NOTICE: This post references card features that have changed, expired, or are not currently available

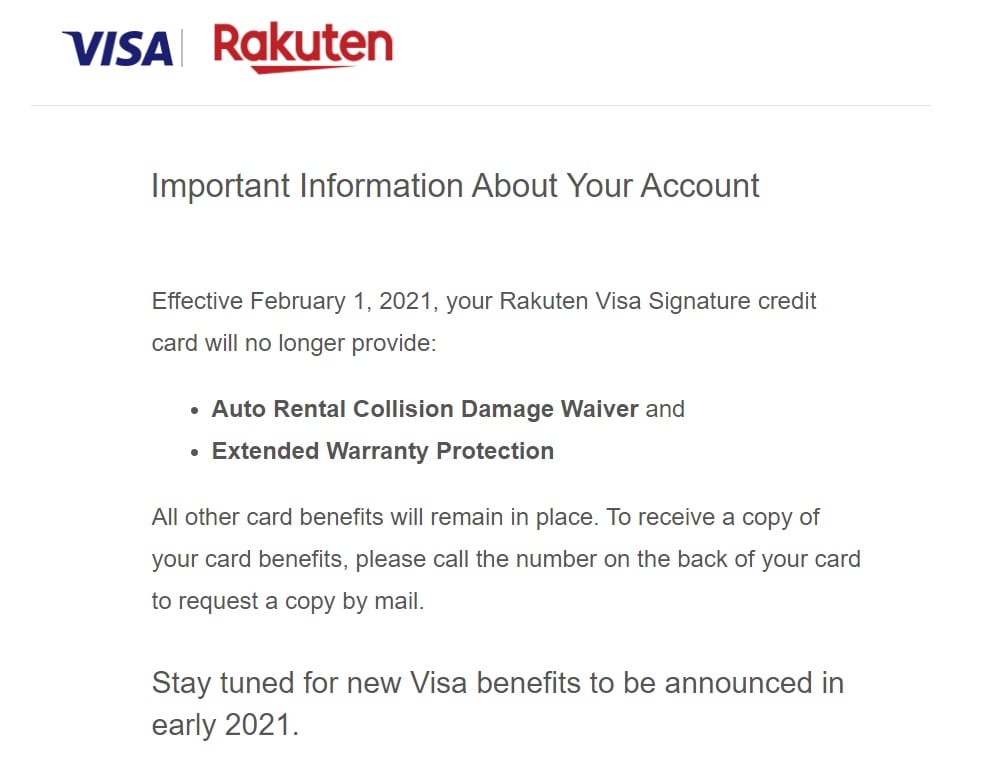

Rakuten Visa cardholders are receiving notification that effective February 1, 2021, the card will no longer include Auto Rental Collision Damage Waiver or Extended Warranty coverage. Interestingly, the email says nothing of price protection, so it seems that the card will retain this valuable benefit for the foreseeable future.

The email goes on to state that there will be new Visa benefits to be announced in early 2021. Maybe that’s just a marketing sentence, but it caught my eye because Mastercard has been adding benefits like cell phone protection and discounts at specific merchants even on debit cards (the SoFi Money debit card has been the most aggressive in marketing discount opportunities, but we’ve seen a few Mastercard-specific tie-ins this year). It does make me wonder if Visa is planning some sort of wider benefits for cards on its network. Again, it may just be the marketing sentence that gets included here to soften the blow of losing benefits without adding anything to replace them immediately.

I suspect that CDW coverage won’t be a huge loss on this card for most people, though losing extended warranty coverage on a card you may be likely to use for most online purchases is disappointing.

Auto waiver was dropped on other Synchrony cards ad well.

This card has been a source of frustration for me, simply because I’ve been denied it twice this year. In both cases I was well under 5/24 (yes, I know that’s Chase’s thing, but still) and have had a credit score of 800+. Did both the ARS & Sagestream freezes. The rejection both times was identical: “high risk source of application.” Do you have any tricks up your sleeve? Think I should unfreeze ARS/Sagestream and try again?

Is there some play I’m missing that would make this card worthy of taking up a 5/24 slot?

Used to be able to buy From gcmall and get 4x MR, since they killed that I have found almost no use for it, would be nice to hear if anybody else has

What about buying $1k VGC’s from Simon mall? Seems like an easy way to get 3 MR per dollar. And if it gets shutdown I don’t know how much I’d really care.