Amex refreshed the Platinum cards on September 18, 2025. The consumer Platinum card now comes with a twice-annual $300 credit for prepaid Fine Hotels & Resorts® or The Hotel Collection bookings (once between January and June and once between July and December). Before September 18, 2025, the Platinum card came with up to $200 in annual statement credits for prepaid Fine Hotels & Resorts or The Hotel Collection bookings. We were told that all Platinum cardholders would get access to the new $300 benefit. That seems to be true for those who had already received $200 in statement credits, but procrastinators who made bookings at the last minute before the refresh appear to be out of luck.

The situation here is a bit nuanced. For clarity:

- Prior to September 18, 2025, the Platinum card prepaid hotel benefit provided for up to $200 in statement credits for Fine Hotels & Resorts or The Hotel Collection bookings per calendar year.

- Effective September 18, 2025, the Platinum card prepaid hotel benefit provides up to $300 in statement credits from January to June and again from July to December for prepaid FHR or The Hotel Collection bookings.

- All eligible Platinum cardholders receive access to the $300 credit for prepaid bookings for the second half of 2025 (through December 31st)

- Those who had already received the $200 once-annual benefit get access to another $300 for this half of the year under the new benefit (for a total of $500 in statement credits)

- Those who had not used the $200 once-annual benefit now get access to $300 for this half of the year under the new benefit (effectively, the $300 benefit replaces the $200 benefit for those who had not yet used it)

Many cardholders made bookings in the final days before the card refreshed, many of whom were likely hoping to receive the $200 statement credit for a pre-September 18th booking and then also get the $300 benefit after the refresh.

If you made a qualifying booking long enough before the refresh to have already received the $200 statement credit before September 18th, you do have access to the new benefit. However, many cardholders who made reservations in the last couple of days before the refresh (such as on September 16th or 17th, 2025) are reporting that statement credits have arrived over the past couple of days, but only for the new $300 benefit, not for the previous $200 benefit (though we have at least one data point in the comments from someone who booked on 9/16 and received the $200 credit).

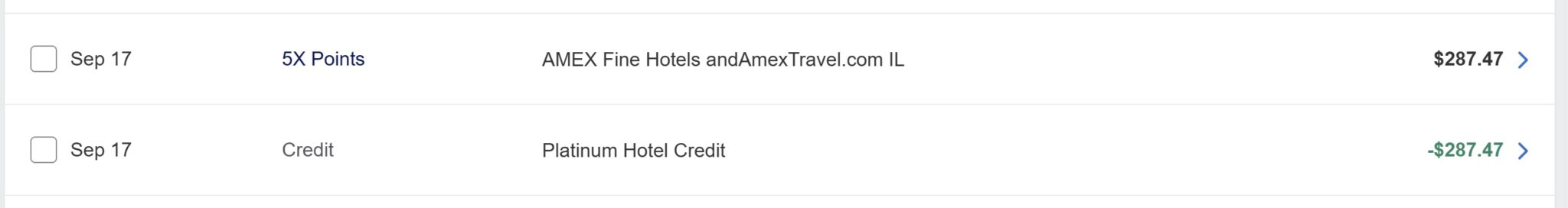

To provide an example, the screen shot above shows a $287.47 reservation prepaid on September 17, 2025 (before the card refresh). Theoretically, that should have qualified for $200 in statement credits under the old benefit, leaving a balance of $87.47 (and providing for further statement credits of up to $300 for a future booking under the new benefit).

However, as you can see, that September 17th booking received a statement credit of $287.47, clearly triggering the new $300 benefit rather than the $200 benefit in effect at the time of the reservation. Furthermore, the benefits tracker shows the $287 as having applied to the new $600 in annual statement credits despite the booking date and associated credit being dated 9/17 (prior to the refresh).

![]()

Others have reported on prepaid reservations that cost more than $300 that triggered $300 in credits despite those reservations having been made before the refresh launched.

I figured this might end up being a toss-up as to what would happen given the fact that the statement credits get backdated to the booking date, but don’t come through for several days, so I wasn’t sure whether they would trigger the old benefit or the new benefit. It seems that those who had not received the $200 credit before the card benefit refreshed are instead seeing the $300 benefit applied.

It is possible that Amex may “fix” this and adjust the statement credits based on the booking date, but I imagine that if that happens, it will likely be down the road. I’ve seen some reader reports of folks reaching out to customer service and being told that they could investigate, but that an investigation would take 6-8 weeks (or longer). Personally, I wouldn’t hold my breath on the outcome since Amex is likely going to count this based on the date you received the credit rather than the booking date. And in fairness, applying a $300 credit instead of a $200 credit sounds more generous, so I can’t imagine that there will be a push to provide even more in statement credits. Still, we’ll see if folks have success and/or Amex adjusts this down the road based on booking date.

I got an email today from Amex telling me…

“What happened

Due to a technical error, previously unearned credits from your $200 Hotel Credit benefit were not considered when calculating the statement credit earned on your September 17, 2025 prepaid booking. We sincerely apologize for any confusion this may have caused.

We’ve credited your account

To make things right, we’ve issued a statement credit to your account. You’ll see this credit(s) on your upcoming billing statement.”

Sure enough, I saw a $200 credit being applied to my card with a date of December 3rd (~2 weeks ago).

What is funny is that this is another error (in my favor). I originally made a last-minute booking to use the $200 credit, but it used up the $300 credit instead. I later cancelled that booking (and got refunded the $300 credit, before making a 2nd booking to use up the $300 credit). So I have only made 1 overall booking with the card, but have received both the $200 credit AND the $300 credit. Not sure if that was intentional on Amex’s part.

Chatted today with Amex on a September 17/$300 credit Fine Hotel booking. They responded quickly with this:

“We are currently evaluating the impact of the implementation of the Hotel Credit enhancement on prepaid hotel bookings made on 17 September 2025.

If you made a prepaid hotel booking on 17 September 2025 and we determine that the statement credit earned on your booking was impacted, we will contact you to provide further details.

Please keep in check in your emails from time to time so that in case we reach out, you can easily respond to us”

I guess at least they are aware and looking at it.

Suppose you cancel your previous booking that has already used a $200 credit. Then, will they claw back the $200 if we rebook to get $300 credit?

can u let us know?

I just ended up cancelling my booking I made on the 17th when they couldn’t charge it to the $200 credit

I booked an FHR stay on September 16 and got the $200 credit

I did as well

9/16 at 7:00pm went to the $200 for me as well.

9/16 @ 9:44mt posted as the old credit

what i booked mine 9/16 but became the new credit

Weird minor issue I am having, I can view FHR & THC properties looking at Amex Travel through the Amex mobile app, but they do not show up on the Amex Travel desktop site.

happened to me as well. Two days prior to the change over. No biggie- can always cancel if needed.

This happened to me. Happy with Amex has turned to very unhappy with one move by them. I’ll likely cancel the reservations then because I can probably find a better use of the $300 than the ‘under time pressure’ that I made

I converted a Gold to a Platinum. Made a Resy purchase just prior to the conversion. When the credit posted, it did not fall under the Gold’s $50 Resy credit but rather the Platinum’s $100 Resy credit.

Shame on me for cutting it so close.

I made a booking on Sep 16 for 445$ and received 400$ credit few days later but posted to Sep 16.

this is not even tracked in the 600 hotel credit on the benefits yet.

I made a $255 reservation on 9/17 and my statement shows the transaction (and credit) posting on 9/17 as well. Despite that, it pulled from the new $300 credit, leaving me with only $45 left.

I spoke with multiple AmEx representatives and they were all equally clueless. Most didn’t understand why I would be complaining about a “new and improved” credit.

You did get the new and improved credit for the same annual fee. Double dipping the old and new credit was generous from Amex and a nice to have, so I don’t see a reason to complain. You waited to long and lost out on the double dip.

I agree that it was a generous policy. But I don’t agree that I “waited too long” – the transaction posted on 9/17 and the new credits were introduced 9/18.

Love all the ‘I got mine’, folks telling us who booked on the 17th that we waited too long. … when they might have booked a day or too before the 17th

Very interesting. I made a booking using a brand new vanilla Platinum on 9/16 and got the old $200 credit posted to my account on 9/18. Shows $300 still available under the new terms.

I’m 2nd DP booked in 9.16 and $200 credit posted on Sunday and the meter is still at $0

Took P2 out to one our favorite local restaurant (also a Resy) had multiple Plats – but it was just me and P2 so I asked Mgr to include two $100 GC on our bill and the meal and tip on seperate bill – then stopped by Lulumon with P2 she bought a few workout shirts and thru a small GC in with the purchase so P2 is happy.

Booking date sep 14 and received the $200 credit. If I cancel this booking, I wonder if the $200 will be clawed back? Thanks

I was literally a day late with the Amex one. Oh well.

Here’s a little secret I probably shouldn’t put here:

The United card’s $50 hotel credit is not clawed back if the reservation is prepaid and then cancelled. You get two per calendar year, and of course so does your P2. That’s $200.

Re: $200, you mean P2, has their own Explorer card, right? I don’t want to burn a 5/24 slot to test this (I know AUs can be ignored if you call reconsideration), but since AU cards have the same number, I can’t imagine it allows duplicating any statement-credit benefits.

It will be clawed back on the platinum. Happened to me multiple times when I have cancelled and rebooked for a lower rate.

Do they craw back but re-apply the credit to the new booking? Since you did do another booking. I had previously made 2 bookings around the same time and canceled one of them and that was fine. This time I know I will cancel both bookings but do plan to book a new one.

They re-apply it on the new booking. So the sequence is Booking – credit – cancellation – claw back – rebooking – fresh credit.

Thanks, so if you got the credit in year t, and rebook in year (t+1), the $200 will still be applied?

I would bet that if you cancel this booking, you will lose the credit without any chance of using it again. You would then be left with the $300 credit.

I spent a couple of hours on the phone with reps yesterday, and they said if I cancelled my already created reservation but not yet completed, the $200 would be reversed AND I would only get the 2nd half $300 credit.

It is likely that it would be reversed, but I wanted to chime in to say that this is the kind of nuanced thing that I wouldn’t waste time asking a phone representative — the phone rep has probably never had a Platinum card, made a reservation, and later cancelled it to know exactly what happens. They aren’t speaking from experience but rather a best guess based on how they think it works, which at best is based on how somebody else told them they think it works. It’s kind of like asking the server at Denny’s whether the spinach in the omelet was treated with synthetic pesticides. That server may well tell you no or they may even check with a manager who will tell you no either because they don’t think so or they think it is the answer that makes the question go away, but they likely have no clue because they aren’t actually involved in even sourcing the spinach for Denny’s no less growing the spinach. Most phone reps just aren’t involved enough in the hobby to really know the nitty gritty stuff. You’re far better off asking these types of questions in a place like our Frequent Miler Insiders Facebook group, where you have the benefit of a lot of collective real-world experience.

Like I said, though, the $200 will probably get reversed if you only have one booking. In the past, I’ve usually made multiple bookings such that if I cancelled one, I still had one that would qualify for the credit, and the credits have stuck. There isn’t going to be a way to recover the $200 credit at this point if you’ve used it on a single booking and you need to cancel that booking — that much is true and correct.

Curious if you’ve had the experience of changing the dates of a THC booking form a 3 night stay to 2 night stay and keeping the $200 credit unchanged? Assuming the new total is still way above $200.

How is this worth it for $200, especially as there’s no guarantee you’ll actually get that money?