For the past 8 years, Kiva loans have been a significant part of my credit card spend strategy. With Kiva, it’s possible to increase credit card spend and do good in the world, all at the same time. With luck and time, you’ll get most of your money back. The idea is to use your credit card to fund microloans, wait for the money to be repaid, and then withdraw the money via Paypal. You do not earn interest on these loans.

For the past 8 years, Kiva loans have been a significant part of my credit card spend strategy. With Kiva, it’s possible to increase credit card spend and do good in the world, all at the same time. With luck and time, you’ll get most of your money back. The idea is to use your credit card to fund microloans, wait for the money to be repaid, and then withdraw the money via Paypal. You do not earn interest on these loans.

While I have written about Kiva as a means to increase credit card spend (here, for example), I usually go into details about it only at in-person presentations. Some of the nuances are complicated and, I think, are better covered in person where I can point to numbers and answer questions. In this post, though, I’ll dive into the complexity in order to describe an experiment I ran and the surprising results.

Several years ago, I started making financial predictions about Kiva loans as part of my Kiva presentations. Then, about two years ago, I started an experiment to see if my predictions were right. While the experiment hasn’t been running long enough to say for sure, I can feel confident in confirming some of my predictions. Unfortunately, the expected default rate turned out to be worse than expected. This is important and goes against what I’ve assured people in the past, so I’m reporting this now rather than waiting for enough time to pass for me to consider the experiment complete. Plus, circumstances caused me to change my processes a few months ago and so any further results are of questionable value.

My Kiva spend theory

Here’s the theory that I’ve communicated in presentations in the past:

If you follow best practices (make safe loans with quick payback & spread risk), and if you loan a set amount each month, then:

- After about 12 months, you should reach equilibrium: on average, you’ll then put in the same amount that you take out each month, and…

- The amount of money “tied up” in Kiva should eventually equal half of your annual loan amount or less (e.g. $30K in annual loans at $2.5k per month = $15K tied up), and…

- Your default rate should stay under 1%

The overall idea was to think of the process as being like a long term investment. If the theory is right and you loan exactly $2500 each month, then after a year you’ll be able to pay your $2500 credit card bill each month with the funds withdrawn from paid back loans. Further, over the course of the first year, you’ll have paid out $30K in loans but only got back $15K. So, in this example, $15K is “tied up” long term. Eventually, if you stop making new monthly Kiva loans, you should get back most of that “tied up” $15K as the remaining loans pay back.

Your “income” from this long term “investment” is the rewards from your credit card. If you use a 2% cash back card for all of these loans, then at $2,500 in spend per month, you’ll earn $50 per month or $600 per year. If none of your loans defaulted, that would be like a 4% return on the $15,000 that is tied up long-term. In reality, some loans will default. If your average default rate is 1% then you’ll lose $300 per year to defaulted loans and your return would be 2% instead of 4%. Of course, things look better when you use credit cards with higher rates of return (found here), or when you earn big welcome bonuses from new credit cards.

My Kiva spend experiment

I had been lending through Kiva for many years and haven’t always followed best practices or loaned the same amount each month. As a result, it was difficult to test the above theory with my own Kiva account. Instead, I created a new account explicitly for this experiment. Here’s what I did:

- I setup the new Kiva account to automatically add $2500 in funds every month from my credit card.

- I configured Kivalens with “best practice” settings so that I could easily make safe loans with quick payback & spread risk across many loans. More on “best practice” settings later.

- Every month, I use Kivalens to quickly find at least $2500 in loans. I’ll do more than $2500 in loans if some of my loans from the previous month expired without being funded. I then use Kivalens to transfer all of these loans to my Kiva cart where I check-out and pay for the loans with my Kiva funds.

- Every month, I record in a spreadsheet the total amount paid back the prior month.

- Every month, I withdraw to Paypal the amount that was paid back. This money is then used to pay my credit card bill. Note that it takes a week or two for funds to get moved to Paypal since there is a manual process involved by Kiva staff. I really wish they would automate this, not because I care about the delay, but because I hate causing Kiva staff extra work every month.

Best practice loans

Kivalens is a free web site that makes it easy to make Kiva loans in bulk. The site is setup to let you filter and sort available loans according to many different criteria, and then you can “bulk add” loans to your cart to pay for them through Kiva’s website.

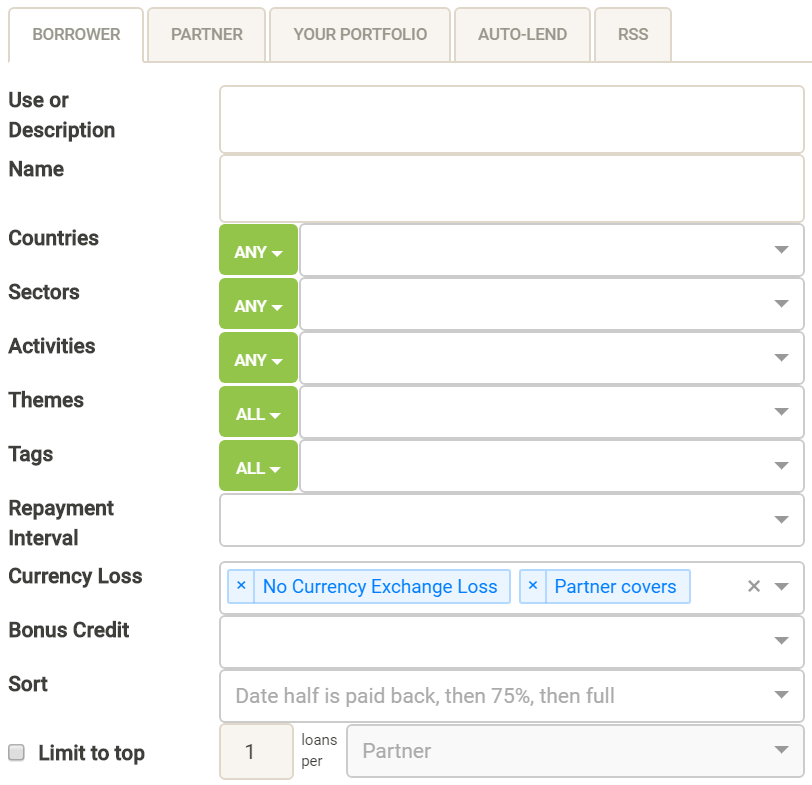

Kivalens filters are grouped by “borrower” and “partner”. Borrower filters are specific to the loan. Partner filters are attributes of the microlending organization that makes the loan.

For the purpose of finding loans that will pay back, the filter settings I look to on the Borrower tab are “Currency loss” and the ability to sort. The sort default is “date half is paid back, then 75%, then full.” That’s my preferred setting. The currency loss filter is used to weed out any loans where you may lose money due to currency exchange (due to hyperinflation, for example). I don’t know if it’s necessary to do both, but I select both “No currency exchange loss” and “Partner covers” (meaning that the microlending organization covers the cost of any currency exchange loss so that you don’t lose out).

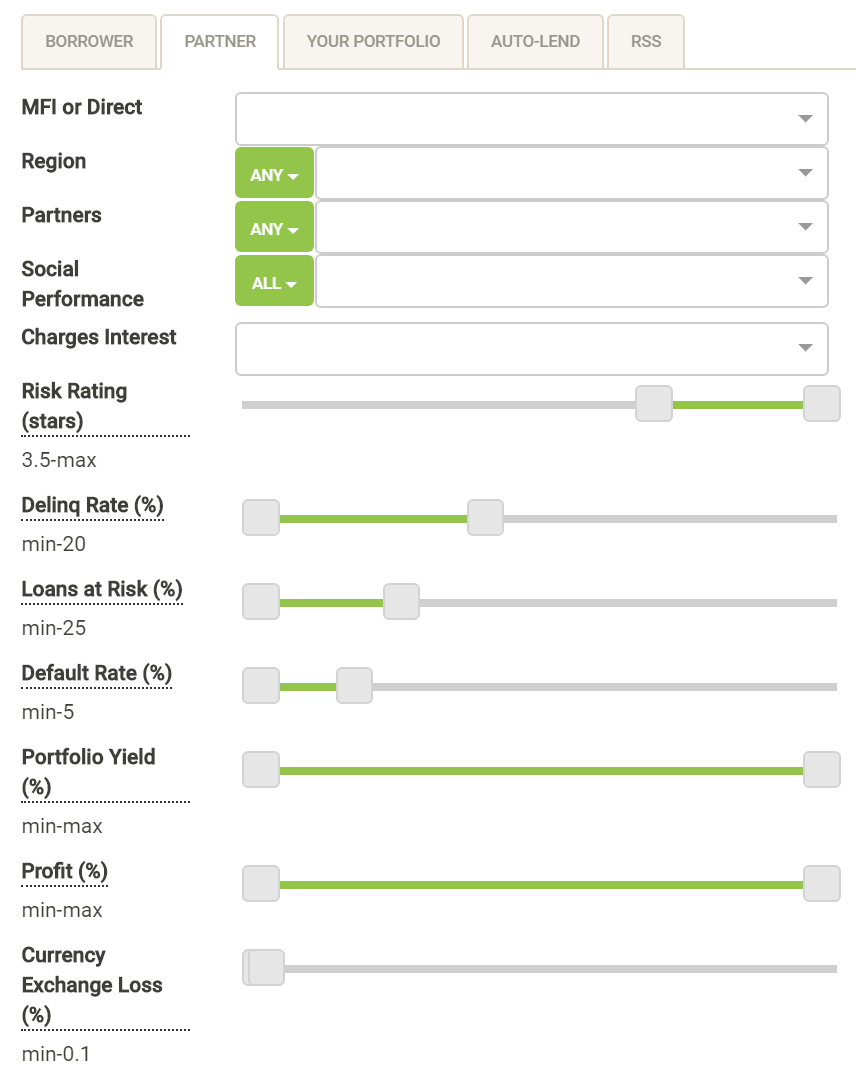

Most of the action for filtering to loans that are likely to pay back is found under the Partner tab. Kiva rates each partner with stars from 1 to 5. The better the rating, the more solid this microlending partner is in Kiva’s eyes. You can also filter to each partner’s historical delinquency rate (how often loans from this partner were paid back late) and default rate (how often loans from this partner end without getting paid back in full). The reason not to set the partner rating to 5 and the other factors to zero is that you are unlikely then to find any loans to fund.

Below are the settings that I used for the first year and a half of the experiment:

Spread the risk

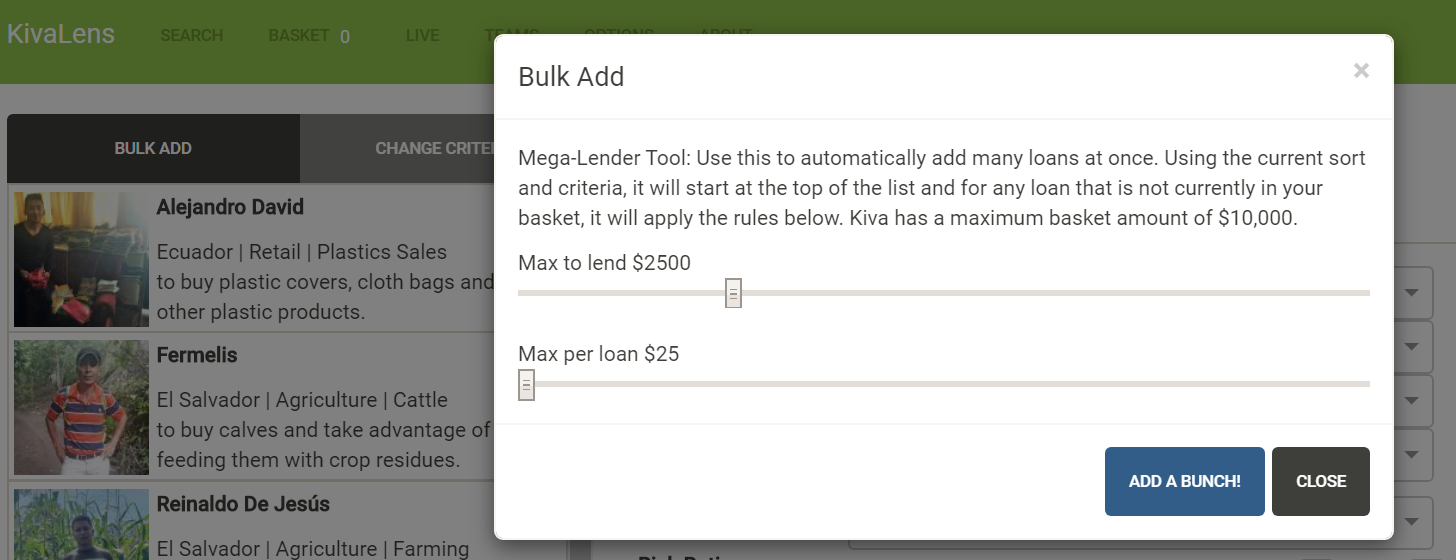

With the above settings in place, I then used the Kivalens “Bulk Add” feature to spread the full amount I wanted to loan across as many loans as possible. In other words, I would fund $25 per loan and add enough loans to cover the full $2500 I wanted to loan (or more if I had some expired loans from the previous month).

Best practice loans take 2

My original Kiva account showed a default rate of under 1% for years and years. Then, when I checked it this past summer I found that the default rate had suddenly shot up above 1.5%! At the time of this writing, the default rate in my original account is now at 1.63%. How did this happen? Before I discovered this myself, a reader had reported that this happened to him. He believes that a lot of loans stayed open for years and were therefore listed as delinquent rather than defaulted. When these loans were finally closed, their status moved from delinquent to default and therefore greatly increased his default rate. I think that’s exactly what happened to me.

At the time I discovered that my old account’s default rate had shot up, I saw that my new Kiva account still had a very low default rate (0.63% at the time), but far more loans were listed as delinquent (late to pay back) than I liked. I figured that the only reason the new account had a low default rate was that few delinquent loans had gone on long enough to be changed in status to defaulted. I was spooked enough by this to cause me to change my approach.

I used to not worry too much about Partner delinquency rates. I figured that it was the default rates that really mattered. I now think that was a mistake. I decided to change my settings to be much more conservative:

- I increased the minimum partner star rating from 3.5 to 4

- I decreased the max delinquency rate from 20% to 3%

- I decreased the max default rate from 5% to 1%

- I added a filter for “loans at risk” and set the max to 10%

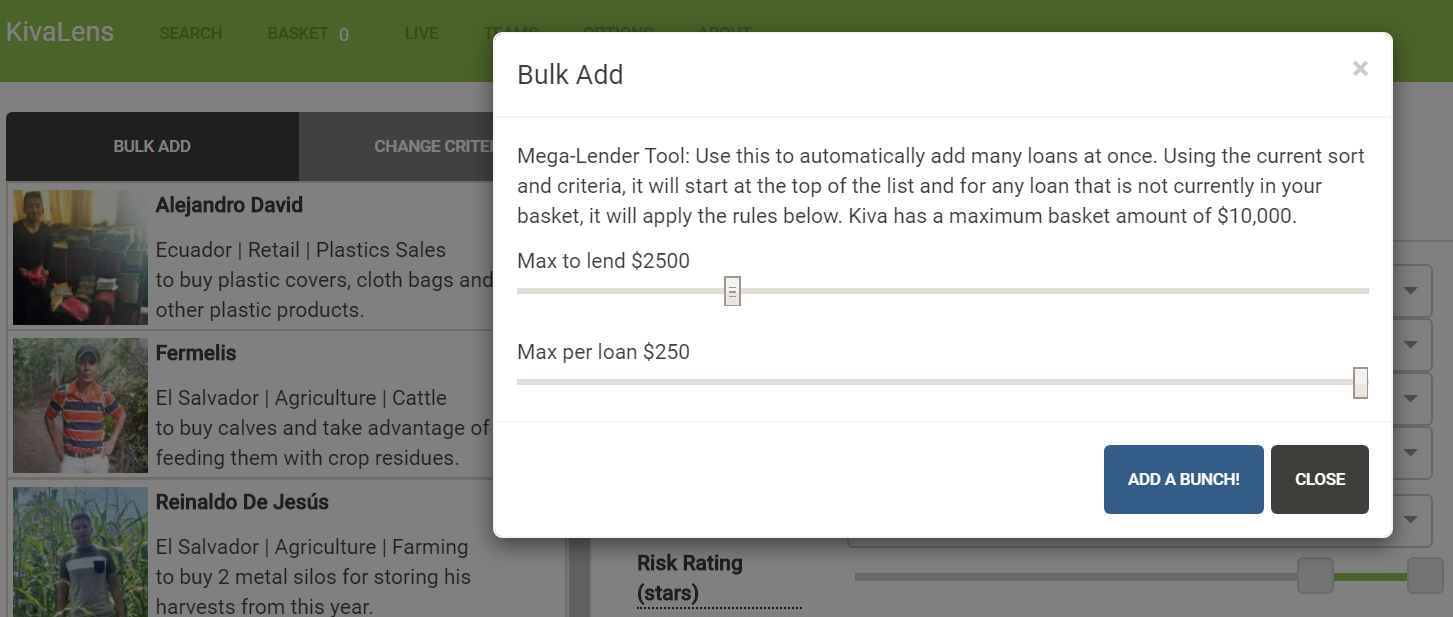

By changing the settings as described above, far fewer loans were then available. So I had to change my approach of spreading risk. There simply weren’t enough loans available to fund them at only $25 each. Instead, I moved to funding fewer safer loans $250 at a time:

One nice side-effect of this change is that far fewer of my loans expire without being fully funded. One downside (besides no longer spreading the risk as much) is that sometimes there aren’t enough loans even at $250 per loan. In those cases, I adjust the default and delinquency ratings a little bit or even lower the minimum partner rating from 4 to 3.5.

It’s far too early to know if these changes are helpful. Worse, my new account is now mixed up between the old way and new way of filtering loans so it will be very difficult to tease apart the results.

My Kiva spend experiment results

As a reminder, here’s the theory that had set out to test:

If you follow best practices (make safe loans with quick payback & spread risk), and if you loan a set amount each month, then:

- After about 12 months, you should reach equilibrium: on average, you’ll then put in the same amount that you take out each month, and…

- The amount of money “tied up” in Kiva should eventually equal half of your annual loan amount or less (e.g. $30K in annual loans at $2.5k per month = $15K tied up), and…

- Your default rate should stay under 1%

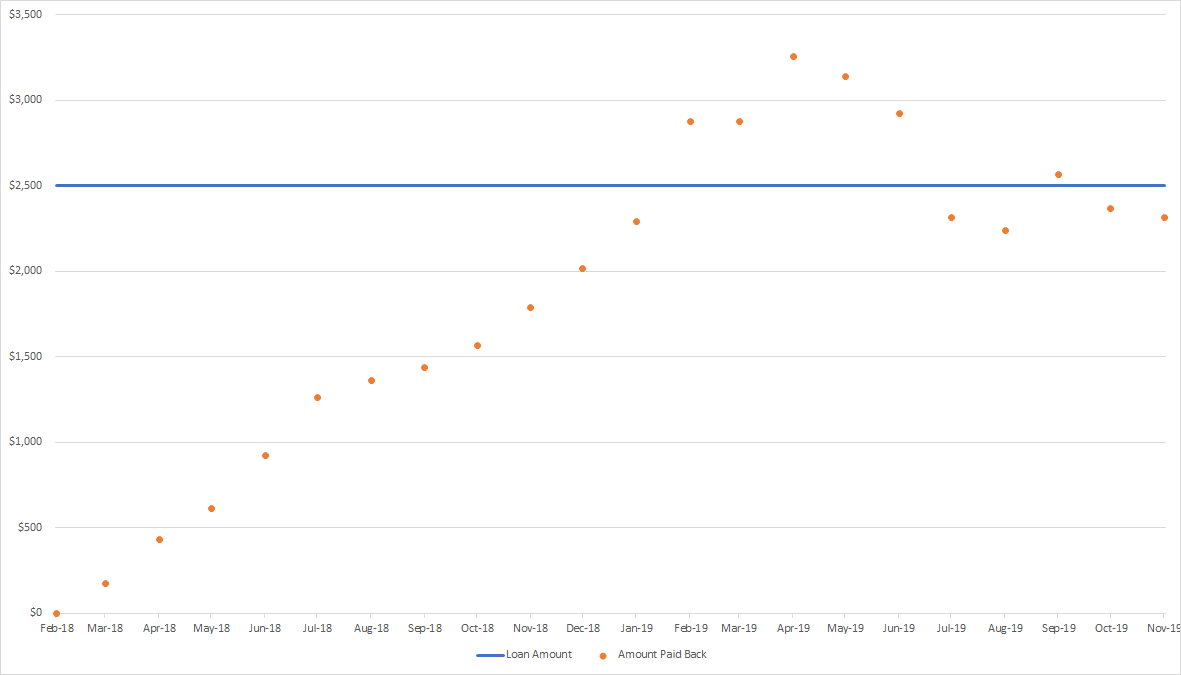

Reach equilibrium in 12 months? Yep

As you can see above, 12 months after the experiment began, I started withdrawing more than $2,500 per month. 5 months after that, the amount dropped to just below $2,500 for most months. The ongoing average will probably be slightly less than $2,500 due to delinquent and default loans, but it’s close enough to call this prediction correct.

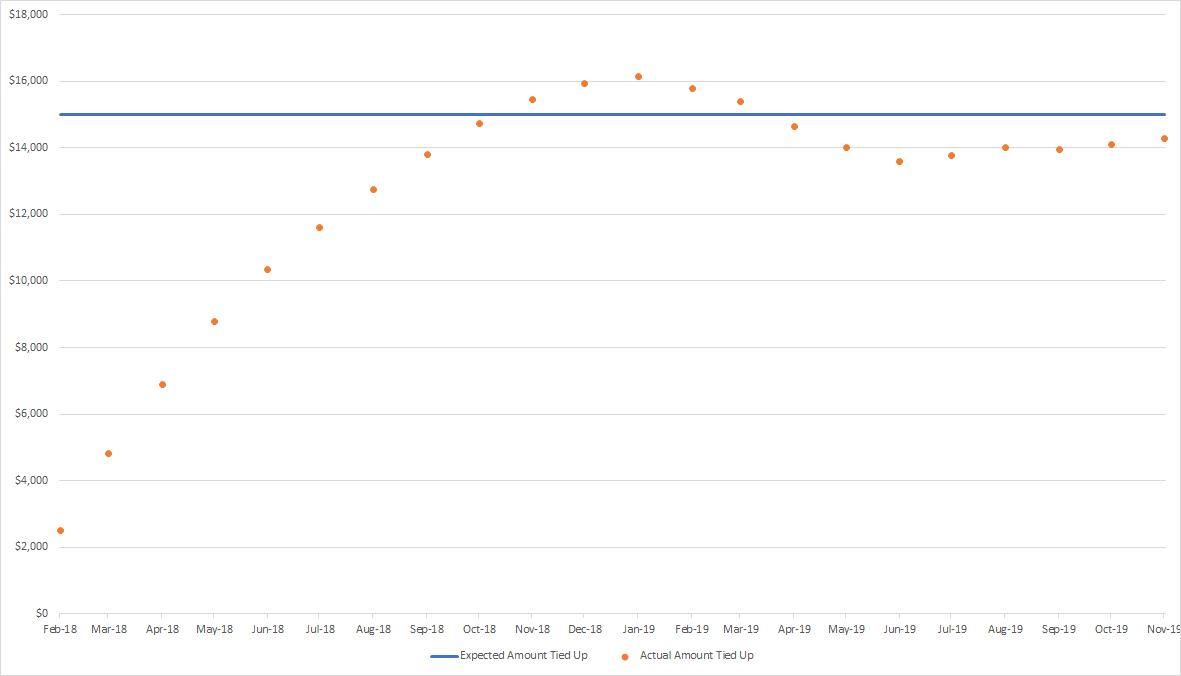

Half tied up?

By loaning $2,500 per month, I’m loaning a total of $30,000 per year. Having reached near equilibrium, I expected to have to float $15,000 or a bit less long term. This is exactly what the data shows. As of December 1, $14,272 has yet to be paid back.

Default rate below 1%?

This is the part of the experiment where the data disproves a significant part of the theory. Based on past experience, I expected my default rate to stay well under 1%. As of December 1 2019, though, my experimental account’s default rate has jumped to 1.1%.

You might think that 1.1% isn’t much above 1%, so I shouldn’t be to hasty in calling it a failure. That’s true, except that I expect my default rate to get worse, not better. Since I’ve been making loans for less than 2 years on this account, many loans haven’t had a chance to default because they’re still considered active. Of those active loans, 2.69% are currently delinquent (late to pay). While I doubt that all of these delinquent loans will default, I can use the numbers to see worst case. Worst case, based on current data, if all of my delinquent loans default, my default rate will jump to 1.65%. As a comparison, Kiva reports that the average Kiva lender’s default rate (as of Dec 1, 2019) is 1.74%.

Unfortunately, since I changed the way I filter loans this past summer, it will be a very long time before I have a good idea of what the real long term default rate will be with my current settings. And even then, I don’t know how predictive the information will be for others. After all, different loans are available at different times, so you may find better or worse loans than I have. Plus, I’ve somewhat randomly changed settings at times in order to have enough “safe” loans to add up to $2500 per month. If I were to do this again, I’d put in place strict rules about what to do when the filter criteria doesn’t result in enough loans.

Conclusion

One of my top take-aways is that I’m not a very dedicated researcher :). If I was more dedicated, I would have kept going for a set number of years with the same loan practices that I started with. Plus, I would have started a new experiment with the new settings so that we could compare to see which is better. Alas.

My poor research practices aside, I think it’s fairly safe to draw the following conclusions:

If you filter to “safe loans” with quick payback and if you loan a set amount each month, then:

- After about 12 months, you should reach equilibrium: each month going forward, on average, you’ll put in the same amount that you take out, and…

- The amount of money “tied up” in Kiva will eventually equal half of your annual loan amount or less (e.g. $30K in annual loans at $2.5k per month = $15K tied up), and…

- Over time, your default rate will likely climb to over 1%. Given that my long-term account’s default rate is at 1.63%, and that my new account’s default rate could theoretically jump to 1.65%, and that the average Kiva user’s default rate is 1.74%, I think that it makes sense to assume a 1.65% default rate for the purposes of estimating your losses. That’s a conservative estimate. If you do better than that… great.

Personally, I will keep lending through Kiva despite my higher than expected default rates. I believe that the loans help the people who need them, so I do not want to stop funding them (see this post for details about why I believe Kiva does good). That said, if your primary interest with Kiva is as an easy way to increase credit card spend, make sure to consider the higher expected default rates before you decide whether to proceed.

Warning on KIVA – it will automatically add a donation to the bottom when you checkout. If you do around 4k in loans the donation will be $600 dollars or so. You have to remove this donation because it is not a loan, unless you want to make this. I was caught in this trap, which is pretty annoying and was not how it used to operate.

[…] flakiest people, FWIW.) But far and away, my experiences are positive.Greg at FrequentMiler authored a great post about his experiences and best practices for making loans through Kiva. Check it out.Those of us who have kids in school (or if you are in school) know all about […]

Greg, are you still running this experiment? If so, can you please give us an update? Thank you!

No, I stopped loaning during the pandemic shutdowns and when I resumed I didn’t follow the experiment pattern anymore.

[…] at FrequentMiler authored a great post about his experiences and best practices for making loans through Kiva. Check it […]

Anyone get his email with a validation link to withdraw successfully? I never receive it, and no one from Kiva answers my email for weeks.

[…] Manufacture Spend (and do good) with Kiva and Kivalens, but also see the more recent update “My Kiva spend experiment” for the real-world results when applying those […]

[…] with Kiva and Kivalens. Yes, I’ve written that defaults are higher than I’d like (see this post), but I still firmly believe that Kiva does a lot of good in the world (see this […]

[…] For the past 8 years, Kiva loans have been a significant part of my credit card spend strategy. With Kiva, it’s possible to increase credit card spend and do good in the world, all at the same time. With luck and time, you’ll get most of your money back. T…Read more […]

I don’t touch Kiva except when I have 5% or 5x back on Paypal

Making loans at 0% interest to people in 3rd world countries leads to a >1% default rate? Wow, would have never expected that.

On a non-sarcastic note, Greg, the problem you are going to face is that when a financial crisis hits that default rate is going to jump to 5%+ and destroy your prior returns.

If you are serious about this as a “long-term” strategy I’d double whatever default rate you are actually seeing because it’s been 10 years of economic growth. At 3% defaults, I don’t think this strategy is better than just Vemnoing someone

[…] My Kiva spend experiment by Frequent Miler. […]

Greg, I started into this following your lead, quickly moved away from kivalens and went to manual, larger loans of $300-$500. I’ve had nearly $200k go through with a 0.05% default rate. Even if I include all delinquent as default, I (like JS) am only at 0.4% I have my parameters in a saved search and come back another day if I don’t find something I like. I think it is a great pajamas capable MS approach. I can handle the float and I really don’t want to hang around Walmarts and grocery stores getting MOs, so it’s the best MS for me.

@greg, do you make your loans all on the same day every month (1st, 30th, etc)? What if you made half the loans twice a month, therefore you would not run out of “safe” loans.

Thanks for posting this; good to acknowledge when things change or an analysis is not correct.

I think you’re underselling the opportunity cost of using Kiva for CC spend.

The 1.65% default rate is essentially the same as paying a ~1.7% fee on CC spend (i.e. you pay Kiva $100 and get $98.35 back, which is the same as paying a fee of $1.65 on $98.35 of spend… 1.65/98.35 = 1.7%).

Then you have to think about the opportunity cost — there are no-risk savings accounts/money market funds that return about 2% if you need to keep your money liquid. Alternately there are investments where an expected return might be 7-8% (S&P index fund), if you are comfortable with a longer horizon.

I’m not clear what the duration of a typical Kiva loan is… working backward thru your math I think it’s 6 months…? If so, the opportunity cost is 1-4% (half of the annualized returns above… ignoring possible taxes for now), so the total cost of Kiva spend is 2.7% – 5.7%.

But there’s no chance to recover the money tied up in Kiva if you have an emergency, so I would argue you need to think of it as long-term funds rather than a place to stash your emergency fund, which means you should compare it to a long-term stock investment.

Furthermore, there is a risk of Kiva default rates increasing, or other bad stuff that can happen with a relatively small, unregulated company (I don’t think there’s anything like SIPC/FDIC/etc. insurance on funds tied up with Kiva… correct me if I’m wrong). All of that would lead me to think of the effective Kiva “fee” after opportunity costs and other risks as at least 6%.

At that point, there are all kinds of ways to increase CC spend that are cheaper and no- or very low-risk:

– Plastiq (2.5%)… if you run out of bills to pay, there’s:

– Paying friends on Paypal/Venmo (~3%)

– Buying online Gift of College gcs — the fee is 3% which typically makes it a no-go, but still much better than Kiva IMO

So if you’re into Kiva for the sake of doing good, that’s great. But I think it’s a rather expensive way to increase CC spend.

It’s a good way to hit spend quickly for credit cards. If you pick the right funds, your default rate will be much lower. The loans vary in length, but if you time things right you can get a 6 month loan where you’ll have half of your money back after just 3 or 4 months. Outside of one risky loan I made 5 years ago before I knew more about what I was doing, my delinquency/default rate is around .2% (with it .5). And I think there is still hope I’ll recover a lot of that money.

If you’re still waiting for money back on a loan made 5 years ago, that money could have been sitting in a 2% savings account and earned 10% in that time frame. That’s why it’s expensive.

Well that money is part of the .5% I’m expecting to never get back. I have invested ~100K in kiva loans. It’s all been either at 5% or 10%+ for credit card bonuses, so it’s been worth it. I don’t waste my time diversifying. When I see something I like I’ll put at least $500-$1500 in it. I don’t need insurance.

I haven’t had to resort to venmo yet, but I’m worried that they would shut me down. Kiva is on my radar for a potentiall fallback option should the MS avenues run dry, I am thinking that it could have use in a worst-case scenario (i.e., it’s certainly better than missing a SUB).