At Frequent Miler, we keep a database of point valuations called “Reasonable Redemption Values.” These are estimates of the “worth” of airline miles, hotel points, transferable points, and more. The idea is that we try to identify the point at which it is “reasonable” to get that much value or more from your points.

This information is critical for making informed decisions. In fact, it’s a key component of the First Year Value information shown on our Best Credit Card Offers page, and it’s similarly used to show which cards offer the best value for everyday spend and which offer the best category bonuses.

When we first started looking at the value of hotel points, we used a laborious process that involved manually comparing the cash and award prices of hundreds of stays each year, then using those results to create RRV estimates. However, we now have a much better way of pinning down the value of IHG points.

Gondola is a terrific free hotel search tool that shows prices of properties both in cash and in points, and it keeps data of both for searches done via its platform.

The kind folks over at Gondola have made this data available to us for the purpose of identifying hotel program point values. Thanks to them, we now have access to the results of around 2 million domestic and international IHG searches at almost 6,300 different properties, and each one notes both the cash and award prices for the same room. Using this data, we can provide a far better estimate of the “Reasonable Redemption Value” of IHG points than we were ever able to obtain by using manual calculations.

Based on Gondola’s data, we’ve lowered the Reasonable Redemption Value (RRV) of IHG points ever so slightly from 0.62 to 0.61 cents per point.

Background

When collecting points and miles, it’s always a good idea to have a general idea of what points are worth. Let’s say, for example, that you have the opportunity to either earn 1,000 Hyatt points or 2,000 IHG points. Which should you go for? If you don’t know what the points are worth, you’d likely go for the IHG points.

However, in our analyses we’ve found Hyatt points to be worth about three times as much as IHG points. Therefore, on average, 1,000 Hyatt points are worth considerably more than 2,000 IHG points. In this post, you’ll find our best current estimate of the value of IHG points.

Methodology

In order to determine the value of IHG points, we looked at Gondola’s collected, real-world cash and point prices at just under 6,300 IHG properties. Since IHG award bookings are fully-refundable, we excluded data from all cash rates that were non-refundable in order to make it a complete apples-to-apples comparison. We also used the Total Cash Rate, which includes taxes and any local fees.

Hotel Programs that Waive Resort Fees on Award Stays

Hilton, Hyatt, and Wyndham waive resort fees when you book stays using points or free night certificates. For these chains, the resort fee does not have to be considered separately from the Total Cash Rate (which includes the resort fee). So, the RRV calculation is as follows:

RRV = Total Cash Rate ÷ [Point Price]

Hotel Programs that Charge Resort Fees on Award Stays

IHG, Marriott, and many other hotel programs impose resort fees on award stays. For these chains, the resort fee must be specifically taken into account in the calculation. We do that by having Gondola subtract it out of the Total Cash Rate. The RRV calculation is as follows:

RRV = [Total Cash Rate – Resort Fee] ÷ [Point Price]

Gondola Data

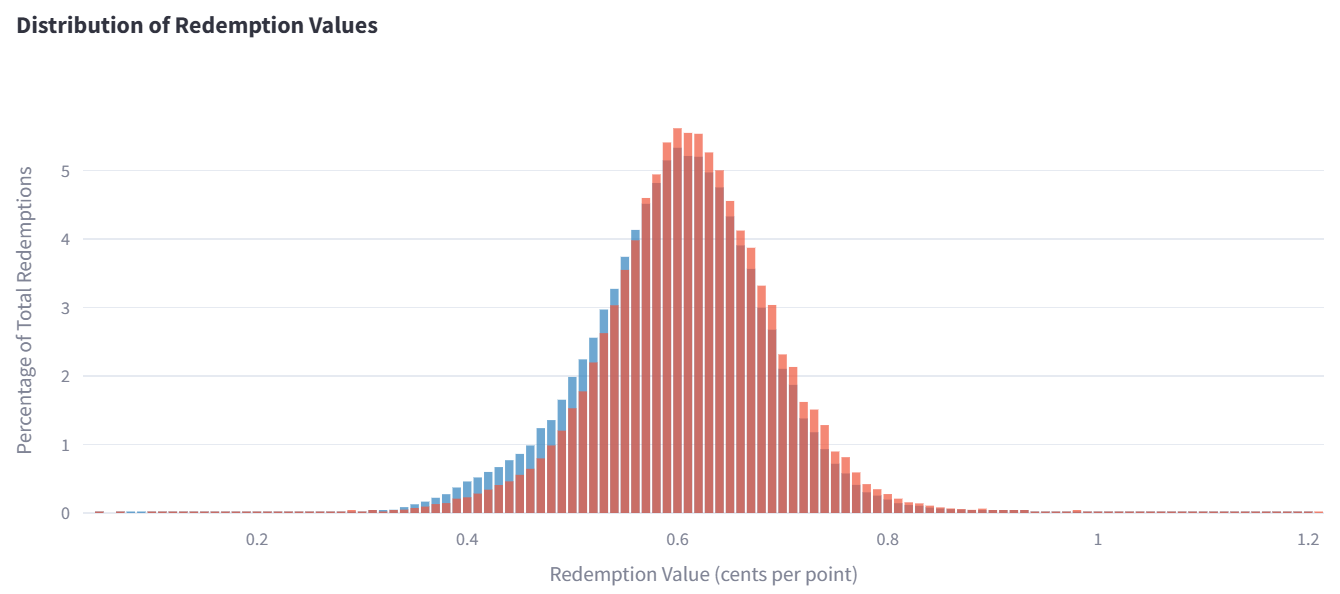

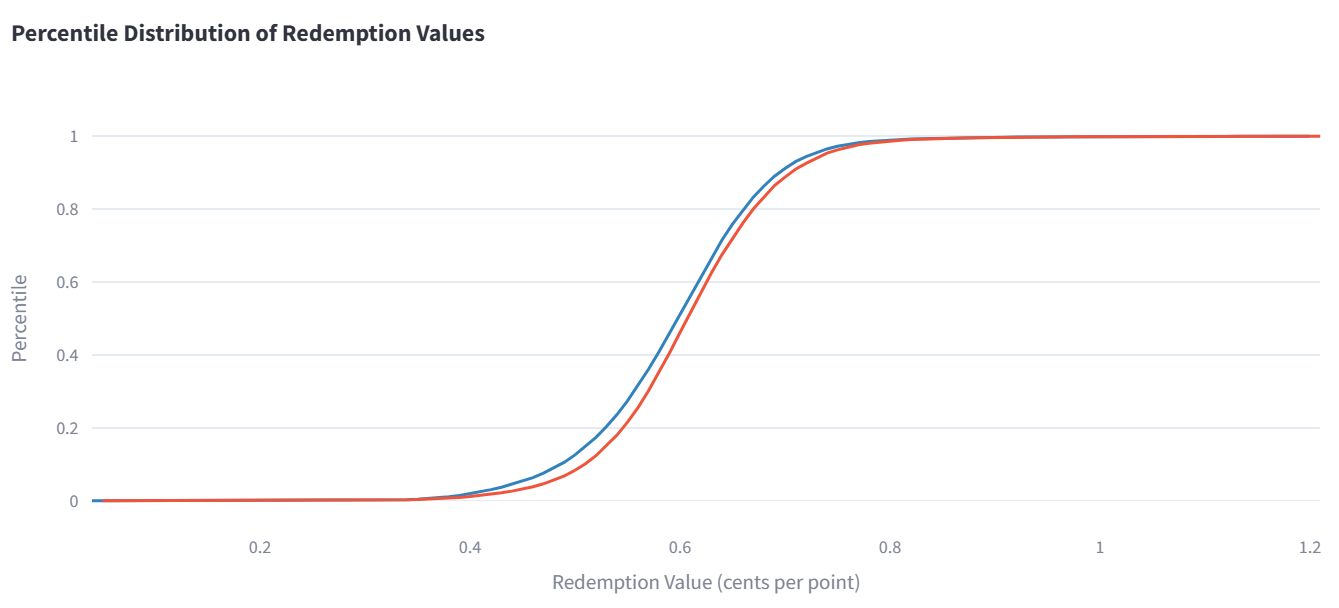

For our hotel RRV values, we use the median value we see based on the data from Gondola. If the median is 1 cent per point, that means that half of all searches produced a value of less than 1 cent per point, and the other half above 1 cent per point.

- Gondola Median Observed Value for IHG redemptions: 0.61 cents per point

(based on data as of June 4th, 2025) - Range: .29 to .98 cents per point

Brand Comparison

Another cool feature of the the data set that Gondola provides for us is that we can actually see how points values vary across a program’s different brands. For some analyses, we’ll break that out in a separate table, but for IHG almost every brand had a median value of .59 – .61 cents per point. The one outlier was the expensive luxury brand, Six Senses, which had a median value of 0.65 cents per point.

That seems to indicate that IHG award prices tend to closely track cash rates across all brands.

Results

Point Value

| Analysis Date: | 6/4/25 | 7/15/24 |

|---|---|---|

| Point Value (Median) | 0.61 | 0.62 |

| Minimum Point Value | 0.29 | 0.49 |

| Maximum Point Value | 0.98 | 0.77 |

The median observed point value was 0.61 cents per point. This means that half of the observed results offered equal or better point value and half offered equal or worse value. Another way to think about it is that without trying to cherry pick good awards, you have a 50/50 chance of getting 0.61 cents or better value from your IHG points when booking free night awards.

Pick your own point value

| Analysis Date: | 6/4/25 | 7/15/24 |

|---|---|---|

| 50th Percentile (Median) | 0.61 | 0.63 |

| 75th Percentile | 0.66 | 0.66 |

| 90th Percentile | 0.71 | 0.69 |

When we publish Reasonable Redemption Values of points (RRVs), we conservatively pick the middle value, or the 50th percentile. The idea is that just by randomly picking hotels to use your points, you have a 50/50 chance of getting this value or better.

But what if you cherry-pick awards?

With some other hotel programs, the 75th percentile cents per point is much higher than the median. This used to be true with IHG, but in recent analyses we found that the 75th percentile was only slightly higher than the median, while even the 90th percentile only offered around a 15% uplift versus the median. There are certainly still cases where you can get better than 0.71 cents per point value, but the chance of stumbling upon that higher value is low.

This analysis shows that even those who cherry-pick good value awards for stays can’t count on regularly getting much more than 0.66 cents per point value with IHG properties.

New IHG Reasonable Redemption Value: 0.61

Our Reasonable Redemption Value (RRV) for IHG points was previously set to 0.62 cents per point. With the latest analysis, the value went down only a smidge to 0.61. RRV’s are intended to be the point at which it is reasonable to get that much value or better for your points. In this case, it’s not necessarily easy to get much more value, but it’s definitely easy to get around 0.61 cents per point value.

- Reasonable Redemption Value for IHG: 0.61 cents per point

- Reasonable Redemption Value for those who cherry pick awards: 0.66 cents per point

Overvaluing vs. Undervaluing Points

There is no perfect way to estimate the value of points. Decisions we made here in some ways overvalue points and in some ways undervalue points. The hope is that these things roughly offset each other…

Factors that cause us to undervalue points

- With hotel programs that offer 4th Night Free Awards (IHG, with some credit cards), or 5th Night Free Awards (Hilton & Marriott), or award discounts (Wyndham), we do not consider the point savings in our analyses.

- With hotel programs that offer free parking on award stays to top-tier elites (Hyatt), we do not factor this in.

Factors that cause us to overvalue points

- We do not use discount rates (other than member rates) in our analyses. In real-life, many people book hotels cheaper (and sometimes far cheaper) by using AAA rates, government & military rates, senior rates, etc.

- We do not use hotel promotional rates. Often, individual hotels have deals such as “Stay 2 Nights, Get 1 Night Free” which can greatly reduce the cost of a stay.

- We do not use prepaid rates in our analyses. Sometimes these rates are significantly lower than refundable rates.

- We do not factor in rebates which can be earned from booking hotels through shopping portals.

- We do not factor in points earned on paid stays.

- We do not factor in rewards earned from credit card spend at hotels.

- We do not factor in hotel loyalty program promotions: Most promotions, but not all, only offer incentives for paid stays. We often see promos offering bonus points, double or triple points, free night awards, etc.

- With hotel programs that waive resort fees for top tier elites on paid stays (e.g. Hyatt), we do not factor this in.

Conclusion

Based on the latest analysis, we decreased the IHG RRV from 0.62 to 0.61 cents per point. Further, the latest percentile results show that those who cherry-pick awards (75th percentile) can expect to get around 0.66 cents per point.

We have to admit, it’s somewhat gratifying to see the much more exhaustive data that Gondola assembles reach a value that’s so close to what we previously had arrived at using our manual methodology with limited data points. It’s also good to see that IHG’s point values have remained fairly steady over the last couple of years.

For a complete list of Reasonable Redemption Values (and links to posts like this one), see: Reasonable Redemption Values (RRVs).

Big data and rigorous methodology? Yes, please!

Not the Seafire Kimpton….but was very happy with an Indigo Grand Cayman spring break reservation for 5 nights at 200K points vs. the $8000 cash rate.

Is this the first “new” evaluation you guys have done with the Gondola data vs. the old methodology? If so, are you planning to update your other program estimates based on the same data source. I always appreciate how much effort you take in explaining these things!

It is! We’re thrilled to have access to such a huge trove of data, and will be in the process of updating the other programs over the next week or so.

Having DPs from Points Path for flights and Gondola for Hotels sounds amazing

Consider also calculating and sharing the data’s standard deviation too. That tidbit of information would be EXTREMELY useful/helpful with this data that follows a normal bell curve distribution, as it allows one to determine thing like:

– the most likely high end of an above-average redemption value (the median plus 1 standard deviation)

– the likelihood (~34.1% or 1 in 3 times) of getting a redemption value between the median and that “median + 1 std deviation” number

– the likelihood (~13.6% or 1 in 7 times) of getting a redemption value between 1 and 2 standard deviations above the median

– the very unlikely chance (~2.3% or 1 in 43 times) that one will get a redemption value higher than 2 standard deviations above the median

Fantastic. I have started to truly appreciate these rrv posts over the past few years. There are so many bloggers trying to assign cpp values, but FM’s evaluations offer by far the most comprehensive and statistically significant results. Great job guys! *Tips fedora.

Greg and the FM crew have spent years doing a great job on this. I told Greg once he’s the only honest guy in the business.

I too appreciate the continued effort.

It’s really bizarre to me how much wider IHG’s redemption band is relative to this time last year. I’d lost a lot of my fondness for the program when they slashed redemption values at the top end of redemption value last year, but if they’re rolling it back a little, as it seems from this analysis, I’d really be interested in engaging with the program again.

Though I did manage to score 8 nights at Indigo Cayman for 300k total – 50k/nt and I used the Chase card’s 4th night free twice – when the rack rate approaches $1250/nt so maybe I should quit my bellyaching.

The increase in range is most likely due to the drastically increased sample size between this year and last. We probably had ~100-125 dps last year when we were doing it manually. This time, we have ~2,000,000. That gives us a much broader view of what the real range of point values is. Note, though, that there was barely any change in the median, 75th and 90th percentiles, leading me to believe that range isn’t really much wider than it was last year.

That’s a great redemption! IHG having a free night on four nights can create some great opportunities.

I appreciate you comparing cash prices that are refundable to point purchases, a lot of people overlook that and fail to realize that adds a lot of value per point. You are ahead of a lot of your peers in that are, well done!

Your compensation for resort fees is also insightful.

I see your calculation for CPP and I understand it, but I politely disagree with your methodology.

Since you earn points paying cash and you can buy points for 0.5 cents per point on sale, which is what all smart IHG members do, I feel the calculation should be:

CPP=(Total Cash Price-Resort Fee-[Points earned on stay x 0.005])/Points Price

You are not paying extra points, you are earning extra points towards a future stay and I think that is something of critical importance. It is not an extra cost in points now, it is a loss of earnings that can be applied to a future stay. Therefore, the value of the points need to be subtracted from the cash price, not added to the points required.

For the IC in Chicago for NYE, points are 42K at $364.47 total price with 27.26 fee. The points earned for a Premier card holder would be 7386 points.

My calculation then yields 0.72 cents per point versus your value of 0.68.

Of course, as others including yourself have noted, Select card holders would get a value of 0.80 cents per point. Also, as you and others have noted, the use of 4 nights for 3 greatly increases the value. Again, as others including yourself have noted, combining both the Select and 4 for 3 night discounts make for an extremely appealing value.

There are thousands and thousands of IHG properties and you can’t analyze them all but I thought the selection of metro areas was pretty limited along with the time frame. Also, keeping it to just one or two nights is not factoring in the common behalf booking for longer stays.

For example, the booking the HIX on the Big Island of Hawaii next year for four nights during spring break gives me a value of 0.85 cents per point. That is available to anyone that gets the credit card. Obviously, Select card holders get an even better deal, but 0.85 CPP for any Premier card holder is a heck of a deal.

Thanks.

Excuse me, “common behavior booking”, sorry about the autocorrect error.

I find IHG points to be sneaky valuable, especially if you hold the Old IHG card + the Premier and Business cards. Then you’re benefitting from 4th night free, 10% back on points bookings, one capped FNC, and two toppable FNCs. That’s a lot of value for their points that doesn’t necessarily show up in the standard RRV.

For example, I could book via points on a 4th night free booking, save 10% of the points for that booking, then top off up to two uncapped FNC night reservations thereafter while saving tens of thousands of points.

I’m doing this for a 5 night stay at the Kimpton Seafire in the spring. 5 nights would run 350,000 points absent holding any cards. With the above trifecta, 5 nights costs only 156,000 points. An awesome deal!

Not saying the analysis is flawed in anyway, but I think the general points and miles crowd doesn’t see IHG as a valuable hotel currency to hold.

Yep, I have both cards too and benefit from all of that too!

Thanks, Greg! Always appreciate these analyses. Lately, I’ve been wondering, would you reassess the RRV of transferable currencies? Given:

1) Our RRVs have always been on the very conservative side. I don’t think the recent devaluations are enough cause to lower them further. Plus, keep in mind that some programs have arguably become more valuable. For example, Flying Blue now offers 50K biz class between North America and Europe, plus they added free stopovers. Alaska (Bilt transfer partner) has many new sweetspots that are arguably more accessible to most of us. Qatar and Finnair have added new, valuable ways to use Avios.

2) Point sales don’t affect our RRVs (which are estimates of how much value you can get for redeeming points). Instead, when you see a sale in which the points cost less than the RRV, you know that it’s worth paying attention to that sale.

3) Restriction of partner award availability: Yes, that makes the individual star alliance programs less valuable (especially to US residents). In some cases, though (not saying United), I think that programs that do that tend to open more space up to their own members. So, for example, you may see Air France/KLM offering less space to partners but more “saver” space to their own members. Regardless, my answer in part 1 stands.

I’m getting 7 cents/ point on 8 night stay at the kimpton seafire over Christmas week- so there still are some opportunities for outsized value- and yes I wouldn’t have really paid 30k for the room- but we did it last year too and it’s a steal with points

Interesting.

I’m seeing a roughly 10% devaluation across the scattered properties I’ve been shopping. Admittedly my method is not as rigorous as yours, but I’m in the camp that IHG recently devalued.

I may write a separate post about this. There are a number of possible explanations here…

Another possibility is that IHG dynamic award has become more effective at identifying and addressing outliers.

Generally the properties I shadow are ones I’ve previously identified as being a good deal and worth keeping track of as my plans solidify.

Thank you for your thoroughness.

You can see this a bit in the reduction of value at the 70, 80, and 90th percentile. IHG might be systematically working on outliers. That being said, all of the Grand Cayman properties will continue to be a steal with points because of the cash pricing and because of the massive taxes (30%+) that the Cayman Islands government puts on cash stays. Because IHG points bookings (and points + cash bookings) waive taxes, they will likely be bigger value than will show up in the RRV.

Thanks for the methodical assessment.

Were bookings with less favorable cancellation policies much cheaper than bookings with free cancellation? If so, then the cash prices you used in your comparison would have inflated the value of IHG points. For instance, if the nonrefundable rate was 25% less than the free cancellation rate, most people would have chosen the non-refundable rate. In such a case, the cheapest rate should influence the value we assign to IHG points.

Also, is your sample size 24 hotels total in 8 different cities? I hope they’re not all downtown. If I were IHG, I could easily game your assessment by offering good point values for those hotels.

Hi Greg, was this analysis done before or after the devaluation last week? I had just checked on a couple of hotels I had recently booked that were consistently in the 85-100K range, and they definitely jumped to the 120K range. I haven’t looked at their cash rates, but I seriously double that hotel would be able to support a 20-25% cash price increase as well for the rest of the year…

The analysis was done today

Thanks, I’ll have to keep an eye out to see if I was getting better than average value before and now it’s consistently lower. Also, I noticed you mention US cities, one of the hotels I know devalued (in points) is in Europe, so maybe it just regressed to the mean… [PS — *double -> doubt in my comment]

My methodology is much simpler. I look at the hotel rate and compare that rate to what a reward stay using points will cost using the value of $5 per 1,000 points.

I purchased 270,000 points at $5 per 1,000 points in 2022.

I averaged about $60 per night using IHG points for 35 nights in 2022. I paid $709 for six nights at Hotel Indigo Krakow and earned 54,000 points.

In 2022 I redeemed points in Lisbon, Portugal; Thessaloniki, Greece; Madrid, Spain; Gdansk and Krakow, Poland with 28 nights booked using 4th night free rate for an instant 25% discount.

For 2023 stays I have Diamond elite status with the choice of free breakfast, annual lounge access and 2 suite upgrades to use.

My redemption value in 2022 has ranged from a low $6.53 per 1,000 points for one 15,000 points night at Crowne Plaza Madrid Airport to $13.91 per 1,000 points for 4 nights in June at 48,000 points at Holiday Inn Express Av Liberdade in Lisbon.

My most recent points redemption used 84,000 points ($420) for 5 nights when the published rate would be $630. That is $7.50 per 1,000 points redemption value.

A snapshot of IHG rates is only data points based on that day. I typically book IHG reward stays, cancel and rebook them two or more times as reward rates change with IHG dynamic pricing.

I have a stay in Amsterdam booked in Nov 2022 for 20,250 per night. That same hotel is now 32,500 points per night.

Book reward stays early and check back periodically for lower rates.

A correction in above comment. I purchased 420,000 IHG points for $2,100 in 2022.

I

Thanks for the update Greg.

I do think Eric is correct to question your focus on big cities.

IHG is a great complement to a big-city focused chain like Hyatt precisely because they have so many properties in more rural or even second-tier areas. So for example, Hyatt has several properties in Washington’s major market (Seattle-Tacoma), but none at all in its second biggest market (the greater Spokane area on the state’s east side). By contrast, IHG has several properties not just in rural areas statewide, but in the Spokane area. And in my experience, the IHG point value in the less populated areas tends to be higher.

Indeed, as a longtime Hyatt Globalist and IHG Diamond, I find the two programs complement each other quite well.

But if you simply do the 4th night free, then your rrv would be 1.33x more, or .84 cpp. That’s easy to get. If you also have the old IHG card you get 10% back on top of that, putting the value around .924 cpp. That is relatively easy to accomplish as long as you do a four night stay. It is the reason I have bought points (and gotten more than 1cpp, though that was in Vietnam). I know you include that in the disclaimer, but given how cheap IHG points are to buy and the low threshhold of four nights I find this doable, whereas I’ve only once been able to take advantage of a Hilton or Marriott fifth night free.

I would add value to IHG bc of 4th night free awards and the cheap cost of points. I would not add value to Hilton or Marriott based on their fifth night free.

I wonder if there might be more higher-value bookings if you considered random locations instead of three places in each of the big cities. I did quite a bit better than 0.65 at a Candlewood in Wyoming for this summer. That’s also an area where IHG (as well as Marriott and Hilton) shines in comparison to Hyatt – the closest Hyatt is about a 4.5 hour drive away.

Not saying the methodology is wrong at all, just that I suspect that’s where more outsized value is available now. (It’s a different program, but on the same trip I reserved a $400 Fairfield for 20k Bonvoy points)