NOTICE: This post references card features that have changed, expired, or are not currently available

Update: This offer was valid at the time of publication, but has since expired. Please click here to see the best offers currently available.

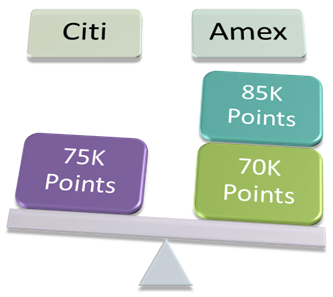

Most hotel chains get in bed with a single credit card issuer. Marriott, IHG, Hyatt, and several others are with Chase. SPG is with Amex (at least, for now). Wyndham and Choice are with Barclaycard. Then there’s Hilton. Hilton seems to like to play the field. Both Amex and Citibank issue two different Hilton credit cards. And, at the time of this writing, 3 of those 4 cards have better than usual signup bonuses:

Amex Hilton HHonors: 70K points after $1K spend. No annual fee.Amex Hilton HHonors Surpass: 85K points after $3K spend. $75 annual fee.- Citi Hilton HHonors Visa Signature: 75K points after $2K spend. No annual fee.

None of the above offers are unusual. The offers go up and down regularly. What is unusual is for all of them to be at the high-water mark at the same time.

Comparing the Hilton offers to other best offers

In general, one can think of 50K airline miles as the benchmark for a good signup bonus. Chase Southwest signup bonuses regularly fluctuate between 25K and 50K. Delta offers tend to fluctuate between 30K and 50K. Same with United. AA cards also usually have 50K offers available if you know where to look. All of these cards have annual fees, but most signup offers waive the first year’s fee.

If 50K is considered the benchmark for a good offer, then 70K to 85K offers must be fantastic. Right? Not necessarily. Hotel points are on a different scale than airline miles.

With airline miles it is usually possible to get at least 1 cent per mile value, and often much more, when using miles to book flights. This is especially true when using miles to book otherwise very expensive flights such as international business or first class, or last minute flights. Hotel points, though, are often worth much less than a penny each. For example, I estimate Hilton points to be worth approximately .45 cents each (e.g. less than half a cent). In fact, if you look at my post “Hotel rewards that offer the best value” you’ll see that only Hyatt and SPG points are consistently valued above 1 cent each.

So… If we conservatively value airline miles at only 1 cent each, then a 50K airline offer is arguably worth $500 in airfare. However, if we value Hilton points at .45 cents each, then the 70K to 85K offers range in value from $315 to $383. Keep in mind, though, that the Hilton Surpass 85K offer does not waive the first year $75 annual fee. So if we subtract that fee from the value of the offer, the range drops to $308 to $338. And, if we include the opportunity cost of meeting the minimum spend requirements on each card (vs. putting the spend on a card that offers more valuable rewards), the range drops even lower.

Comparing to other hotel offers

Let’s look at my Top 10+ Hotel Credit Card Offers page. On this page, credit card offers are sorted objectively by their estimated first year value (full calculation details can be found here). At the time of this writing (2/22/2016), my calculations sort the offers with the best at the top, as follows:

- SPG personal 25K

- Hyatt Visa 2 free nights + 5K

- SPG business 25K

- Fairmont 2 free nights

- Hilton HHonors Reserve 2 free weekend nights

- Marriott Rewards Premier 87.5K

- IHG Rewards Club 60K

- Ritz Carlton Rewards 2 free nights

Amex Hilton HHonors 70K- Citi Hilton HHonors 75K

- Marriott Rewards Business 80K

Amex Hilton HHonors Surpass 85K

As you can see above, while the seemingly huge 70K to 85K Hilton offers are considered top hotel offers, there are plenty of other offers that are even better (based on my calculations).

High end bias

Four of the signup bonuses that are valued higher than the Hilton card bonuses offer 2 free nights rather than points. This is due to an assumption I made with the first year value calculations. My assumption was that you would signup for a 2 free night offer only if you have plans to use those 2 free nights at an expensive hotel. If, instead, you would like to use your signup bonus for low to middle-end hotels, then you would almost always be better off with point offers.

Let’s look at Hilton’s award chart:

| HOTEL CATEGORY | HHONORS POINTS REQUIRED FOR ONE FREE NIGHT |

| 1 | 5,000 Points |

| 2 | 10,000 Points |

| 3 | 20,000 Points |

| 4 | 20,000 to 30,000 Points |

| 5 | 30,000 to 40,000 Points |

| 6 | 30,000 to 50,000 Points |

| 7 | 30,000 to 60,000 Points |

| 8 | 40,000 to 70,000 Points |

| 9 | 50,000 to 80,000 Points |

| 10 | 70,000 to 95,000 Points |

As you can see above, free nights go for as little as 5,000 points. Those category 1 properties can be extremely hard to find, though. Instead, let’s say that you find hotels available for 30,000 points per night. In that case, a 70,000 point signup bonus will get you more than enough points for two nights. Overall, if you plan to stay in low category hotels, then you may get considerably more value from points than from free night certificates. At the extreme, if you do find a category 1 property that you’d like to stay at, a 70,000 point offer can result in up to 18 free nights (thanks to Hilton’s 5th Night Free awards).

Signup Strategy

Even though these offers aren’t the best of the best, they’re still very good. I’ve never seen better point offers for Hilton cards. If you’re interested in Hilton points, you could sign up for all three cards (but you would have to separate the two Amex card signups by at least a week). A better approach, for some, is to signup for the two no-fee cards. Then, 13 months after signing up for the Amex card, check to see if you have an upgrade offer for moving from the Amex Hilton to the Hilton Surpass card (see: How to find Amex upgrade offers online). The typical upgrade offer is for 50,000 points after $3K spend. That’s not as good as the signup bonus offer, but it doesn’t require a hard credit inquiry and you’ll keep the same account number.

One reason to consider going for the $75 Surpass card right away (besides the extra points) is to obtain Hilton Gold status, which is granted automatically when you get the card. Gold status gives you (among other things) free breakfast at most Hilton properties. That alone can be worth more than $75 per year. Another option, though, is to request a Hilton Diamond status match by emailing HHonors@hrcc-hilton.com. Include proof of mid to top tier elite status with a competing hotel chain. If you’re lucky, they’ll match you to Diamond status. If not, they’re very likely to offer you a Diamond status challenge (requiring a huge number of nights to complete). That’s not bad, though, because they’ll probably give you Gold status in the meantime.

When applying for Amex and Citi cards, keep in mind these signup rules:

- For personal cards, like the Hilton cards, Amex will give you a signup bonus only once per lifetime. If you’ve had either card in the past, don’t bother applying for the same card again. That said, you can get the bonus if you’ve had a different card. For example, if you had the

Surpasscard before, but not the no-fee Amex Hilton card, then you can get the bonus for the no-fee card. - Citi lets you get the bonus again, but not if you have “had a Citi Hilton HHonors Visa Signature Card account that was opened or closed in the past 18 months.”

- Amex will let accountholders have up to 4 credit cards (across both personal and business credit cards) and an unlimited number of charge cards. Since the Hilton cards are credit cards, you may have to cancel other credit cards in order to free up space for these. Other popular Amex credit cards include: Blue Cash, SPG, Delta, and both EveryDay cards.

- Amex will not approve more than 1 credit card per week.

- Citi will not approve more than 1 personal card per 8 day period (but you can get 1 personal and 1 business at the same time).

Wrap Up

The current crop of Hilton signup offers are very good, but not the best of the best. Still, for many, it can make sense to signup for one or more of these cards. Before deciding on Hilton cards, though, I think it’s important to finalize your Chase credit card approach. Please see: Chase calls an end to the game. Should we seek quick wins or long term benefits?

Why is amex 70k no fee over Citi 75k?

Also…on the Marriott offer, does chase count added as AU as part of your 5/24? If so, might not be worth 7.5k points….

Amex Hilton is less spend for minimum

1. As Tyler said, the 70K offer has a lower minimum spend requirement

2. Yes they do, but you don’t have to add an AU that is busy signing up for cards. I’ve been adding my teenage son an an AU, for example.

Does upgrading an AmEx card nullify the possibility of a future sign up bonus? For instance, if I followed your suggestion and applied for the AmEx Hilton then upgraded to the surpass card, does that mean I would not be eligible for the AmEx surpass sign-up bonus in the future? Thanks.

Yes upgrading would prevent you from getting the bonus in the future for the surpass card

The value of hotel points and status is very much of a personal crapshoot. It depends on when and where you’re travelling, and it’s impossible to make generalizations and predictions. I try to hold status and points in ALL the programs because, usually, there’s one hotel and one hotel deal that stands out from the other offerings. This is particularly true because the hotel companies often undercharge — or overcharge — on the number of points required for a particular hotel stay. Like with Hilton, you could need 20,000 points, or 50,000 points for a $200 hotel room.

The value of “status” also varies dramatically. With HHonors, gold status is usually pretty useless at a Hampton Inn or Embassy Suites, but can be insanely valuable at a full service Hilton where you’re likely to get lounge access and a full breakfast buffet.

On Hilton award stays booked with points, is there a way to combine points with your spouse to get the 5th night free? Can you book 2 nights and have spouse book 3 nights then combine reservation, so the last night’s points get saved or credited? Going to use your link for the HH Amex 70K. Thanks!

I don’t think there’s a way to combine points with your spouse other than paying 1 cent per point to gift them (don’t do that!). It can’t hurt to call and ask though.

Could you not have your spouse book his/her nights, then call to book nights in your spouses name, using your points? I have not done that with Hilton but have with Hyatt and Marriott. Maybe Hilton does not allow that.

Yes you could do that, but then you wouldn’t get the 5th night free

where do you see this? Currently i only see the Marriott Rewards @ 80k.

“6. Marriott Rewards Premier 87.5K”

They’ll give you another 7.5K for adding an authorized user. Add anyone who is willing: a child, uncle, friend, etc. You don’t have to actually give them the card.

i see. thanks for clearing that up!

You get an additional 7,500 points if you add an authorized user.

Question: I’ve had the Amex Hilton HHonors Surpass card for almost a year with Gold status. If I get the no fee Amex card, will the Silver status on that card somehow cancel out the Gold status on the card I already have… or is that a non issue?

No, your existing Gold status will be fine

I have never heard of a one week rule with AMEX. Is this a recent change?

Yes, I think they started enforcing that in the past year or so. You won’t necessarily be denied for the 2nd card, but they’ll rerun the credit pull later in order to approve it.

How about one credit card and one charge card on the same day? I did SPG and Plat on the same day in last August.

Yes a credit card and charge card in one day is fine