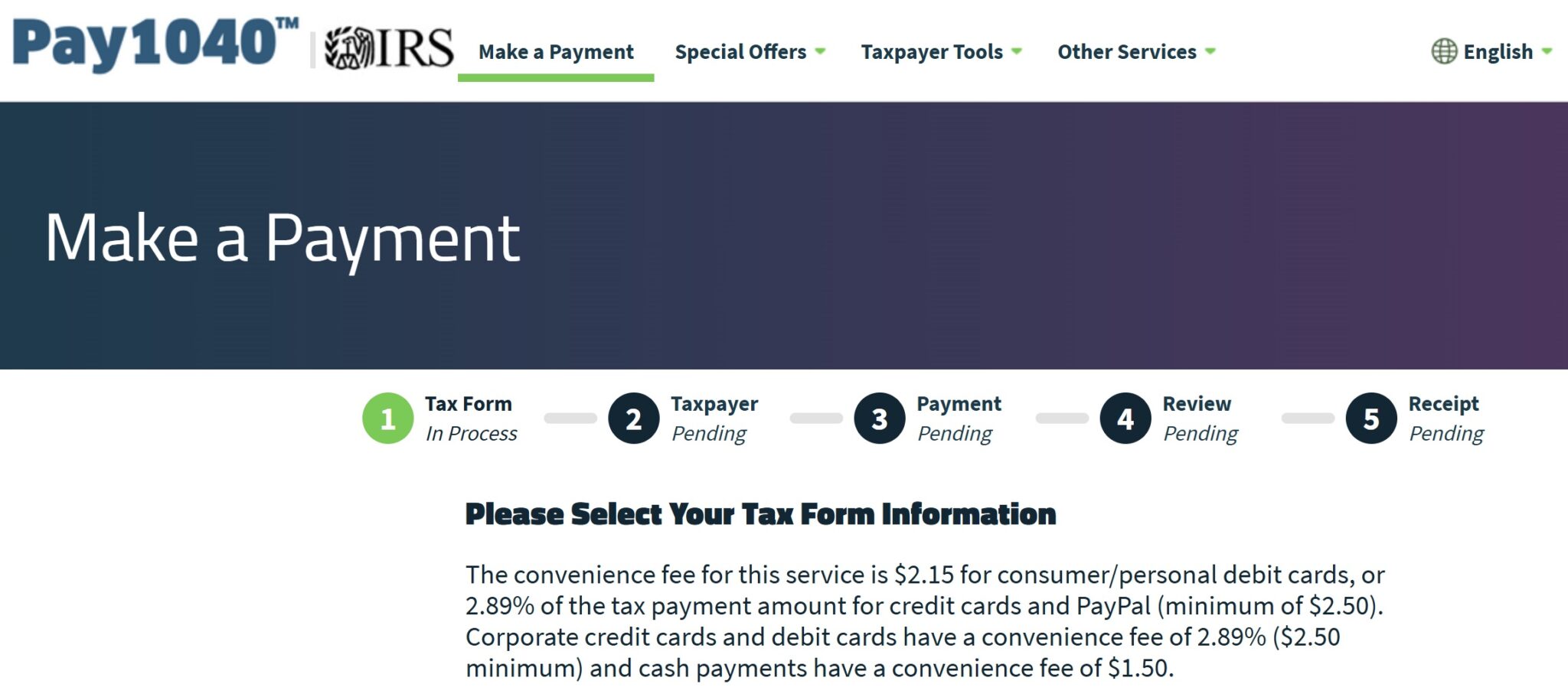

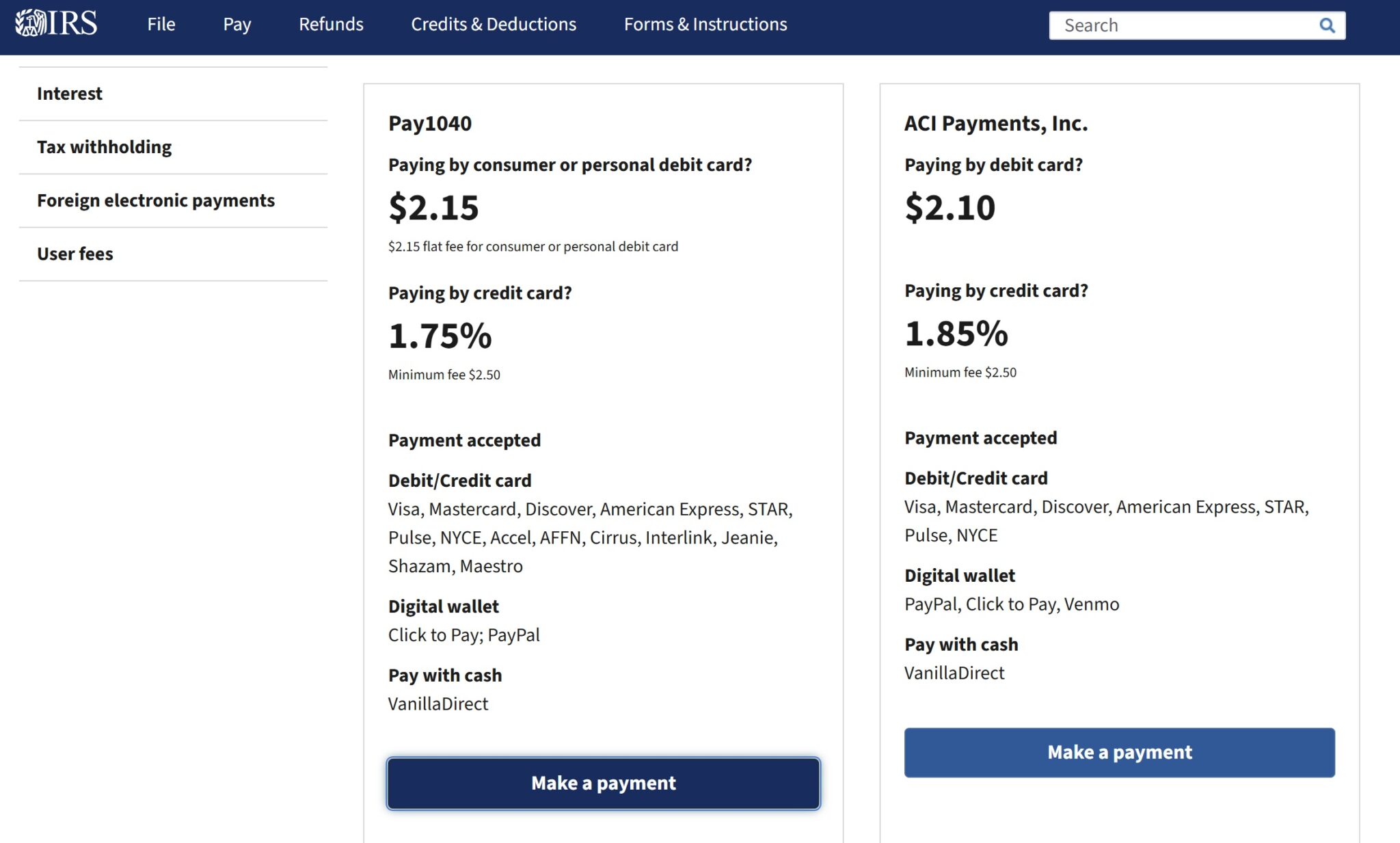

An eagle-eyed reader points out that while the IRS website lists the fee to pay taxes with a credit card as 1.75% at Pay1040, the fee shown on the Pay1040 website is now 2.89%. Not only does the landing page display that greatly-increased fee, but if you try to make a tax payment it does indeed assess a 2.89% fee during the checkout process. We don’t yet know whether the error here is on the IRS side or the Pay1040 side, but if you have a tax payment to make you’ll want to go with ACI Payments as things stand.

Reader Andrew pointed out this morning that he saw the increased 2.89% fee shown above when clicking through to make a tax payment today. This stands in contrast to the IRS website, which shows a fee of 1.75% for Pay1040 at the time of writing.

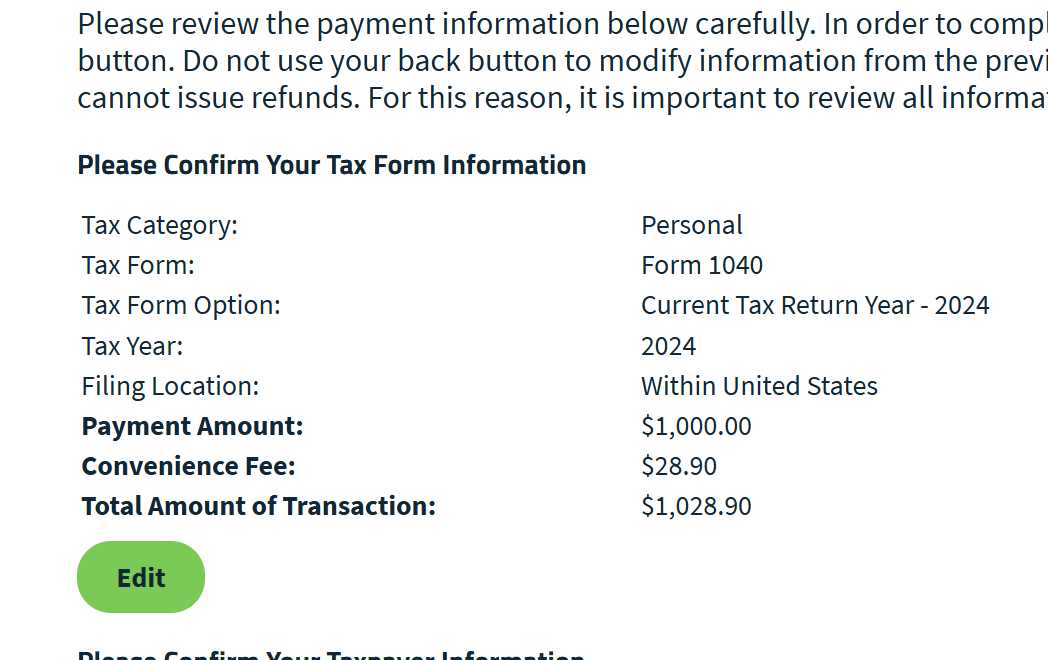

Curious if this may be a case of a mistaken display on the Pay1040 website, I clicked through and went through the motions to check the fee. Sure enough, the system is charging 2.89%.

That would be an increase of about 1% year-over-year in the fee to pay taxes with a credit card, which adds up to a sizable hit for those with large tax bills. If this increased fee sticks, it’ll essentially only make sense to pay taxes with a credit card if you’re working on a welcome bonus (or perhaps if you’re paying with the US Bank Smartly Visa and you have $100K with US Bank).

The good news is that ACI Payments is still charging 1.85% at the time of writing. If you need to make a near-term tax payment, that would obviously be a much cheaper choice.

We don’t yet know whether this change is intentional and the IRS website is displaying the old/inaccurate 1.75% rate or if Pay1040 has it wrong with the 2.89% fee. Making this all really strange is the fact that Pay1040 just reduced the rate to 1.75% a few days ago and the third payment processor dropped out altogether.

This much is certain: paying taxes with a credit card is a situation that is very much in flux at the moment. We’ll continue to keep our eye on this in the coming days and hope to see a (better) update.

Just tried Pay1040 with Paypal. Charging the 2.89% even when trying to use a personal Visa through PayPal.

I just got the same error. Charging the 2.89% when trying to pay with my Chase Freedom Visa through PayPal.

Do you know of any alternatives to ACI and Pay1040 when using a business credit card to avoid paying almost a 3% fee?

Nick, That’s an increase of 50% year over year, not an increase of 1%. Charging 3% instead of 2% is a 50% increase!

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

I tried paying the federal estimated tax with Pay1040 via PayPal with a personal card to take advantage of the targeted Chase’s Freedom Unlimited’s 5% back with PayPal. and the fee was 2.89%.

Thankfully, ACI Payments is still 1.85% via PayPal with a personal card.

dang i didn’t even realize i paid 2.88% on paypal with Pay1040. Rats

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

[…] of Pay1040 displaying a 1.75% charge on the IRS.gov web site, some TPG and Frequent Miler readers have reported being charged larger charges when utilizing playing cards from some issuers […]

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

This is crap. I just paid with PayPal and it’s 2.89% … fk this. I have been paying for years using PayPal and putting on my Paypal credit card, getting 3% back and paying 1.75.

As the article above mentions, “ACI payments” is the other company that processes credit card payments to the IRS. It only charges 1.85% for paypal and regular credit cards; and you can even use a business card via paypay to get the same 1.85%.

I assume you tried with Pay1040; I tried paying via PayPal with a personal card, and the fee was 2.89%. So, I used ACI Payments whose fee is still 1.85%

The IRS website now displays the correct information, including the difference in fees for corporate cards

I don’t think the IRS website shows the right info for “pay1040”, still says regular credit cards are 1.75%, which is not the case.

It is the case for Visas and Mastercards, no?

Not sure I understand your question. This article explains it all. The IRS website shows incorrect information for the company “pay1040” in regards to regular credit cards being 1.75%. When you click through to their website, it then says they are 2.89% which is does indeed charge you for regular credit cards. So, use the other company @ 1.85%. And as someone pointed out, if you do want to use a business credit card, you can use it through paypal to avoid the surcharge on business cards.

Yep, it says that, but if you actually click through, Pay1040 only charges 1.75% for personal Visa and Mastercards. It charges the 2.89% for all business cards, all Amex cards, and all PayPal payments.

Whether the 1.75% is going to rise to 2.89% at some point even for personal Visa and Mastercards remains to be seen.