthly service fee, which can be waived with a minimum balance of $25,000.

Terms and Conditions

Quick Thoughts

Based on the terms, you only have to leave $5K or $30K in the bank for 60 days to get the bonus. It doesn’t matter how the funds get there (ie, no direct deposit requirement), so long as they don’t come from another Capital One account. These business checking bonuses used to require you to have a Capital One business credit card in order to apply, but there’s no such requirement on this one as far as I can see.

It’s important to note that the net upside is a bit lower than $500 or $1000. You’re effectively losing 60 days of interest on the money that you put in. Still, the $500 bonus is like earning ~60% APR on your money for two months, while the $1000 earns ~20%. That’s clearly far better than you could do with a normal high-yield deposit account. The smaller version is a no-brainer if you have $5,000 that you can free up for a couple of months.

Do note that there is a $15 monthly fee for the basic checking account that can only be waived by having a $2,000 minimum daily balance. That’s obviously not an issue when you have the required amount in the account, but remember to factor it in to the deposit or add at least $2,000 initially to avoid the fee being taken off in the first month.

I have multiple Cap One cards and a personal checking but they declined my application – even as a legit LLC. They don’t like real estate businesses where you rent out property it seems. Crazy to me, but will try to reapply as my personal business instead that is a sole properitor.