NOTICE: This post references card features that have changed, expired, or are not currently available

A month ago, Amex and Chase announced changes to the SPG / Marriott credit cards to account for the Marriott Bonvoy rebranding. Some of those changes included new benefits, with one of them – the ability to earn up to 100,000 bonus points per year – coming into force today. You can register for the spending offer here. That said, the benefit isn’t very enticing for a few reasons.

A post today by Lucky reminded me of this new benefit. If you had the old personal SPG American Express card, that’s been converted over to a Marriott Bonvoy American Express card. It typically earns 6x at Marriott properties and 2x on all other spending.

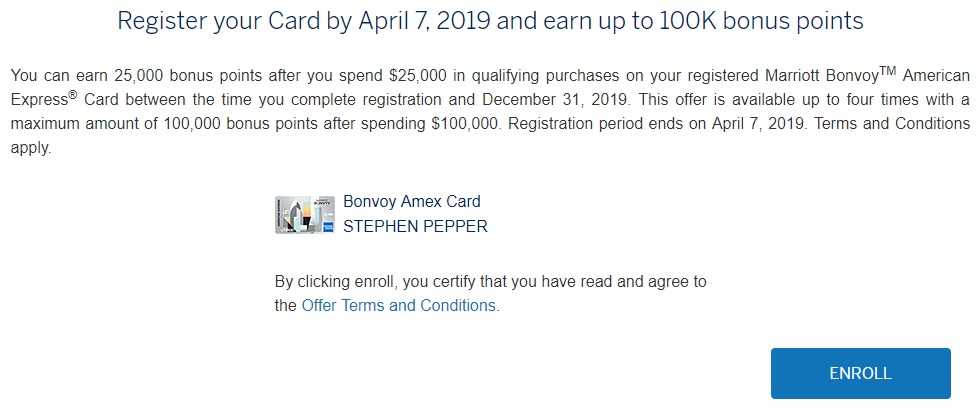

The new benefit offers 25,000 bonus points when spending $25,000 until the end of 2019. This can be earned four times, so up to 100,000 bonus points over the course of the year.

This benefit isn’t automatic though as it’s something you need to register for. You can either register here directly, or you can log in to your American Express account, select your Marriott Bonvoy account and scroll down to your Amex Offers where you should see this:

Clicking on ‘Register Now’ doesn’t actually register you for the promotion in the way that clicking ‘Save Offer’ for the Amex Offers saves them to your card. Instead, it’ll take you to another screen where it’ll explain the new benefit. If you’re happy with the terms, click ‘Enroll’.

There’s a fairly long list of terms and conditions:

- Registration for this offer is required. You must register by April 7, 2019 to participate in this offer.

- Starting from the time you complete registration through December 31, 2019 (“Purchase Period”), if you make eligible purchases on your Marriott Bonvoy American Express Card that total $25,000 or more, you will receive 25,000 bonus points (“First Purchase Requirement”). If in that Purchase Period you make an additional $25,000 in eligible purchases on your Marriott Bonvoy American Express Card (for a total of $50,000 or more), you will receive an additional 25,000 bonus points (“Second Purchase Requirement”). If in that Purchase Period you make an additional $25,000 in eligible purchases on your Marriott Bonvoy American Express Card (for a total of $75,000 or more), you will receive an additional 25,000 bonus points (“Third Purchase Requirement”). If in that Purchase Period you make an additional $25,000 in eligible purchases on your Marriott Bonvoy American Express Card (for a total of $100,000 or more), you will receive an additional 25,000 bonus points (“Fourth Purchase Requirement”).

- You may earn a maximum of 100,000 bonus points with this offer.

- Bonus points will be posted to your Bonvoy member account 10-12 weeks after you reach each of the Purchase Requirements.

- Purchases may fall outside of the Purchase Period (and therefore not be eligible for the bonus points) in some cases, such as a delay in merchants submitting transactions to us or if the purchase date differs from the date you made the transaction. (For example, if you buy goods online, the purchase date may be the date the goods are shipped.)

- This offer is only available to the Basic Card Member; however, eligible purchases made by Additional Card Members will contribute to the Purchase Requirements.

- Eligible purchases do NOT include fees or interest charges, balance transfers, cash advances, purchases of traveler’s checks, purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or purchases of any cash equivalents. Eligible purchases to meet the Purchase Requirements are for goods and services minus returns and other credits.

- To receive the bonus points, your Card Account must not be cancelled or past due at the time of fulfillment. American Express reserves the right to modify or revoke offer at any time. The bonus points you may earn during the Purchase Period as part of this offer are in addition to any other points you may get from using your Card.

- You are not eligible to register for this offer if your Card Account was opened after January 24, 2019. This is an exclusive offer only for Marriott Bonvoy American Express Card Members who receive this email and is not transferable.

There are a few things to note regarding this offer and why it’s unlikely to be worthwhile pursuing.

Registration

I explained above how to register for this promotion, but it only seems to be available through one avenue. I initially logged in to my Amex account using the old login interface as that’s my preferred way of viewing my account. As noted in the past though, not all Amex Offers and upgrade offers show up when logging in this way and this spending offer is no exception.

Registration for this spending offer didn’t show up when logging in to the Amex app either. The only place I found it was when going directly to americanexpress.com and logging in.

Edit: You can now register directly using this link.

Registration Dates

Although you have until December 31, 2019 to complete your spending, you only have until April 7 to register. Any spending before enrolling in the benefit doesn’t count either.

Registration Terms

I’ve bolded some of the terms above as it states the following purchases are excluded from meeting the spending requirement:

purchases or reloading of prepaid cards, purchases of gift cards, person-to-person payments, or purchases of any cash equivalents

Now, given that this is a spending bonus rather than a signup bonus, Amex might not be strictly enforcing those terms. However, the Amex Rewards Abuse Team (RAT) might be on the lookout for MS techniques, so be aware of the risk of clawbacks if you don’t meet the spend requirements through organic spending.

Is It Worth It?

Is it worth putting all that spend on the card though? That’s the $64,000 25,000 / 100,000 bonus point question.

Spending $25,000 means you’re earning 3x on the Marriott Bonvoy card for everyday spend (2 points per dollar as standard and a bonus 1 point per dollar). When the Marriott and SPG schemes were being merged, you could transfer Starpoints to Marriott Rewards on a 1:3 basis and vice versa. The SPG card used to be the go-to card for many people’s everyday spend due to the ability to convert Starpoints to airlines on a 1:1 basis, or a 1:1.25 basis in increments of 20,000 points.

Marriott Bonvoy has continued that transfer ratio on a similar basis (3:1 or 3:1.25 in increments of 60,000 points), so on the face of it this spending offer would seem enticing as it reverts things back to how they used to be.

There are three large problems with this though. The first is that you have to spend in $25,000 increments in order to earn 3x rather than 2x. With the old SPG card during the merger, you were effectively earning 3x Marriott Rewards per dollar spent on any amount. If you spend $24,999 on the Marriott Bonvoy card, you’ll only earn 2x. If you spend $40,000, you’ll only earn 3x on $25,000 of that spend.

Secondly, $25,000 of spend can get you numerous signup bonuses, so an extra 25,000 Marriott Rewards points pales in comparison.

The third issue is that 25,000 bonus points don’t have the same value compared to a couple of years ago due to both last year’s devaluation and this year’s.

Unless you have a need for Marriott Bonvoy points and can meet the high levels of spend required without affecting your ability to earn signup bonuses, this spending bonus is going to be worth giving a miss.

[…] Amex Bonvoy Legacy Consumer card only: How To Start Earning 3x On One Type Of Marriott Bonvoy Card (Although It’s Probably Not Worth It) […]

[…] February 24th, the offer went live for some. We published: How To Start Earning 3x On One Type Of Marriott Bonvoy Card (Although It’s Probably Not Worth It). Some cardholders saw the offer directly in their account. Others (like me) had to click a […]

[…] a spending bonus available on the personal Marriott Bonvoy Amex, although in that post I explained that it probably wasn’t worth taking advantage of. This […]

This is back to what it was last year in 25k increments. This feature is not even offered on the Brilliant. Plus you get the 35k night. So actually a better deal. The bad: New $125 annual fee on the account

To put a finer point on how much the devaluations have changed the equation consider this: Before the travel packages were devalued, you could spend $90k on the SPG card, convert them to 270k Marriott Points and use that to buy a 7 night travel package at an old category 1-5 hotel plus get 120k AA miles. If you spent that same $90k under this promo, you would get only 255k Marriott points which is just enough for the same category 7 night package with only 50k AA miles. If you value the 7 night hotel certificate at $1,500 and AA points at 1.4 cents per mile, you would be getting 31% less value for the same spend, even with this promotion.

Depends on your other options for everyday spend and how much you need MR points. We often use Marriott /PSG hotels on vacations and never have enough points. So this is a good offer equal to the old SPG Amex card. There is no other way to earn 3/$1 points in Marriott except through actual stays & Marriott spend. And those of us with dedicated corp travel cards can’t get the latter.

Now you may prefer Chase or Amex points at $1=1 point for everyday spend (for use on airlines) and that make sense. But if you need Marriott that won’t work.

Join the discussion…why don’t you just rack up some bonus points with chase (e.g. freedom card) and transfer them to Marriott?

Because instead of transfering to, say, a Hyatt point worth more than a Chase UR at .015-.018, you would be transferring to a lesser point value (Marriott points are only worth from .016-.019). Better off to redeem at .015 on the Chase portal towards a Hyatt room.

exactly my take, save your $25k & use it everywhere. there is no value within MR the sinking boat that’s worth the spend. Spend that kind of amount for anything including cat 6,7,8 straight pay is better.

Can it be combined with the spg amex offer to upgrade to the brilliant card?

The spending offer is only available on the standard card and not the Brilliant card. I’m therefore assuming that if you upgraded to the Brilliant card, the spending offer would disappear. If you were to load it to your card before upgrading I suppose there’s a chance that it’d stick around after the upgrade, but that’s doubtful.