NOTICE: This post references card features that have changed, expired, or are not currently available

Ever since COVID-19 hit, our 5 year, 50 state road trip plans have ground to a virtual halt. Since mid-March, we’ve gone from moving every 5-7 days to staying 4-6 weeks at a time in the same place.

Much of that time has been spent in Airbnbs, but we started the lockdown in March with a 4 week stay in a Candlewood Suites and recently finished up a 33 night stay at a Residence Inn on the outskirts of Cincinnati. Both of these brands include a full kitchen in every suite and we’d booked a 1 bedroom suite in both places to have more space.

I’d booked that latter stay because Marriott was charging a decent rate ($79 per night before taxes) due to the length of stay, but after booking it I realized that we might be able to save even more. That’s because some states exempt you from paying taxes on hotel stays when staying 30+ nights consecutively at the same property.

I became aware of this policy a couple of years ago because Texas is one of the states that doesn’t charge tax when staying 30+ nights. We weren’t able to take advantage of that at the time because even though we spent 10 weeks in Texas, we didn’t spend longer than 2 weeks in the same location. A lot of that time was spent in Hyatt Places because there are loads of category 1 properties in Texas which meant they only cost 5,000 points per night, or we were able to get low paid rates.

Fast forward to this year. We were due to spend all year out west, with my parents flying in from the UK in March to join us on the road trip for 7 weeks so we could hit up all of Utah’s National Parks, the Grand Canyon, some of Colorado and more. We decided to cancel their trip literally hours before a travel ban went into place that would’ve prevented them from flying over anyway.

We subsequently decided to head back east for the rest of this year so that we can be closer to my wife’s family. There’s no great hurry though, so we’ve tended to stay a month or more in each place to semi-shelter in place and not have to regularly check in and out of hotels and Airbnbs.

We picked a month-long stay in Cincinnati on the way through because we have good friends who live there that we try to see every year or two, plus it’s home to Skyline Chili which we need in our lives just as frequently. I know you can get Skyline Chili in a can or as a frozen meal from Kroger stores around the country, but it’s not the same.

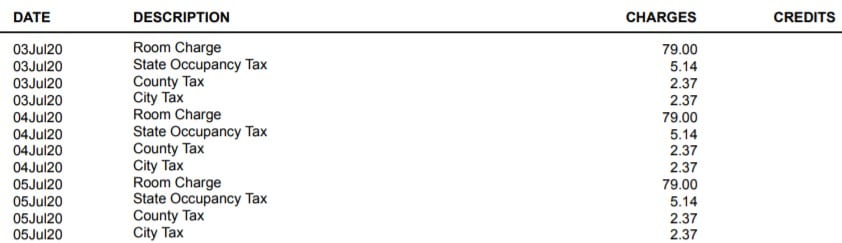

As I mentioned earlier, we booked a stay at a Residence Inn which cost $79 per night. The taxes added almost $10 per night to that cost:

- State Occupancy Tax @ 6.5% = $5.14 per night

- County Tax @ 3% = $2.37 per night

- City Tax @ 3% = $2.37 per night

- Total = $9.88 per night

At $9.88 per night, that meant we were due to pay a total of $326.04 in taxes seeing as we were staying 33 nights. It was after booking the stay that I realized we might not have to pay that amount after all due to some states not charging taxes on stays of 30+ nights.

I therefore did a search online and most of Google’s search results focused on the policy in Texas. For example, per this site:

When does a guest qualify for the permanent resident exemption?

If in advance or upon check-in, the guest provides written notice of intent to occupy a guest room for 30 days or longer, no tax will be due for any part of the guest’s stay if the guest stays for more than 30 days. A signed registration card indicating a guest’s intent to occupy a room for 30 days or longer is sufficient evidence. A written reservation or confirmation of a reservation that indicates the stay will be more than 30 days is also sufficient notice.

In addition, a hotel is permitted to honor the 30-day permanent resident exemption even in cities with a 30-day check out requirement if the guest immediately checks back in so that the stay remains continuous to meet state law requirements.

As a side note, that latter exemption could also be useful because some hotel chains don’t award points on stays of more than 30 days. You could therefore book at least two or more consecutive stays that don’t exceed 30 days and be eligible for earning points while still being exempt from paying hotel taxes.

That didn’t help me with our stay in Cincinnati though because Porkopolis obviously isn’t in Texas. I therefore adjusted my search to include ‘Ohio’ and the results were a little more pertinent, but not definitively. The top search result was this PDF for an Embassy Suites which confirmed that when staying at their property for 30+ nights we wouldn’t have to pay taxes, but that property was in Columbus rather than Cincinnati. A PDF for Montgomery County stated something similar, as did a document from 2014 for Hamilton County.

Our Residence Inn was in West Chester though which is located in Butler County. I didn’t find anything specifically for that location or anything that was valid statewide in Ohio, so I figured my best option was to ask the hotel directly.

We’ve been trying to reduce our face-to-face contact with people over the last few months (not too hard for me as an introvert), so I sent a message late one night to the property through the Marriott app asking if the taxes would be waived. They replied the next day confirming that they would be, so that was great news.

It wasn’t quite that easy though. Despite booking our stay as one 33 night chunk, the Residence Inn took payment for our stay week by week. When checking our bill, the taxes were all still on there.

That meant contacting the front desk again. They confirmed that we were still exempt from paying tax, but that we’d need to stop by the front desk once we’d actually stayed 30 days. I’m not sure why they couldn’t just set a reminder for themselves to process the refund rather than needing me to remind them in person, but for more than $325 it was something I was willing to do.

On day 31 of our stay, I therefore stopped by the front desk to remind them about the tax being waived and was assured it would be done. In the early hours of the morning that we were due to check out, I received an email from the Residence Inn containing our final bill which still showed the tax being charged for the entire stay.

That meant another trip to the front desk, but because it was 3am there wasn’t anything they could do, but they assured me that their General Manager would be arriving in a few hours and they’d sort out the taxes. Thankfully that seemed to do the trick because when checking out later that morning, the taxes had indeed been removed.

The line items were a little confusing though. It initially looked like they’d only refunded taxes for 30 nights of our 33 night stay, but upon closer inspection I realized the taxes hadn’t actually been charged for days 31-33, so everything was correct.

That means we saved a total of $326.04 in taxes on our stay, but it got better than that. Knowing back in May that we had this stay coming up, I took advantage of the 20% discount Marriott offered when buying their gift cards. I paid for our stay using these gift cards, so that saved us an extra $521.40.

As a result, our stay which should’ve cost $2,933.04 only cost us $2,085.60, or $63.20 per night – not bad for a 1 bedroom suite with a full kitchen.

Summary

In some states (such as Texas and Ohio), you can have your taxes waived when staying 30+ consecutive nights at the same property on a paid stay. This means your savings will usually be $300 or more (assuming taxes of at least $10 per night), so it’s definitely something worth exploring if you’ll be booking an extended stay somewhere in the US.

Hotel extends by the week and charges new reservations weekly to avoid this

It shouldn’t matter if you’re paying by the week; if you’re staying in a state where they don’t charge tax when staying x number of nights, the tax should still be waived even if you pay weekly once you’ve stayed more than x number of days.

Also when I went to the front desk they told me that this is not a permanent resident that people don’t live here but I’ve been here for 6 months my neighbor they’ve been here for 4 months and the other girl that has kids here she’s been here longer than me she’s been here almost a year but he says that he’s not that kind of hotel I also have that letter that says assignment of right to refund and they refuse to sign it so what are my options and what can I do I’m in Texas

I’m afraid I’m not sure of what to do in your scenario. Perhaps contact your city or county’s tax office or the Comptroller for Texas https://comptroller.texas.gov/about/contact/

This is an old thread, but I’ll weigh in case someone searches and finds this topic later: so I’ve been researching GA law about this subject. You can actually call your state revenue dept about filing a claim for a refund for these taxes if you get nowhere with the hotel. Also, find out what your state law says about extended stay tax refunds, print it out and show the hotel manager. In GA, we now have tenant rights after 30 days. And don’t listen to them if they say you have to have one consecutive booking. In GA it doesn’t matter even if you change rooms, pay daily or in chunks, you still are owed those taxes back. As long as your stay is unbroken time-wise, you are good in this state, but find out the facts in your state. And, you can tell the hotel: it’s better for you to pay now than later because the state might make them pay interest on that unpaid tax refund amount. Do your research and be armed with that info and hopefully you will quickly be refunded that money.

Hi, I am in a present situation where I am being talked to in a rude manner due to me mentioning the tax laws to a General manager here in one of Ga’s extended stays. I have been vocal about my plans on staying here for long term. I stated that I would be tax exempt etc and they refused that. Now they have went as far to bring a notice by to me for me to sign that basically is against the law and would give them leverage to rob me of my rights.

Please tell me where to find proof to all that you stated in your comments so that I can shut this down.

I didn’t know that the taxes were to be refunded. Need your help please

This is a helpful page that shares the rules for each of the states. https://www.avalara.com/mylodgetax/en/resources/state-lodging-tax-requirements.html

It looks like in Georgia you need to spend 91+ days in the same property to be tax exempt. If you’d be staying for 3+ months at that property, it seems like the tax should indeed be waived. If the hotel is part of a chain and the manager continues to refuse to remove the tax, it’d be worth contacting the hotel’s corporate team to report this as a first step. If you don’t get anywhere with that, see if there’s a local lawyer who’d be able to work on this, perhaps on a no win, no fee basis.

I’ve been staying at Rose City hotel for 6 months now they refuse to tax accept me I finally got the letter that says assignment right of refunds the front desk will not sign it what can I do

I been stay a year paying everyday s9metime skip a day because the taxes are hard to pay.Dose this still count for me in Texas

If you’re staying in hotels 31+ nights at a time, it looks like you should be able to ask to have the tax removed.

Stephen, did elite night credits post okay for 30+ stays?

They did for the Residence Inn stay, although the way they posted was a little goofy. The hotel had been taking payment weekly on my card which resulted in the points posting weekly. We’ve since stayed at an Element for more than 31 days and got the elite night credits without a problem.

I have lived in a motel for over a year…can I request the taxes back?? I mean dang I had no idea…should I wait until I have somewhere to live??

Also the manager and the owner are one in the same…

It depends on which state you’re in – check the list here https://www.avalara.com/mylodgetax/en/resources/state-lodging-tax-requirements.html If it says that after staying more than x number of days you don’t have to pay taxes, it’s worth speaking to the manager/owner.

Hi Stephen! Im a little late to the discussion but hope you might be able to shed some light for me?! My fiance and I, phoenix residents, intended on staying short term while apartment searching in Marriott hotels in our area… due to my marriott membership, more perks… originally we stayed 30 days at a courtyard, completely unaware that AZ honors the tax exemption u speak of…. this is where the question comes in… so we originally booked that stay for 2 weeks, extending either a day or to to up to a week at a time until the stay turned into a full 30 days by mid september ( no tax credit was mentioned. After such we did a similar scenario stint at a towne place suites starting september 20th, learned of a reduced rate by staying monthly so october 5th we confirmed we would be staying until the end of october. Well when tbe 31st rolled around we told them our check out date is TBH so just put us down till Nov 30… as of December 10th we are still here. I have not approached the management about the tax bc basically, shes a “Karen” and i want to make sure i dont get bulldozed by her by knowing my facts. So basically where my situation gets sticky is for out least 1 of the 3+ months stayed at the combined 2 hotels, with neither I never confirmed that i would be staying a full 30 days, but with the courtyard we stayed a full month and towneplace so far just 10 days shy of 3 months. What are your thoughts on this situation? Is it even possible to get any of the taxes back? Can you tell me the best way to go about it, if so?

Thanks in advance!

It looks like in Arizona the rule is that you need to stay 31+ nights to not have to pay tax. If your first stay was for 30 days, unfortunately that would’ve been one day too short to be eligible.

With regards to your current stay, it sounds like you’re definitely eligible seeing as you’ve been there 2.5+ months. From what I can remember, with our stay I chatted to the front desk a few days before checking out and then again a day or two before checking out to confirm that they would be removing the taxes – we had to do that proactively as it sadly doesn’t seem like hotels do it proactively.

With the management at the hotel you’re staying at, it might be worth stopping by the front desk earlier in the morning or later in the evening if there’s a staff member you know is particularly helpful as that’d hopefully mean the manager isn’t there at that moment for them to call them over. They might not know enough to be able to sort out the tax situation, but it could be worth a try as an initial attempt just in case they are familiar with the procedure.

If the manager ends up refusing to remove the tax, you could reach out to customer service online or to Marriott Bonvoy Assist on Twitter as they might be able to help by getting involved https://twitter.com/MBonvoyAssist

Good luck!

How do I dob this if the hotel denies any knowledge and says no im in sharonville ohio

Is it the manager who’s denying knowledge? If not, I’d ask to speak to them first. If it is the manager and the hotel is part of a larger chain, I’d contact their corporate team.

Stephen–to clarify–were you saying that doing consecutive reservations allows you to get around the points earning cap for a hotel? Usually hotels will treat consecutive nights as one stay irrespective of check out and check in for promos in my experience.

That might be the case in some circumstances. In my experience where we’ve booked consecutive stays (due to cheaper rates rather than gaming promos), we’ve nearly always had them post as separate stays.

In fact, with this particular 33 night stay, we booked it as one stay but it posted in separate weekly increments.

Oregon appears to be exempt from taxes after 30 days:

“Lodgers exempt from the state lodging tax include:

https://www.oregon.gov/DOR/programs/businesses/Pages/lodging.aspx#:~:text=The%202016%20Legislature%20passed%20House,rate%20decreases%20to%201.5%20percent.

Great article Stephen, as well as the recent one on extended stay brands. Do you know whether this tax benefit also applies to extended stays with AirbnB? My husband is going to need somewhere to stay for 3 months in NJ and we are trying to figure out the best options. So fas AirBnB and VRBO are offering the best options.

That’s a great question and something that hadn’t occurred to me previously. I’m afraid I’m not sure if Airbnb or VRBO would waive the tax for 30+ nights as I don’t know if the taxes/fees they charge are the same as those charged by a hotel, or if it’s taxed differently in some way.

[…] you’re planning on staying somewhere for 30 days or more, you might not have to pay the hotel taxes which can save you hundreds of dollars. Note that some hotel chains don’t award points for […]

[…] points are awarded per stay, this offer is best for people who book one or two night stays. For those of us who book longer stays, a total of 2,500 points isn’t going to move the needle. For example, that’s only just […]

[…] work out which cut the cost of our hotel stay by ~$325 (you can read more about how it worked in my post over at Frequent Miler). Was that enough to keep us under budget during July though? Read on to find […]

Any tax exemptions in Canada provinces?