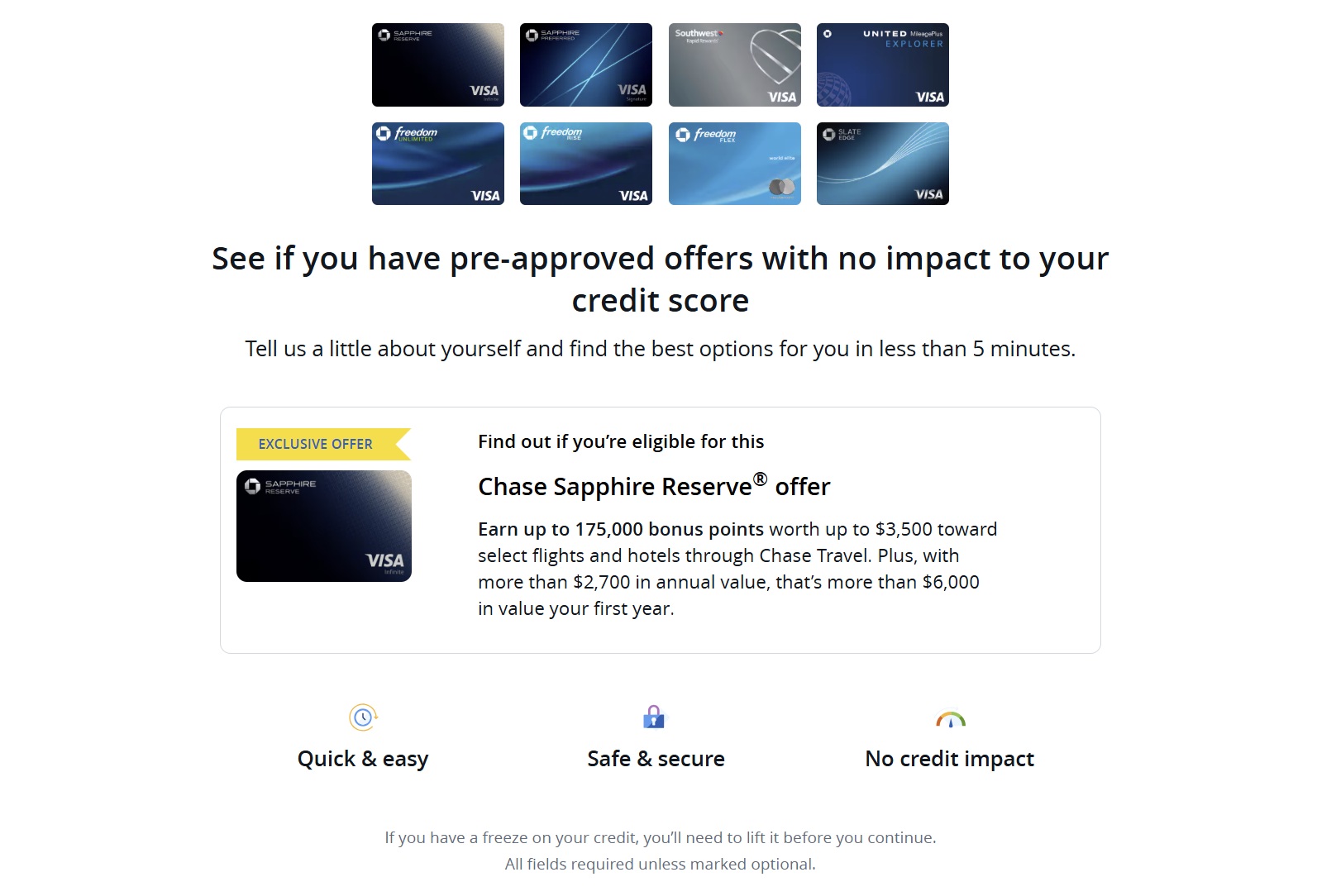

Doctor of Credit has reported on a preapproval offer that some folks are finding via the Chase “Check for Offers” tool that could be very attractive for those interested in the Chase Sapphire Reserve® Card. While I’ve only found a preapproval for an offer of 125,000 points after $6,000 in purchases in the first 3 months, Chase is advertising up to 175,000 points for some.

The Deal

- The Chase preapproval tool is showing the opportunity to check if you are eligible to earn up to 175,000 bonus points with a new Chase Sapphire Reserve card

- Link to check for Chase offers

Key Terms

- Note that this is a preapproval tool. You may or may not receive an offer.

Quick Thoughts

We recently reported that some people are eligible for a 200,000-point offer when checking in-branch, though I think that offer is not widely available. For those without a branch nearby or who weren’t eligible for the 200K offer, the chance to get up to 175,000 points could be compelling.

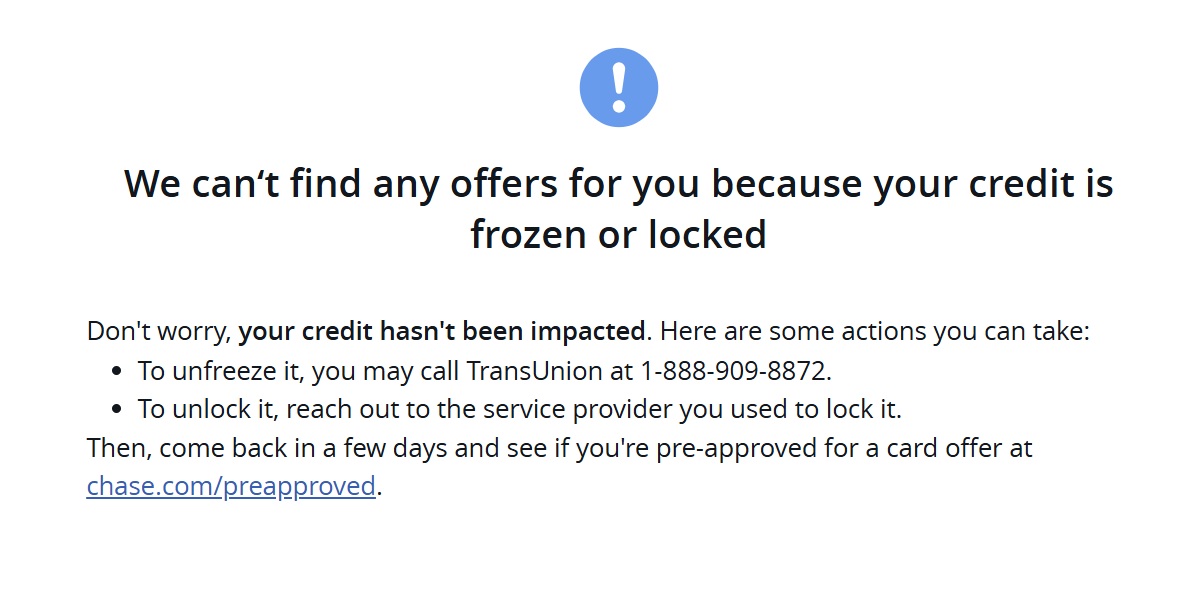

Note that if you have your credit report frozen, you may not be able to access preapproved offers.

I don’t know how many days you need to wait between thawing and coming back to see if you have an offer, but thawing does not seem to have an immediate impact.

Another way to find a preapproved offer (but probably not as good)

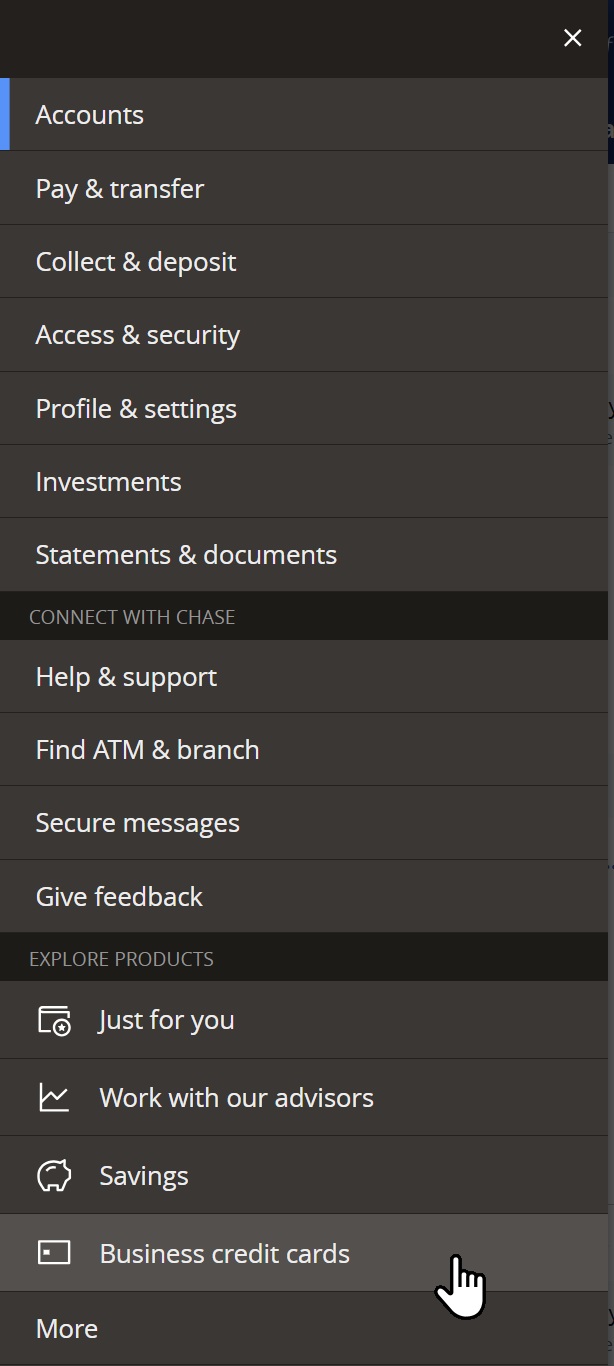

I separately logged in to my Chase account, hit the hamburger menu in the top left corner, and went down to “Business Credit Cards” (because my accounts are under a business login).

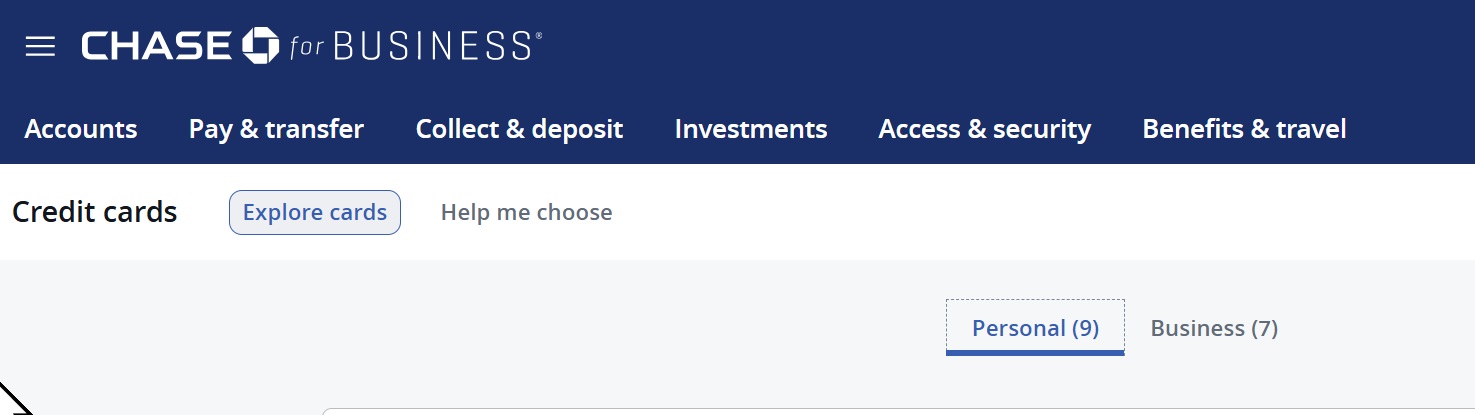

Then, I chose “Personal” cards.

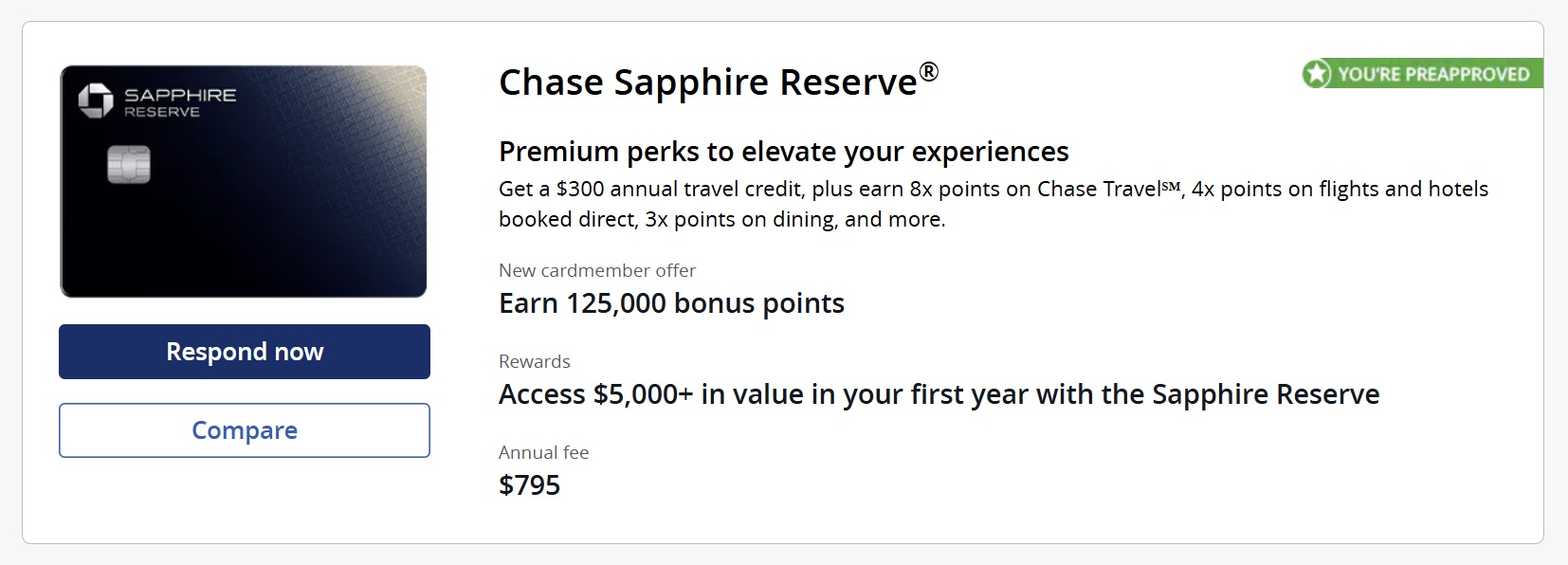

After scrolling down, I found that I had a preapproved offer for the Chase Sapphire Reserve card.

Unfortunately, that offer was only the standard offer for 125,000 points after qualifying purchases.

Interestingly, I did not find that offer under the “Just for You” section on either the website or in the app, but rather I found it under “credit cards” in both places. In the past, green “You’re preapproved” banners have been good even for those over 5/24.

Since I expect to be under 5/24 soon and I also hope to get preapproved for the 175K offer, I held out for now.

tysm i checked the prequal site twice this week and my green offers. nothing but a car loan. but I followed your biz to pers trick and got an offer 125 csr. Oddly enough, it was the third pers offer so I had to scroll down to see it.

update offer gone! as others reported. drat – i was greedy and was gonna wait til dec 1 to try to triple dip…….. oh well, i may have gotten the pop up anyways. You snooze you lose.

only 125K offer on 6k spend though either way of checking

5/24 applies? I recently went over and with Bilt changes coming I won’t be under for over a year.

Not asking for a friend.

Wondering about that too, not under 5/24 AND got the CSP SUB within the last year when it was 100k, but i do see the pre-approval for 125k using Nick’s second technique.

Historically, the green check mark pre-approval offers have bypassed 5/24, but YMMV.

However, I know someone who tried to apply (using that second technique green banner offer) and got the pop-up about being ineligible for the bonus because of having gotten another Sapphire bonus, so I expect that you would get the same pop-up for bonus eligibility. Apparently, pre-approval must mean pre-approved for the card, but not for the bonus. Go figure.

Thanks for the reply, Nick! Go figure, indeed 😐

I dumped my CSR and product changed to an OG Freedom. I was thinking of applying for the CSP but I have the Ink Preferred so I’m not sure I will bother unless another good SUB comes along.

Good SUBs are exciting, aren’t they?

Yes! Certainly more exciting than The Edit.

Chase keeps chasing the crappy parts of Amex. 🙁

P2 was targeted for the 125,000 pts, but got the “You’re not eligible for the bonus” pop-up. Oh, well.

I thought Chase changed the reserve card so the bonus points can only be earned once in a lifetime?

How is that related?

In your article, you state you had been prequalified for a 125k offer but wanted to hold out for a 175k offer. I assumed you’ve held the chase reserve card before, so you wouldn’t be eligible for the sign up bonus again. But I guess I made the wrong assumption.

Ah, I see. I can see why you would assume that. But, no, I haven’t had it before. My wife has had it since launch, but there never seemed to be a good reason for us to both get it. The intro bonus hasn’t been all that exciting in the years since launch, and I’ve spent more time over 5/24 than under. When under, I’ve had other priorities. I actually haven’t had a Sapphire card at all since the CSR launched (I product changed my CSP to a CFU when my wife got the CSR).

Apparently the new CSR is exciting.

This is meant to be sarcastic, right? The excitement is highly dependent on the individual.

A certain thought leader finds it exciting. I found it so exciting I cancelled mine.