Citi has expanded the ability to transfer to most airline and hotel partners to most cards that earn ThankYou points. Whereas previously, some no-annual-fee cards either had very limited transfer partners or none at all (the Custom Cash previously did not have transfer partners), it is now possible to transfer from most cards that earn ThankYou points to most Citi partners — albeit at a poorer ratio and not at all to American Airlines.

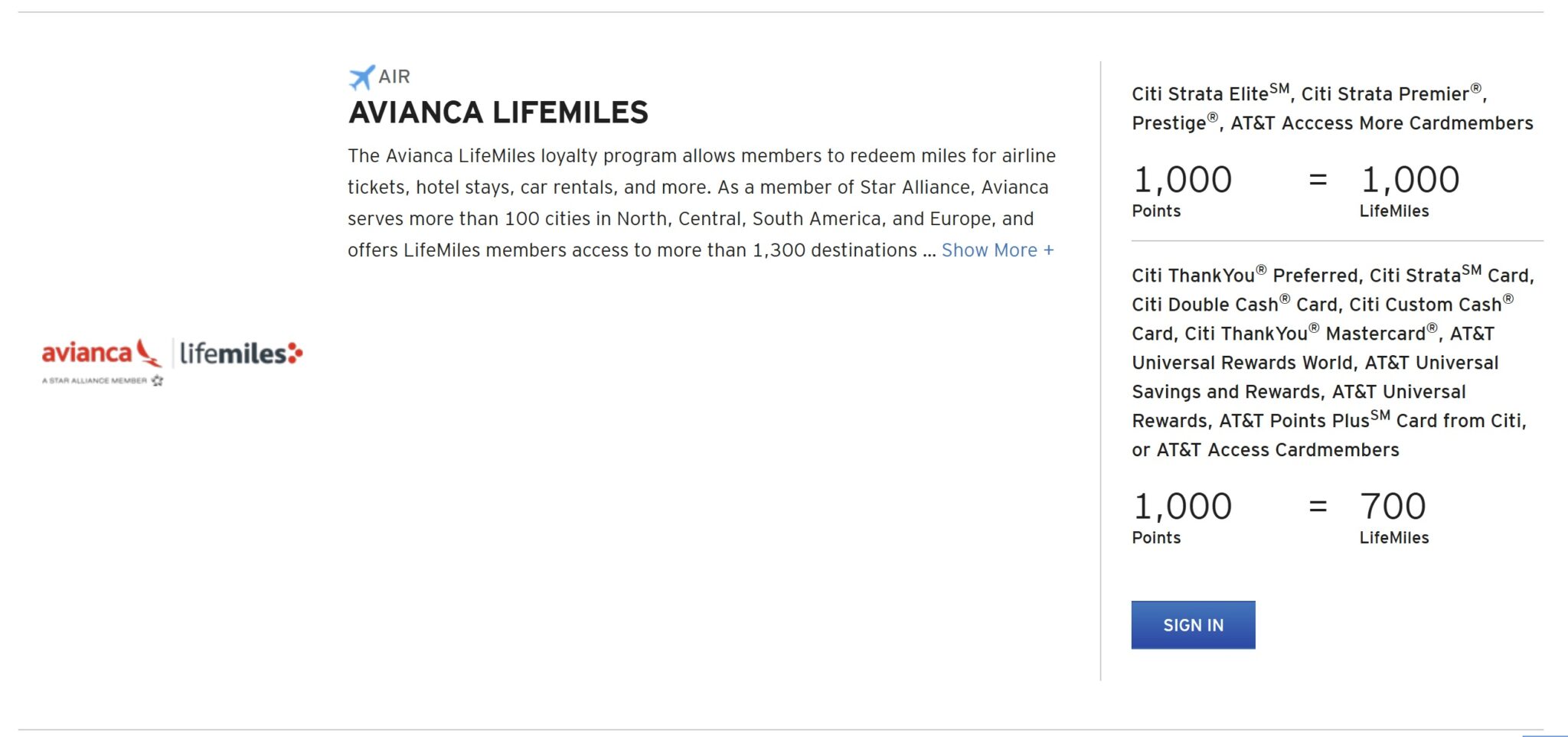

As you can see above, while Citi Strata Elite, Strata Premier, Prestige and AT&T Access More cardmembers transfer 1,000:1,000 to most airline partners, the ratios differ a bit for those with other Thank You cards. If you have a Strata Elite, Strata Premier, Prestige, or AT&T Access More card, you can still pool your points earned from other cards and enjoy the better transfer ratios when transferring from one of those premium cards.

Note: Only Strata Elite, Strata Premier or Prestige cardmembers can transfer to American Airlines. You must have one of those three cards to transfer to AA.

However, it is now possible to transfer from other cards to most of Citi’s airline and hotel partners (other than AA) without having a premium card. The Citi ThankYou Preferred, Citi Strata, Citi Double Cash, Citi Custom Cash, Citi ThankYou Mastercard, AT&T Universal Rewards World, AT&T Universal Savings and Rewards, AT&T Universal Rewards, AT&T Points Plus card or AT&T Access cards to airline and hotel partners. Here are the ratios for those cards from Citi ThankYou points to partners:

Airlines:

- Air France / KLM Flying Blue: 1,000:700

- AeroMexico Rewards: 1,000:700

- Avianca Lifemiles: 1,000:700

- Cathay Pacific: 1,000:700

- Emirates Skywards: 1,000:560

- Etihad Guest: 1,000:700

- EVA Air: 1,000:700

- JetBlue TrueBlue: 1,000:700

- Qantas Frequent Flyer: 1,000:700

- Qatar Privilege Club: 1,000:700

- Singapore Krisflyer: 1,000:700

- Thai Royal Orchid Plus: 1,000:700

- Turkish Miles & Smiles: 1,000:700

- Virgin Atlantic Flying Club: 1,000:700

Note: It is not possible to transfer to American Airlines AAdvantage without a Strata Elite, Strata Premier or Prestige card.

Hotels:

- Accor Live Limitless: 1,000:350

- Choice Privileges: 1,000:1,400

- Leading Hotels of the World Leaders Club: 1,000:140

- Preferred Hotels & Resorts: 1,000:2,800

- Wyndham Rewards: 1,000:700

As you can see, the transfer ratios aren’t great. However, it is worth noting that the Choice Privileges transfer ratio is 40% better than what Amex or Capital One offers as both of those programs only offer 1:1 transfers to Choice (you still may be better off buying points on sale, but it is notable that you’ll get a better ratio here than through other partnerships). Similarly, the transfer ratio to EVA Air, at 1:700, is only slightly behind Capital One’s 1,000:750 transfer ratio to EVA Air.

I’d still usually recommend getting or upgrading to one of the premium cards when you want to transfer to a partner in order to unlock the better transfer ratios, but it is great to see that it is no longer necessary for those who do not want to do so. And when you consider a card like the Custom Cash offering the ability to earn 5x in one category each month, the transfer ratio here would make that card effectively earn 3.5 airline miles per dollar on that bonus category, which could be a good deal for a low spender who wants to avoid paying an annual fee.

[…] everyone, I hope your weekend is going well. A few days ago, I read Frequent Miler’s post (Now transfer from most Citi cards to most ThankYou partners (even from Custom Cash)) and I started thinking about Citi ThankYou Point (TYP) transfers. Among my 6 Citi TYP earning […]

[…] The BIG development in this space last week was this: You Can Now Transfer ThankYou Points to American Airlines. At a 1:1 ratio. It came at the same time with Citi finally releasing its own premium credit card that it has been working on for years, more on this in its own section under Travel Rewards Credit Cards below. Many bloggers are cheering this development. Will they still be cheering when American Airlines does a colossal devaluation? It is not a matter of if but when. And to continue on the same theme: Now transfer from most Citi cards to most ThankYou partners (even from Custom Cash). […]

Not sure about the other cards, but the double-cash already had Choice as a transfer partner at 1:1.5 before this update so for Choice specifically, this is a deval.

Since the Rewards+ is no longer a thing (for most), is there any reason to pool your points across multiple cards together anymore? That is, of course, if one can transfer points between cards without them being combined. It would certainly make it easier to track expiring points 🙂

I have 6 Citi TYP CCs. They are automatically pooled in my case. The only exception being transferred points. They still expire after 90 days.

Great question. I’m not sure whether the 100k limit on transfers applies when transferring to yourself. Also previously the Custom Cash didn’t allow transferring points at all to other accounts. I don’t know if that’s still true.

perfection! we are 2k cathay points short for our upcoming trip to Australia and I will sacrifice 3k TYP in this case.

aside from the lack of recurrent, huge SUBS, is this now the best transferrable currency?

Currently seeing 5 seats on August 4th and 5th on Etihad first from JFK using AAdvantage miles. It’s on the 787. But 5 seats seats is what caught my attention.

Also seeing 5 seats on Etihad first with AAdvantage on August 5th with the first leg JFK to CDG on AA metal and the 2nd in Etihad apartments on the leg to AUH

I downgraded my Premier to a Rewards+ 1.5 years ago (applied and got the SUB 2.5 years ago). If I upgrade that back to Premier right now, will I have to pay an immediate annual fee, will the next AF wait until the membership year (~Dec/Jan), or will it be prorated? I do not have a near-term need for AA points or the other transfer partners unless my Choice plans eat up all my Wells Fargo points.

Call and ask.

Nah, this is bad. It creates a pathway to reduce transfer rates across the board. Before long I can see them enhancing the ‘elevated’ transfer rates for the premium cards to the new standard rates based on customer feedback requesting a more simple process

Or for them to stop allowing pooling of points

This is one of my concerns

The adept will survive.