NOTICE: This post references card features that have changed, expired, or are not currently available

At any moment in time, at least several of the very best credit card offers of the moment are business credit cards. We’ve long included tidbits reminding readers that they may have a business without even realizing it, which was certainly true for me for many years. In many cases, getting approved for business credit cards just means finally realizing that something you do can indeed be considered a business (and obviously meeting the bank’s lending criteria). But what if you want to make your business more “official”? Is it difficult? This will vary widely depending on the type of business and your location, but as I found recently, the process can also be exceedingly simple.

The most common form of business is small business

In our posts about business credit cards, you’ll often find the following blurb explaining that what constitutes a business may be simpler than you realize (you can click “more” for more detail):

More:

You must have a business (but you probably do): In order to apply for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort.When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website.

Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so.

I think the key to keep in mind here is that there isn’t a standard definition of how big a business needs to be in order to be considered a business. Many of us hear the term “business” and we think “big”, forgetting that the vast majority of businesses in the United States are small.

My wife and I have long had business credit cards opened under sole proprietorships. The Small Business Administration says this about sole proprietorships:

A sole proprietorship is the simplest and most common structure chosen to start a business. It is an unincorporated business owned and run by one individual with no distinction between the business and you, the owner.

That blurb tells us that not only is it the simplest form, but it is the most common structure of business. A quick Google search yielded several results saying that more than 70% of the business in the US are sole proprietorships. The numbers were staggering — 23 million-plus sole proprietorships versus fewer than 8 million partnerships and S corps and only a couple million C corporations. Not only is it not uncommon to have a business made up of just one person, it is by far the norm for businesses in the US.

The clear reason this structure is so popular is because it is so easy. That same Small Business Administration resource goes on to say:

You do not have to take any formal action to form a sole proprietorship. As long as you are the only owner, this status automatically comes from your business activities. In fact, you may already own one without knowing it. If you are a freelance writer, for example, you are a sole proprietor.

The next time your favorite blogger tells you that you may already own a business without knowing it, remember that even the US Small Business Administration thinks that is true.

Setting up a sole proprietorship is easy

In its simplest form, setting up a sole proprietorship is really easy. If you use your own name as the business name (rather than some fictitious business name, otherwise known as an “assumed name”), there is a good chance that you don’t need to do anything at all to officially “form” your business (you should check this in your state). Rules will obviously vary from state to state, but in my home state of New York, the Department of State Division of Corporations, State Records, and Uniform Commercial Code says this about sole proprietorships:

An Assumed Name Certificate must be filed with the clerk of the county/ies in which the business is conducted ONLY IF you are operating under a name other than the proprietor’s (no formation document is required).

Again, in my home state, to do business as a sole proprietorship using my own name, I don’t need any formation document. That’s not to say that there aren’t any pertinent licenses — depending upon the type of business you do, you may need to get licenses / approvals (for example, you can’t open the Little Shop of Horrors dentist office without having the proper license to be a dentist). However, many types of individual businesses do not have any such requirements.

Long-time readers / those with business credit cards know all of the above to be true, but I’m referencing materials here to provide some examples that the concept of owning a very small business (that perhaps you didn’t even realize was a business and that requires no formal documentation) isn’t a scheme conceived by bloodthirsty points-and-miles vampires trying to suck the banks dry of their imaginary rewards currencies but rather a real thing.

Now and then a reader questions the validity of such very small businesses and whether or not really small sole proprietorships should qualify for business credit cards. I’ve long maintained that what qualifies someone to be approved for a business credit card has very little to do with everything above (and with anyone’s interpretation of what constitutes a business) and is rather up to the bank. Banks determine their own rules in terms of what size and type of business they require in order to extend credit. Just as the decision to start a small business involves weighing up the risk and reward, the bank makes the same decisions about customers in terms of how much risk they’re willing to accept in exchange for the reward of a new customer. Whether or not they want to take a risk on my small business is up to them. The bottom line is that having a very small business with no document filings is totally legitimate for many businesses.

Note that you’ll obviously want to keep in mind the tax implications. I have always reported my profits and paid taxes accordingly (over the years I took a very small resale business to a decent-sized side gig and back down, but I always reported what came in and went out). As a sole proprietorship, this can be done on your personal taxes. Consult with your tax professional for advice on how it works for your situation.

Making it even “more official”

My wife has long had a sole proprietorship doing resale on eBay, Craigslist, and Facebook Marketplace. She’s never put much energy into it, but she resells things now and then and has used that as her main small business for years.

However, she has expressed some interest in blogging (not about miles and points). I wondered how difficult it would be to get her set up with what small business skeptics would deem a more “official” business. She had a name in mind and we had previously checked to see if the domain name was available before taking any other steps (because, ya know, that can be important), so we wanted to see what it would take to get her set up with a true business that’s recognized in some official capacity beyond her own declaration. I don’t expect this business to be profitable in the first year. Truthfully, I don’t know whether it will ever be profitable. That is indeed often the case with businesses.

It turns out that the process of making it official – even with an assumed name – is really simple in our area.

First, Greg has previously written about how one can get an Employer Identification Number for free on the IRS website in just a few minutes (you can do it here). While she has long just used her personal Social Security Number as her small business tax ID number, the EIN would give her a separate tax ID for this new blog business. It isn’t necessary as a sole proprietor, but it’s free and easy and could have advantages in terms of getting credit for that separate business, etc.

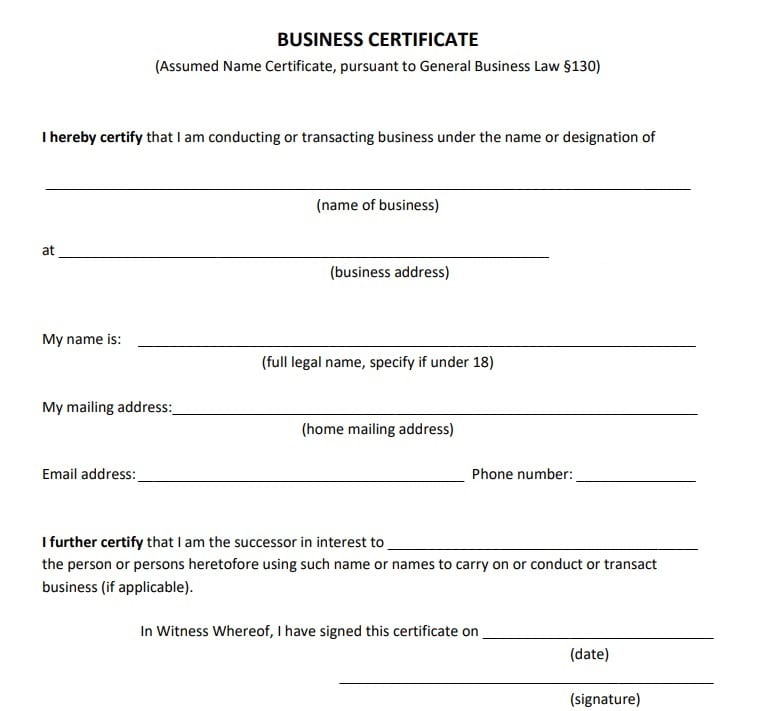

The other thing we wanted to do was to officially register the business name. That requires an “assumed name certificate” — what many people refer to as a “dba” (“doing business as”). I assumed that this would require some complicated paperwork and fees. In fact, when I initially Googled it, I saw a bunch of results telling me how I could start a business for “less than $2,000” or “less than $500” and so on. As it turns out, the basic filing fee for an assumed name certificate in New York State is $25 in all counties but the 5 boroughs of New York City (where the fee is $100). You then pay a few dollars more for certified copies.

Again, in my state, one needs to register through the county clerk’s office in the county where the business is to be conducted.

In my specific county, this is the entire document to be filled in (minus a section at the bottom to be signed by a notary):

My county clerk’s office will notarize it for free. All you need to do here is fill that out and bring it to the office and pay your $25 plus $5 for each copy. It’s easy like the Staples button. It just so happens that the county clerk’s office is in the same building where early voting is taking place in our area, so the timing was perfect for pairing the dawn of a new business venture with doing our civic duty.

My county clerk’s office will notarize it for free. All you need to do here is fill that out and bring it to the office and pay your $25 plus $5 for each copy. It’s easy like the Staples button. It just so happens that the county clerk’s office is in the same building where early voting is taking place in our area, so the timing was perfect for pairing the dawn of a new business venture with doing our civic duty.

I didn’t expect it would be hard to set up a business (one that doesn’t require special licenses, as noted before), but I didn’t realize quite how easy it could be. In fact, I have a couple of other ventures in mind that just may need to get registered.

You will obviously want/need to make sure that there aren’t other businesses operating with the same name. There may be some more leg work involved in terms of preparation, but the actual process is very easy.

Approvals may be tough at the moment

Keep in mind that we weren’t looking into all of the above solely for the purpose of credit cards. In the current environment, approvals can be more difficult (especially small business approvals from certain banks). The purpose of setting up the business here was more to learn about the process and to have something separate created for future cases when it is useful to have. My wife won’t be in any rush to apply for business credit cards with this business but rather is laying the groundwork in case she wants to do so in the future.

Bottom line

Setting up a business as a sole proprietor is easier than one may expect. That is a concept that you’ll often see noted on blogs in this space, but in the words of LeVar Burton, “you don’t have to take my word for it” (a Reading Rainbow reference for children of the 80s). A little digging into what is required to create an employer identification number and official assumed name certificate showed me that it is even easier than I expected to create a business even with an assumed name rather than the proprietor’s name. While small businesses and small business credit cards aren’t for everyone, the truth is that the barrier isn’t in the difficulty of getting started but rather whether or not you’ve got the desire to make a business in the first place. Many types of businesses will require a lot more legwork and may require special licenses and approvals, but at least some small businesses can literally take minutes to form. Thankfully, the barrier for entry is low and the long-term rewards of having a small business — beyond miles and points — make it worth the small risk in many cases. Indeed, I can be glad that Greg took that chance 9 years ago and that he had the confidence to push through tougher times. I don’t know as though any of the businesses in my household will be nearly as successful, but for twenty five bucks and a few minutes of time, it’s worth at least setting up the building blocks. YMMV.

[…] will not rest until everyone becomes an “entrepreneur”! Setting up a business: easier than you might expect. Hey, making money selling plastic may have something to do with it you may say, cough. Am I doing […]

Remember that if you open official business with EIN, you should file business tax every year and it raise the cost significantly.

On the other side, you can have sinificant house expense as business expenses and save a lot on taxes.

“You’ll be a success!”

“Here he comes, the leader of the plaque!”

Sorry…just had to

When it comes to business form, you want to stay away from having to file a schedule C on a personal 1040 return. In my humble opinion, incorporate. Really very easy and no the annual filing is very easy contrary to what you my hear. Then once incorporated file S corp status with IRS. It means your profits or losses go to your personal return via a K-1 and none of this indexing out jumping over thresholds required on a schedule C. I know you’re thinking, geez all this. It’s not that hard and sure looks better than some d/b/a when applying for cards and stuff. Lastly, I’m a civil engineer and not a CPA. Just learned all this by doing. Good Luck

Been doing SP for 35 years step ONE good CPA . Then no IRS troubles and give the right data not made up . Don’t be cheap a dollar spent on good people is a hundred saved down the line.

Nick, thank you. I have been mulling this over for awhile, but am still a little concerned/in-the-dark on tax implications.

Anyway, thanks for all the great articles and content over the years.

P.S. In the first paragraph you have a typo: “and obviously meeting the ban’s lending criteria.” Sorry, SAT prep tutoring is one of my many sole proprietorship businesses I am considering for an EIN and DBA.

Thank you – I must have caught that and fixed it while you were typing your comment. Get that business going – you’re a natural!