Update 9/4/23: Today is the last day for this offer via referrals. Doctor of Credit points out that you could score a companion pass for two years by changing the statement date to the first of the month (this would cause points earned in December to post in January). This would allow you to finish the initial three months spending after December 1, so the first 60,000 points should be awarded on January 1, 2024, counting towards CP qualification for 2024 instead of 2023. If you want to give it a shot, now’s the time.

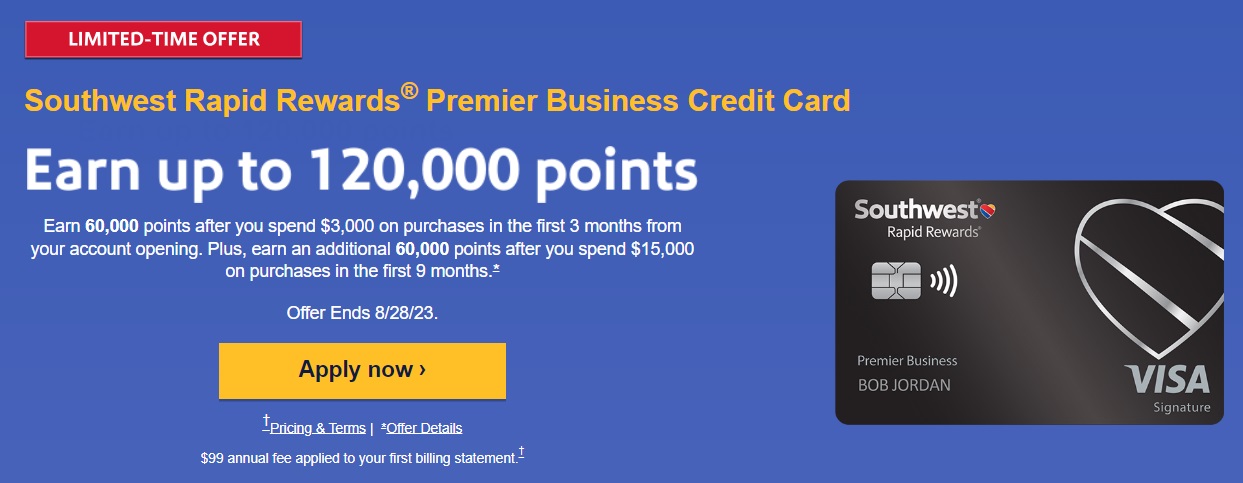

The Southwest Airlines Rapid Rewards Premier Business Card has a new two-tier welcome offer and it’s a very interesting one if you can meet the spend requirements as it can get you the Companion Pass with just this one card. That said, it might be worth delaying some of your spending until 2024 if you want to use it to jumpstart your earnings towards a 2024 Companion Pass that’ll be valid through the end of 2025.

The Offers & Key Card Details

| Card Offer and Details |

|---|

ⓘ $577 1st Yr Value EstimateClick to learn about first year value estimates 60K points ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer 60K points after $3K spend within first 3 months your account is open$149 Annual Fee This card is subject to Chase's 5/24 rule (click here for details). Earning rate: 3X Southwest ✦ 2X gas station and restaurants (up to $8K in purchases combined per year) ✦ 1X on all other purchases. Card Info: Visa issued by Chase. This card has no foreign currency conversion fees. Big spend bonus: If you earn 135,000 points in one calendar year, you'll get a companion pass good for the rest of that calendar year and all of the next year ✦ Earn 2,000 TQPs for each $5,000 spent in purchases annually. Noteworthy perks: 6000 bonus points each year upon card renewal ✦ 10,000 Companion Pass qualifying points each year ✦ First bag free for cardholder and up to 8 companions ✦ Receive a 15% promo code each year on cardmember anniversary (Excludes Basic fare) ✦ Complimentary Instacart+ for 3 months (must activate by 12/31/27) ✦ $10 monthly Instacart credit ✦ Group 5 boarding ✦ Standard or Preferred seat selection up to 48 hours pre-departure (when available) |

Quick Thoughts

This is an excellent offer which, if my memory serves me correctly, is the highest welcome offer we’ve seen on the Southwest Business card.

Earning the full 120,000 bonus points does require a significant amount of spend – $15,000 within 9 months. However, that should be doable for many people because having 9 months to meet that spend requirement means you only need to spend $1,667 per month. Note that the bonus comes in a two-tiered format – 60,000 Rapid Rewards points after spending $3,000 in 3 months and the additional 60,000 bonus points after spending an additional $12,000 within 9 months of opening the card.

The return per dollar is therefore much better for the first tier as that represents a 20x return versus only 5x for the subsequent $12,000 of spend (on top of your regular points earnings). However, many people will be interested in spending the full $15,000 within 9 months because that’s enough to get you a Southwest Companion Pass. You have to earn 135,000 Companion Pass-Qualifying points in a year to get that. The 120,000 bonus Rapid Rewards points will get you most of the way there, the business card comes with 10,000 Companion Pass-Qualifying points automatically (note that those 10,000 points aren’t redeemable Rapid Rewards points, they just qualify for the Companion Pass), with the remaining 5,000 qualifying points needed coming from the spend you put on the card.

There are two ways of playing the Companion Pass. One is to spend the entire $15,000 in 2023. That’ll get you the Companion Pass for the rest of 2023 and all of 2024. That’s a fairly good deal, although how good it is depends on how quickly you can meet that spend requirement. If you don’t hit the $15,000 of spend until late in the year, you might only get 13 months to enjoy the Companion Pass.

An alternative is to spend $3,000 in the first three months to earn the first tier of 60,000 Rapid Rewards points, then continue putting spend on the card through the rest of the year but not spending the full $15,000 until after your statement closes in December. You have 9 months to complete that $15,000 of spend, so you could finish it off at the beginning of 2024 to earn 60,000 bonus points early in the year. At the end of 2023 or beginning of 2024, if you’re still under 5/24 you could then apply for a personal Southwest card which, provided the offer on that card will earn you ~60,000+ points, will get you a Companion Pass that’s good for all of 2024 as well as all of 2025. The biggest risk of this strategy is that Chase doesn’t subsequently approve you for a personal Southwest card as that would mean you’d miss out on a Companion Pass entirely unless you’re able to generate enough Companion Pass-Qualifying points through these other methods.

In terms of whether you’re eligible for this Southwest business card and other Southwest cards:

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

More:

You must have a business (but you probably do): In order to apply for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort.When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website.

Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so.

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

Readers suggest another option here: freeze your credit and apply for the card. The application will remain dormant in the Chase system for up to 30 days. You can unfreeze your credits (let’s say in 3 weeks), and then call in to have them run your credit and proceed with application. This will give you some more time for the spend.

geez, applied & was denied for the following reason: Insufficient business deposit relationship with us… don’t think most or all folks got approved for a biz CC do have an existing biz chkg / savings accts with chase, right? will call in later this week for a reconsideration & see

Stephen, important correction: change the statement date to the 25th not the 1st. If your statement date is the 1st, your closing date for the next statement will be after Dec. 4 — i.e. more than 3 months from today. If your statement date is the 1st and you spend the $3k on Dec. 4, it will close Dec. 5-7 or so, meaning you’d earn the 1st 60k bonus THIS year.

stmt & closing date is the same; u were confused b/w pymt & stmt date

Sorry you’re correct. I meant due date not statement date. AFAIK you can’t directly request a change in the statement date — just remember to set the due date so the next billing period closes between Dec 1-4.

I’m not following this logic? Stephen can you explain if this is true or not? I thought it needed to get changed to the 1st of each month.

DON’T CHANGE TO THE 25TH! Statement close date is 3 days after this, so your statement will close on Dec 28, and your first 60k bonus will hit in 2023. No good. And you can only change it once every 180 days.

If you want the bonus to hit in Jan 2024, change your payment due date to the 26th for a statement close date on the 1st of the month. If you set it to the 27th, it’ll be 2nd of the month, and 28th will be 3rd day of the month.

This page explains it:

https://www.dansdeals.com/credit-cards/on-the-topic-of-chase-due-dates-and-statement-close-dates-sapphire-reserve-is-costing-chase-how-much/

Is it dead?

Referrals show the Sep 4th expiration date.

Just used my wife’s referral link to sign up. Was approved even though I believed I was 5/24. Now to follow gameplan to try and get Companion Pass for close to 2 years.

This offer is only working by referrals now. Can we post a link since I’m not seeing that on the frequent miler site?

can someone explain how changing the closing date will make this work? If you get the card on 9/4 then 1st statement closes on 10/4, second statement on 11/4, and 3rd statement on 12/4. Points will post in December, right? If you change the closing date to the 1st, then the first statement would close on 10/1, second statement on 11/1, and 3rd statement on 12/1. Points post in December. How does changing the closing date to the 1st result in points posting in January rather than December?

In your scenario, spend as close to $3k as possible before 12/1 but don’t complete that spend by then. Let’s say you spent $2950 by then – the 60k would not post on Dec 1 statement. On Dec 2, start spending again – you would still have a few days for the 3 month timeframe to get the first 60k (which would post with Jan 2024 statement)

Can someone’s point me in the direction for the 120k Sub referral link that ends September 4th. Thx

Here you go https://frequentmiler.com/SWbiz/#Goto

Thank you! Love the FM team!!

Though, I just saw the link you provided is a referral for application ending Aug 28. I did find a Sept 4 with Dr of Credit. (Much rather use the FM team referral link. I will check with the link you provided come September to see if it works.)

On paper, it’s definitely possible to get the first 60K bonus to post in January. If you have a referral link, it doesn’t expire until 9/4/23 (as noted in the update to the article). Also, if you don’t get instant approval, you could wait a few days before you call in, and if you are subsequently approved you should have an approval date after 9/4 even though you still get the offer since you applied on 9/4. Therefore your 3-month spending deadline would be a few days after 12/4/2023, and if you set your statement cutoff date to the 1st or 2nd of the month, you can meet the spend requirement in early December and have the bonus post in early January.

Lots of moving pieces and lots of things that could be messed up, but it’s possible it could work.

My thought is to apply on 9/3, then let your application get declined/ pending, then call in to reconsideration less than 30 days and become approved. When you get approved around the end of September, then you would spend the $3k in December, and the remainder of the $12k for the SUB in 6 months past that point. Earlier the better. Welcome to CP for 2 years.

Will this work? Apply on 9/4/23 and get approved. Wait for your card then call to set your statement date as of the 1st of each month. Spend 3K in one day on December 2. Then the points would post in January right? Hit the rest of the 12K spend asap in 2024 for CP through end of 2025.

Potentially one of the greatest SUBs of all time. If you and a companion fly SW 5 times a year round trip, a 2 year CP might be worth 300,000 Rapid Rewards points. Plus 135,000 for meeting the minimum spend, that’s north of 400k. One card.

Since it’s a business card, if operating under a LLC and have two cards, can both earn CP status individually? So each partner has a companion?

I don’t think so. The card is linked to a specific Rapid Rewards account. That account is what gets the CP.

I’m thinking of having my wife get this. I currently have the CP expiring end of this year. She could get the business card and earn 60 this year and 60 in 2024. Then apply for the consumer card to get the CP for 2024-25. I’ll cancel my cards at the end of this year.

how about applying for the card of the 28th and adjusting the closing the of the card to the 1st of the month once the card is received?

That might work. If doing this, you’d want to apply very early on the 28th as Chase sometimes ends offers at 9am.

Can you please spell out how this gets the bonus to post in January? If you apply on the 28th does this not mean the spend has to be completed by 11/28?

Heads-up that Chase/Southwest reserves the right to award the points whenever they want. I’ve read stories of people being awarded the points before the billing cycle, at the end of a calendar year. Your plan Is clever but it may not play out in real life like it does on paper.

I genuinely wish you the best of luck! If you do this, report back!

When do you receive the 10,000 Companion Pass-Qualifying points? At the beginning of each year or at the anniversary of account opening?

On the first business day of the year.

Math is off. 120k bonus for spending $15k means 135k (120k+15k) points total even without the 10k Companion Pass-Qualifying points that comes with the card = companion pass just for meeting the spend target.

Yep, you’d effectively get there without the 10k qualifying points that the card comes with. However, the 10k qualifying points will be the very first thing you earn which is why I’d included that in the equation.

How quickly do you think the 10k credit card qualifying points will post after the New Year? I’m asking because I have my statement date set the 3rd and I have a couple flights starting on Jan 16th that I’m really hoping to have the companion pass in place for? I’m planning to meet the full spend in December but close to $3K of it will post in 2023 since I’m only finishing the first $3K right after my Dec statement closes. So basically I’m anticipating that I’ll have about $12K of spend (to get to the $15K) that will post in early January plus the 120K bonuses so that gets me to 132K qualifying points. If the 10K from the credit card post quickly enough I’ll be there but if it doesn’t happen until closer to the end of January I won’t make it…which means I probably need to spend more in December to ensure I get there. Any thoughts would be appreciated.