In order to earn a welcome bonus for a new Sapphire Preferred or Sapphire Reserve card, you can’t currently have a Sapphire card open. Luckily, there’s an easy solution: cancel your current Sapphire card or product change it to a Freedom card. Then wait “a few days”. I was curious about exactly how long “a few days” was, so I tested it out. The answer: 2 business days.

On Tuesday, at around noon, I called Chase to product change my Sapphire Reserve card to the Freedom Unlimited card. I then logged into my Chase account and saw that the card already showed up as a Freedom Unlimited. So, I began the experiment right away…

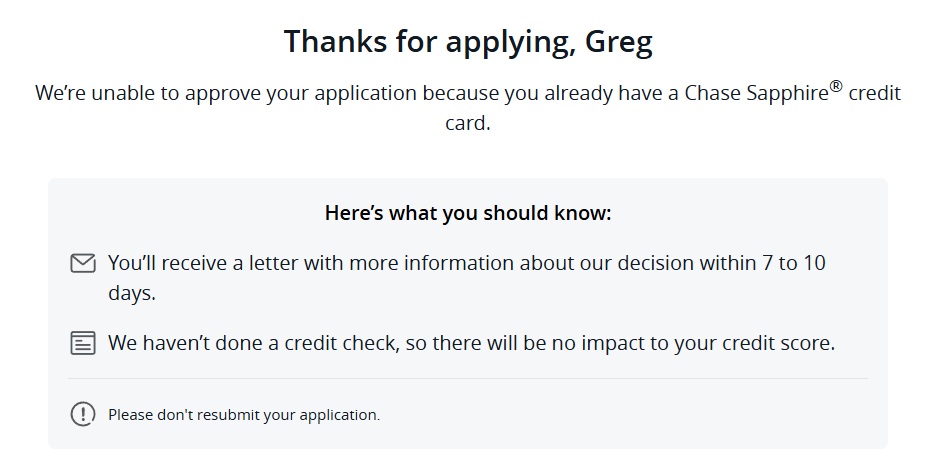

Attempt 1: 30 minutes after product change

Approximately half an hour after product changing, I applied for the Sapphire Preferred card. Chase immediately denied the application with the assertion that I “already have a Chase Sapphire® credit card.”

The good news was that there was no credit inquiry, so it didn’t hurt to keep trying…

Attempt 2: Next day, less than 24 hours later

I tried again the next morning (Wednesday) at 9am. Same result. Denied. No credit inquiry.

Attempt 3: Next day, more than 24 hours later

I wondered if it was necessary to wait at least 24 hours, so I tried again at about 2pm. Same result. Denied. No credit inquiry.

Attempt 4: Two days from product change

On Thursday at 3:30pm, two days after I had product changed, I tried again. Chase finally processed the application. I wasn’t approved instantly, but they did run a credit check with both TransUnion and Experian.

It was disappointing that I wasn’t instantly approved, but I expect that I’ll be approved after review. If not, with past denied applications I’ve had great luck calling Chase’s reconsideration line to ask them to reconsider.

Next Day Update: Approved on Friday

The next morning after my application finally went through, I received an email saying that my application was approved!

Final Answer: 2 Days

It took 2 business days for Chase’s systems to acknowledge that I no longer had a Sapphire card after product changing. I can’t promise that it’s always exactly 2 business days, but I expect it to be approximately that long in most cases. The good news is that if you apply too soon, there’s no harm. Chase won’t run a credit inquiry if they think you still have the old card.

did you still get the points after signing up again?

Closed my CSR on Thursday. Applied immediately bc I didn’t know I had to wait. Then I tried again yesterday (Monday). Still said I had a Sapphire product. Tried today same thing. Hopefully this will clear before Friday’s deadline!

If you have applied multiple times you may be denied for “multiple applications” as I was. I have also been told by two different chase reconsideration agents that I have to wait at least 1 month before reapplying. I don’t have any evidence of this, but am speculating that chase has recently made a change in their policy on how long after closing or product changing a card you have to wait before reapplying, probably due to how many applications they have received because of the elevated bonus.

anno

UPDATE: I just saw Forbes reporting that Chase announced the offer ends May 15.

Does having the Sapphire no fee prevent you from applying to CSP?

I am not eligible as it is less than 48m from last CSP bonus. When I downgraded, I downgraded to Sapphire no fee. Should I product change to Freedom to avoid conflict?

Yes, the no fee version would disqualify you from the CSP, product change it to a freedom, wait 4 days and then apply for CSP.

I downgrade my to freedom flex on Saturday, and apply today (which is more than 2 business day), I get an instant declined, when should I call recon? If I was told I still have the saphire card, do I wait a few more days to apply?

Can’t recon an existing sapphire denial, just have to apply again, maybe wait until Friday to be safe. Data points over the years from Reddit show 4 days is typically enough, but every once in a while it can take a few more, but not very common.

I am coming back to share my card was approved but I had to go through the strangest identity verification. When calling to verify application was told my SSN was entered wrong and requesting I provide again. Called Chase again to verify everything and was legitimate. They were able approve over the phone but some of the questioning truly felt like a scam.

Exact same thing happened to me. Was annoying and also ran credit checks back to back 2 days in a row,. Got approved as well but was weird.

Be careful doing this. I tried repeating your “experiment” and on the second day was denied for “too many recent credit applications”. Had to spend an hour with reconsideration line to explain why I applied 3x over 2 days (first two applications did not go to hard inquiry because it thought i still had a CSP card)

Same exact thing happened to me.

Same here. Any luck with approval?

With both Freedom Flex and Unlimited in the wallet, didn’t think there was a no/low fee card for a CSP downgrade but I was surprised to be offered the Freedom card (no bonus) since it doesn’t appear available for new sign-ups. All the card #s and pts transferred from the CSP. Probably too late to snag the 100k/Chase + 30k/Rakutan best offers, but one can hope.

FYI, you can have multiple of the same freedom card, so if for some reason you wanted another Freedom Flex, they could product change to that version while you already have one. Having the Visa version of the regular Freedom is nice though in case Chase does a quarterly bonus with Costco, then you can use it in store (since Flex is a Mastercard, wouldn’t work in store).

I canceled my CSR today and it shows up as canceled on the app. I know, I’m late, but I thought it would take 1-3 months to be eligible. I transferred my points to my existing Chase Freedom. (My last Sapphire bonus was plenty long ago.) I’m wondering if I could bypass the 3-day wait by going to my local branch. Anyone tried this? Any thoughts?

It resulted in a hard pull with no pending review. I applied 4 times over the course of Friday – Tuesday. I called Recon they told me to wait until it clears. Not sure if I should apply again tomorrow. But the system flagged me.

Thanks for the great info. I downgraded my CSP on Friday and tried a couple times Monday. Each time it said that I already had a Sapphire product. Today (Tuesday) I was denied and they did pull a credit report. I knew I had excellent credit and only 2 open CC in the last 4 years so I called the reconsideration line thinking I needed to decrease a couple really high credit limits on other Chase cards.The person told me that I was denied for still having a Sapphire card. She didn’t give a lot of information and I questioned why a credit report was pulled. She just read from a script and kept telling me I had a Sappire card already. She said I had to wait 3 cycles (meaning 3 months) to reapply after switching products or closing an account for it to show up properly on their side! Anyone else have this issue? I’m still going to wait a couple days and try again but I’m worried I’m going to miss the 100K bonus because of this :/

Guess I’m curious from others how many days from downgrading they were approved and if they pulled a credit report.

Shoot! I downgraded Saturday and was able to apply Monday evening. I was surprised my application was being reviewed as my credit is great and I haven’t opened any credit card in over 5 years. Haven’t heard yet on determination but worried may be headed same way for it being too soon… I guess was a risk but I’ll probably take business elsewhere next good offer I see if it is denied

Wait a few days and call reconsideration again. You’re definitely shouldn’t have to wait three months.

Hmm similar situation however my rep said 1 to 2 months. I assume I should have waited a few business days to try again, unsure if I’ll allow another hard pull considering I’ve been flagged down. I’ll just get the 60-80K bonus after hahah

Ugh, same issue here. Application went through with a hard pull but was denied due to having a sapphire product already. Recon couldn’t help either. I am going to wait a couple of days and try again but it looks like 2 days isn’t enough time to fully reset the system.

Update….. I received a letter (in my chase account) dated May 6th that I was denied due to ‘Too many requests for credit or opened accounts with us’. My only requests for credit were to them for this card and I only have 3 open accounts with them….. the freedom card I downgraded to, a Marriott card and a Hyatt card??? I may try reconsideration again. Maybe I can lower my credit limit on those since they are quite high. Pretty disappointed. They listed my credit score they used for the application and it was high so that’s definitely not he issue.

See my update below

They gave me the same reason, but in my case it was due to multiple applications over last 4 days, not for the number of accounts I have, nor for the number of applications in last 24 months.

Were all of your applications to Chase?

Yes, I tried multiple times based on Greg’s experience/recommendation, but the multiple applications to chase appears to generate a fraud alert and thus the denial. I have a fuller explanation in the earlier comments of my experience (below). Still waiting to see if I will be approved.

Did you get approved eventually? I am on the same boat…

After downgrading from CSR to OG Freedom and then getting approved for CSP, can I do a product change to CSR? I really want the Reserve back

Can’t product change until the account is at least a year old, but you can product change any freedom to a CSR after CSP approval. One sapphire rule doesn’t apply when product changing.

Thanks so much, very helpful!

Downgraded to the Freedom Unlimited Friday morning and still getting the rejection due to having an existing sapphire preferred card as of Monday morning. Maybe business days?

Thinking the same. Had a friend do the same as you and was also denied for still having CSP as of last night (Sunday night).

Thanks for this info since I was worried I wouldn’t be able to take advantage of this offer because I had read previously that I should wait a month before applying after downgrading my Reserve. I did wait the 48 hours you suggested, but it still told me I had a Reserve and therefore it was denied. It was over the weekend, so maybe that extends the time. I will try again tomorrow and hope that Chase doesn’t pull the offer before then.

Day 3 and still getting denied. Hopefully it is business days and I can submit tomorrow without being immediately rejected.

keep us updated!!

Good news is on day 4 I was able to have my application processed. Bad news is I was immediately rejected.

did you call recon, I was rejected, but was not given a reason

As an update, I just called the recon line and was told I was declined due to multiple credit applications and therefore was not eligible for recon. I initially thought they meant I was over 5/24, but I am only at 1/24 so I probed this a bit further and was told that it was due to multiple applications over the last few days! I explained why this was and she finally transferred me to another department where we went through several different verifications of my identity and my planned spending on this card. So my guess is that the multiple applications in a short period triggered a fraud alert and shut down the application. I was transferred to another department (and another, but different verification process was done). He asked me if I had credit freezes on my credit files (which I do, but had unfrozen before I applied). He had to clear a credit related alert item regarding my credit report and then told me it was in final review; so not yet approved, but much further along than where I started – i.e., denied and no recon. Unfortunately in this situation it was probably bad advice to try multiple applications since this may trigger a fraud alert, even if it didn’t result in multiple credit pulls. Greg may have lucky when he applied, but I wasn’t. My suggestion would be to wait at least until the preferred card shows up as a recommended card when you log in to your account. I noticed that in the period between product changing and when I was finally able to have my application processed ( in my case 4 days), the preferred card was not shown as a recommended card. However, after the 4 days, all of a sudden it showed up as a recommended card. I interpret this to reflect that Chase at that point no longer believed I had a sapphire card and that is why my application all of a sudden processed. However, when it did, it got rejected due to a fraud alert. Will let you know the final outcome – good luck for those still waiting.

Thanks for testing this Greg. We downgraded P2’s card and will be reapplying this week. Any DP’s on if I refer them when they reapply if it makes them less likely to be approved?

I don’t think that the referral source is considered when they determine whether or not to approve your application