NOTICE: This post references card features that have changed, expired, or are not currently available

Late last year, many of us loaded funds to the United Travel Bank as a way of banking airline credit since Travel Bank credits are valid for 5 years. However, The Points Pundit at Travel Update points out an important detail: if you do not have any Travel Bank activity for 18 consecutive months, your Travel Bank Cash is subject to expiration or forfeiture.

As The Points Pundit notes, United says the following in its Travel Bank terms and conditions:

As a general rule (and unless stated otherwise by United under the terms of a particular offer or the terms of certain qualifying activity as determined by United from time to time) all accrued TravelBank Cash in an Account is subject to expiration and/or forfeiture for any Member who fails at any time to engage in Account Activity (as defined above) for a period of eighteen (18) consecutive months. United may, but shall have no obligation to, send a Member a notification of TravelBank Cash nearing or subject to expiration.

The section defining account activity indicates that canceling / redepositing doesn’t count to extend that, so you’ll need to book a ticket or add cash every 18 months to keep from losing your United Travel Bank Funds:

“Account Activity” shall be deemed to occur when a Member either (a) accrues TravelBank Cash in such Member’s account in any manner recognized by TravelBank, including without limitation the use of a United credit card, or (b) obtains a TravelBank Award by the use of TravelBank Cash in the Member’s account. In cases where TravelBank Cash is for any reason removed from an account, as for example the use of TravelBank Cash for a TravelBank Award, and there is a subsequent cancellation of a transaction and a redeposit of the TravelBank Cash to the Member’s account, the cancellation of the transaction and redeposit of the TravelBank Cash to the account shall not qualify as “Account Activity.” Neither United’s correction of TravelBank Cash in an account nor Prohibited Conduct shall qualify as Account Activity.

That is an important distinction considering the fact that the Travel Bank shows a date 5 years in the future for newly-added funds.

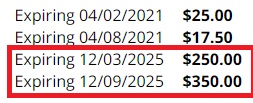

This won’t affect you for quite a while if, like me, you loaded funds in December 2020. However, I’ve just set a calendar reminder for May of 2022 to remind me to use it before the 18-month mark. I’m hopeful that I’ll be booking travel in the nearer-term. If and when I do, I’ll have to remember to set a new reminder.

A new benefit to the IHG Premier CC is $25 deposit to United Travelbank made in July and January every year. I received the first $25 on May 5th and the second $25 on July 1st. Guess when they expire? The first expires on July 15th, 2022 and the second expires on Jan 15, 2023. How can I use these fast?

[…] 翻译:数字游民指南 || 原文链接:Set a United Travel Bank Reminder so you don’t lose your funds 其它 […]

Nick or any folks,

have an expiring $200 TB end of this mo but don’t have a sure plan where to go… if booked a basic economy fare then cancelled within 24 hrs, will UA issue an ETC or a future travel credit? TIA

if basic economy fare is not cancelled within 24 hrs, will we still have til mar 31 to change for free to another future date?

Might want to see this before you spend on Travel Bank:

https://www.doctorofcredit.com/united-airlines-travel-bank-no-longer-works-for-american-express-airline-credit/

I already have a post about this scheduled. This certainly may be dead, but I personally think it’s too early to know. It has only been 4 days since the charges that people are claiming as evidence that this is dead. Sure, United changed the way the charge is classified — but four days just isn’t long enough to say it definitely dead.

I’d certainly not make a new United Travel Bank purchase yet though pending any change in those reports in the next two weeks.

I just found this comment on flyertalk saying that the 18 month rule only applies to the Chase United Travel Bank? I wonder if this is true (I don’t even know what the “chase” united travel bank is) or if this is another case of the representative not knowing what they are talking about…

Curious as to the impact of laws and regs related to gift cards/certificates. In California, they cannot expire ever. Since this is not a points purchase but rather a cash credit, a case could be made that it qualifies as a gift card or account credit.

I had no idea. Thanks so much for the tip. I loaded my Aspire $250 in December 2020 and then again yesterday. Thought I had 5 years.

It’s an old term from before TB funds had expiration dates.

Not enforced anymore.

I read on FT that someone had funds in for 2 years with no activity and they were still there, but still, I’m not taking any chances.

Why do I feel like this confusing… and not entirely accurate? Can someone confirm?

I think the 18 months term is an outdated term… In that term it does not even mention the 5 year expiration. Hope UA can clarify this issue…

Nick,

I became somewhat concerned about what the PointsPundit wrote, as well, but as you will see, he/she did not do his research and his/her sleuthing is a non-event due to United’s sloppy housekeeping — that language should have been removed because it relates to way to fund the TravelBank that no longer exist.

For a worthwhile review and history of the United TravelBank, I point you to the estimable pages of FlyerTalk and specifically its, Wiki relating to the genesis and changes in TravelBank over the years: https://www.flyertalk.com/forum/united-airlines-mileageplus/2029660-ua-travel-bank-q-new-option-deposit-funds-get-bonus-10.html

The 18 month rule is thus void, but even if it were not, a $50 charge to one’s travel bank every 18 months would keep it alive.

However, I would remind those that United classifies TravelBank as seemingly part of its “Gift Registry” noting that the smallest contribution can be $25.00,

However, nowhere as it is now constituted can one increase one’s TB’s holdings by that amount — that has led me to the conclusion that the wiki is correct, and that the 18 month language is an artifact that should have been removed in earlier iterations of the rules.

In light of that, the expiration of one’s funds as denoted by the TB at 5 years after funding should be the controlling precedent…….

Thanks for the shout out, Happy New Year!

Nick, why do you need to set a timer to use your funds in 18 months? As I understand it, as long as you add deposits to your travel bank, all chunks of previous added fund will have a 5-year shelf life.

Adding funds to Travel Bank could be disabled by United. They did it before. So you wouldn’t be able to add more funds and existing ones would expire.

Adding funds is unlikely to be disabled in the next 18 months. Air travel is unlikely to have fully recovered, and United will need the cash.

I assume adding more funds with the Amex airline credit this month also counts as activity?

Affirmative.

Except that feature is leaving some cards.