Many people don’t realize that Amex allows cardholders to earn Membership Rewards points by referring friends from one card to multiple different Amex cards. With most credit cards, you can refer friends only to the same exact card that you have. However, with some Amex cards you can refer friends to almost any Amex card.

This means that, when a friend or family member wants an Amex card that you don’t have, you can still earn points or cash by referring them from a different Amex card. Additionally, even if you have the card that your friend wants, you can refer them from a different card in order to earn a bigger referral bonus. In this post we’ll discuss how to find your referrals and how to decide which of your cards offers the most valuable referral rewards.

Below, you’ll find a handy video where Nick explains how to use a an Amex Gold card to create a link to the Delta Gold SkyMiles card so that your friend can open the SkyMiles card and you can get a Membership Rewards referral bonus on your Amex Gold card.

Key information regarding Amex multi-card referrals

Here’s a few things to know about Amex Multi-Referrals:

- Co-branded cards with their own rewards programs (Delta, Hilton, Marriott) can refer only to other cards within the same brand.

- Co-branded Membership Rewards cards (Schwab, Morgan Stanley) can refer a friend to multiple cards, but those cards receive cash back for every referral rather than standard Membership Rewards referral offers.

- Non co-branded Membership Rewards cards can refer to almost any card in the Amex portfolio (not including cards from Schwab and Morgan Stanley).

- Non co-branded cash back cards can refer to almost any card in the Amex portfolio.

- When you refer a friend to a card which earns a different type of reward, you will earn the rewards promised to you. E.g. if you start with a Membership Rewards card and refer someone to a Hilton card, you’ll earn Membership Rewards points for a successful referral.

- Annual earning limits are per card. For example, if you had both the Platinum and Gold Membership Rewards cards, you can ordinarily earn up to 200,000 points per year total even though each card is capped at earning 100,000 Membership Rewards points for referrals each year.

How to find your Amex multi-card referrals

To find your refer-a-friend offers, you can log into your Amex account and switch your focus card one by one. However, I think that the easiest approach is to log into the Amex Refer-a-friend site.

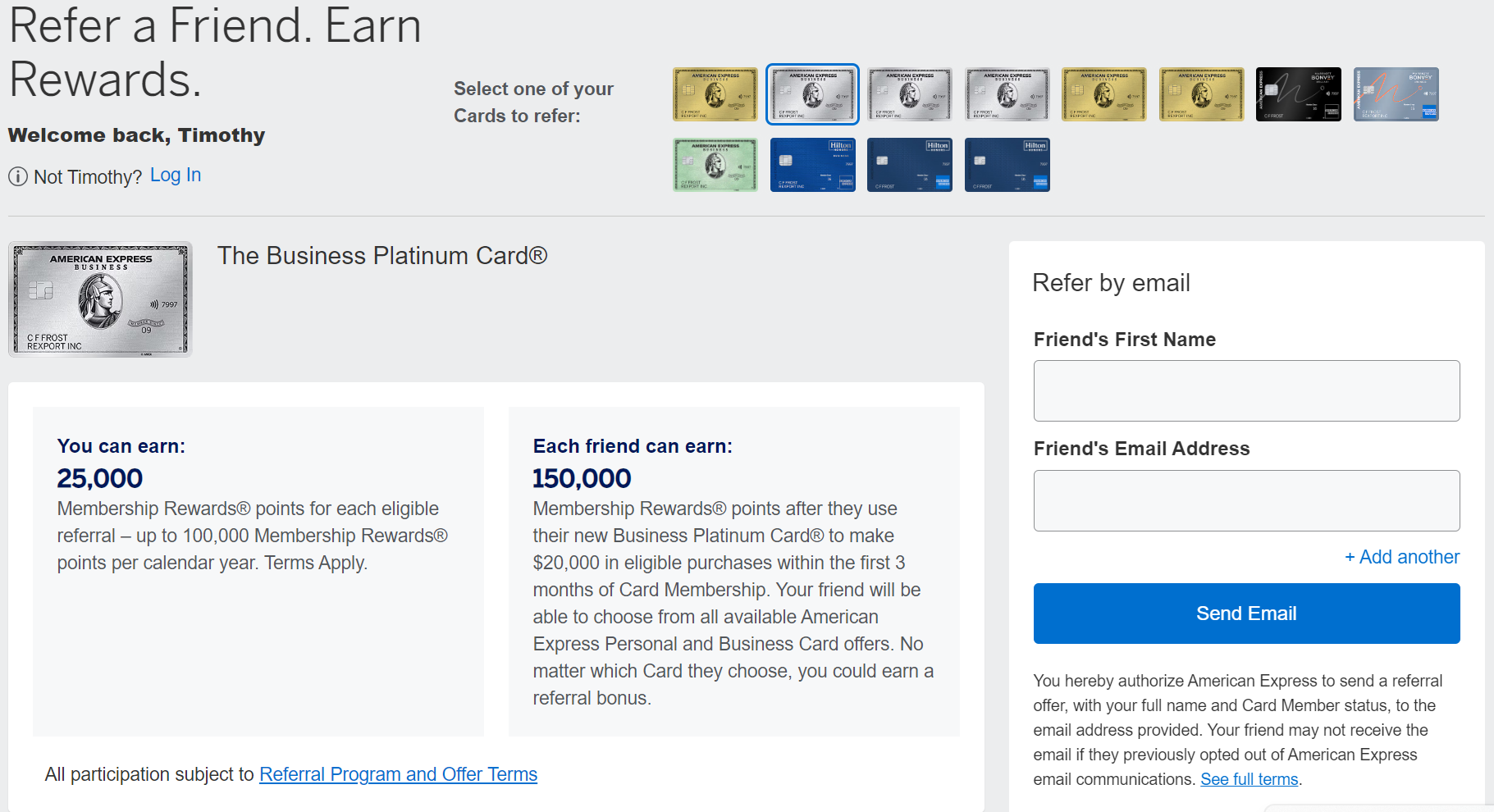

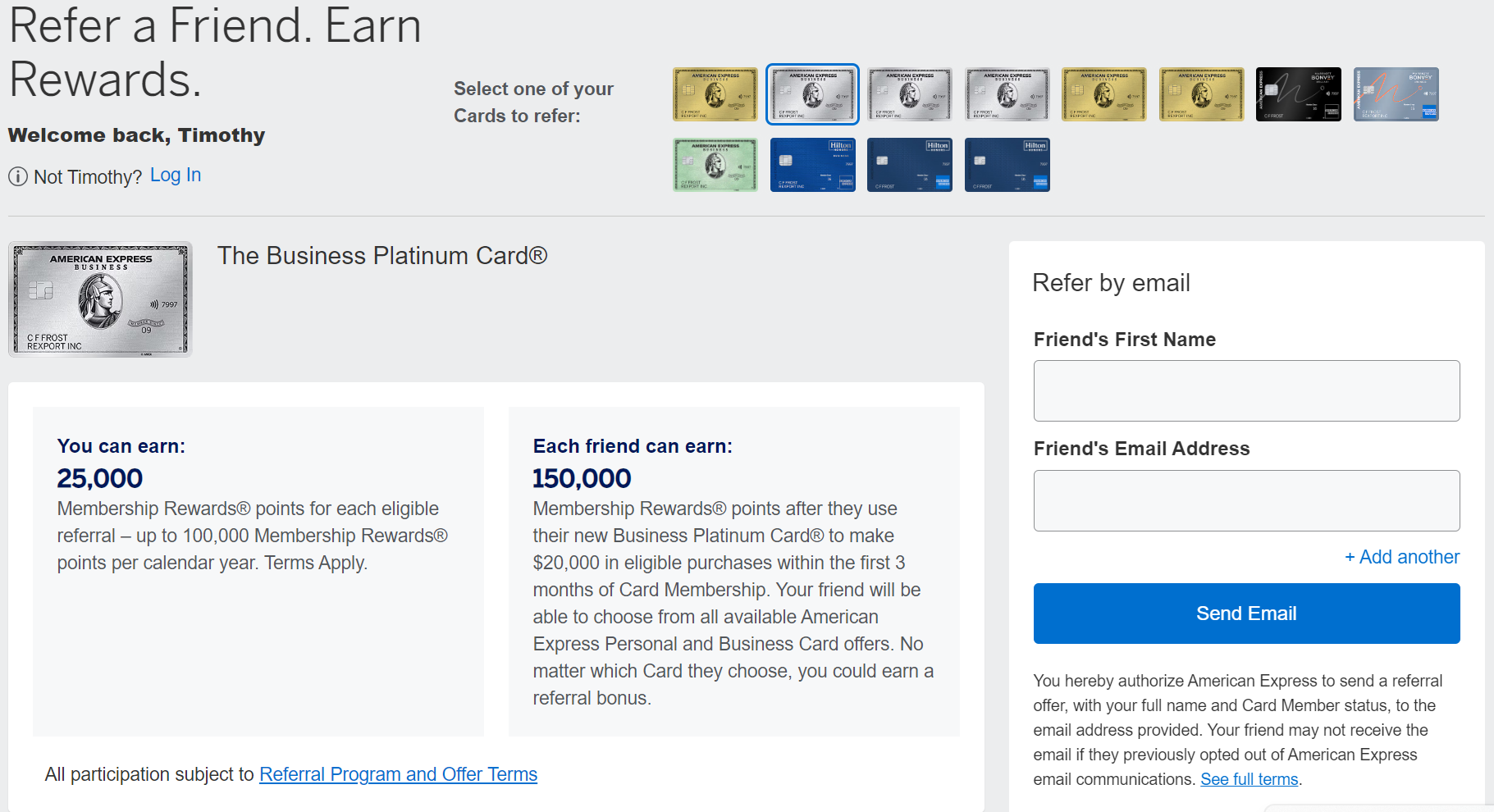

Once there, you’ll see a referral offer (if any are available for your Amex cards), and, if you have more than one offer, there will be a list of cards you can click to view the next offer, like this:

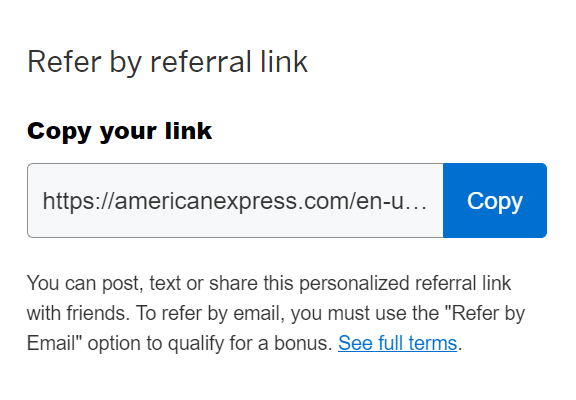

If you scroll down, on the right side you’ll see something like this:

Press “Copy” to get the referral link for the card you were viewing.

Next, paste that link into a new browser window. You may have to remove the extra text (remove everything up to “http://”):

Apply for an American Express Card with this link. With your new Card, you could earn a welcome bonus and your friend could earn a referral bonus. Terms Apply. https://americanexpress.com/en-us/referral/business-platinum-charge-card?ref=TIMOtSJJUi&xl=cp01

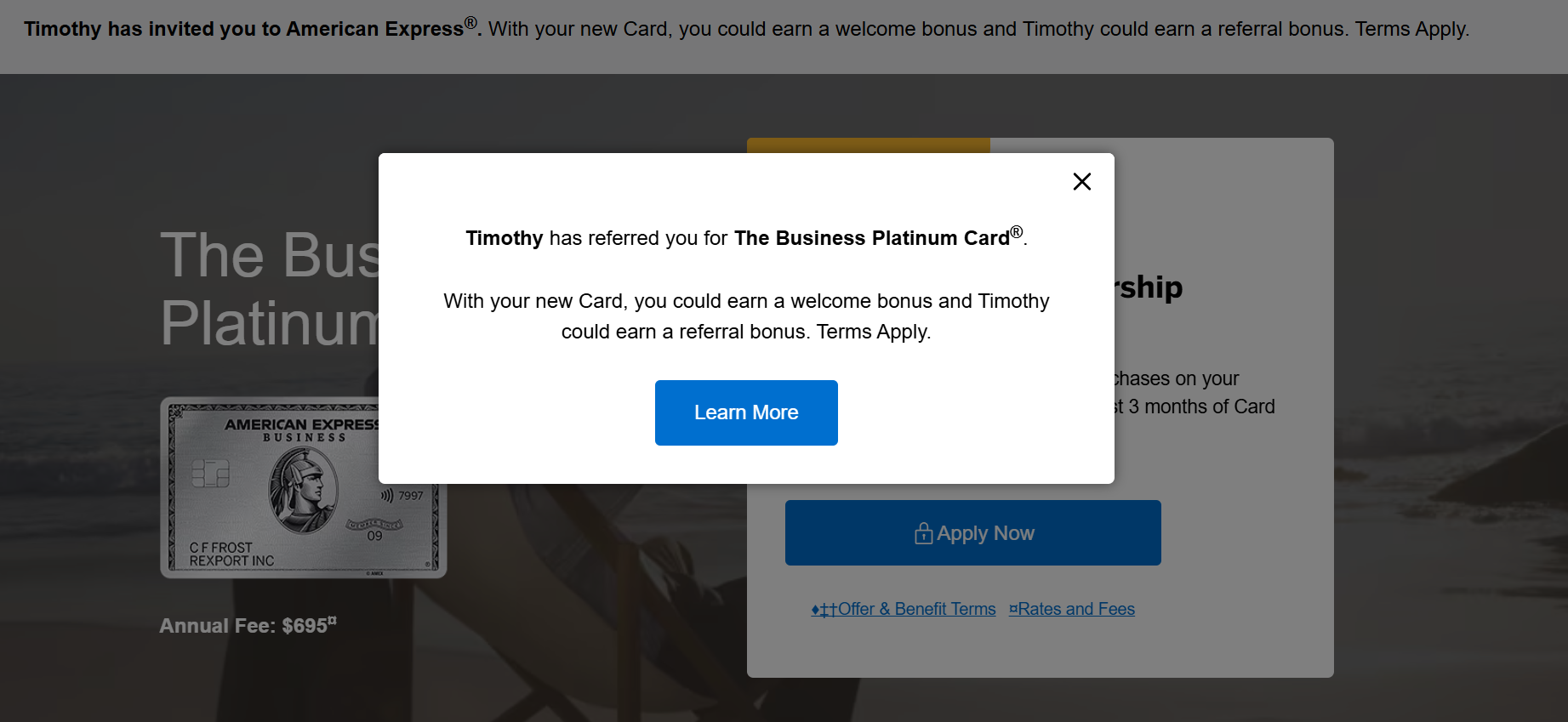

You will then see a direct referral screen (a referral to the same type of card that you started with):

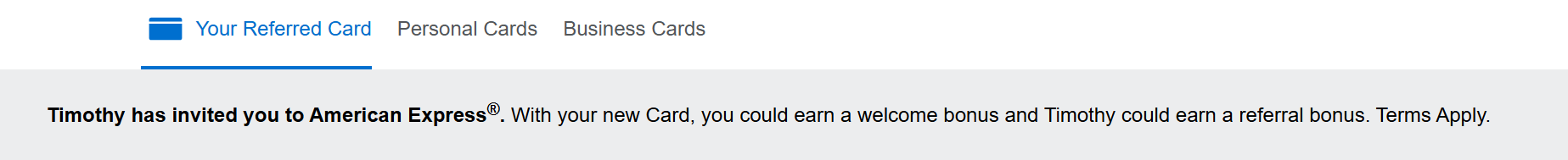

Press Continue, and above the offer you’ll see this:

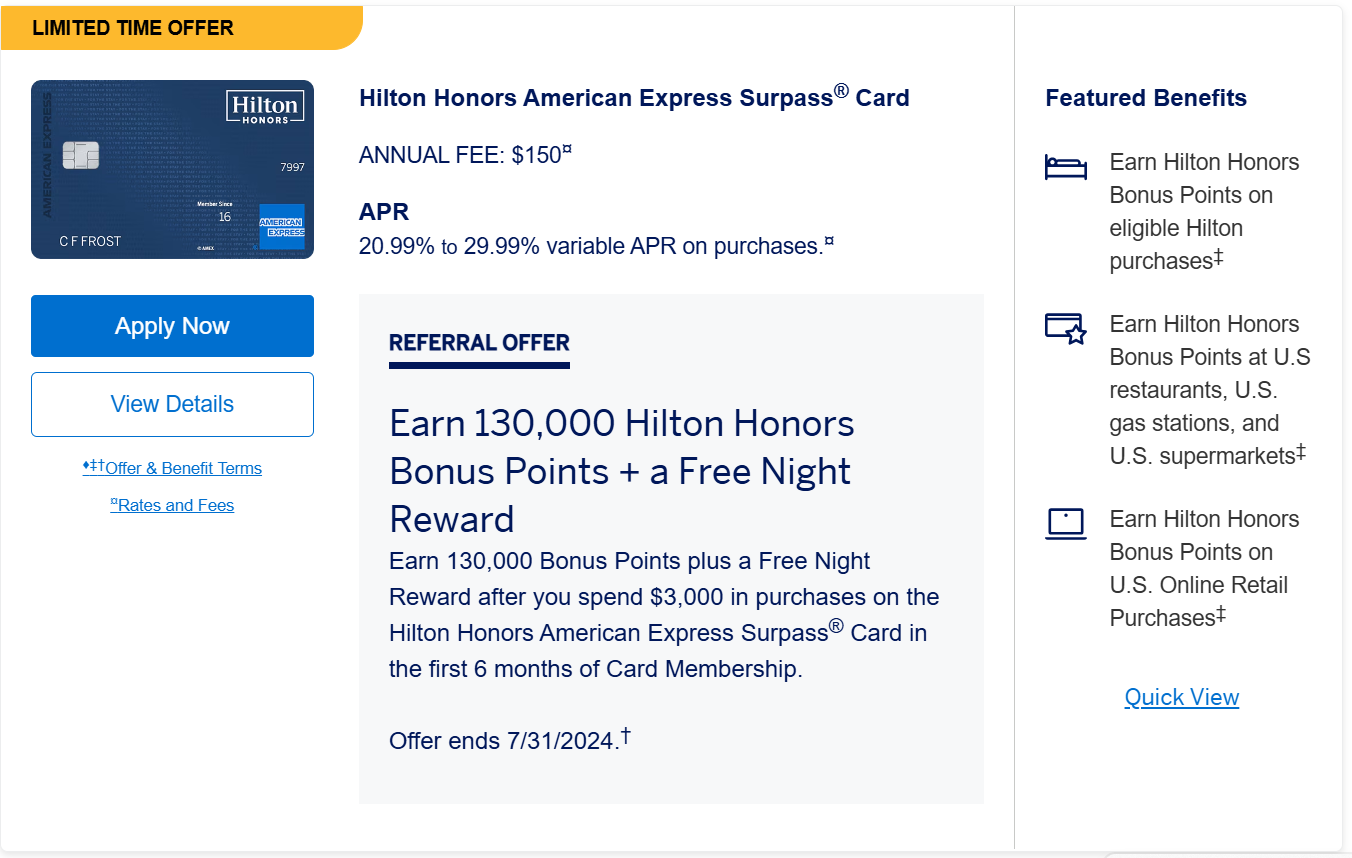

The above options let you find referrals to other cards besides the one you started with. For example, in the images above, I started with a Business Platinum card, but let’s say I want to refer my friend to a Hilton Surpass personal card. In that case, I would click “Personal Cards” and I’d see a bunch of personal card offers, allowing me to scroll down to find the Surpass offer for my friend:

Next, I would press “View Details” whereupon I’d finally see the referral page for the Hilton Surpass Card:

Finally, I’d copy the URL and email it to my friend. If my friend signs up through my link and is approved, I’ll earn my Business Platinum refer-a-friend bonus of 25,000 Membership Rewards points!

Picking the most valuable card

Referral offers change over time and can range from as low as 5K points per referral up to 35K or even 45K points per referral (though note you’re still limited to earning a total of 100K points from referrals on any single Amex card).

At a high level, picking the card to use for referrals is simple: choose the one you have that offers you the most value per referral.

Pay attention to maximum yearly limits

Most readers won’t have the “problem” of having too many referrals, but for those who do, consider the following:

Annual maximums are often not a simple multiple of the referral bonus. As a result, if you max out your referrals for one card, you will often earn fewer rewards with that last referral. For example, let’s the you have an Amex Gold Card that offers 45,000 points per referral, but with a 100,000 point limit. After you’ve successfully referred 2 friends, you would only earn 10,000 points for the sixth friend. For that third friend, you’d probably be better off using a different Amex card in your arsenal to refer them.

Similarly, if you think you may max out your best earning card, consider referring within brand when possible. For example, if you have both an Amex Platinum card and a Delta Reserve for Business card, you would probably prefer to earn 25K Membership Rewards per referral from the Platinum Card rather than 25K Delta SkyMiles from the Reserve for Business Card. However, if you’re pretty sure that you’ll max out your Platinum referrals, when a friend wants a referral specifically to a Delta card, you should consider using your Delta Reserve Card for those referrals (since that card can refer only to other Delta cards).

How referrals affect Amex card value

The ability to refer friends to multiple different Amex cards from one source card makes Amex cards more valuable than before. Consider, for example, a couple that tends to sign up for at least one new Amex card each year. The extra points they could generate through these referrals may be enough to justify keeping an Amex card that they were previously considering cancelling. For example, in the post “Is 4X worth $250 per year? How much are those Amex Gold 4X categories (grocery & dining) worth?” Greg offered a simply formula to help readers decide if the new Gold card is a keeper…but he didn’t include the value of referrals. If you filled out the formula and decided that you would cancel your Gold card when the annual fee came due, you may want to rethink that decision in light of the value of multi-referrals. An extra 15K or more Membership Rewards points per year might just make the card a keeper.

The added value of Amex cards is especially true for cards that tend to offer very high referral rewards (such as the Platinum and Business Platinum cards). In fact, this is one feature that the generic Amex Platinum card has which its branded rivals does not.

Here’s a fun one – I would like to refer P2 to multiple Amex cards. The best referral card I have currently is the Business Platinum, with 25K and the other cards I have are 15K MR points or worse. What is the best way I can get multiple bonuses referring her from the same card? So far I’ve referred her to the NAF HHonors card and to the Surpass cards, and got a 25K bonus for each. But I noticed that the link had changed between those two referrals. Can I use the same link, or do I need to wait until the link changes? I want to refer her to the Green card ASAP, but I want to make sure I’ll get the 25K MR points too.

Well, this sucks. I have two Amex cards and I can only refer from Blue Cash Everyday right now, nothing from Platinum. Screenshot of what I see

Does anyone have any DPs on less approvals when applying via a referral link then not? I just tried to have P2 refer me from her Hilton Biz (which I already have so switched over to apply for a consumer card that has the free night SUB but got pop up prisoned)

Yes, I’ve had that happen myself. For some people, referral links sometimes seem to have worse odds of approval than head-on (direct to Amex) links. I’ve never seen any concrete answers as to when or why it happens.

How long did you PUJ last? I suspect this just happened to my P2 trying to get the Brilliant with my Plat Bus referral.

My wife and I both have the vanilla personal Amex Platinum card and Amex will not let either of us refer from these cards. Very annoying.

[…] 1099 season again, and the bill for all of our referrals and bank account bonuses from 2023 has come due. On Monday, I went to the mailbox and found it […]

Sorry to ressurect this old thread, but I wanted to clarify the 55k maximum per calendar year referral bonus. I have 3 amex cards (personal gold, personal plat, biz plat). the personal gold has a 30k referral bonus offer and the other 2 have 15k referral bonus offers. I have referred 2 people for the gold. for the first person I got the 30k referral bonus 2 days after they were approved. it’s been 5 weeks since the second person I referred was approved and no additional 30k (25k) MR points showing up. I called Amex and they said it can take 8-12 weeks for the referral. so I will patiently wait, but am a bit skeptical the points will show at all given my first referral.

second issue was they rep insisted referral bonuses were 55k max per calendar year regardless of the number of amex cards I have. This is contrary to what I read online (and here). Can you confirm this? I still have the other 2 cards (Personal platinum and personal business) I can refer people to, but I can wait until the new year if I’m capped at 55k total for 2022. Thank you.

I want to apply for the AMex Biz Plat 160k offer. P2 has 2 amex cards–the NF hilton and the Hiton Biz card. Using this trick only opens up other Hilton AMex cards (biz and personal) but no other types of Amex cards. how can I get the link to bring up other categories of AMEX cards, particularly the Biz Plat 160k offer? figure if I’m going to apply for that, P2 may as well get some bonus

You can’t. Co-branded cards like Hilton cards can only refer Hilton cards. Plus, the 160K offer isn’t available through referral anyway.

Thanks Greg. Ok the topic of referrals I just applied and was approved for the 90k Amex gold. How can I refer P2 to get the same order and I get 10k points for the referral? Any link I send just generates a 60k (not 90k) offer. Thanks

When I clicked on the 90k offer through your website it said “lawerence” has referred you. So there must be a way to generate a 90k referral link? Thank.

Every now and then, only select people can refer to the best offer. The 90k Gold offer and the Personal platinum 150k offer are two current examples. We don’t know why this happens or how to become one of the few lucky ones.

Lucky Larry!

Two questions:

1) Even tho I have many Amex cards, but don’t say have a Delta card of any kind, am I still eligbile to be referred for a Delta card of some kind from another person, or Hilton or green or some other random Amex card I don’t have…..and I and referrer will still get respective bonuses?

And…

2) Just to be clear, EACH card I have is eligible for the +4? So if I have five cards, each of the five could get +4??? Or can we only do this on one card once no matter how many amex cards we have?

1) Yes. In the example video embedded in this post, I show how to use an Amex Gold card (that earns Membership Rewards points) to generate a link to a Delta card (and I don’t have any Delta credit card). If my friend is approved for the Delta card, they will get the associated Delta bonus and I’ll get the +4 Membership Rewards points per dollar spent on the Amex Gold card. You do not need to have the card for which the applicant is applying.

2) Yes, each card that earns Membership Rewards is eligible for the +4. Let’s say you have the Amex Platinum, Amex Gold, Amex Everyday, and Blue Business Plus card. You could refer one person with your Amex Platinum referral link and refer one person with your Amex Gold link, etc, and get +4 on all of those cards when the people you refer are approved.

That’s awesome, and I really like you video showing me and confirming this. I have my husband just applied for PLAT, and generated the referral link. I want to use his link to refer someone for gold card. I notice the SUB of gold is 60K, not 75K. Is it the trade off?

Is there a way of telling which card I am referring from? I have 3 Business Platinums and 1 Personal Platinum. I want to refer from the Business Platinum I just opened before I do my $15k spend. But when I go to refer it defaults to my Personal Platinum. I can select any of my 3 Business Platinums but I have no way of telling which one is the new one I want the bonus on. I’ve tried the app and desktop, but I don’t see any way to differentiate between the 3.

Great question. Sometimes the referral link shows up right on the home page for the card you want to refer from. In that case, you can just use that. Otherwise, the only option I can think of is to temporarily remove the other Business Plats from your online log-in.

Thanks! Removing the other cards worked.

Another question. I tried referring my P2, but got the no bonus pop up. I went ahead and applied anyway for the Blue Biz Cash. Will I still get my +4 bonus?

Yes, you should.

Can you clarify something? My wife has BBP and Plat Business cards. Both have 15k referral bonuses. If she sends me a referral from her BBP and I use that link to sign up for the Plat Business 120k offer, I’ll get the 120k and she’ll get the 15k plus +4K on her BBP? Basically, she’ll get the bonus if I apply for a different card than she referred to?

Yes that’s correct, but do double check that the BBP has the 15K +4x offer. I’ve only seen that on the Business Platinum. The BBP has the +4 but not the 15K component.

Can we create a referral for Resy Amex?

I realize this is quite an old thread but relevant to the current offerings, thanks!

No, there is no Amex Platinum referral offer that is as good as the offer available through Resy and you can’t refer to Resy.

Can you refer from a personal card for a business card?

Absolutely! See the video embedded in this post.

I was ready to send my Plat referral this morning, & it’s gone! AMEX replaced it with several of my other non-MR cards. Thought I was safe since said til 12.1 but apparently AMEX can, & will, yank at will.

Gone as in you are not seeing it as an offer? If you haven’t, it might still be there by going to the right side of your home page and click on referrals. When I do that, all my cards appear. Scroll right on each card the referral terms will show. Your Platinum referral might still be there. I’ve had referrals and other bonuses to appear in my offers and be gone the next time I sign-in. It can be a game.

You are the second person today to say that their Platinum card referral was gone, so I guess Amex must not be showing it where you expect to see it, but I’ve never ever heard of being unable to refer from an Amex-issued card except when some people got the ability to refer taken away for referring themselves a couple of years ago. Unless you’ve been referring yourself, I am 99.7263517% sure that your referral is available, it’s just a matter of you finding the path to the links.

If you’re on desktop, log in and scroll all the way to the bottom and click “refer a friend” and you can scroll through all of your Amex cards to see the referral offers. You can also copy down all of your links now so you don’t need to worry about finding them later (the links do expire now and then, but they are usually good to go for a while).

You could also try clicking here to log in and see your referral offers:

https://www.americanexpress.com/en-us/referral?id=201279&intlink=US-MGM-Inav&inav=footer_refer_friend

Well I immediately take all that back. See this post from Doctor of Credit:

https://www.doctorofcredit.com/american-express-removes-some-users-ability-to-refer-friends/

i have had my links come and go on multiple accounts. so i am not sure it is always available.

I’ve literally never ever seen referral links “go” on any of the cards in my household. Ever. Nor have I heard of it happening outside of that self-referral thing.

I should add that at times the “refer now” button between the transactions and Amex Offers isn’t always there, but clicking the refer a friend link at the bottom of the page has always brought me to the referral links for all the cards on a login.

Thanks for the tips, and I have been using the Refer a Friend link.

My 5 other non-MR cards all show up, just not my Platinum anymore since this a.m. It still shows in my Offers even under my Plat account, but when I click on it I’m taken to the same (other) 5 non-MR cards as the Refer a Friend link does.

I have never referred myself or done anything suspect with AMEX or ever gone thru any type of review thru decades of card ownership. BUT last evening I went on AMEX chat to confirm the referral bonus would stack with my Plat upgrade bonus and was told “yes” (I wanted to check before sending the referral link today since other posts didn’t specifically address stacking with an upgrade bonus).

I went back into chat after the Plat referral offer disappeared, and the agent said they can come and go and to keep checking back. I wonder, however, if it was removed from my chat above of my stacking intentions? Very coincidental. And doesn’t feel right to me them doing that since they put an expiration date on the offer! Seems if they are going to hold me to 12.1, they too should extend it til then. Major bummer, though, I had finally sat down and figured out massive spend on the card over the next few months to maximize both offers.

Have you tried different ways of logging into your Amex account? Here are some options to try:

From phone app, click on “membership” at the bottom of the screen (at least that’s where it is on my iPhone) and then you should see a Refer a Friend square to click on.

I hadn’t tried #3 before your suggestion, but I now did/redid all 3 methods, & the Refer A Friend/Business Square is still there for all my 5 non-MR cards just not my Platinum.

I could understand if I was simply never targeted to begin with, but to be sitting in my Plat acct for weeks (waitinv for the right time) & then poof.

Thanks for your help, though – I also contacted AMEX but they say they cannot manually put it back or provide me a referral code for my friend to use.

If/when it shows up again should I send it out & tell my friend to hold off applying til I’m ready or are there also expiration dates on applying with the referral links?

Your friend has to be approved by 12/1 so there really isn’t much time left.

Sorry, I meant if AMEX brings it back again after 12.1. And hopefully a mth or so before the expiration of my upgrade bonus so as to double dip part of the spend anyway!

Greg, interesting article! Do you think they might extend the referral offer that ends in 12/1?

No, I don’t think they will extend it. Maybe they will offer it again sometime, but I don’t think they will extend it.

Can you refer to 2 different people to get 8X?

No