NOTICE: This post references card features that have changed, expired, or are not currently available

Greg thinks that the ability to book travel through Chase at 1.5c per point is a huge advantage in our 40K To Far Away Challenge. I’m not buying it. I think Greg is either intentionally trying to throw us off his scent or he’s grossly overestimating the advantage of being able to book travel through Chase Travel℠. Lest you make the same mistake he may be making, allow me to explain why being able to book travel for 1.5cpp is cool but far from being as valuable as it is cracked up to be and even farther from being useful in attempting to hang with Stephen and I in this challenge. In short: Greg, I’m not scared of your weapons, secret or otherwise.

More is better, but how much better under ideal circumstances?

As a red-blooded American, I believe that more is better than less. Whether it’s a super-sized cola, a BOGO sale, or an extra quarter of a cent per point in value, I can agree that I’d rather have more.

But how much more value can Greg get than Stephen and I?

Not much.

I know that when the Chase Sapphire Reserve debuted, we all got excited about the ability to redeem points for a value of 1.5 cents each towards travel booked through Chase Travel. Suddenly, the Freedom Unlimited seemed a lot more sexy than a 1.5% cash-back card, 5x bonus categories started to feel like goldmines, and getting 1.5cpp came to be known as a large competitive advantage for the CSR.

And I’ll admit to having drunk some of that kool-aid.

The truth is that I’ve redeemed far more Chase Ultimate Rewards points through Chase Travel than I ever imagined I would (note: zero this year, but far more than anticipated during the previous two years). Over the meta game, small differences really add up. Heavy manufactured spenders may redeem hundreds of thousands of points per year, and the CSR’s additional 0.25cpp over the Chase Sapphire Preferred can become pronounced.

But our challenge is not at all the meta game: it’s the definition of micro-game. Greg, Stephen, and I are starting out with just 40K points each (and $400 cash). Greg has pointed out on several occasions that this means he could just buy $1,000 worth of airfare by redeeming 40K points for $600 in travel through Chase and adding that to his $400 cash allowance. What about Stephen and I?

Nick can get nearly as much airfare

I have 40K Citi ThankYou points. Since I have the Citi Prestige card, that means that I can redeem points at a value of 1.25 cents per point towards flights until September 1, 2019. In other words, if I go after Greg’s strategy of simply buying flights, I can use 40K Citi ThankYou points to book $500 in flights and add in my $400 cash allowance to buy a total of $900 in flights. That’s a mere hundred-dollar difference between Greg and I — a difference of just 10% in purchasing power. I’d call that difference entirely surmountable if not negligible. All I have to do is out-shop Greg. Thanks to dear old Mom, yours truly spent a lot of time couponing his way around the shopping mall as a kid. I don’t know that I can out-shop Greg in terms of flights to get as far away as possible, but I’m not sure that even Greg would be willing to bet big on himself winning that contest.

In short, I don’t think that 1.5cpp is a huge advantage over 1.25cpp when you’re dealing with numbers this small. Sure, there is some advantage — but I think that some strategery can mitigate it.

Stephen is sitting pretty with Schwab

If I were Stephen, I’d be even less intimidated by Greg’s 1.5cpp secret weapon.

Stephen has American Express Membership Rewards points. As he surely knows, those points can be cashed out at a value of 1.25cpp with the Schwab Platinum card.

Side note: I don’t know for sure that Stephen has a Schwab Platinum card. If he doesn’t, he might be smart to open one. If he opened a Schwab Platinum today, he could get all of the following by paying this year’s $550 annual fee and meeting the spending requirements (i.e. he could get all of this before getting charged another annual fee next year):

- The current welcome bonus

- $200 in airline incidental credits for 2019

- $200 in airline incidental credits for 2020 (renews on 1/1/20)

- Up to $200 in Uber credits

- $150 in Sak’s 5th Ave credit ($50 for the second half of 2019, $50 for the first half of 2020, and $50 between July 1st 2020 and when his annual fee hits)

- Amex Platinum benefits like Hilton Gold status, Marriott Gold, National Executive, etc

That’s a pretty decent haul. If he waited until December to apply, he might be able to triple dip the airline incidental credits and pick up another Sak’s credit since his annual fee likely wouldn’t be due until sometime in January 2021, giving him one more chance to use each benefit before paying for year 2. Unfortunately for him, the challenge will be over before December.

But all that is to say that with the Schwab Platinum, Stephen could turn his 40K points into $500 in actual cash, which he could then use for flights, lodging, food, extra cheese on a big mac, a massage, another round at the bar, or to buy the bicycle he’s going to use to ride more miles than we fly. Cash provides the ultimate flexibility, and Stephen can straight up cash out his points for greater value than either Greg or I can.

And I’d argue that for this competition, that makes Stephen’s points worth way more than Greg’s.

Why Greg’s points are worth much less under our specific circumstances

The particular challenge the three of us are facing is to get as far away as possible. We’ve deliberately left the rules loosely-defined and the coronation of a winner open to debate. Will it be the one who flew the farthest in cumulative segments? The one who got the farthest from the starting point? The one who booked the coolest trip? You’re going to decide.

But in order to win, we’re obviously going to need to travel far. Greg ran some example math in yesterday’s post. Specifically, he talked about how he’d “easily” beat my ability to fly back and forth to Hawaii with the following nested itinerary that he said is entirely bookable:

- New York to Copenhagen one-way for $165 (3,856 miles distance)

- Copenhagen to Los Angeles (via Vienna) round-trip for $279 (13,365 miles distance, round trip)

- Los Angeles to Shanghai (via Xi’an) round-trip for $398 (15,235 miles distance, round trip)

- Copenhagen to Madeira Portugal via Manchester one-way for $118 (2,217 miles distance, round trip)

- Total price for airfare: $960

- Total miles flown: 34,673

Except, unfortunately for Greg, it is not entirely bookable at that price.

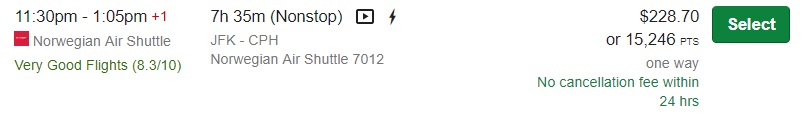

If Greg’s goal is to get as far as he can on cheap airfare, it will undoubtedly involve booking some budget airlines. For example, Greg could fly from New York to Copenhagen for $165 as he says….on Norwegian.

The problem with that? Greg can’t get that price through Chase. Chase Travel prices the same flight at $228.70.

Suddenly, Greg’s master plan would increase in price by $63 and put him over budget if he booked through Chase.

Suddenly, Greg’s master plan would increase in price by $63 and put him over budget if he booked through Chase.

But “No problem!”, you say. “Greg can take that $165 from his cash budget”. True story. Greg would then be down to just $235 left in his cash budget plus his 40K points.

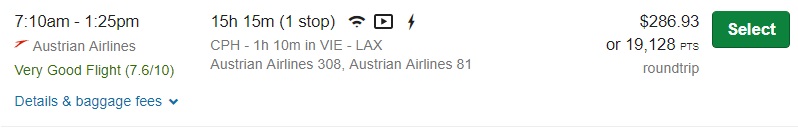

Next up, he said he could fly from Copenhagen to Los Angeles round trip for $279. That’s true if he uses cash.

But if he books those same flights through Chase, they will cost him $287 in cash or points — a difference of only $8, but that eight bucks could be the meal that breaks him in this challenge.

This time, we should assume that he’ll book through Chase Travel (since he doesn’t have enough cash left to pay cash), thereby increasing his theoretical total paid for this mythical trip from $960 to the true price of $968 thanks to overpaying for the flight from Copenhagen to Los Angeles.

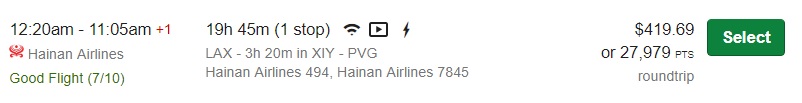

Then there’s that $398 round trip flight he mentions from Los Angeles to Shanghai, where he’d earn 10,000 Alaska miles that he could use for a round trip from Portland to Seattle or something. Unfortunately for Greg, he wouldn’t have enough cash left to book it for $398 through Google Flights.

That’s a bummer since Chase is going to want an additional ~$21 for those same flights.

That’s a bummer since Chase is going to want an additional ~$21 for those same flights.

Toss another $21 on top of Greg’s theoretical budget since he’ll have to overpay for that flight, too. For those keeping track, he’s now spent $989 on his flights assuming that he uses the cash he has left to book that $118 flight from Copenhagen to Madeira.

That would leave Greg with eleven dollars. That’s eleven dollars for food, lodging, experiences, tips, transportation, etc. Could Greg make it pretty far? Yeah, he could. Is it realistic? I don’t think so — and that’s assuming his options through Chase were pretty close to his best cash alternative.

The differences become far more glaring in other parts of the world

I’ve already established that I can get to Hawaii to kick off this challenge for just 7,500 miles and $5.60. But then what? Hawaii is an expensive destination. And it’s….isolated. It’s not like I can hop a bus or train and get very far. And while I have some percentage of Scandinavian in my bloodline, there is not nearly enough viking in me to row my way towards another continent. So what’s a fella to do after he gets all the way to Hawaii?

Would you believe me if I told you that you can get from the mainland US to Australia for 7,500 points and $123 one-way ($5.60 in tax on the domestic award + $118 for the flight shown above)? If you said you believe that, it’s probably because you watched our FM on the Air Facebook Live broadcast last week (or downloaded the podcast) and heard me mention it.

Jetstar is but one of many low-cost carriers operating in the Asia-Pacific region. As shown above, I could theoretically fly from Honolulu to Sydney for just $118 on the right dates. That’s an absolute steal for a 10-hour flight. Almost makes you want to live in Hawaii a little bit more than you already did before you woke up this morning, doesn’t it?

But let’s imagine that Greg could also get to Hawaii really cheaply. What would it cost him to book a flight on the same route (Honolulu to Sydney) via Chase Travel?

On the same date as the Jetstar flight shown above, Greg’s best option through Chase would cost $380.68 or 25,378 points. In other words, Greg would be far better off paying $118 cash to fly on Jetstar — but that would come out of his cash budget rather than being booked at a value of 1.5cpp.

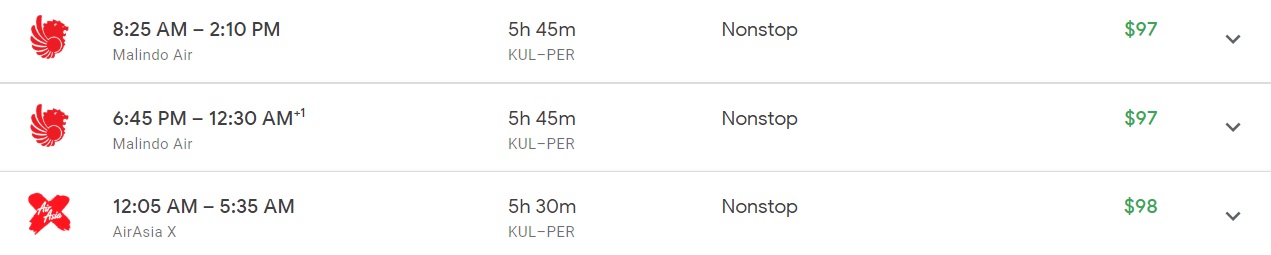

Maybe Greg isn’t interested in seeing Sydney. Let’s say he instead somehow makes his way to Kuala Lumpur and he then wanted to get to Perth, Australia. For the 5.5hr flight from Kuala Lumpur to Perth, Greg would have multiple nonstop options for less than a hundred bucks if booking with cash.

If he would rather hang on to his cash to pay for food, lodging, and entertainment and use his Chase points to book flights, he’d get pretty poor relative value for his points, burning almost 16,700 points on the same route and date since Malindo Air and AirAsia X are not options through Chase.

Within Asia, the list goes on. There are a lot of cheap low-cost-carriers in the Asia-Pacific region where cash can take you a lot farther than points — and unfortunately for those looking to book through a credit card portal, most of those ultra low-cost-carriers are not bookable through the credit card portals.

Within Asia, the list goes on. There are a lot of cheap low-cost-carriers in the Asia-Pacific region where cash can take you a lot farther than points — and unfortunately for those looking to book through a credit card portal, most of those ultra low-cost-carriers are not bookable through the credit card portals.

Of course, Greg wouldn’t really pay 16,700 Ultimate Rewards points for the Malaysia Airlines flight above. Even if he had ripped through his cash budget, he could cash out his Ultimate Rewards points at $0.01 each and buy one of those Malindo / AirAsia X flights for the equivalent of 9,700 Ultimate Rewards points.

But since Stephen can cash out his Membership Rewards points for $0.0125 each, he could get the same flight for 7,760 points (cashed out for $97 in his Schwab brokerage account via the Schwab Platinum card). That leaves Stephen with a 2,000-point advantage — on just that one cheap flight. His ability to hunt for the absolute cheapest travel rather than being locked to a portal is a huge advantage for him.

Is Chase Travel just garbage that is riddled with bad deals?

Based on the above, it might look like I’m making an argument that Chase Travel is a bad deal for flights and/or usually overpriced. In reality, Chase Travel typically has prices that match or closely mirror what you’ll find at Google Flights provided your chosen carrier is available via Chase. For many (most?) itineraries, pricing is pretty close to what you’ll see at Google Flights.

In my opinion, where Chase Travel really shines is at two different ends of the spectrum:

- When cash prices of mainstream carriers are really low. When the mainstream carriers are offering really low prices, you can often get a better deal by purchasing airfare through Chase Travel using points than you would with an award ticket. For instance, you can sometimes buy a round trip ticket to Europe for less than 20K Ultimate Rewards points ($300 in airfare). There aren’t many award programs that offer a better value than 10K each way to Europe.

- When you’re flying in business class. Paid business class airfares are often much more expensive than economy class fares. However, competition has brought business class fares lower and lower. For example, you can sometimes fly in business class to Europe for under $2,000 round trip. If you’re able to book that at 1.5cpp, that $2K flight would cost 133,333 Ultimate Rewards points — a rate of less than 67K points each way. That’s comparable to the price of an award ticket with many programs, and you’ll earn miles on the flight.

However, when we introduce low-cost-carriers and the challenge to use just 40K points and $400, the plot thickens and the general value proposition decreases since the need to fly those low-cost-carriers likely increases.

What about other travel like activities and hotels?

Both Citi and Chase allow you to book other travel like activities and hotels. Greg’s certainly got options there, though I don’t know if he can beat my $0.04 bus tour in Bangkok.

Before you get excited, it’s not really four cents. As Greg notes is often the case with Chase Travel, the price skyrockets once you pick dates (to about $27 in this case). In other words, the portals are similar for activities. That means Greg has an advantage here if he intends to book a lot of activities this way. Can I just contact some of the operators directly and arrange the same tours for less? I don’t know. That seems like it should be possible, but I haven’t yet tried. Perhaps we’ll find out.

In terms of hotels, Greg does have some advantage there in that he can book many more budget options than I see available through Citi. On the other hand, if I can do some respectable stacking via other bookings means, I’m not convinced that I can’t sleep cheaper than whatever he sees through Chase.

In short, he may have some advantage in booking hotels and activities through Chase, but it remains to be seen.

Bottom line

Greg seems to be pretty convinced that spending points at 1.5c per point is his huge advantage in the 40K To Far Away challenge. While I’ll concede that there are instances where this could present some advantage, I don’t think it’s nearly as much of an advantage as he hopes. That’s because we will likely be faced with some amount of travel on low-cost-carriers (perhaps a lot of that kind of travel), many of which are not available for sale through Chase Travel. With such a relatively small number of points to burn in this challenge, I just don’t think the small bump Greg could potentially get in value is going to make much difference — and in fact if he limits himself to booking through Chase Travel that advantage may get mitigated by overpriced flights. Will Greg be beaten in the challenge? I can’t say for sure, but I’m not intimidated if his strongest weapon is paying for flights at 1.5cpp.

Fiji from Hawaii……..

Nick is continuously proving himself as the clear cut winner in this challenge. Great stuff in this article. Can’t wait to see Greg and Stephen’s response. But wow, 7,500 TYP and $123 is an incredible deal / sweet spot to get from the US to Australia!

Btw, I have the exact same blue Nautica suitcase that you have!

I love this contest. What would make it even better would be for the winner to take on similar winners from other BA blogs. Start a movement.

…and then Norwegian suddenly cancels Greg’s flight. Also, if this were to apply to a regular traveler, the additional fees for bringing any amount of normal luggage would quickly inflate the price.

Greg implied that he intends to use miles earned from travel during the contest to further his travels. Is that legal? If so, where are you drawing the line on usage of assets earned while traveling? Does this mean it’s okay to take a $500 travel voucher for an oversold flight and apply to the competitor? What about “selling” a preferred seat to a 6’5” NFL quarterback who offers up $1,000?

*competitor = competition

I love the smack talk y’all are doing. Too funny

Speaking of the Schwab, do we really think Stephan could get $200 in airline incidental fees or is the common gift card route closed? Haven’t seen anything new posted in a few days on hat issue. Thanks!