Cardless has announced the launch of a new TAP Miles&Go American Express credit card. This new card features a limited-time public intro bonus of 60,000 bonus miles after spending $2,500 in the first three months, while those who joined the waiting list in advance can earn an additional 5,000 redeemable miles and 5,000 status miles. Frankly, I don’t find this card very interesting at all, but it could nonetheless provide a decent value in the right situation.

The Offer & Key Card Details

Click the card name below to go to our dedicated card page for more information and to find a link to apply.

| Card Offer and Details |

|---|

ⓘ $354 1st Yr Value EstimateClick to learn about first year value estimates 40K miles Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 40K after $2,500 spend in first 90 days$79 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: (Expired 1/10/25) Earn 50K bonus miles + 10K status miles after $2.5K in first 90 days FM Mini Review: The two free checked bags per year and two lounge passes could justify the annual fee, but this card isn't a clear win for most people. Earning rate: 3x TAP Air Portugal purchases ✦ 3x hotels, car rentals, & rideshare ✦ 1x everywhere else Card Info: Amex issued by FEB. This card has no foreign currency conversion fees. Big spend bonus: Earn 1 status mile for every 5 miles earned from spend up to 10,000 status miles from 50,000 miles earned from spend (excludes miles earned from the welcome offer). Noteworthy perks: Preferred boarding ✦ 2 lounge passes per year to TAP lounge at Lisbon Airport ✦ Free extra checked bag twice per year ✦ 1 status mile per 5 miles earned from spend up to 10K status miles per annual qualification period |

Quick Thoughts

I flew TAP Air Portugal for the first time a couple of years ago and I was pleasantly surprised by the in-flight experience. Business class was comfortable, catering was not bad (not great, but certainly better than some), and service on-board was sufficient. The ground experience in Lisbon could use some work from an organizational standpoint, but the lounge was pleasant. However, my satisfaction with flying TAP Air Portugal doesn’t translate to interest in this card.

If you fly TAP Air Portugal a lot in economy class, I could see where this card could have some niche appeal in the sense that it offers preferred boarding, an extra checked bag for free 2 times per year, and 2 lounge passes per year to the TAP Premium Lounge at Lisbon Airport. That’ll upgrade your experience a little bit and between those three benefits, someone who flies economy to and from Portugal a couple of times each year could justify the $79 annual fee.

Nonetheless, theoffer here is, in my opinion, underwhelming.

On the one hand, TAP Air Portugal charges 30K miles each way for Star Alliance economy class between the US and Europe, so you could get a round trip economy class flight with this bonus. That could be a pretty good trade in exchange for $2,500 in spend.

On the other hand, TAP charges 100,000 miles each way for business class between Europe and the US. That’s just uncompetitive….and it means that the welcome bonus here only gets you 60% of a one-way business class ticket to Europe, which just isn’t very competitive with most airline credit card offers.

Even rates for flights within Europe are pretty ridiculous at 30,000 miles each way in economy class or 45,000 miles each way in business class on Star Alliance. TAP flights may price at less, although on the other hand I just searched a route from Lisbon to Vienna that came up at 36,500 miles one-way in economy class on TAP.

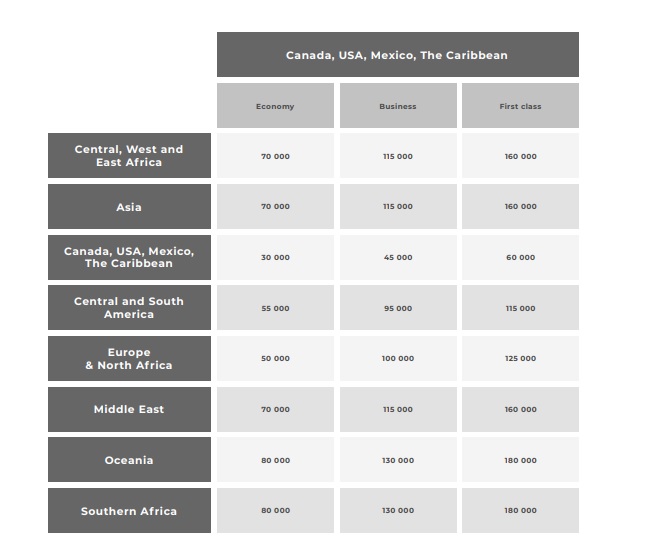

TAP has announced award chart changes as of 10/19/23 that have some routes increasing in price, though the routes noted above aren’t among them. You can see the full chart here, but here are one-way award redemption rates from Canada, the USA, Mexico, and The Caribbean.

As you can see, one-way economy class redemptions cost 70,000 miles to the Middle East or 80,000 miles to Oceania or Southern Africa. You can fly in business class for far less. As a point of comparison, Turkish Miles & Smiles charges 47,000 miles one-way in business class to/from the Middle East or ANA Mileage Club charges 105K round trip in business class to Africa.

The card earnings aren’t terribly attractive given that the card’s key bonus category is 3 miles per dollar spent on TAP Air Portugal purchases. With no travel protections mentioned on the landing page, I would imagine that you’d be better off putting airfare purchases on a different card.

The 2x bonus categories aren’t interesting since you could alternatively get a Capital One Venture card and earn 2x on all purchases and transfer 1:1 to TAP Air Portugal if you really wanted TAP miles.

Someone seeking TAP Air Portugal elite status could benefit from the fact that the card earns 1 status mile per 5 miles earned with your card up to 10,000 miles per annual qualification period. In other words, you get 20% of the miles you earn from spend as status miles up to 10K status miles when you’ve earned 50K miles from spend. The welcome bonus does not count here, but if you spend $17,000 on the card on TAP Air Portugal purchases at 3x, you’d earn 51,000 redeemable miles and 10,000 status miles.

However, TAP Air Portugal Silver status requires 30,000 status miles and Gold status requires 70,000 status miles, so the status boost is of limited utility. Silver and Gold status actually have some decent benefits if you’re flying on TAP, but dedicating spend in this card to earn them comes at a pretty significant cost.

I could imagine this card possibly being worthwhile for someone who just wants to earn enough miles to redeem for a round trip ticket to Europe, but even then I’d rather be earning a transferable currency that will give me more opportunities for an even better deal. This card seems like a very niche product.

All that said, I am glad to see Cardless continue to expand its portfolio because I want to see competition in this space. And I’m glad to see Cardless go after foreign programs because I think both those foreign airlines and US customers can benefit from additional players in this space. TAP’s weak award chart makes this specific card a poor value, but I think other opportunities abound. Can someone at Cardless please get us a Turkish Miles & Smiles card? That would be a 60K bonus well worth pursuing.

Dumb question — is this a soft pull or a hard pull? I’ve never used Cardless before so went through application steps and they only asked for last 4 digits of SSN.

I don’t know for sure, but I always assume a hard pull…..and honestly, it doesn’t really matter much to me because pulls are largely irrelevant in my experience.

For someone who flies to Portugal a lot lately, I was really hoping that this would be a great opportunity. Buy flying from the West Coast to Lisbon in economy is a no go. TAP business award flights from SFO are ridiculous. Flying from east coast to LIS might be doable with that card, but LifeMiles is a better option. I did fly from LIS to Cancun and that wasn’t bad…

As I read the award chart it looks like one way NA to Europe redemptions are 50k. Not 30k.

Oh you’re right! I looked at that incorrectly. It’s 30K right now, but going up to 50K apparently! Yuck. Will edit.

Garbage card for a garbage FFP..