NOTICE: This post references card features that have changed, expired, or are not currently available

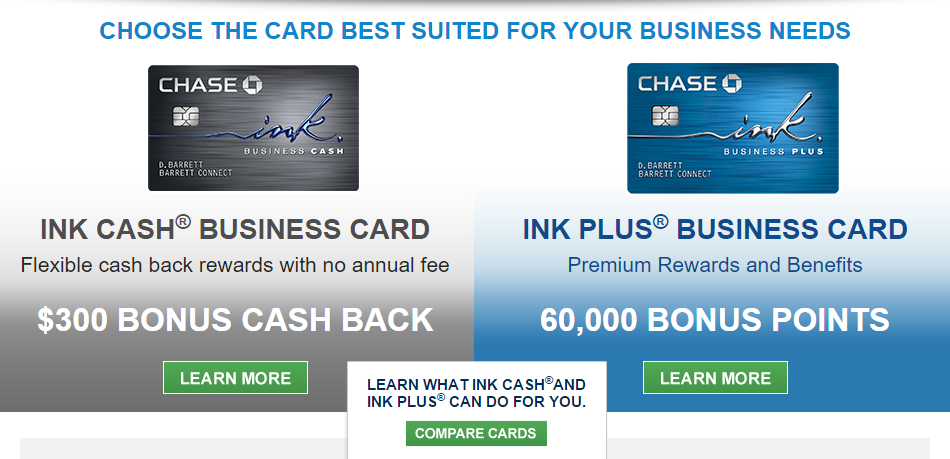

Chase has increased the public offers on both their Ink Plus and Ink Cash cards. Here are the details:

- Ink Plus – Get 60K Ultimate Rewards points after $5K spend during the first 3 months. $95 annual fee NOT WAIVED the first year.

Ink Cash – Get 30K Ultimate Rewards points after $3K spend during the first 3 months.This has reverted back to the normal 20K offer.

You can find up to date application links for these cards on the Best Signup Offer page.

Warning for Churners

As a warning, Chase has made it more difficult to get approved for cards that earn Ultimate Rewards points such as the Ink Plus and Ink Cash. Many people have reported that Chase is automatically denying applicants who have opened 5 or more cards across all banks in the past 24 months.

Related posts:

HT: Waller’s Wallet on Twitter

Never miss a Quick Deal, Subscribe here.

[…] Increased Chase Offer – Ink Plus 60K […]

[…] Increased Chase Offer – Ink Plus 60K […]

[…] Increased Chase Ink Offers – Plus 60K & Cash 30K Bonuses […]

[…] Increased Chase Ink Offers – Plus 60K & Cash 30K Bonuses […]

Looks like Chase has most of us locked out, time for Citi, US Bank and others,better get the best use possible on Chase Ultimate Rewards while you can

I’m not sure why anyone thinks they should be entitled to keep opening cards and getting bonuses when they don’t charge enough to make the deal profitable to the bank. But, of course, I’ve held this view for years and banks have continued to allow it to occur.

50,000 in charges x 5 points on Visa gift cards annually isn’t helping the bank.

Heck , there are so many cr cards with so many bonus categories I almost never have a charge that isn’t bonused (can always get 1.25 to 1.5 with Starwood and Amex everyday preferred).

Limiting someone to 5 or 6 cards isn’t intelligent. Limiting cancellation and reissue with bonuses on the same cards well, it was overdue.

[…] HT: Frequentmiler […]

Hi – I am thinking of applying for the AA World Elite card – would it be helpful to you if I signed up thru your site?…and if so would you send me a link to do so. Thanks

Darn, just signed up and was approved for Ink Plus a few weeks ago. Do you think if I called them, they’d up the bonus to match what’s advertised here?

In the past people have had mixed success with this since the 50K offer comes with no first year annual fee and the 60K offer charges the $95 first year annual fee.

“Many people have reported that Chase is automatically denying applicants who have opened 5 or more cards across all banks in the past 24 months.” -FM

It’s actually more than five cards, not five or more.

Having gone back and read it again, the original language is correct based on the data points I have heard. If someone has opened 5 accounts and this will be #6, then people have been denied.

And people have also reported that they have been approved with 5 or more prior cards. So it’s not automatic.