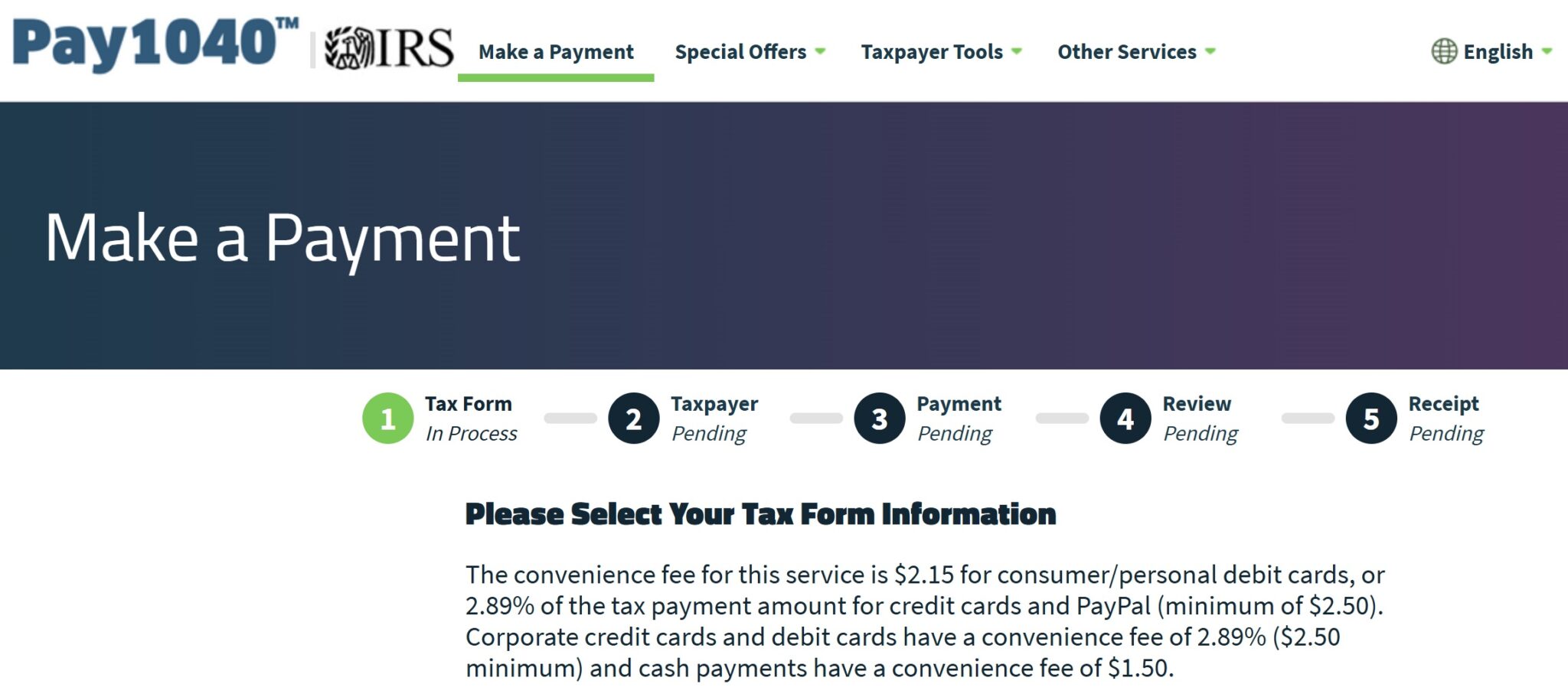

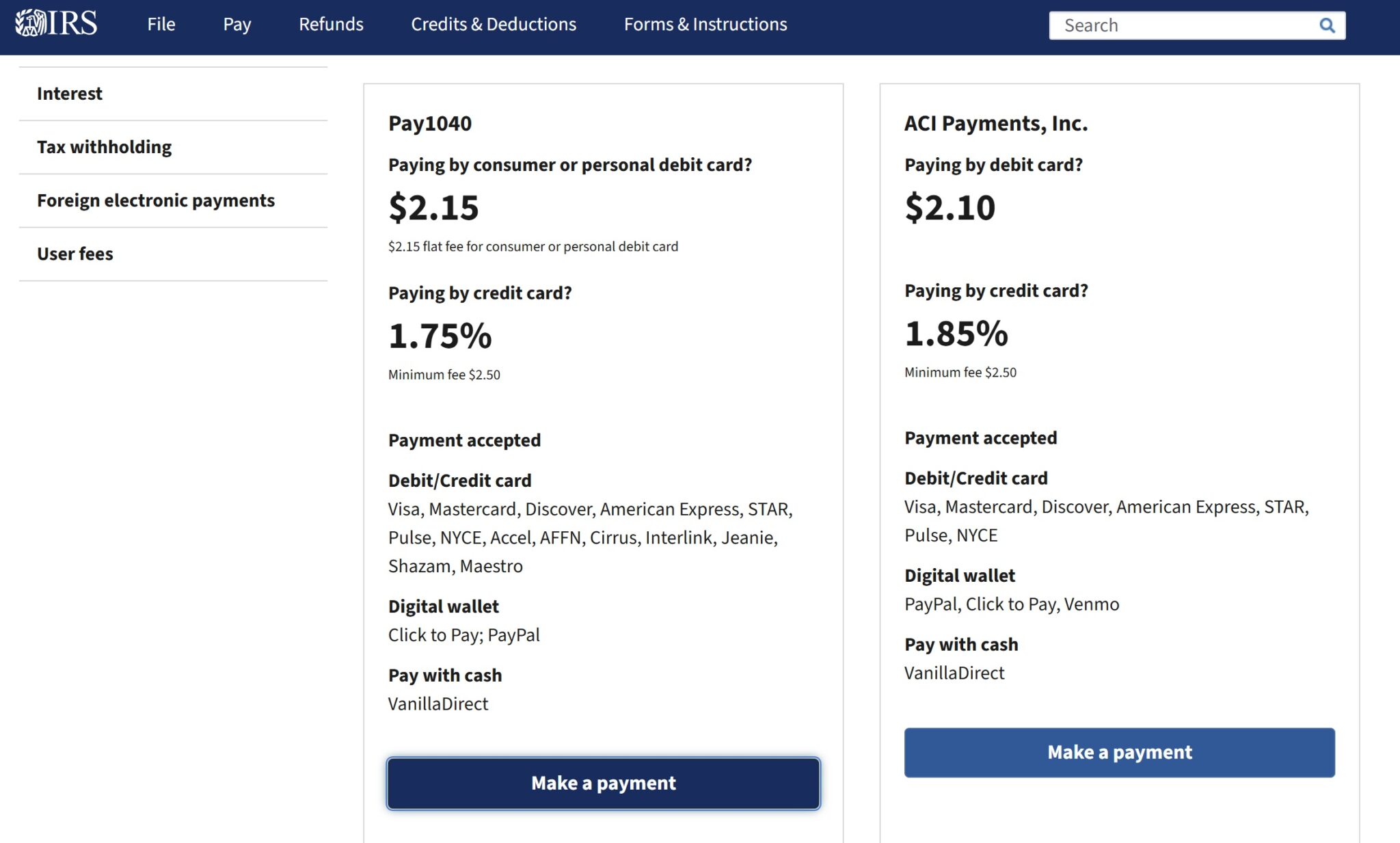

An eagle-eyed reader points out that while the IRS website lists the fee to pay taxes with a credit card as 1.75% at Pay1040, the fee shown on the Pay1040 website is now 2.89%. Not only does the landing page display that greatly-increased fee, but if you try to make a tax payment it does indeed assess a 2.89% fee during the checkout process. We don’t yet know whether the error here is on the IRS side or the Pay1040 side, but if you have a tax payment to make you’ll want to go with ACI Payments as things stand.

Reader Andrew pointed out this morning that he saw the increased 2.89% fee shown above when clicking through to make a tax payment today. This stands in contrast to the IRS website, which shows a fee of 1.75% for Pay1040 at the time of writing.

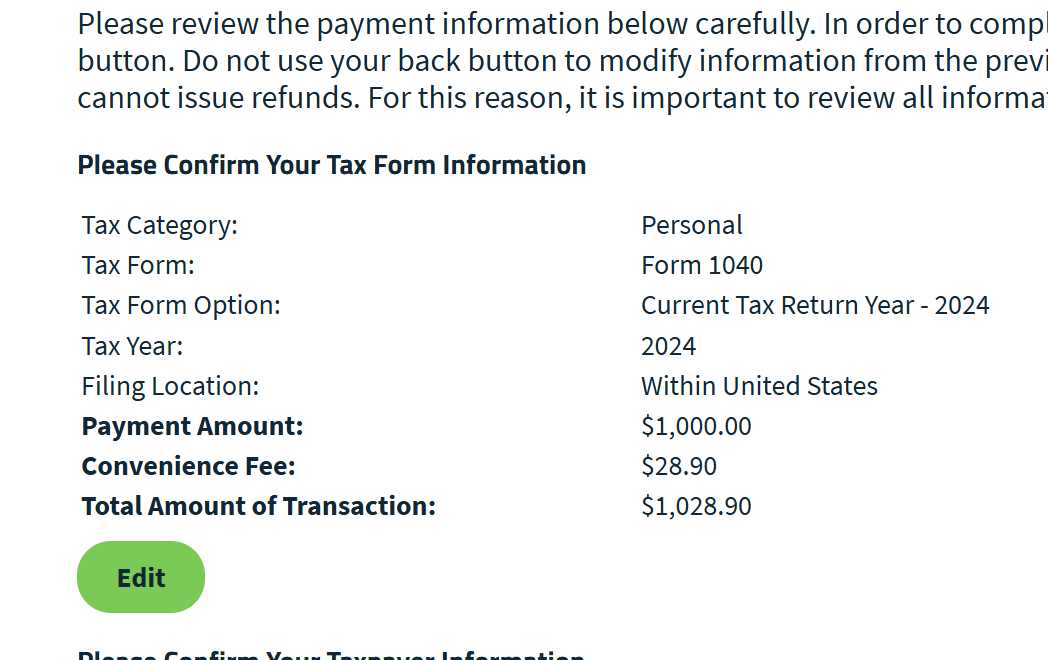

Curious if this may be a case of a mistaken display on the Pay1040 website, I clicked through and went through the motions to check the fee. Sure enough, the system is charging 2.89%.

That would be an increase of about 1% year-over-year in the fee to pay taxes with a credit card, which adds up to a sizable hit for those with large tax bills. If this increased fee sticks, it’ll essentially only make sense to pay taxes with a credit card if you’re working on a welcome bonus (or perhaps if you’re paying with the US Bank Smartly Visa and you have $100K with US Bank).

The good news is that ACI Payments is still charging 1.85% at the time of writing. If you need to make a near-term tax payment, that would obviously be a much cheaper choice.

We don’t yet know whether this change is intentional and the IRS website is displaying the old/inaccurate 1.75% rate or if Pay1040 has it wrong with the 2.89% fee. Making this all really strange is the fact that Pay1040 just reduced the rate to 1.75% a few days ago and the third payment processor dropped out altogether.

This much is certain: paying taxes with a credit card is a situation that is very much in flux at the moment. We’ll continue to keep our eye on this in the coming days and hope to see a (better) update.

Do you know of any alternatives to ACI and Pay1040 when using a business credit card to avoid paying almost a 3% fee?

Nick, That’s an increase of 50% year over year, not an increase of 1%. Charging 3% instead of 2% is a 50% increase!

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

I tried paying the federal estimated tax with Pay1040 via PayPal with a personal card to take advantage of the targeted Chase’s Freedom Unlimited’s 5% back with PayPal. and the fee was 2.89%.

Thankfully, ACI Payments is still 1.85% via PayPal with a personal card.

dang i didn’t even realize i paid 2.88% on paypal with Pay1040. Rats

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

[…] of Pay1040 displaying a 1.75% charge on the IRS.gov web site, some TPG and Frequent Miler readers have reported being charged larger charges when utilizing playing cards from some issuers […]

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

[…] Pay1040 showing a 1.75% fee on the IRS.gov website, some TPG and Frequent Miler readers have reported being charged higher fees when using cards from some issuers like American […]

This is crap. I just paid with PayPal and it’s 2.89% … fk this. I have been paying for years using PayPal and putting on my Paypal credit card, getting 3% back and paying 1.75.

As the article above mentions, “ACI payments” is the other company that processes credit card payments to the IRS. It only charges 1.85% for paypal and regular credit cards; and you can even use a business card via paypay to get the same 1.85%.

I assume you tried with Pay1040; I tried paying via PayPal with a personal card, and the fee was 2.89%. So, I used ACI Payments whose fee is still 1.85%

The IRS website now displays the correct information, including the difference in fees for corporate cards

I don’t think the IRS website shows the right info for “pay1040”, still says regular credit cards are 1.75%, which is not the case.

It is the case for Visas and Mastercards, no?

Not sure I understand your question. This article explains it all. The IRS website shows incorrect information for the company “pay1040” in regards to regular credit cards being 1.75%. When you click through to their website, it then says they are 2.89% which is does indeed charge you for regular credit cards. So, use the other company @ 1.85%. And as someone pointed out, if you do want to use a business credit card, you can use it through paypal to avoid the surcharge on business cards.

Yep, it says that, but if you actually click through, Pay1040 only charges 1.75% for personal Visa and Mastercards. It charges the 2.89% for all business cards, all Amex cards, and all PayPal payments.

Whether the 1.75% is going to rise to 2.89% at some point even for personal Visa and Mastercards remains to be seen.

It looks like Pay1040 now charges the higher fee for all business cards, including Visa. My Chase Ink Preferred coded at 2.89%.