The purchasing power of Southwest Airlines Rapid Rewards points was for many years relatively constant across all flights, with award pricing being closely correlated with the cash price of a flight. However, recent sweeping changes mean that we are now seeing the value per point vary with demand. Due to that major change, it was time to revisit our Reasonable Redemption Value for Southwest Rapid Rewards points. Regular readers may recognize that we updated our Southwest Rapid Rewards Reasonable Redemption Value just two months ago. Given the short time span between updates, we were in many cases able to check the exact same flights to see how value has changed since our last analysis. In the new world of Southwest Rapid Rewards points, it is possible to get more value than ever before, but you are likely to get less value per point today than you were a couple of months ago.

Southwest Rapid Rewards is a revenue-based program

Southwest Rapid Awards has long run a revenue-based program whereby the price of an award was determined relative to the cash price of a ticket on the same flight. That is to say that more expensive flights cost more points and less expensive flights cost fewer points.

However, changes made in 2025 have put a new emphasis on demand, where the demand for a flight will influence the value of redemptions, with high-demand flights likely to yield less value per point and low-demand flights likely to yield better value. Since some flight taxes are waived for award redemptions, it has long been the case that inexpensive flights with high taxes have often yielded opportunities to get higher value out of points and that remains true. Generally speaking, the cheapest flights offer opportunity for the highest value per point.

In the past, we’ve seen some international routes to offer higher value per point. In our most recent analysis, the value of points topped out at just over 1.8 cents per point. This is because some taxes aren’t charged when using points. You can read more about that in a previous analysis of the value of rapid rewards points.

Our methodology

In order to refresh our Reasonable Redemption Value for Southwest Rapid Awards points, we collected hundreds of data points over a range of routes to analyze the value of points as compared to Southwest cash prices.

For this analysis, we selected a variety of city pairs that included both long and short domestic itineraries (including popular nonstop routes like San Francisco to/from Los Angeles, hub connections like Baltimore-Washington International Airport to Las Vegas, and major cities to/from smaller markets like Orlando to/from Albany, etc) and select international itineraries (including Chicago Midway to/from Cancun, Sacramento to/from Cabo San Lucas, etc). New this time, we included routes to/from Hawaii as well as a couple of airports where Southwest dominates traffic like Dallas-Love Field and New Orleans (MSY).

For each city pair, we collected flight examples for a random Wednesday one month in the future and for a Friday or Sunday during peak summer travel dates (to sample weekend / peak demand pricing).

For each example date, we selected two to three desirable daytime flights departing after 8am where possible (or as close as possible) to analyze in each direction as follows:

- Nonstop City A to City B (departing daytime after 8am)

- 1-stop City A to City B (departing daytime after 8am)

- “Cheapest” flight City A to City B departing during reasonable hours if it wasn’t either of the above

- Nonstop City B to City A (departing daytime after 8am)

- 1-stop City B to City A (departing daytime after 8am)

- “Cheapest” flight City B to City A departing during reasonable hours if it wasn’t either of the above

The purpose of the constraints (such as a daytime flight departing after 8am) was to collect examples of desirable flights that a traveler would be likely to want to book rather than solely measuring cherry-picked flights chosen for value over convenience (although I did include a “cheapest” option departing during reasonable hours to see whether it made a measurable difference on results, but it didn’t have a significant impact).

For each selected flight, we recorded each of the available Southwest fares both in terms of cash rate and award price:

- Wanna Get Away

- Wanna Get Away+

- Anytime

- Business Select

We further recorded the taxes on award flights, which are typically $5.60 each way for domestic flights, but which vary internationally. Additionally, itineraries with a long layover sometimes include $11.20 in taxes even on domestic itineraries (I did include one such example for analysis and it yielded results close to the average, though I generally avoided including such flights for analysis since the long layover rarely made them a reasonable selection for the stated criteria).

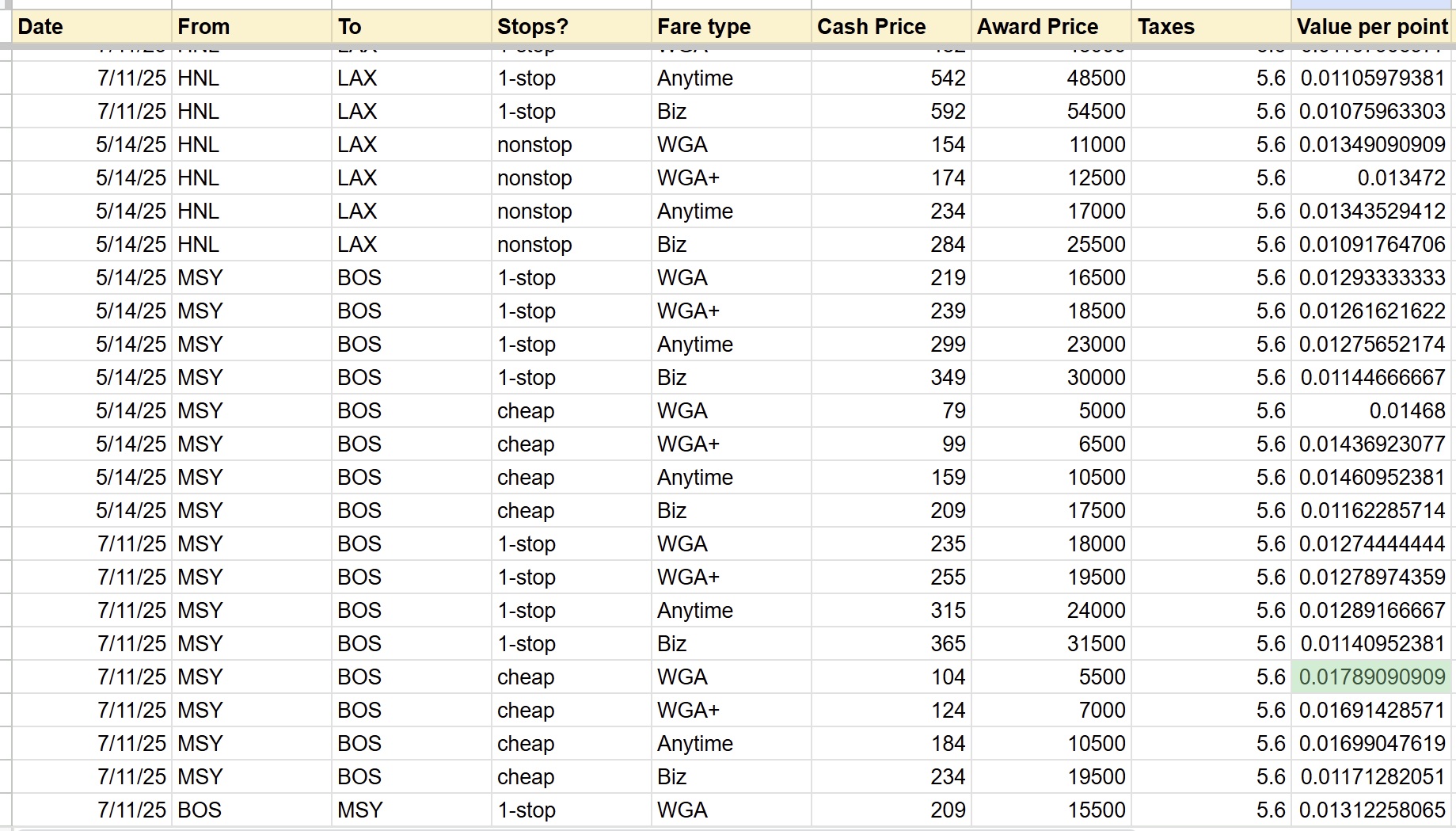

I then used a spreadsheet to subtract the taxes from the cash rate and divide it by the number of points required to book the flight as an award in order to determine the value per point for each flight in each fare class. Here’s a look at some examples:

While the analysis here only gives us a glance at one sliver of time, it provided enough consistency through the data points as to provide a reasonable expectation as to the value of points.

Average values

At a high level, when considering all data points collected, here were key outcomes regarding the value of Rapid Rewards points in the observed data set:

- Average value: 1.29c per point

- Median value: 1.21c per point

- Minimum value: 1.07c per point

- Maximum value: 1.86c per point

The first three figures are down anywhere from about a tenth of a cent to two tenths of a cent from the last time we did the analysis. The maximum has increased more than two tenths of a cent. For those curious, the maximum value was found on flights from Chicago-Midway to Cancun on Friday, July 11th.

Notably, the spreads have increased between Median/Average and between Minimum/Maximum. In other words, the value of Southwest Rapid Rewards points are far less predictable than they were in the past.

Interestingly, points are worth more toward Wanna Get Away and Wanna Get Away Plus fares than for Anytime or Business Select fares. When filtered to Wanna Get Away and Wanna Get Away Plus, we see the numbers increase a bit:

- Wanna Get Away Average: 1.35c per point

- Wanna Get Away Median: 1.29c per point

- Wanna Get Away Minimum: 1.09c per point

- Wanna Get Away Maximum: 1.86c per point

There was about 0.01c per point in difference between Wanna Get Away and Wanna Get Away Plus. Savvy travelers may utilize Southwest free same day changes to leverage the value per point offered by Wanna Get Away+ fares to book a fare yielding better value per point and then same-day change to a flight that may have offered lower value per point at the time of booking, which means that there are some opportunities for arbitrage.

Generally speaking, opportunities to get higher-than-average value were found on flights costing less than $250 one way. Again, as the price of a flight decreased, the value per point generally increased.

How much are Southwest Rapid Rewards points worth?

We believe that most readers would be most likely to book Wanna Get Away or Wanna Get Away Plus fares. Since the median value for those fare types (1.29c per point) also happens to match the overall average value (1.29c) per point, we’re pegging the value there and rounding up. Our new Reasonable Redemption Value for Southwest Rapid Rewards points is 1.3c per point.

Some members may assign slightly higher value to points when considering the fact that points bookings are highlight flexible in that they can be cancelled up until about 10 minutes prior to departure. In the event of cancellation, the points are immediately returned to the member’s account and are available for use to book any flight for anyone. Further, they never expire. By contrast, flights booked with cash and later canceled will yield a credit that in some cases (Wanna Get Away fares) can only be used to book travel for the originally-ticketed passenger and which will expire within 6 to 12 months (for credits created from May 28, 2025 onward).

[…] FrequentMiler analyzed the value of Southwest points and is confident that they will be worth around 1.3 cents (you’ll see ~1.1–1.7¢ depending on route/date) each after 2025 due to some price. With a 25% transfer bonus, 1 UR effectively becomes 1.25 Rapid Rewards ≈ ~1.6¢ of flight value at the 1.3¢ midpoint. For many, especially those with a Preferred card, that’s better than using your points to book through Chase’s travel site where you only get 1.25 to 1.5 cents per point. But, if you have a Reserve card, it only sometimes makes sense because they can still get 1.5 cents per point on points they had before Oct 26, 2025, until 2027, and there’s a new Points Boost thing now. […]

Thx Nick for your in-depth analysis. Hopefully like me and many of your followers they have a CP; thus points are worth double what is presented here. Still a decent deal however I don’t like the direction SW is headed. But at the end of the day this points game affords all of us travel at a ridiculously low price. Thx again for all that you (& Greg) do.

No, points are *not* worth double. This is a common fallacy that comes up with Southwest points.

Here’s the simplest explanation I can offer:

Ryan doesn’t have a companion pass. A flight costs 10,000 points or $100. Ryan needs to book for 2 passengers. Ryan has two options:

1) Use $200

or

2) Use 20,000 points.

Using 20,000 points keeps $200 in Ryan’s pocket. Points are worth $0.01 per point.

Shane has a companion pass. A flight costs 10,000 points or $100. Shane needs to book for 2 passengers. *******Shane’s choice is different because he has a BOGO coupon*****. Shane has two options:

1) Use 10,000 points

or

2) Use $100.

Using 10,000 points keeps $100 in Shane’s pocket. Points are worth $0.01 per point. Using 10,000 points doesn’t keep $200 in Shane’s pocket because Shane wouldn’t have needed to spend $200 for those tickets, Shane’s cash option was to use $100. If Shane had zero points, Shane wouldn’t have to spend $200, Shane would have to spend $100.

The Companion Pass is a coupon. It’s a great coupon, but it doesn’t increase the value of the points any more than it increases the balance of your bank account, it just decreases the cost of 2 passengers. If you have $500,000 in the bank, you don’t become a millionaire with the Companion Pass, you just get the chance to pay less for your flights.

To be clear, if the Companion Pass only worked on award tickets, it would be different. Then Shane’s choice would be to use 10,000 points or spend $200 — and in that case, the points would be worth $0.02 per point since using points would keep $200 in Shane’s pocket. But since the Companion Pass works equally on tickets purchased with points or with cash, it’s just a fancy discount.

Look at it this way: when Macy’s offers a coupon for 30% off and so you buy a $1.00 item for $0.70, would you say that your pennies were worth 1.43c per penny? Of course not. You got a discount and that’s great, but the discount doesn’t increase the value of your pennies, it just decreases your cost.

Again, this comes up frequently and is a commonly misunderstood topic. I love the companion pass because it does save me points or save me money, but the points still replace about 1.3 cents worth of cash that would come out of my pocket if I had zero points.

That’s why you are the “Master” Nick!!

Thx for taking the time to clarify.

In my world, Shane has a 3rd option. Shane is a relatively nice guy so he only charges his companion 50% of the ticket price to net 1.5 cents per point.

In my world, if Shane charged a companion anything, Shane would soon be companionless. 🙂

[…] estimating that Southwest Rapid Rewards are currently worth right at 1.4 cents per point (applying Frequent Miler’s 2025 calculation which is deeply […]

Apart from card open bonus / referral bonus , any other points u accumulate through spend to achieve the spend requirement to get companion pass, i consider those points as 2.8x per $.

Once i get the companion pass, i dont spend anything on my card, unless i get multiplier like 3x or 5x bonus spends.

Look at the table. Would the point values be clearer if they were expressed in pennies to one decimal place than the unrounded dollar values shown?

I wasn’t really intending for the table to be a key part of the post, just to show what it looked like.

A little related to this: I logged into my Southwest account this morning and found a promo for 3000 bonus points on $1K spend between Feb 01 and Mar 31 on my Rapid Rewards credit card. Must register. That essentially makes it a 4x card everywhere on the next $1K, and at this valuation puts it similar to 6.4% return on spend.

I always fly Southwest with a companion pass. If you include the companion pass, I would value the points at 2.8 cents for 2 people, 2.1 cents for 3 people, and 1.9 cents for 4 people flying in the group.

I love the Southwest companion Pass and we’ve long had one in my household, but your math is flawed there. The value of points

does not double when you have a companion pass. The points replace the same amount of cash.

Let’s keep the math simple: pretend a flight costs $100 or 10,000 points.

If you don’t have the companion pass, and you need two tickets, you can use 20,000 points to buy those two tickets or you can use $200 to buy those two tickets. In that case, using 20,000 points keeps $200 in your pocket. You’re getting 1c per point.

If you do have the companion pass, and you want to buy the same two tickets, you can use 10,000 points to buy those two tickets or you can use $100 to buy those two tickets. In that case, using 10,000 points keeps $100 in your pocket. You’re getting 1c per point.

Having the companion pass doesn’t double the value of your points any more than it doubles the money in your bank account. It’s a great deal for sure, but the fact that it works equally whether you’re using points or cash means that it replaces the same amount of cash either way.

Respectfully, I think your logic is flawed; the companion pass unlocks a higher redemption value. You have to compare the cost without the companion pass to the cost with the companion pass, having the pass doubles the value when flying with two people. This might be worth a discussion on the podcast, it reminds me of the travel is free (sort of) episode.

Nick is correct. Since the companion pass works equally with cash and points, the points per cent value does not change. Comparing the redemption value using the companion pass with points to not using the companion pass with cash is not apples to apples.

Companion pass is like a BOGO free coupon. The value is in the companion pass. It saves how much you spend using points/dollars

This has been discussed on previous podcasts and blog posts. (https://frequentmiler.com/no-the-southwest-companion-pass-doesnt-double-the-value-of-your-points/).

Another way to think about it is if you had the Sapphire Reserve and a Companion Pass and you were going to book a ticket for yourself and a companion on Southwest, would you rather book with Southwest points or through the Chase Travel Portal?

For Southwest points, the cost of an example $147.10 ticket is 9,434 points plus $5.60 (Which is actually good value at close to 1.5 cents per point). You transfer enough Chase points to Southwest from your Sapphire Reserve to book one ticket and then pay $5.60 to add your companion.

Alternatively, you can book yourself a ticket with the Chase Travel Portal at 1.5 cents per point if you have a CSR. This would be 9,812 Chase points with no additional cash cost. You can then add your companion for $5.60.

Would you rather pay 9,434 points plus $5.60 for yourself plus $5.60 for your companion with Southwest points or 9,812 points for yourself plus $5.60 with Chase points?

As you can see, the options are pretty much equivalent in cost. Barry above said two tickets with a Companion Pass is worth 2.8 cents per point. If that is so, how does buying the ticket through the Chase travel portal at 1.5 cents per point look just as good of a deal?

Given that you can readily buy gift cards at 10% off at Costco, this gives cash an advantage. Additionally, you dont earn rewards on award tickets.

Thus, points are worth less than 1.4 cents.

You should obviously take that into consideration if that’s your preference, but I disagree with you there.

Personally, I rarely consider using a gift card to pay for a flight because I want credit card travel protections.

Further, although I do have a Costco membership now for online purchases, I don’t live anywhere near a Costco, so for years I didn’t have a Costco membership and most people where I live don’t. Obviously my situation isn’t applicable for everyone, but the bottom line is that not everybody has a Costco membership and access to those discounted gift cards.

I further find points to be more valuable to me because it is much less of a hassle in the case of cancellation since points go back in your account immediately and can be used for anyone. After spending several hours booking and canceling and transferring flight credits to be able to buy tickets for five people recently, I find that to be much more hassle than the 10% discount is worth.

For those reasons, I find booking with points preferable to booking with cash. You do miss out on a tiny rebate in terms of points point that could be earned on a cash fare, but I don’t find those earnings to outweigh the strengths of points noted above.

Obviously you can and should adjust based on your own valuations of those factors.

I’ll add to that that my money is where my mouth is on that so to speak. I had a few thousand dollars in Southwest flight credit in my account from using airline incidental credits over the past couple of years and I didn’t even attempt to use that until I had exhausted our Southwest points balances to the point where I needed to use that credit to book flights. Like I said, the hassle of moving those credits around was the barrier that in practice made me book with points even though I had existing credit in my account – so I’m not just theoretically saying that I prefer points, my actual real life practice has been to use them ahead of Southwest credit.

Hi Nick, I agree with you regarding the 10% discounted Costco giftcard not being equivalent to cash in the same way we shouldn’t compare a Hyatt award booking with an “advanced purchase rate” since that cash booking option is non-refundable.

However, I do want to highlight the second part of Jason’s comment regarding opportunity cost of booking with cash and getting points (both from credit card and Southwest miles). I did notice in one of Greg’s recent posts that was discussing RRV of a hotel brand (I think it was Hyatt but can’t find the post now) and I saw the RRV calculated as (cash price – taxes/fees)/(points price + points you would have earned had you paid cash) which makes sense because you will earn points by booking cash both through the credit card and the loyalty program. Why isn’t this methodology used for airline RRV’s?

You can certainly factor it in if you want to. There are so many variables that we decided it was impossible to account for it in a meaningful way. For instance, if you’re going to book one or two flights a year, you likely won’t earn enough points to be able to redeem them for a flight – so the points earned from spend may be completely meaningless.

I think of Delta as being a good example of that for me. I don’t currently have Delta miles. I think I’ve maybe only once ever redeemed Delta miles. If my option for a Delta flight is to pay $200 or use 20,000 miles (presumably transferred from Amex for me). Let’s just say I could earn 1,000 Delta miles by paying for the flight and our RRV for Delta miles is 1.3cpp. Should I account for that as having earned $13 back? I certainly wouldn’t personally – those 1K miles are meaningless for me since I’m probably not going to fly Delta often enough to make use of them. They certainly aren’t worth thirteen bucks to me – they may expire unused.

Obviously many other people would make easy use of those miles – but then how do we account for it? The earnings on an individual paid flight are likely to be so insignificant for many people, so I personally almost never consider what I could earn by paying for the flight.

Again, you aren’t wrong to consider it – but I think it makes more sense to leave that to the reader to decide.