NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

Swagbucks and MyPoints have increased offers out for ~$175 back when opening a new SoFi “Better Banking” account by clicking through a portal link. These stack with SoFi’s direct $300 Q4 sign-up bonus for a total of up to ~$475 back when opening a new online checking/savings account and completing qualifying direct deposits.

The Deal

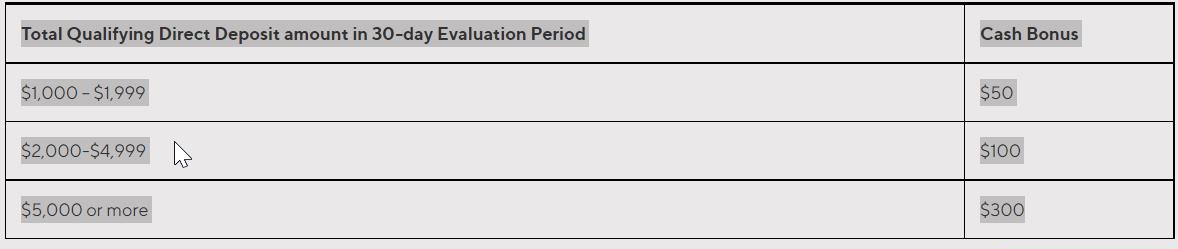

- Open SoFi Checking/Savings account and get a $50-300 bonus when completing qualifying direct deposits by 12/31/22 (see table below for amounts).

- Stack with Swagbucks/MyPoints for an additional ~$175 when opening a new account through the portal and completing a direct deposit of at least $200 within 30 days.

- Direct links to offers:

Key Terms

Sofi Checking

- Promotion Period: 10/1/22 12:01AM ET to 12/31/22 11:59PM ET.

- Must be a new user to SoFi.

- In order to qualify for eligibility for a bonus, SoFi must receive at least one Qualifying Direct Deposit from an Eligible Participant during the Promotion Period. Qualifying Direct Deposits are defined as deposits from enrolled member’s employer, payroll, or benefits provider via ACH deposit. Deposits that are not from an employer (such as check deposits; P2P transfers such as from PayPal or Venmo, etc.; merchant transactions such as from PayPal, Stripe, Square, etc.; and bank ACH transfers not from employers) do not qualify for this promotion. The amount of the bonus, if any, is described below. No bonuses shall be paid for qualifying Direct Deposits of less than $1,000 during the Evaluation Period (defined below).

- Evaluation Period: Defined as 30 days from the date your first Qualifying Direct Deposit is received. For example, if you receive $1,000-$1,999 in Qualifying Direct Deposits in the Evaluation Period, you will receive a cash bonus of $50. A member may only qualify for one bonus tier and will not be eligible for future bonus payments if inflows subsequently increase beyond the Evaluation Period.

- SoFi will credit members who meet qualification criteria within 14 days of the end of the Evaluation Period.

Swagbucks/MyPoints

- Must be a new user to SoFi. Existing accounts are not eligible to earn 17,500 SB.

- Must open a new account and set up a qualifying direct deposit of at least $200 to earn SB.

- Qualifying Direct Deposits must be made from the enrolled member’s employer, payroll, or benefits provider via ACH deposit.

- SB will appear as Pending for 32 days.

- Must enter valid sign-up information, including funding information to earn SB.

- Must be first deposit to earn.

Quick Thoughts

$300 from SoFi and $175 from Swagbucks matches the largest bonuses that I’ve seen recently for a new SoFi checking/savings account. In order to max out these offers, you just have to sign-up for the checking account through the Swagbucks link and then do a total of $5000 in direct deposits.

In terms of timing, if you make your first direct deposit on October 25th (for instance), then you have until November 25th to meet the $5,000 in combined total direct deposits to qualify for the full $300 bonus…it doesn’t need to happen all in one shot but it does need to happen within 30 days of the first direct deposit.

SoFi is known for being fairly strict with what it considers a direct deposit (see DOC methods list here). Earlier this year, the last time that the Swagbucks bonus was at $175, I was able to trigger both SB and SoFi by making a $5,000 transfer from Wells Fargo and putting “Payroll Direct Deposit T. Steinke” in the reference (this was based on a few positive comments I saw in the DOC thread). But, of course, YMMV.

SoFi Checking offers 2.5% APY for account holders who have a monthly direct deposit set-up, so it can be an ok regular option if you actually need an online checking account.

Was denied when I went to sign up. 800+ score. Not sure if it is because I recently opened some CCs but bit annoying.