NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

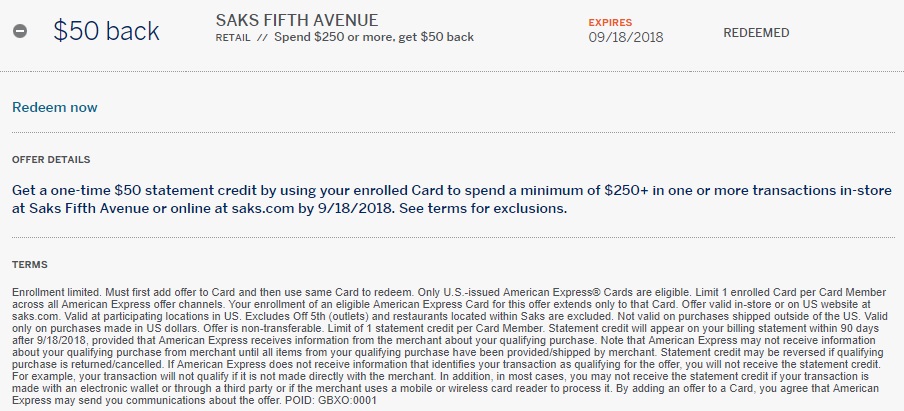

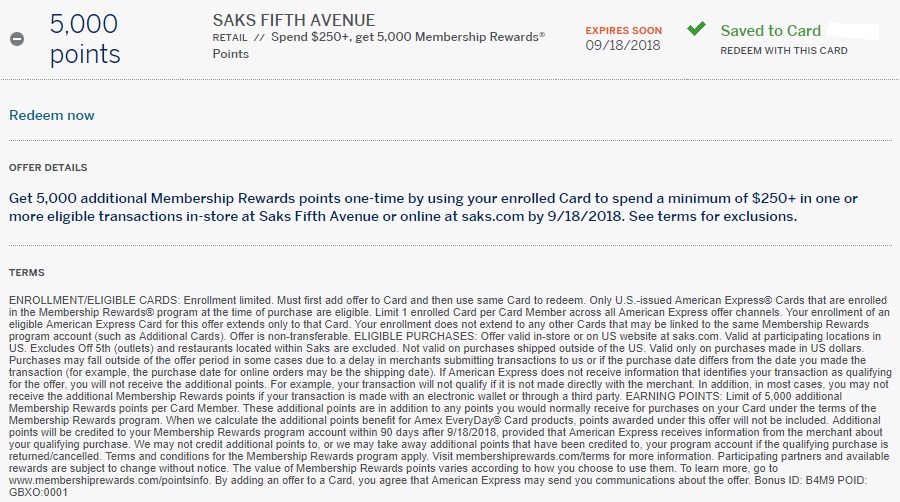

There’s currently a Saks Amex Offer that’s offering either $50 back or 5,000 Membership Rewards when spending $250. To make this deal even sweeter, you can get an additional $50 back when paying with a personal Amex Platinum card and it even works on gift card purchases.

The Deal

- Spend $250+ at Saks Fifth Avenue and get $50 back, or

- Spend $250+ at Saks Fifth Avenue and get 5,000 Membership Rewards.

Key Terms

- Expires September 18, 2018.

- Offer valid in-store or on US website at saks.com.

- Valid at participating locations in US.

- Excludes Off 5th (outlets) and restaurants located within Saks are excluded.

- Not valid on purchases shipped outside of the US.

- Valid only on purchases made in US dollars.

Quick Thoughts

This offer has been around for a few weeks and I thought we’d written about it, but evidently we hadn’t. There’s only one week left of this Saks Amex Offer, but it could be worth taking advantage of, especially if you have a personal Amex Platinum.

That’s because a couple of months ago, a new benefit was added to personal Amex Platinum cards. That gives a twice-annual $50 statement credit when spending $50+ at Saks Fifth Avenue (once from January-June and once from July-December). Note that you have to enroll in this benefit in order to get the statement credit.

I’d tried buying a $250 gift card online a couple of weeks ago due to this Amex Offer. However, the Saks site is as bad as ever and wouldn’t let me checkout no matter which browser I used. (n.b. Their site has historically had many issues. One time it displayed other people’s orders – including email addresses and personal messages – when I tried buying a gift card.)

My wife and I have been in Litchfield IL for the last few days and I noticed that there was a Saks store in St Louis which is about an hour away. That’s as close as we’ll be to a Saks store before the Amex Offer ends on the 18th, so we took a trip down there a few days ago.

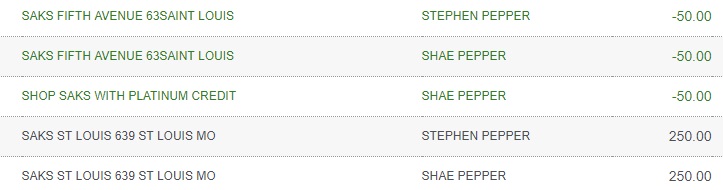

My wife has a personal Platinum card and I’m an authorized user, so we paid for the two $250 Saks gift cards using those cards. A couple of days later and not only have the Amex Offer credits been applied to the account, but also the $50 Saks benefit credit.

That’s notable because the terms of the Saks benefit on the Platinum card state that gift cards are excluded. It looks like – for now – level 3 data isn’t used to filter out gift card purchases.

One thing we didn’t try is linking those cards to my Ebates account. Ebates offers 2% cashback on Saks purchases in-store, so we potentially missed out on an additional $10 cashback. That said, they’ve been strict with in-store gift card purchases at Office Depot, so we might not have gotten the $10 cashback anyway.

Has anyone had luck with a $250 online gc?

My American Express offers no longer displays the savings tab for me. This makes it difficult to keep track of when ive reached the maximum on some offers (10% of on Mobil up to $100). Did this get removed from everyone? Is there an easy way to see this besides going through statements?

What a ridiculous store Saks is. I also got the $50 free from my Amex Plat. All it got me was 3 pair of fancy underwear supposed to be made of cotton but feels more like polyester or even some other cheap chemical-based material — cannot be cotton. I can get better quality at street markets in third-world countries but these have some designer’s name on them so they’re supposed to be impressive.

FWIW: Level 3 data is only for business cards.

[…] American Express cards are eligible. While gift cards aren’t supposed to work, Frequent Miler found that the credit did apply when gift cards were purchased […]

Did you get $50 credit for authorized user on Saks as well. I thought only good for primary cardholder. Thanks

We got the statement credits for the Amex Offer for both primary and AU. You only get one statement credit for the Saks benefit, so that was allocated against my wife’s primary cards – I’m not sure if it would have worked if we’d only used my AU card.