NOTICE: This post references card features that have changed, expired, or are not currently available

If you’re in the market for AAdvantage miles, there are increased signup bonuses on a couple of American Airlines credit cards. One of them can be earned after your first purchase and payment of the annual fee, while the other requires $10,000 of spend in order to earn the entire bonus.

Offer 1

| Card Offer |

|---|

ⓘ $-99 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available to new applicants$99 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Up to 75K: 60K miles after first purchase and 15K after adding an authorized user and making one purchase on that card [Expired 2/24/24] |

Key Card Details

| Card Name w Details & Review (no offer) |

|---|

$99 Annual Fee Earning rate: 2X AA ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 + tax domestic companion certificate with $20K membership year spend. Noteworthy perks: First checked bag free ✦ Preferred boarding for the primary cardmember and up to 4 companions traveling on the same reservation ✦ 25% off in-flight purchases ✦ $25 wifi credit per membership year ✦ Flight cents: round up purchases to earn more miles |

Offer 2

| Card Offer |

|---|

ⓘ $842 1st Yr Value EstimateClick to learn about first year value estimates 65K miles 65K miles after $4K spend in first 4 months$0 introductory annual fee for the first year, then $99 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card usually has a great welcome offer, but if you're looking for a card to keep long term, you'll find better options. |

Key Card Details

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: This card usually has a great welcome offer, but if you're looking for a card to keep long term, you'll find better options. $0 introductory annual fee for the first year, then $99 Earning rate: ✦ 2X AA ✦ 2X certain telecommunications merchants ✦ 2X car rental merchants ✦ 2X gas Card Info: Mastercard World issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 plus taxes domestic companion certificate after $30K spend Noteworthy perks: First checked bag free ✦ Priority Boarding ✦ Save 25% on inflight purchases |

Quick Thoughts

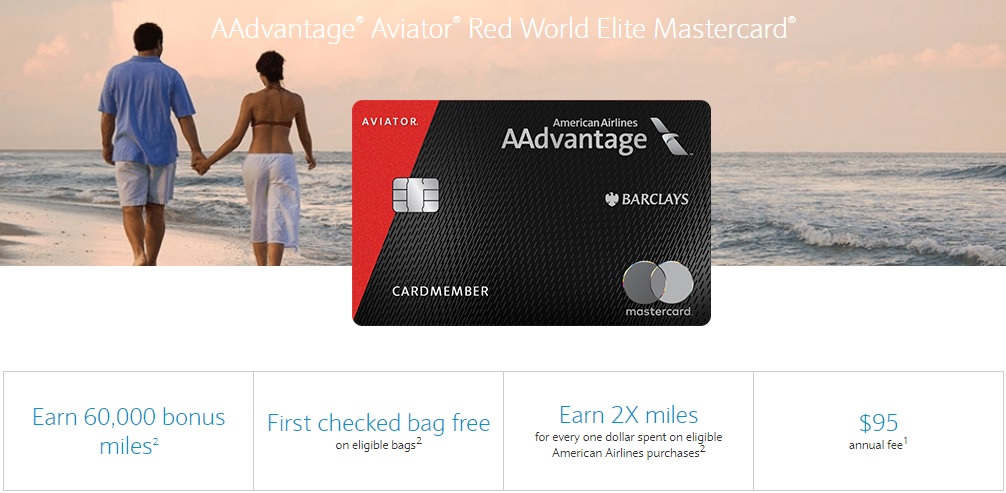

The Aviator Red card has the easiest bonus to earn of these two cards. That’s because it offers a signup bonus of 60,000 miles which is earned after making only one purchase of any amount and paying the $95 annual fee.

That’s the highest bonus we’ve seen on this card, although in the past it’s been possible to earn an additional 500 miles by using an application form obtained on an American Airlines flight. Let us know in the comments below if you see forms for this offer in the wild this time around.

The CitiBusiness AAdvantage card has more stringent spend requirements with a couple of tiered bonuses. You’ll earn 50,000 miles after spending $3,000 within the first three months, then an additional 15,000 miles when spending a total of $10,000 in your first year of membership. This therefore requires far more spend than the Aviator Red credit card, although the annual fee is waived on the CitiBusiness AAdvantage card.

These two cards have some similar benefits – they both offer your first checked bag free, access to reduced mileage awards, 25% off in-flight purchases and more. There are a few key differences though.

For starters, the Aviator Red card offers a 10% rebate on award flights, up to 10,000 miles back every year. That alone can be worth paying the annual fee if you know you’ll be making redemptions.

The CitiBusiness AA card doesn’t include that benefit, but it does come with the opportunity to earn a $99 domestic companion certificate after spending $30,000 on the card. If you can put that spend on the card without it affecting your ability to earn other signup bonuses, that might provide good value in some circumstances.

Be aware that in order to be eligible for the CitiBusiness AAdvantage bonus, you must not have opened or closed this card within the past 24 months.

[…] Increased AA Bonuses: 60k Aviator Red & 65k CitiBusiness AAdvantage Platinum […]

[…] Increased AA Bonuses: 60k Aviator Red & 65k CitiBusiness AAdvantage Platinum […]

[…] Increased AA Bonuses: 60k Aviator Red & 65k CitiBusiness AAdvantage Platinum […]

[…] Increased AA Bonuses: 60k Aviator Red & 65k CitiBusiness AAdvantage Platinum […]

My Citi Bus.and Personal card Doesn’t get the 10%% Rebate ?? So I need the Aviator card and pay with that card then the bank will put the rebate in my AA account correct ?? I had all 3 in the past and got the rebate too.

CHEERs

The CitiBusiness doesn’t offer the 10% back, but the personal Citi AA card does.

Thanks !!! u saved me $$$ .I was TINKing I needed to cancel both then get the Aviator card . But that’s not the case..

CHEERs

Got this 2wks ago @50k. Do you know if Barclays match?

I’m not sure, but it’s worth a try regardless as there’s nothing to lose.

In general they do as long as it was within 30 days of the offer changing.

I had the personal aviator red card for about 3 yrs before cancelling it about 2 months ago; any data points on if and when I can re-apply for a new one? Thanks!

I think you’d be eligible for a signup bonus right now, although it seems to have gotten harder in recent years getting approved for cards by Barclays, so there’s no guarantee that they’ll approve your application.

Any DPs on having multiple Aviator Red cards? I’ve got one that was a conversion from the old US Airways card, but it’d be nice to pick up an easy 60k.

My understanding is that you can – in theory – get another, but there’s no guarantee that you’ll get approved as Barclays has gotten quite picky about approvals.

They always been PICKY (Get ur Ducks in a row) I will apply by ur link for the Aviator card in May after I apply for C1 Venture card .I need free nites in1/15/2020..

Thank You

I tried 6 months ago and got denied

Wait 6.5 months then apply again .That worked with Barclays and another who denied me. I won’t be Denied ..

CHEERs

I can say that I had the old US Airways card, it was converted to the Aviator. Then canceled it before the 1 year mark to avoid the annual fee. Less than 24 months later, I applied for this AAdvantage Aviator Red World Elite MasterCard and got another 60,000 miles. I’ve since canceled this card before the next annual fee.

$190 for 120,000 AA miles. TBH I wanted these for for redeeming business class and its been very difficult. Still have the 60k miles from last year just sitting in my account.

For those asking about the old US air card converting to The Aviator, I had cancelled mine about 12 months ago, and then reapplied just three months after that to Barclays Avaiator and got approved with bonus.

As for Citi AA biz, am still finding the 70k link online after $4k spend in four months. Search for “Citi AA business 70k”. Click on a certain Citi weblink, not AA or other indirect ref which default to current smaller offer and higher spend. Just got approved. GL. Curious to hear if anyone else can do that.