NOTICE: This post references card features that have changed, expired, or are not currently available

One of the problems with credit card sign-up bonuses is that many have large spend requirements. For example, the current public offer for the Ink Bold requires $10K in spend in 3 months to get the full 50K bonus (half of the bonus is given when you first use the card). Most cards have more modest requirements, but even those can be a challenge.

For a high level overview of ways to meet minimum spend, see my post from last year “Top 10 ways to spend a lot of money and get most of it back”. In that post, the #2 option I listed was to make loans via Kiva. You can read more about Kiva here “How to maximize points and virtue through Kiva loans”.

Kiva is a nonprofit organization that facilitates micro-loans to enterprising individuals around the world so that they may earn their own way out of poverty. By making loans through the Kiva website, you can be part of the solution to poverty AND earn points and miles. You can use your credit card to make loans (that’s how you earn points and miles) and you will get paid back over time. A typical loan takes about a year to pay off fully, but you will usually begin to see partial repayments in a month or two. Kiva’s default rate is barely over 1% (1.06%). Personally I have not yet had a single loan default.

If you’re new to Kiva, you can try it risk-free by signing up through this link: http://www.kiva.org/invitedby/FrequentMiler. This will give you $25 that you can loan to get a feel for the process. Just note that this loan is different than ones you fund yourself in that when it is repaid you will not get the money back. Also, while you’re in the process of joining Kiva, consider joining the Milepoint Lending Team on Kiva. It’s a fun group of like-minded micro-loaners.

The only problem I have with Kiva is that their web site can be a challenge if your goal is to loan a lot of money all at once. Kiva.org is setup for the average person who browses through prospective borrowers one at a time to find the ideal candidate for a $25 (or so) loan. Suppose, though, you want to loan thousands of dollars all at once?

Kivalens is a web app that makes it easy to loan lots of money all at once. The web site uses a technology called SilverLight so it may not load on your favorite smart phone or tablet, but it should work with most full fledged laptops. Browse to kivalens.org and you’ll see a screen like this:

On the left side are filters. In the “Loan” section you can pick characteristics of the loans. For example, if you want to be repaid quickly, you can filter out loans with greater than, say, 8 months before they are repaid.

On the left side, you will also see a “Partner” section. Kiva loans are managed by field partners. These are the organizations made up of people who actually live and work in the region being served by the loans, and who provide bank-like services to people seeking loans. In this section of the screen, you can filter to highly rated partners with low default rates in order to ensure you make only relatively safe loans.

In the middle of the screen are the loans that meet the criteria from the left side. When you click on a loan, more information is given to the right (not show above).

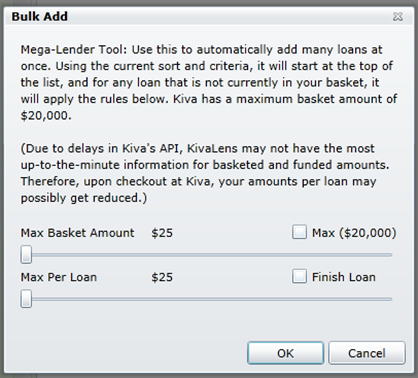

What I really like is the little “++” button at the bottom of the screen. When you click it, the following dialog box appears:

Let’s say you need to spend $3K on a credit card to meet it’s minimum spend requirements. Assuming you have enough money in the bank to cover the credit card bill, you can use this “Bulk Add” tool to spend $3K all at once. Simply slide the “Max Basket Amount” slider to the right until the total comes to $3000. You can also increase the max amount per loan if you want to. Personally I like to keep it at $25 in order to spread my risk as much as possible. Click OK, and then click the “Checkout!” button at the bottom of the screen. This will move all of your selected loans to the Kiva.org website where you can then pay for the loans by credit card.

For details about how to use a credit card to pay loans on Kiva.org, please see “How to maximize points and virtue through Kiva loans”.

Stay informed:

Follow me on Twitter / Like me on Facebook / Join the Club

If you’re new to Frequent Miler, please start here

does it mean that you have enough money in the bank to pay the loan charged to your cc fully back or you just incur interest but in the long run the interest you pay to the bank ends up being less than the interest Kiva pays back to you?

efraim: I have enough money in the bank to pay my cc fully. I would never recommend doing this if you can’t afford to pay off your cc fully each month

Curtis: It looks like a spam comment got through. I’ll remove it.

@Launa…Wtf?

[…] here and here, while Frequent Miler has seemingly made a profession out of doing it here and here, and lots of other places. Oh, and Target seemingly made it easy for us a couple of weeks ago, […]

[…] Minimum spend requirements? Kivalens to the rescue […]

FM – lots of posts talking about adding funds to Kiva, but few offer details about ability to withdraw funds and then add more funds for churn. Would be a great topic and you are one of the masters.

Are you slowing down Kiva usage with BB/VR/Target options?

Ron: Great idea. I’m still lending via Kiva just as much

FM, thanks – I presume you mean total credit utilization %.

My credit utilization is ~7%. And the more cards I get, the lower the utilization rate is going. About the only reason I “spend” anything on many of the cards is to earn the bonuses. That’s where Kiva may come in handy.

I’d like to flip $3K-$4K/mo on average. Been an active Kiva user for 5+ years, but in much more modest amounts.

Has anyone heard about the size of lending that would cause CC companies to look askance at this “spend”? Obviously, I’d be using a steady series of different CCs (as my spend requirements are met) to lend for 3-6 months, and then withdraw the cash and repeat with other CCs.

Any guidance would be appreciated.

Thanks

Ron: it really depends on your credit utilization ratio. If flipping $4K per month means that you are using 40% of your available credit, that might raise some eyebrows. If it is more like 10%, you should be fine

[…] here and here, while Frequent Miler has seemingly made a profession out of doing it here and here, and lots of other places. Oh, and Target seemingly made it easy for us a couple of weeks ago, […]

[…] Minimum spend requirements? Kivalens to the rescue […]

Life is short.

We have enough money to travel and experience the world…

This is an opportunity to help others. Some people value interest payments on their loans as the return, others value the potential impact it will have on the lendee.

Best case, you get all your money back. Worst case, you lose 5% or so… In either case, the money went to someone who was in need and was trying to move their life forward.

Mark seems not to realize that the purpose of Kiva is not to richen investors, but to help small businesses in capital-starved countries.

The potential losses if there’s a default is in fact your expected donation to the cause.

If Kiva didn’t want to disperse repayments via paypal they wouldn’t use Paypal. That’s part of their business model.

@Grant Thomas

Be careful you don’t get shut down. Kiva and Paypal aren’t too happy with people using them and not re-loaning. They encourage re-loaning, and will email you warnings when you score high enough on Paypal’s fraud detection algorithm.

@Mark

From friends of friends who work at Kiva, most of their funding comes from institutional grants. Much less than 5% of lenders leave some percentage for Kiva itself when they check out, though that donation is tax-deductible. Their field partners are allowed to charge a small amount of interest to remain in business, justified by the fact that their interest rates are much lower than other local sources of credit. You’re correct about the risk of losing principal, but the risk is small. Though plural anecdotes aren’t data, I’ll confess to losing ~$55 on my loans, out of >15K loaned so far. For the points and bonuses I’ve made, while diverting real spending to other cards, I come out ahead.

Be wary. Near as I can tell, users of Kiva are making 0% interest loans while taking all of the risks. The basic role of capital markets is the transfer of risk, and the assumption of more risk should always come with a corresponding payment from the “giver” to the “taker”. In this case, Kiva has only operational risks (web servers, staff, business relationships). They use your money to fund loans to individuals via field partners, and act as a clearinghouse for the transaction.

Any interest the borrower pays will be taken by the field partner. If the borrower defaults, the field partner loses the revenue – but you lose the principle. If the currency fluctuates, the field partner takes the first 10% of the risk, and then you shoulder the rest – you will lose money. I noticed in their FAQ they explained that currency fluctuations could cost you part of your principle – but they never said you might get *more* money back. You can bet that if the USD gets weaker, someone pockets the currency profits, too.

Kiva is a non-profit, as explained in their Terms of Use. Where exactly their revenue comes from isn’t clear – they only talk about interest earned on funds while it sits in an account waiting for distribution, and in our current economic climate that has to be pretty minimal. And I get that folks from this blog get an added benefit of satisfying their spend requirements. But please realize that you are funding a non-profit without getting a tax break, and you are massively funding a whole bunch of foreign lenders who are most definitely not non-profits. And you’re taking on all the risk for them, out of the goodness of your heart.

In the business, we call that a “bad trade”.