IHG One Rewards ditched their award chart years ago and its prices now fluctuate dynamically. However, there have still been unofficial limits for some brands, which cap the top points rate that you can expect to pay for a property.

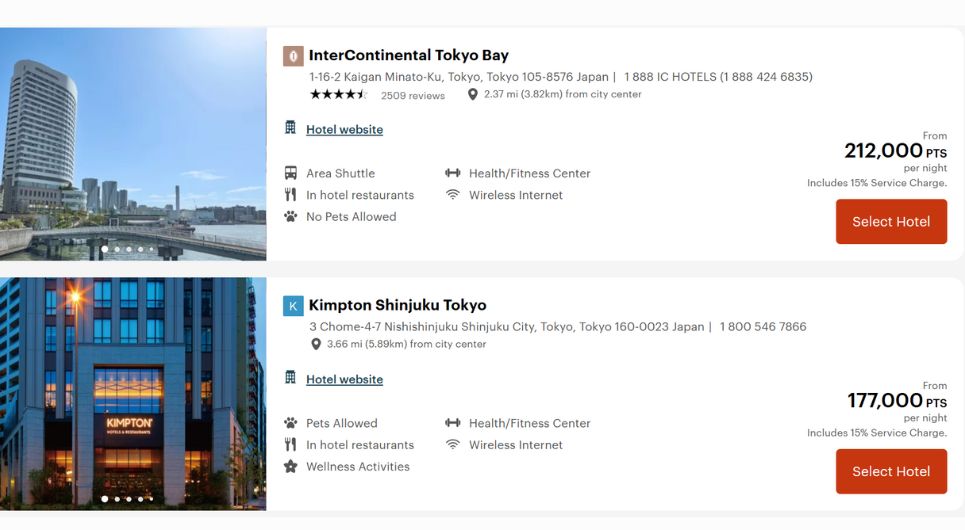

Until recently, non-resort Intercontinental properties had a top rate of 120K points per night for a standard room, but that “cap” seems to have almost doubled overnight – some properties are now pricing at over 200K points. Folks on this FlyerTalk thread first noticed the changes and it’s since been reported by several blogs as well. In addition to the astronomical Intercontinental rates, I’m seeing some Kimpton properties with prices in the upper-100Ks.

If this is a permanent change, it would mark a significant devaluation of the ability to use points at two of IHG’s most desirable brands.

120K+ pricing at Intercontinental hotels

IHG points have steadily degraded in value over the years. We currently peg their average redemption value for domestic properties at .62 cents each, but you can often find them for sale at ~0.5 cent apiece. Despite that, the rate caps that used to be in place at some properties both limited what you could spend a night to relatively reasonable amounts and also provided some opportunity for outsized value when cash prices escalated to the stratosphere.

Now, the upper limit for expensive nights at top, non-resort properties appears to be somewhere in the 200Ks, almost double what it was previously. Even worse, although I’m not seeing a ton of examples of properties above 200K, there’s plenty around the world that are ~120K+.

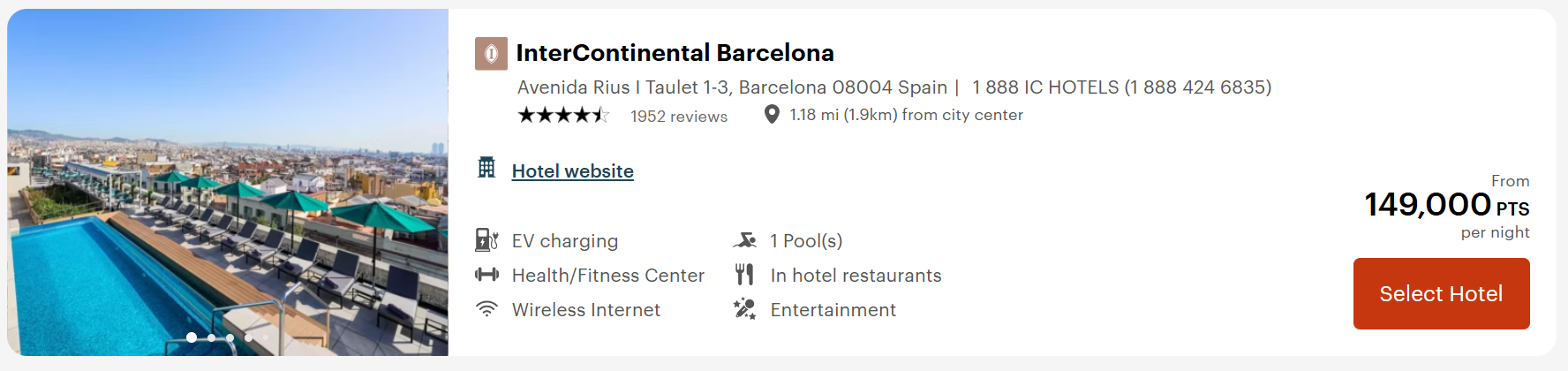

I don’t recall ever having seen the Intercontinental Barcelona above 100K before, but now it passes that threshold for almost the entire month of June, going up to 149K per night:

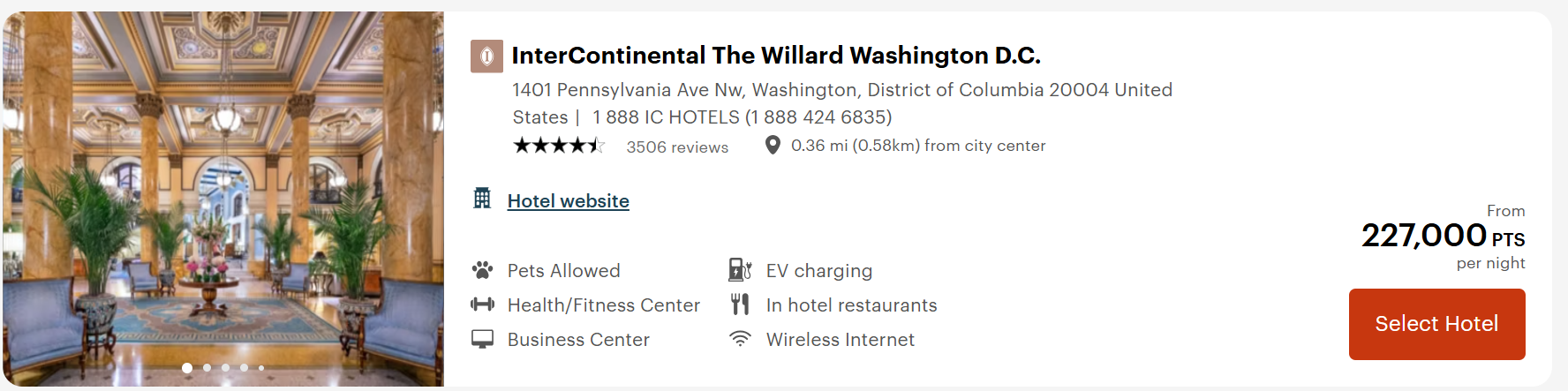

Looking domestically, my jaw dropped when I saw the Intercontinental Willard in DC (one of my favorite IHG hotels in the US) coming in at an insane 227K per night in May:

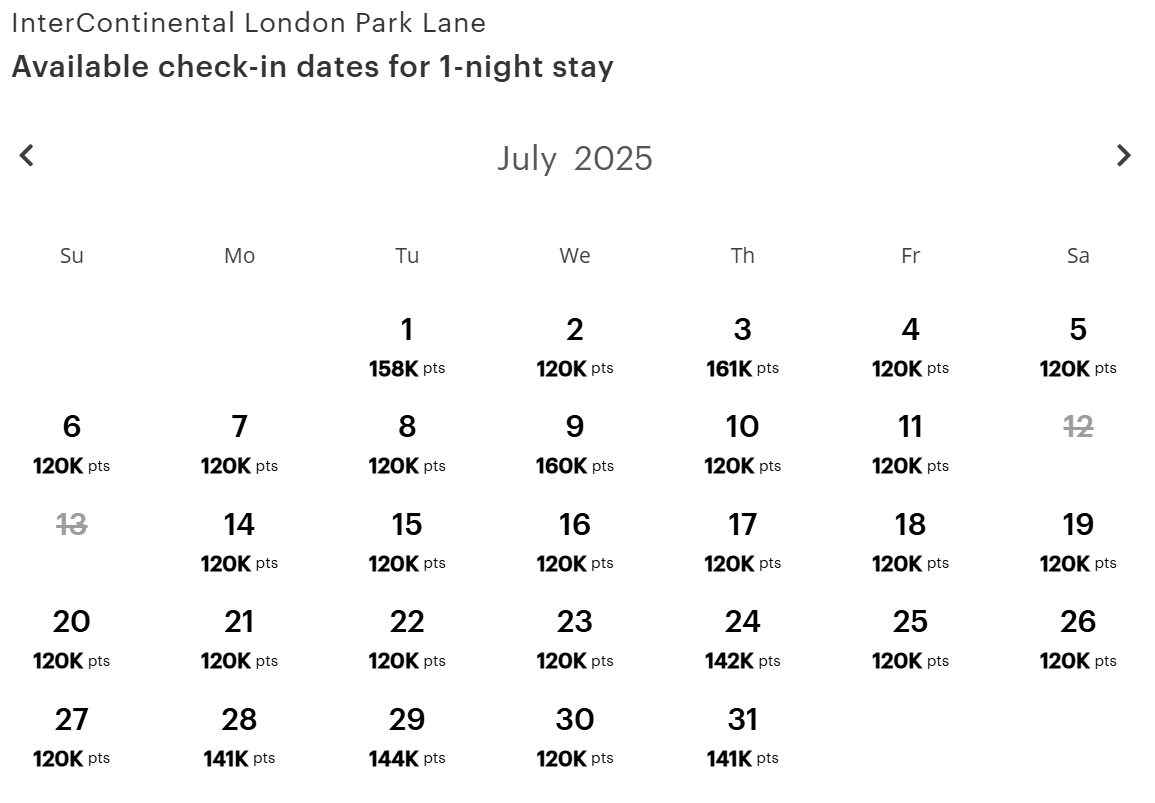

Meanwhile, the Intercontinental London Park Lane is 120K+ for the entire month of July, topping out at 160K:

Quick Thoughts

It bears mentioning that all of the properties shown above also had sub-100K rates throughout the year and many of the most expensive nights still provided 0.5 cents per point or more in value. However, it certainly appears that IHG has thrown any unofficial upper price limits that it once had to the winds.

It seems like IHG One Rewards is increasingly moving towards standardizing its redemptions at ~0.5 cents per point, severely limiting any aspirational upside that the program still had.

[…] I did not regret dropping this program from my hotel bank points collection. Because, boom, they did it again: IHG increases top award rates at Intercontinental hotels to 200K+ per night. […]

With the economy heading towards recession, I cannot see how jacking up award nights’ cost is inducive to loyalty. Why bother being loyal, since it seems that being loyal equals being screwed?

Seafire 70k’s days are numbered. Get it while you can.

Sadly, all the nicer properties are going up in point cost.

Wow, I remember when I first got the IHG card the highest priced hotel was 50,000 miles. It was controversial when Intercontinental hotels went up to 60,000 max. Now the sky is the limit when it comes to how many points are charged for a hotel.

I’m so glad I was able to use a bunch of my old $49 Chase certs for free nights at the IC Amstel Amsterdam back in the not-too-distant past. Best FNC use EVER.

Anybody who BUYS hotel points deserves to get screwed when this happens.

How naive to think earning points is not also buying…

Its not actually. When you buy points for cash then the company makes those points worth half of the value that you paid for them, you effectively lit half of your money on fire. Plus when you use points for stays, most chains consider those nonrevenue or ineligible rate bookings. You earn nothing and often the hotels won’t confer elite benefits, night credits etc. It’s a win/win for the hotel. They get your money, you stay anyway and they don’t have to give you anything but the room….and they have the freedom to arbitrarily devalue those points as often as they’d like making your investment worth less and less.

Understand now?

(removed by admin)

This was a pretty nasty response. No need to call names. Please try to keep things civil

It was in response to the naive part. He’ll be okay.

So you’re saying naive and sensitive?

This might explain the new elevated offer on the business card.