NOTICE: This post references card features that have changed, expired, or are not currently available

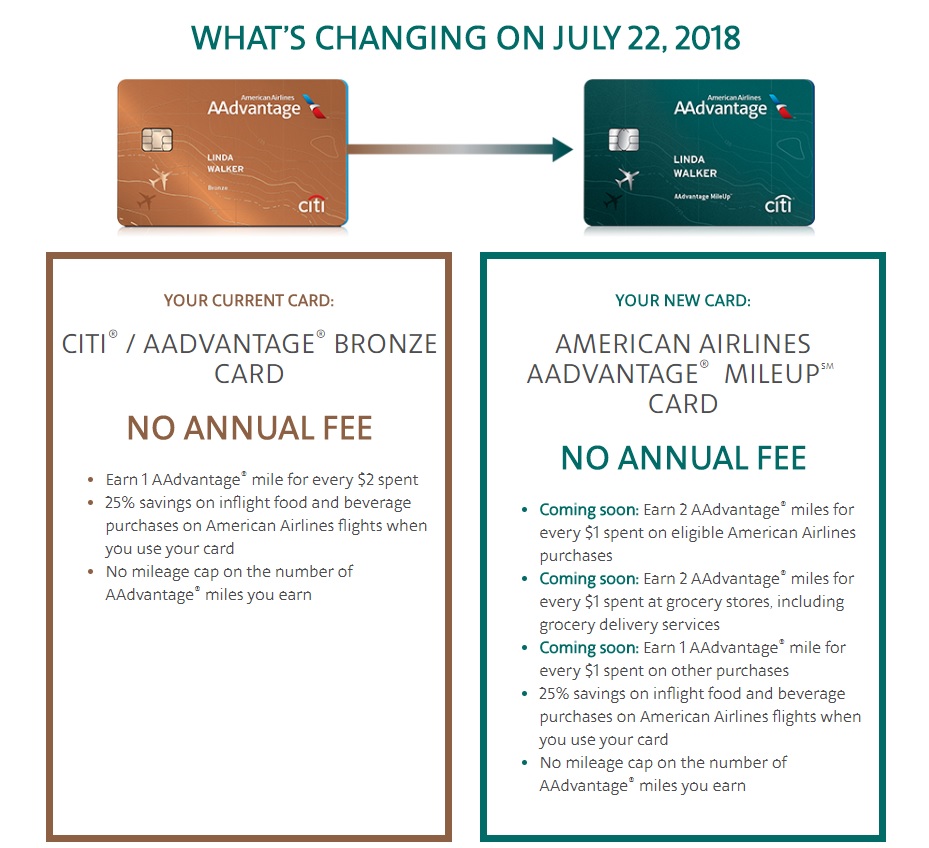

Citi and American Airlines have announced that on July 22nd they be will launching a brand new credit card with no annual fee called the AAdvantage MileUp Card. While the new cardmember bonus isn’t terribly exciting, this might be an awesome option for a product downgrade and it might even work as an introduction to rewards cards for something starting out. Current Citi AAdvantage Bronze cardholders will also be transitioned to this card.

The Offer

- Citi is launching a new American Airlines MileUp credit card on July 22nd

- New member bonus will include 10,000 AAdvantage miles and a $50 statement credit after spending $500 on purchases in the first three months

- Direct link to press release

Key Card Details

- No annual fee

- Earns 2x at grocery stores

- Earns 2x on American Airlines purchases

- Earns 1x everywhere else

- 25% savings on inflight food and beverage purchases on American Airlines flights when you use your card

Quick Thoughts

Again, the new cardmember bonus on this card pales in comparison to the 50K to 60K offers we often see on all of the other American Airlines cards. However, they say that domestic economy tickets are the most common redemption, and 10K to start combined with 2x at the grocery store would probably be a good gateway drug for someone who is initially averse to annual fees or perhaps for a student if they were approved.

Of course, most readers will find this much more interesting as a new downgrade option when looking to get rid of the annual fee on an AAdvantage Platinum Select or Executive card. Being able to continue earning 2x AA miles at the grocery store with no annual fee certainly isn’t bad if you value AA miles. It still wouldn’t make it to the top of our list of the Best Category Bonuses for grocery store spend, but it certainly wouldn’t be a bad way to put together some American Airlines miles – especially if you live near one of the many grocery chains regularly offering fuel point bonuses or discounts on gift cards.

As noted above, current Bronze cardholders are receiving emails indicating that their cards will be transitioned to this new MileUp product.

We’ll have to wait to see the terms and conditions when the application page launches, but I assume that the welcome bonus will not be available to those who have or have had another personal AAdvantage card opened or closed in the past 24 months. Since this one stays within the same family of cards, I would expect that downgrading to it likely would not reset your 24-month clock for AA cards, but we’ll have to wait for data points to see.

Either way, I’m excited to see an airline card with no annual fee that also has a category bonus.

[…] New no-fee AA card with 2x grocery debuts. […]

Insane to get that Card should be a WW11 Mine sign on it .

CHEERs

Have you ever downgraded a Citi card? Is this guaranteed as opposed to making you cancel the card?

does it give you a free checked bag?

No, I don’t believe it does.

So happy AA/Citi are finally getting competitive. I would easily pay a $50 AF (or the old AA Gold card fee) for a AAdvantage mile earning card like this with a decent bonus category.

Say what you/I will about URs, Avios is a tedious & time consuming way to get on AA flights – I live in Texas &

AA miles are critical to have on hand for last-minute travel.

Is this going to be the best card to earn AA miles with grocery spend with the SPG cards going Marriott and only earning 2 Marriott points instead of 3?

This card would be better even if the SPG card still earned 3 Marriott points / 1 SPG point. In a word, “yes”.

Any word on the definition of “grocery store”? I assume it won’t work at Walmart Supercenters, Super Target, Sam’s, or Costco. Unfortunately, those are where a lot of people buy the bulk of their groceries.

No word yet, but I assume those places won’t code as grocery. I also assume a lot of people will buy the bulk of their “groceries” on this card rather than groceries if you know what I mean.

Is there a limit of the grocery spend for the 2x or is it unlimited?

Unlimited.

Their definition should follow the MCC that Mastercard categorizes as grocery stores.

For Walmart Supercenters and Super Targets, it really depends on the area of the US you’re in, as it seems to be region based. Where I live Walmart Supercenter and Super Targets code as grocery stores for Mastercard. Other regions these stores code as wholesale/discount stores instead of grocery stores.

Sam’s and Costco should always code as wholesale clubs and would not be considered grocery stores.

Me too, Walmart is grocery store in NJ

At Neighborhood Grocery Walmart it it gives me 2x on my Amex ED. When it was 5x grocery category on Freedom it only gave me 1x.

Lots of Neighborhood Markets around here. I was going to get the Chase Freedom just for the 5X grocery, but doubt I will now. Thanks for the info!

Question is will they be sending out Mailers with the $500 spend requirement 🙂

Would love to be able to pick up 10k AA miles on a quick $4.95 grocery store run if you know what I mean.

I don’t recall a no-annual fee $1:1 mile card since Delta/Northwest’s old JCB card! This is a decent option especially to help keep AA miles from expiring.

The recently introduced Amex Delta Blue is $1:1 — in fact this card mirrors it, except the 2x category is groceries, rather than restaurants.