Last month, we shared about the new Mesa Homeowners Card which is interesting for a few reasons. A couple of key reasons are that it enables you to earn rewards when paying your mortgage and that those points can be transferred to a selection of travel partners.

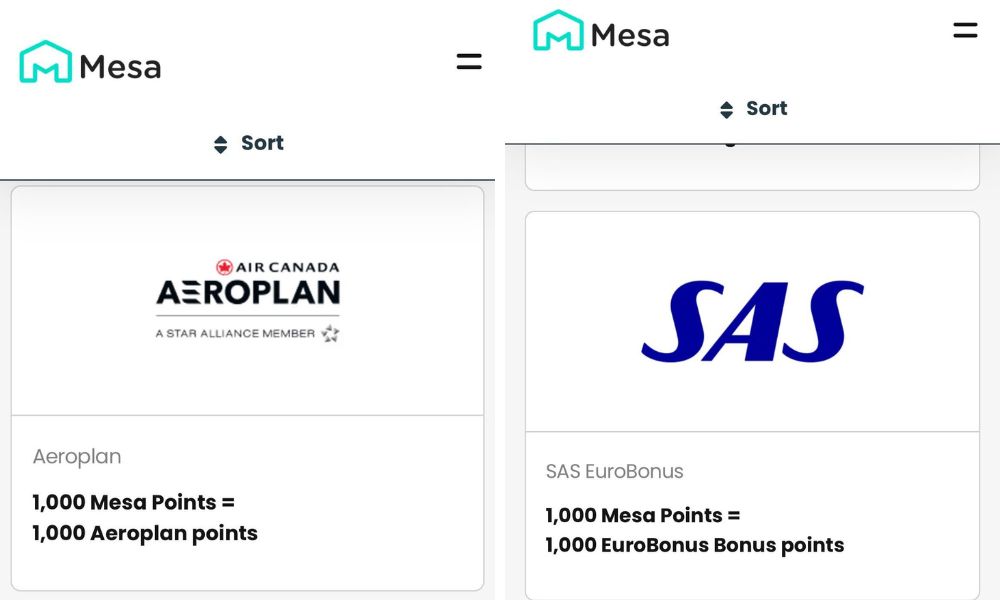

There’s good news on that latter front because the number of transfer partners has expanded to include Air Canada Aeroplan and SAS EuroBonus.

Thanks to Ocean Disciple who gave us a heads up about this. As you can see in the screenshots above, you can transfer to both partners on a 1:1 basis, with transfers starting at 1,000 points.

That’s great news because both of these partners have some good redemption options. Aeroplan is already a partner of other transferable currencies including Chase Ultimate Rewards, Amex Membership Rewards, Capital One miles and Bilt Rewards, but it’s always nice to have another option.

The addition of SAS EuroBonus is much more interesting though because that makes Mesa the only transferable points currency in the US that has the ability to transfer to SAS. With flights in business class to Europe on SAS metal available for 50,000 miles one way, that’s a great redemption option if you earn sufficient points with Mesa.

It’s also a good sign that SAS EuroBonus is open to becoming a partner of transferable points programs in the US. Hopefully they’re testing the water with Mesa and will sign on as a transfer partner of one of more of the more established currencies in the future.

[…] Competitors to banks keep coming, here is Mesa Homeowners Card introducing two transfer partners, Air Canada Aeroplan and SAS Eurobonus. […]

The big deal for me is the 3x on insurance and taxes. Many people have that rolled into their mortgage, but some peel that off and pay them separate. I pay separate and in this case I get 3x on $5k property taxes and $500 homeowners insurance. FWIW the system gives 3x for ANY taxes and ANY insurance not just home related with NO CAP.

Yes, that’s why I want to apply for this card. I have 5 houses, and I’m paying insurance on 4 and taxes on all of them. When paying taxes with CC, there is a fee of 2.5-2.65% here, though. I still usually pay taxes with CC (if I’m doing Amex SUB, or with GCs from Staples/ODOM). Also home expenses are covered at 3x.

I wanted to apply for this card today, but they put me on a wait-list. How can I apply, and also I’d like to get this 50k bonus as well.

i applied today and did not go on waitlist.

I applied and got the following message:

“Thank you for your application for the Mesa Card, issued by Celtic Bank. The following information is needed to process your application:

No additional information is required at this time.”

It doesn’t allow me to apply.

[…] me cover all the details, because (dare I say) this almost sounds too good to be true. Thanks to Frequent Miler for flagging […]

[…] ser vi derimot en endring, og SAS har kommet på plass som en overføringspartner i USA for første gang. Først ut er «Mesa Homeowners Card», et kredittkort siktet mot […]

[…] The Mesa Mastercard added Aeroplan and SAS EuroBonus as transfer partners, the latter of which is a unique in the US Market and is a great frequent flyer program for redemptions. (Thanks to FM) […]

What’s the process look like to validate and link your mortgage? I assume not, but can my wife utilize this card if she’s not listed on the mortgage but she’s on the joint account that pays the mortgage?

The bank account you use to pay your mortgage should be linked. I pay my mortgage and credit cards out of my main checking account. It was seamless. They don’t know anything about your mortgage except the amount you pay. Your wife’s spend would count towards the total.

I was never asked to validate it in any way. I’m assuming that they compared it to the amount that’s listed on my credit report.

Thanks Tim. Interesting data point – I have to check whether it’s on her report

I’m assuming that the only time that they ask for validation is if it’s not on your credit report, or they may just randomly check a certain percentage of applicants. I have heard of some folks having to submit mortgage statements.

I have the card and I’m not listed on the mortgage. Didn’t need to do any extra validation apart from linking our joint checking account to Mesa.

Thanks for the data point!

I’m so annoyed they pulled the 50 K bonus on this card almost a month early. I was going to apply at the end of this month.

Did they? What a shame! Also I can’t apply, since they put me on a waitlist.

I don’t have any mortgage to pay off at the moment but this card 3x categories are amazing! Now wtih AC Aeroplan and SAS transfer partner, it’s even better!

I think the coupons are great for a no annual fee card too. $30 credit at Lowes and a free membership at warehouse stores such as Costco or Sam’s Club seems like a good keeper even if for sock drawer.

How does Mesa work in tandem with Bilt?

With Mesa, you just need to list your mortgage payment amount, and they will give you 1 point per dollar at the end of each statement as long as you spend $1,000 on your Mesa card during the statement period. They are not involved with processing of mortgage payments.

So if/when Bilt begins offering points on mortgage spend processed by Bilt, you would be able to double dip.

Theoretically, yes. I’ve already validated my Bilt account with Mesa and will pay with Alaska Visa. Just waiting on Bilt

Caveat: this card only makes sense if you are a contractor or a parent with a kid in day care (must spend $1k/month in non-mortgage payments to collect points on mortgage payments, and those are the main categories that fetch more than 1x point/dollar). For the vast majority of homeowners, it makes sense to pass on this and wait for Bilt to give points for mortgage payments.

The math can still work without home improvement or daycare spend, depending on your opportunity cost, spend capacity and mortgage payment.

For simplicity, let’s say you pay $2,000/month on a mortgage, which is probably pretty low for most people. If you spend the minimum $1,000/month on this card in base 1x categories, you would earn 1,000 Mesa points on spend plus 2,000 more for your mortgage at 1x point per dollar, for a total of 3,000 Mesa points. If your alternative on the same $1,000 of spend is a 2x card, you’re only earning 2,000 points.

Another way to think about the earning rate on this card is +1x per $1,000 of mortgage for the first $1,000/month in spend. If you had a $2,000/month mortgage, you effectively earn 3x on the first $1,000 of unbonused spend (1x base + 2x mortgage).

Of course Mesa points certainly are not as valuable as some of the other currencies like Amex MR, but with the addition of Air Canada and SAS, plus original partners like Finnair Avios and Accor, they’re still pretty decent. Obviously the math is different if you would alternatively be putting that $1,000/month spend towards SUBs instead, but even then it could still be worthwhile depending on how high your mortgage payment is.

It does also have some more widely useful categories: 2x on grocery and gas, and 3x on utilities (gas, electric, cable/internet). Throw in a $65 big box membership and $30/quarter Lowe’s credit with no annual fee, and it can definitely make sense. The drawback is it does take a 5/24 slot.

Not to mention that you should be able to double dip with Bilt mortgage payments, if/when that does happen.

You’re much better off chasing signup bonuses than chasing the ability to earn relatively small amounts of Mesa points. It’s one thing to earn 4x or 5x on regular spend but it’s another to have to think about always spending 1k/month, 12 months a year. This is especially true now since the biz card bonuses require so much spend and many of us don’t have enough spend to spare. This takes as much mental energy, and on an ongoing basis, as sign up bonuses and there is much less payoff. If you are spending hundreds of thousands a year your situation is probably different.

Chasing signup bonuses will beat all credit card regular spending. Not really a fair comparison since no cards regular spend can match a signup bonus. Agree this card is not for you.

There are some cards, which exceed signup bonuses with spend.