NOTICE: This post references card features that have changed, expired, or are not currently available

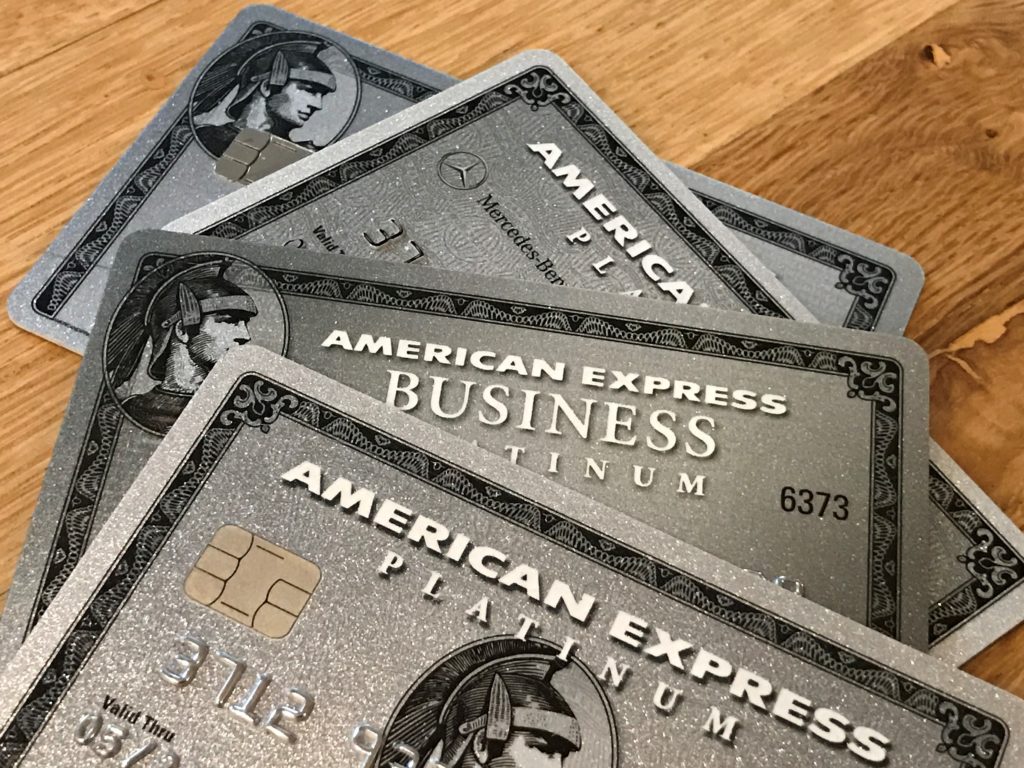

As expected, The Platinum Card from American Express was re-launched today with an increased 60,000 point welcome bonus and new $550 annual fee along with some new benefits, and that same intro bonus is also being offered on the Charles Schwab, Mercedes-Benz, and Morgan Stanley versions of the card (all of which can be found on our Best Offers page). The new benefits also apply to the Ameriprise version of the card, which waived the annual fee for the first year, though it continues to come with no intro offer. We’ve previously written about these new and expected changes that have fallen kind of flat among many cardholders.

New Welcome Bonus and New Benefits

- 60,000 bonus points for $5,000 in purchases in the first 3 months

- 5X points for airfare purchased directly with airlines or with amextravel.com

- 5X points for prepaid hotels booked with amextravel.com

- Up to $200 in annual rides with Uber ($15 per month; $35 in December)

- Uber VIP status where available

- Free Gold card authorized users

Quick Thoughts

There are a couple of other much less tangible benefits — an “expanding global lounge collection’, a new Global Dining Collection, and access to some similarly undefined “events” and “experiences”. As Greg pointed out, on the face of it, this seems to be not much enhancement for an additional $100 annual fee. It’s even more surprising that Amex didn’t come out with a stronger welcome bonus. There have historically been higher targeted offers on most of the versions of the Platinum card with the previously lower annual fee. As the Business Platinum pay-with-points rebate has proved more and more valuable, a slightly higher bonus might generate a bit more excitement on this card. One bright note is that users are reporting that the Uber credits are working for UberEats, so those living in markets served by that service may be able to take advantage of the credits even if they do not use the ride sharing service. It is unclear whether the credits were intended to work with UberEats, so we don’t know if they will continue to work this way for the long-run — but for now, that may help some users justify the fee increase. Out of the numerous versions of the Platinum card, the one that has not seen a higher bonus is the Platinum Card for Schwab.

In the end, whether the 20,000 point intro offer increase is worth the additional $100 fee will likely come down to how highly you value the new Uber credits — and whether or not you are willing to patiently wait for a better offer to come around.