Update 1/29/21: The Motley Fool has reached directly out to Frequent Miler to tell us that loyalty programs are either pausing their campaigns or updating their terms to note that their rewards can not be combined with other offers specifically to block a double dip. Here is the email we received from The Motley Fool’s business development team.

I just wanted to let you know that the loyalty programs are either pausing their campaigns during the Amex campaign or have updated their terms and conditions so their cash back or rewards cannot be combined with other offers.

Obviously, we’re thrilled with anyone who wants to join our services and learn about The Motley Fool approach to investing, and we want to incentivize folks to give us a try. But for those interested in stacking offers, best to look elsewhere now, as there is no longer a double dipping opportunity.

Would appreciate it if you could update your audience.

Best Regards,

John

This is the first time I can remember receiving an email directly from a merchant about blocking a double-dipping opportunity. Sure enough, I see the following update in the terms at the AAdvantage shopping portal (bolded for emphasis):

Mileage terms

Please note these terms & conditions: Eligible on one (1) subscription per loyalty account number. Only eligible on paid 1 year subscription to The Motley Fool. Monthly subscriptions are ineligible. Offers cannot be combined/stacked with any other offer.

It was surprising to see the word “stacked” specifically as we don’t often see that terminology used in restrictions. Further, I can’t think of a time when portal rewards have been blocked based on which credit card used to pay at checkout. Could this type of action extend to other card-linked offers? In this case, I think the restriction is a one-off because this must be costing The Motley Fool more than they care to pay for customer acquisition. At any rate, I would expect this to be dead for new sign-ups. Hopefully there won’t be clawbacks given the lack of restriction in place previously. The original post follows, but I wouldn’t expect the double or triple dip stack to work anymore.

~~

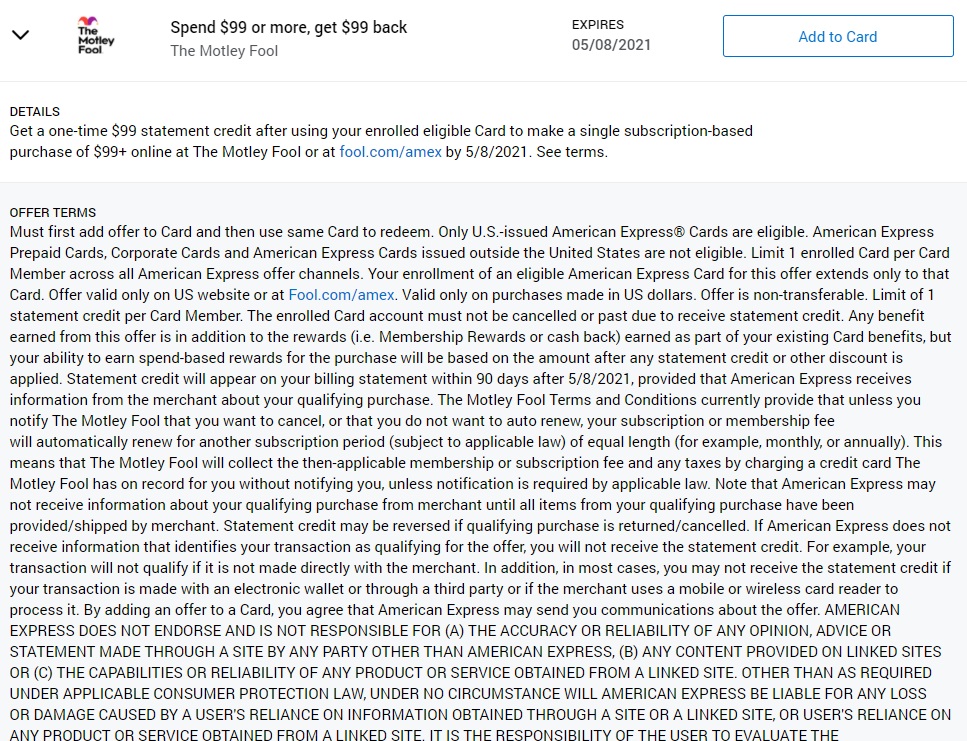

There’s a stunning new Amex Offer available today giving $99 back when buying a $99 The Motley Fool subscription. While that might not sound enticing by itself if you’re not in the market for that subscription, you might be interested once you take into account the generous portal bonuses that are available right now.

The Deal

- Make a single subscription-based purchase of $99+ online at The Motley Fool or at fool.com/amex & get $99 back with an Amex Offer.

Key Terms

- Expires May 8, 2021.

- Offer valid only on US website or at Fool.com/amex.

- Valid only on purchases made in US dollars.

- Offer is non-transferable.

- Limit of 1 statement credit per Card Member.

- The enrolled Card account must not be cancelled or past due to receive statement credit. Any benefit earned from this offer is in addition to the rewards (i.e. Membership Rewards or cash back) earned as part of your existing Card benefits, but your ability to earn spend-based rewards for the purchase will be based on the amount after any statement credit or other discount is applied.

- Statement credit will appear on your billing statement within 90 days after 5/8/2021, provided that American Express receives information from the merchant about your qualifying purchase.

- The Motley Fool Terms and Conditions currently provide that unless you notify The Motley Fool that you want to cancel, or that you do not want to auto renew, your subscription or membership fee will automatically renew for another subscription period (subject to applicable law) of equal length (for example, monthly, or annually). This means that The Motley Fool will collect the then-applicable membership or subscription fee and any taxes by charging a credit card The Motley Fool has on record for you without notifying you, unless notification is required by applicable law.

Quick Thoughts

This is a simply fantastic offer, especially if you’re interested in a The Motley Fool subscription in the first place. An annual subscription costs $99, so this Amex Offer fully offsets that cost.

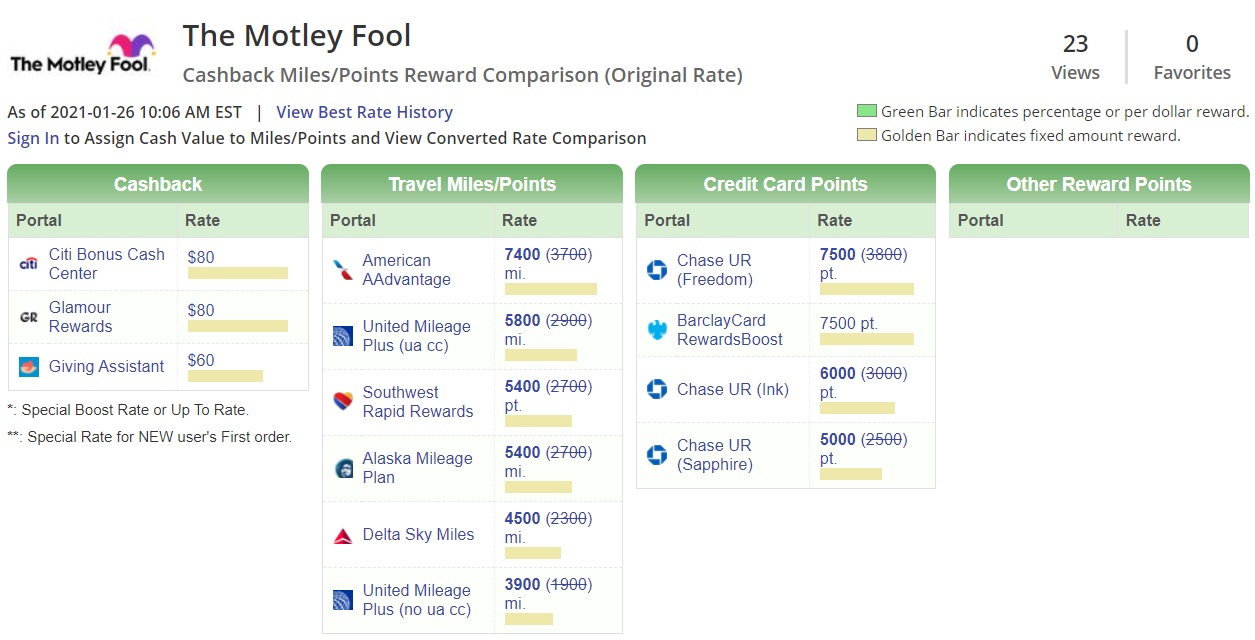

The deal gets significantly better once you take into account shopping portal rewards and makes it a deal almost certainly worth jumping on, even if you don’t care about the investment advice from The Motley Fool.

That’s because many shopping portals are offering extremely generous bonuses when taking out a subscription. A couple of portals are offering $80 cashback, while airline shopping portals are offering up to 7,400 bonus miles right now.

Update: As of today (1/27/21), Dollar Dig is offering $87.50 and RebatesMe is offering $85 – those changes were added to Cashback Monitor after publishing this post. The rates can change from day-to-day, so what’s available right now could change by tomorrow.

On the cashback side of things, Glamour Rewards is likely the safest option as Citi Bonus Cash Center states that you have to pay with a Citi card. The same goes for Chase Travel℠ in terms of paying with a Chase card, although I have had transactions track through Chase Travel in the past when paying with a non-Chase card. With Glamour Rewards offering $80 though, I’d personally prefer that safe option rather than risking not getting anything at all by going through Chase Travel in the hope I’d get 7,500 Ultimate Rewards seeing as I’d have no recourse if it didn’t track.

Another good option is the American Airlines AAdvantage shopping portal as that’s offering 7,400 bonus miles. Depending on how you value Mileage Plan miles, using the Alaska Airlines portal for 5,400 bonus miles might be preferable.

It might even be possible to stack this deal even further by taking advantage of card-linked programs. That’s because there are a few shopping portals that offer points when paying for a The Motley Fool subscription with a card you’ve linked with the portal. That includes Choice Privileges, Caesars Rewards, JetBlue and Emirates. I’m not 100% sure which network they use for tracking though, so if they use the same network as the shopping portals, it could invalidate the cashback/miles.

One stacking option that sadly won’t work is Uber Visa Local Offers. That program is offering 5% back in Uber Cash when taking out a The Motley Fool subscription, but you have to pay with a Visa card for that.

If you do take advantage of this offer, be sure to set a reminder to cancel your subscription at the end of this year/ early next year.

I purchased the $99 subscription through Dollar Dig the first day this deal was available (before the portal terms changed). Received $99 cashback from AmEx, but cashback is being denied by Dollar Dig:

“Unfortunately, Motley Fool declined the transaction stating that we weren’t the last click.

“Usually, this occurs because a link was clicked, or copied/pasted after ours.”

Was anyone able to successfully receive cashback via Dollar Dig? I have screenshots of the original terms, but I don’t know how I can prove that Dollar Dig was “the last click.”

I just saw 10,700 Southwest Points at Rapid Rewards shopping, however in the fine print:

“Only eligible on paid 1 year subscription to Discovery: Everlasting Portfolio, Motley Fool Options, and Extreme Opportunities: Augmented Reality and Beyond.”

These subscriptions are $299 or more. 🙁

For those who signed up via Dollar Dig — is your purchase tracking/pending? Mine isn’t (now more than 10 days later), and even worse, when I try to submit a ticket for missing cash back, The Motley Fool isn’t even included in the drop down.

Can you combine the Amex offer with an offer from Motley Fool? I received an offer from MF for $98 for 2 years and I’m wondering if I use my Amex with the offer added if it will pick it up? (I’m assuming after taxes it will exceed $98)

Has anyone actually gotten the Amex credit to post yet? It shows the offer as redeemed and got the email from Amex confirming this, but I still don’t have a $99 credit on my account.

Me too, I got the email more than a week ago? Any updates for you?

The AMEX credit finally posted on Feb 2. Will have to wait and see if the Glamour Rewards $80 actually pays.

I used AA and the 7400 miles posted to my account & p2 used rebatesme, but has not received the $$ trasaction is pending but says $0 we both already got credited the $99 from Amex

I received the confirmation from Glamour Rewards that I have received the $80.00. I did it on the first day and have all the screenshots so hopefully it will stick.

I did this deal on 1/27 through the American Airlines portal. The $99 amex credit has posted. But on the AAdvantage shopping portal, it doesn’t list any transactions and shows I visited the Motley Fool store on 1/27 but has no order attached to it. Am I screwed? I thought I did everything right.

Contact them after the 14 days or whatever they require to pass and no CB posts. I have found in general the airline portals (all managed by Cartera) have generally worked with me and with one or two exceptions I have gotten my points.

I signed up using the AAdvantage shopping portal, using both my wife’s and my Platinum cards. I got confirmation emails for both from Amex, then I got AAdvantage tracking emails for both, and then got AAdvantage emails confirming that we each earned 7400 miles. But I signed up immediately after receiving Stephen’s email (thank you!).

Just signed up with hoopla & Amex. $85 reward. We’ll see how she blows…

$10 in taxes for me.

Clicking through from cashbackmonitor on the Chase Freedom the offer is showing for 15k UR! But then I read the T&C, cheapest plan it’s good for is $999. So… Not useful

You may be right…there’s a link to the right offering $99 plan, but that may not be included in the “program terms”…rolled the dice anyway.

Also, Ink portal is 12k now

Man Troy, I don’t know you but I love how we avoided blowing each other up over that. Sorry for the misunderstanding, thanks for the edit.

*edit* also sorry I called you Tony lol

Sorry, didn’t see Tony’s post before I posted. Here are the T&C’s:

The Motley Fool Terms and Conditions.

Eligible on one (1) subscription per loyalty account number. Only eligible on paid 1 year subscription to Discovery: Everlasting Portfolio, Motley Fool Options, and Extreme Opportunities: Augmented Reality and Beyond. Monthly subscriptions are ineligible. Offers cannot be combined/stacked with any other offer. Subscription must be active for at least 60 days. Not eligible on any free products, trials, services, memberships, subscriptions and retailer marketing subscriptions. Not eligible on purchases made with coupon or discount codes that are not found on this site. Not eligible on gift cards, gift certificates or any other similar cash equivalents. Purchases made with a gift card may be ineligible.

*WARNING*JayP points out that even though the $99 sub is linked directly to the right on the Chase UR page, the “Program Terms” fine print on the UR portal doesn’t list any of the $99 plans as eligible for rewards. Shady AF, but I’ll let ya know in an hour if it tracked for anything.

Chase UR (Freedom) now 15,000 Points…says no stacking, but I rolled the dice. Even if you don’t stack, 15k points for $99 is a win.

What the hell do they care for. The subscription is being paid for…..

My guess is that they must be subsidizing it. I imagine they don’t want to pay both Amex and the portal.

Hoopla portal does not have updated T&Cs…for whatever reason. I just bought the 1 year sub through them. $85 payout. Screenshot it.

FIrst time using Hoopla

If we got in on it the first day, will we get it? I’m showing $80 as posted in GlamourRewards. When will they pay out?

How long did it take for the $80 to post on glamour rewards? I also purchased through glamour rewards & nothing is showing.

When did you purchase? I purchased the day this deal was posted and it posted today I think, but I’m not positive-it could have been yesterday- I haven’t checked it over the past couple of days.

I purchased yesterday. Thanks.

[…] And later in the week, Motley Fool told Frequent Miler that stacking will not be allowed. […]

How exactly would a shopping portal know that I had also used an Amex offer? Is this new anti-stacking language just to discourage someone from trying, but with no real teeth?