I love transferable currencies like Amex Membership Rewards, Capital One miles, and others like those. We most frequently write about those transferable points programs because of the abundance of opportunities to get far outsized value out of the points. And the truth is that the cream of the crop offers at any given time tend to be transferable point cards (which tend to dominate the list of Greg’s top picks). However, I’ve got a growing crush developing on a bank with no transferable points cards at all. We don’t talk much about U.S. Bank because its cards aren’t very flashy, but they are nonetheless a player that you should want on your team, particularly for those times when you want to supplement your miles and points with some cash reserves.

A stable of “cash back” cards

It feels like U.S. Bank often gets overlooked. That’s largely because they don’t have a flashy transferable points system, nor do they issue many co-branded cards (and the Korean Airways cards that they do offer aren’t very exciting).

And the truth is that if you want to open one or two credit cards per year, it is highly unlikely that U.S. Bank is going to be your dance partner. If you’re currently under 5/24, I think you should certainly consider a Chase Ink card ahead of anything U.S. Bank has on the market. If you’re eligible for one of the targeted offers on the Business Platinum or Business Gold card that feature welcome bonuses of 150K points or more, those should certainly be a priority for you.

However, if you have played the field and picked up a number of the game’s flashier offers, you have probably at some point hit a moment where you’d like to supplement your point earnings with some cash. Whether you want to cover travel expenses beyond award flights and award nights or you want cash you can use to buy points on sale or you just want to put a little extra away for a rainy day, U.S. Bank probably has something that fits the bill. For the most part, these cards won’t be the stars of your wallet, but they can make for some nice supporting cast members.

Most of U.S. Banks cards technically earn points, but with most of those cards points are worth a simple $0.01 per point, so it is easy to look at the welcome bonuses as cash. The once exception to the $0.01 per point rule is the Altitude Reserve.

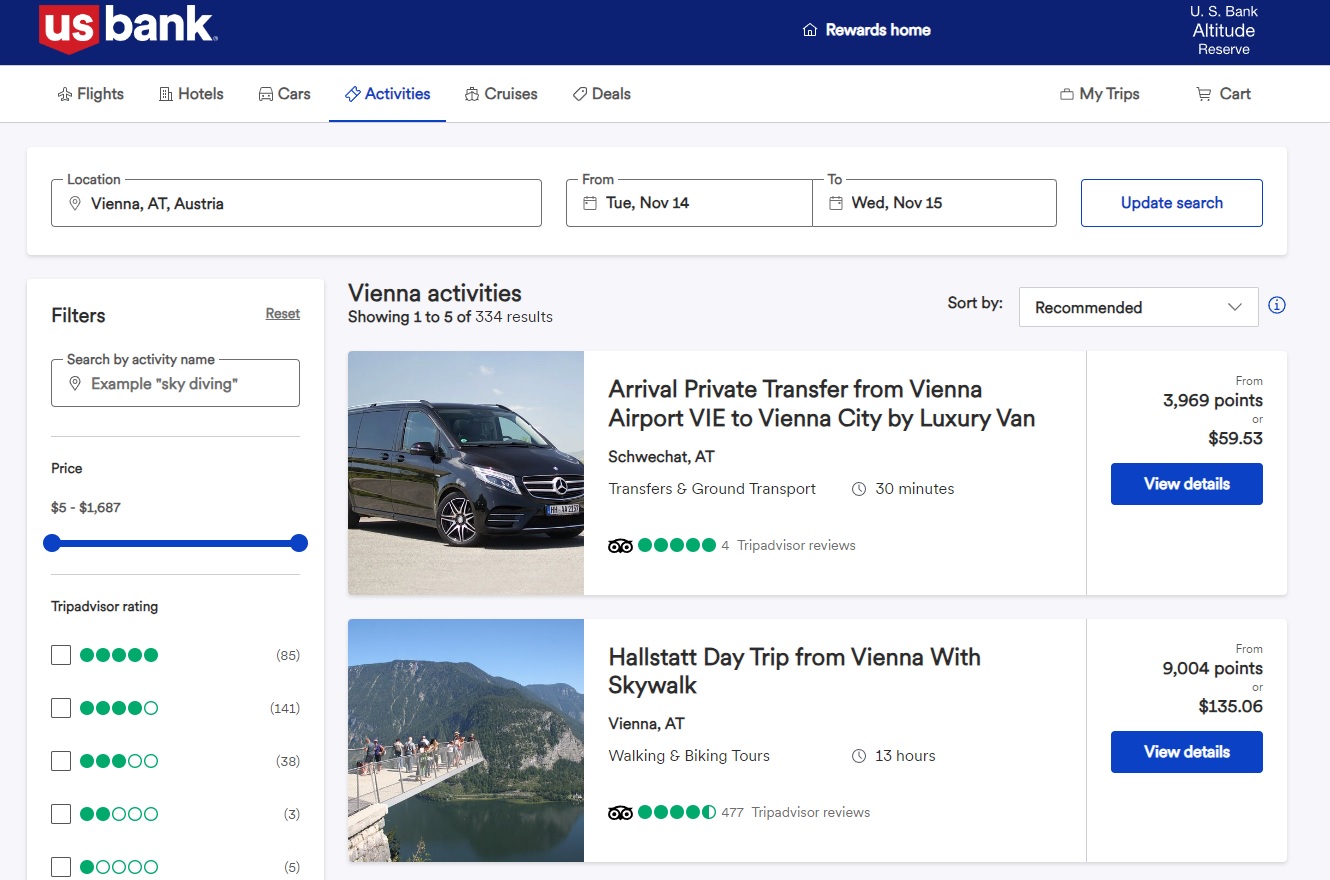

The best “everywhere else” (in-person) card: The U.S. Bank Altitude Reserve

| Card Offer and Details |

|---|

ⓘ $-400 1st Yr Value EstimateClick to learn about first year value estimates Not accepting applications This card is not currently available.$400 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: With points worth 1.5 cents each towards travel, this card offers an excellent signup bonus. For ongoing use, this card is a winner for those who spend a lot on mobile payments (at 3X, rewards are worth 4.5%) Click here for our complete card review Earning rate: 5x prepaid hotel & car rental through Altitude Rewards Center ✦ 3X travel and mobile wallet payments Card Info: Visa Infinite issued by USB. This card has no foreign currency conversion fees. Noteworthy perks: $325 in travel/dining credits per membership year ✦ Points worth 1.5 cents each towards travel ✦ Real Time Mobile Rewards (redeem points at full value at time of purchase) ✦ Priority Pass Select airport lounge access (8 per year) ✦ Primary car rental coverage ✦ No foreign transaction fees ✦ Free authorized user cards |

Whether you shop at Costco or the mall or you pay for visits to a veterinarian or at a mechanic’s garage or anything else done in person, the U.S. Bank Altitude Reserve is likely your best option (and in the case of supermarkets and office supply stores, it isn’t far behind the best category bonus). While I said above that U.S. Bank doesn’t feature a lot of flash, the Altitude Reserve is the one U.S. Bank card that probably belongs in your (virtual) wallet long-term.

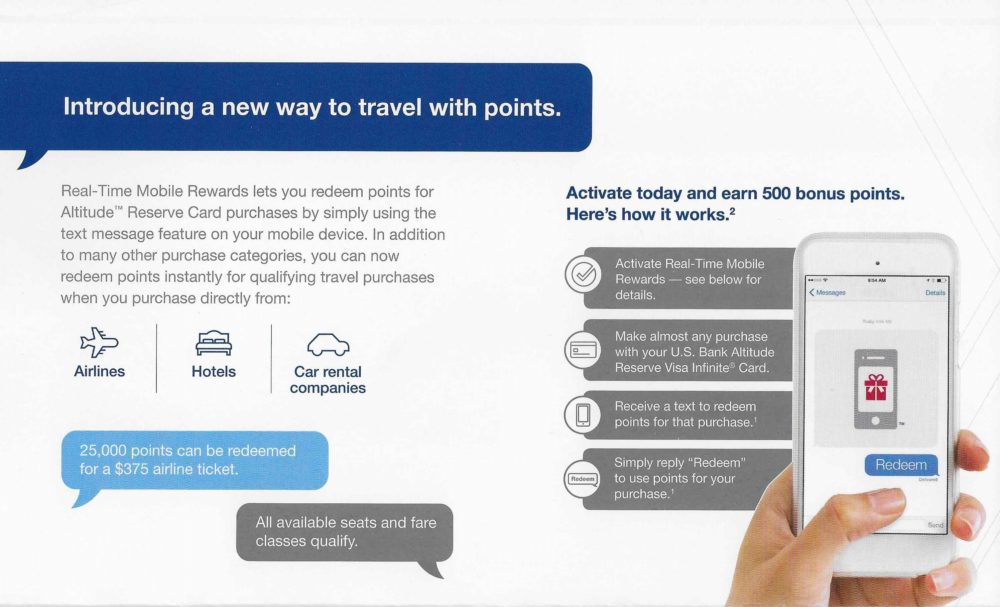

That’s because this card offers 3x on mobile wallet. That means you can use Apple Pay or Google Pay, tapping your phone or smart watch to the terminal, and earn 3 points per dollar spent. At a base level, those points could be redeemed for 1c per point for a statement credit, but you can do better: With U.S. Bank Real-time Mobile Rewards, you can redeem points at 1.5c per point toward qualifying travel purchases. While there are some limitations to Real-Time Mobile Rewards, the minimum redemption for most types of purchases is just $10 (lodging and rental cars come with a minimum redemption of $150).

You can also earn 3x on travel in general, making this a decent card for travel purchases. While the travel protections aren’t as good for flights as you can get with other cards, I am using this card for both hotels and car rentals and have used it for on-board charges on a cruise.

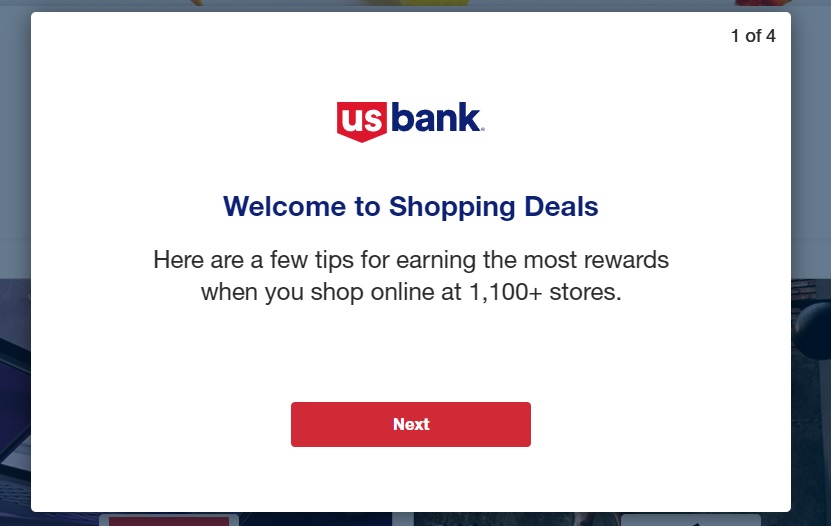

And U.S. Bank has slowly and quietly been making strides to become more competitive with other banks. For instance, I’ve hard card-linked offers in my account that mirror Chase Offers / Bank AmeriDeals / etc since picking up the Altitude Reserve this summer and the deals have expanded. I recently reported some offers for 10% back at several Marriott brands, but I have many more card-linked offers in my account.

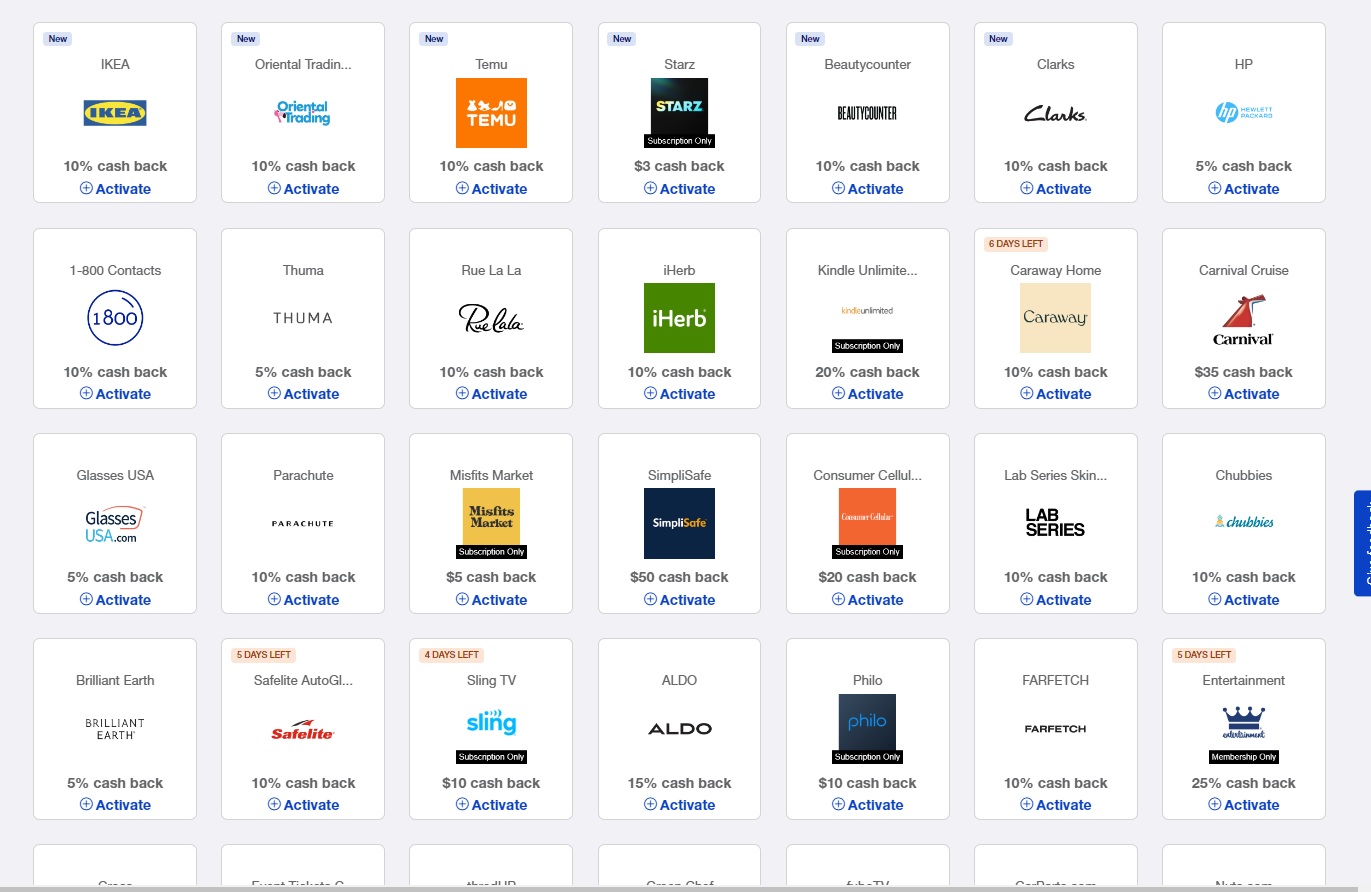

I also only just realized that U.S. Bank has a shopping portal called US Bank Shopping Deals (you can find it here) where you can click through to earn extra rewards, just like you can with Chase Ultimate Rewards shopping or Rakuten (for earning Membership Rewards points).

One thing that isn’t entirely clear to me is how U.S. Bank determines which rewards account to which it should credit those portal rewards. For instance, I have an Altitude Reserve and an Altitude Go card (a forced conversion from the old Radisson Rewards credit card). I’d want the shopping rewards credited to my Altitude Reserve account so that I could use the points at 1.5c per point, but I don’t know for sure whether that’s where the points would go.

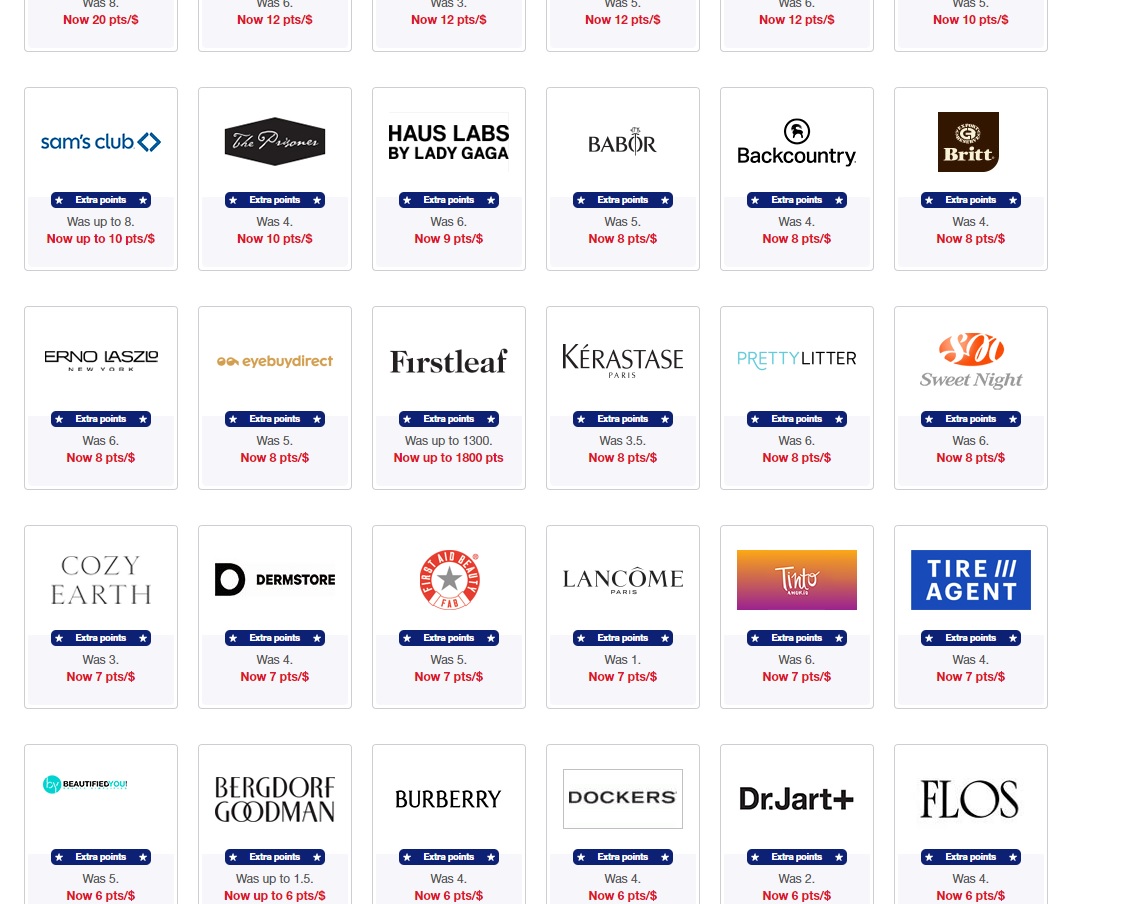

And keep in mind that in addition to real-time mobile rewards, you can also redeem rewards through the U.S. Bank Travel Center and get 1.5c per point toward flights, hotels, activities, and cruises. I don’t generally love uses points through a credit card travel portal for these types of redemptions, but it can certainly be useful at times.

I didn’t go after this card for a long time because I didn’t think I spent enough money in-person (where I could use mobile wallet) to justify it, but I’ve found that changing just due to changing habits and needs.

While mentioned in passing above, it is worth a second mention that the Altitude Reserve is the best card to use for Costco in-store since you can effectively earn 4.5% back for those purchases by using Apple Pay or Google Pay. That’s also true for lots of other in-person purchases, but I call out Costco here since there aren’t many cards that offer a consistent bonus for warehouse club purchases. The U.S. Bank Altitude Reserve offers a great return on all in-person purchases when you use mobile wallet, so it’s a great card for warehouse clubs.

Good cash back bonuses

It is worth remembering that several U.S. Bank cards feature nice cash back bonuses. I like bonuses like these to add cash to cover ancillary travel expenses or sometimes to buy points on sale. For instance, if you earned a $500 cash back bonus on a particular card and used it to buy IHG points or Hilton points when those points are on sale for half a cent each (which happens often with both programs), you could look at that bonus as being worth 100,000 points in those programs.

As noted above, there are cards with banks like Chase and Amex that offer even bigger bonuses at the moment, so I don’t look at these bonuses as being attractive instead of those bonuses, but rather to supplement those or to pursue when you aren’t eligible for those bonuses.

Somewhat bizarrely, U.S. Bank does not allow you to move rewards from other cards to the Altitude Reserve…..even from other cards with “Altitude” branding. That’s a bummer since it means that you can not combine the points from any of the following welcome bonuses with your Altitude Reserve points and redeem them for 1.5c per point. I hope that U.S. Bank changes that at some point. U.S. Bank does allow Altitude Connect and Business Altitude Connect cardholders to combine their points between the business and personal cards, but since both offer the same redemption options that isn’t of huge benefit.

U.S. Bank Business Leverage

| Card Offer and Details |

|---|

ⓘ $593 1st Yr Value EstimateClick to learn about first year value estimates 75K Points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 75K (worth $750 as a statement credit or deposit into eligible account) after $7500 spend in first 4 months$0 introductory annual fee for the first year, then $95 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Since the points are worth 1c each, this card isn't terribly rewarding for ongoing spend. Note that points can not be combined with the Altitude Reserve. Earning rate: 2x on top two categories where you spend the most each month. Base: 1% Other: 2% Card Info: Visa Signature Business issued by USB. This card has no foreign currency conversion fees. Noteworthy perks: Earn 2x in the two categories in which you spend the most each month. Full list of categories can be found here. |

Some will balk at the spending requirement, but $750 is a nice bonus to put in your pocket (an effective 10% back on that spend on top of whatever rewards you otherwise earn isn’t bad). Unfortunately, this card doesn’t offer much value beyond the welcome bonus.

U.S. Bank Altitude Connect

| Card Offer and Details |

|---|

ⓘ $179 1st Yr Value EstimateClick to learn about first year value estimates 20K points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 20K (worth $200 as a deposit into eligible account or towards travel) after $1K spend in 90 daysNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 50K after $2K spend in 120 days (Ended 9/9/24) FM Mini Review: This card offers decent returns on gas station and travel spend and it features no foreign transaction fees, but points are now only worth 0.8cpp. However, return on most other spend is relatively weak. Earning rate: 4X travel, gas stations & EV charging (excludes discount stores/supercenters and wholesale clubs) ✦ 2x take out, food delivery (including apps like GrubHub, UberEATS, etc), dining, grocery (including meal kit delivery) and streaming services Base: 1% Travel: 4% Dine: 2% Gas: 4% Grocery: 2% Other: 2% Card Info: Visa issued by USB. This card has no foreign currency conversion fees. Noteworthy perks: Complimentary Priority Pass Select with 4 free visits ✦ Up to $100 in credits for TSA PreCheck or Global Entry ✦ Complimentary 5 GB / 15-day plans + 20% off on all other GigSky plans (international roaming) |

There aren’t many cards that offer a welcome bonus of $500 with such little spend, which I think can make this offer an especially appealing addition. For those who prefer cash back rewards, this card could be appealing for its effective 4% back on gas and travel. I’d rather have the Wyndham Rewards Earner Business card for gas and if I kept my Altitude Reserve card, I would use that for travel since the 3x points earned on travel could be used for an effective 4.5% back rather than the 4% back on this card, but if you don’t want the Altitude Reserve, this card could make sense, particularly if you can get $30 in value out of the annual streaming benefit (effectively reducing the annual fee a little bit).

If you don’t want to pay the annual fee long-term, I think you should be able to downgrade to the U.S. Bank Altitude Go, which features 4x (an effective 4% back) on dining with no foreign transaction fees and no annual fee, so I often carry the Altitude Go as a backup dining card.

U.S. Bank Business Altitude Connect

| Card Offer and Details |

|---|

ⓘ $474 1st Yr Value EstimateClick to learn about first year value estimates 60K points Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 60K (worth $600 as a deposit into eligible account or towards travel) after $6K spend in 180 days$0 introductory annual fee for the first year, then $95 Note that only spend on the Account Owner's card (not including purchases made on employee cards) counts toward minimum spending requirements. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This card offers decent return on gas station and travel spend and it does feature no foreign transaction fees. However, the return on most other spend is relatively weak. Earning rate: 5x hotels and car rentals when booked through US Bank Portal ✦ 4X travel, gas stations and EV charging ✦ 2x take out, food delivery (including apps like GrubHub, UberEATS, etc), dining and streaming services Base: 1% Travel: 4% Dine: 2% Gas: 4% Other: 5% Card Info: Visa issued by USB. This card has no foreign currency conversion fees. Noteworthy perks: $25 statement credit after every three consecutive monthly taxi or rideshare transactions paid for with your card. 4x Priority Pass lounge visits per year. |

At first glance, the Business Altitude Connect looks like almost the same card as the consumer Altitude Connect, but there are a few distinct differences.

First of all, the business version of the card is a World Elite Mastercard (whereas the consumer version is a Visa Signature). Second, the 4x categories on the business card are limited to a combined total of $150K in purchases per year (by contrast, the consumer card doesn’t state a limit). The business version does not feature cell phone insurance or the complimentary GigSky mobile data plan or reimbursement for Global Entry or TSA PreCheck (all of which are available on the consumer version of the card).

However, one advantage that might make this card appealing is that the business version offers an annual Priority Pass Select membership. While some cards with a $95 annual fee come with a limited number of Priority Pass visits (the consumer version of the card comes with four Priority Pass visits per year), it is less common for a $95 card to come with unlimited annual visits as it appears the Business Altitude Connect does. I am not certain what the guest policy is or whether it allows for Priority Pass restaurant access.

U.S. Bank Shopper Cash Rewards Visa

| Card Offer and Details |

|---|

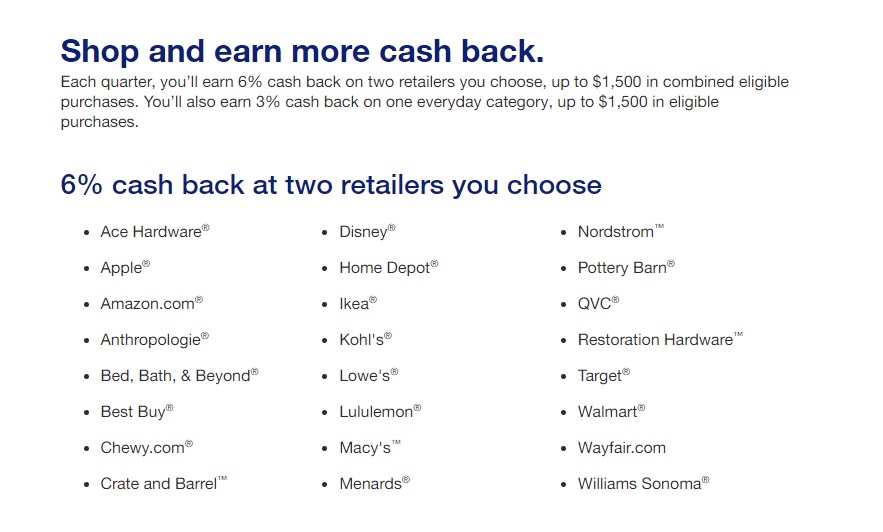

ⓘ $218 1st Yr Value EstimateClick to learn about first year value estimates $250 cash back Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler $250 after $2K spend in 120 days$0 introductory annual fee for the first year, then $95 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This is a niche choice for 6% cash back at certain retailers that some may find rewarding. Otherwise this card is not particularly exciting. Earning rate: 6x on first $1,500 in purchases each quarter with two retailers you choose ✦ 3x on first $1,500 in purchases per quarter on one everyday category (like wholesale clubs, gas and EV charging stations, bills and utilities) Base: 1.5% Gas: 3% Other: 6% Card Info: Visa Signature issued by USB. This card imposes foreign transaction fees. |

Finally, I think the U.S. Bank Shopper Cash Rewards Visa could make for an intriguing addition to the wallet, albeit a questionable fit for anyone who would otherwise keep an Altitude Reserve.

The welcome bonus on this card is only OK, but what makes this card potentially appealing is the quarterly cash back opportunity. Unlike rotating-category cards, U.S. Bank allows you to choose the two stores where you would like to earn 6% cash back each quarter on up to $1,500 in combined purchases. The list features some very popular merchants that aren’t typically covered under bonus categories on other cards, so I imagine that many people could max out the quarterly cash back.

My family likely spends $1,500 in any given quarter between Amazon and Walmart. Those stores and also Lowes, Home Depot and Target sell plenty of gift cards, so it wouldn’t be difficult to max this category out each quarter.

The main problem with this card is the ongoing $95 annual fee. If you would use the card for 6% back on in-person purchases at stores like Home Depot, Lowes, Target, or Walmart, you have to consider that the card only offers 1.5% additional on top of what you could already earn with the Altitude Reserve card (given that you could use mobile wallet and assuming that you redeem the points at 1.5c per point). It wouldn’t make sense to have both cards:

- U.S. Bank Shopper Rewards could earn 6% on up to $6,000 in purchases per year ($1500 per quarter) = $360 per year – $95 (annual fee) = $265 net

- U.S. Bank Altitude Reserve could earn an effective 4.5% on the same $6,000 in purchases if made with mobile wallet and redeemed at 1.5cpp = $270

The equation above doesn’t factor in the annual fee on the Altitude Reserve card. The fee on that card is a substantial $400, but the card comes with $325 in annual credits for travel or dining purchases, so it feels pretty close to a $75 fee for me. If you would use the card for enough in 3x spend to justify the annual fee, it might not make sense to pay the $95 per year for the Shopper Rewards card. But if you would skip the Altitude Reserve, or if you would use this as a dedicated 6% Amazon.com card and max it out each quarter, this card might be of interest long-term.

Bottom line

U.S. Bank doesn’t get a lot of air time since it doesn’t offer flashy transferable points cards or notable co-branded cards. However, that doesn’t mean you should snooze on U.S. Bank. Beyond the much-loved Altitude Reserve, they offer a couple of business cards (which shouldn’t add to your 5/24 count) and some consumer cards that feature pretty generous cash back welcome bonuses. No, U.S. Bank is unlikely to rock your entire wallet any time soon, but it’s worth keeping in mind for the tail end of your next app-o-rama.

New data about USBank business cards. If you have card tied to a business account as I do as small busines, they only allow you to charge 2x the credit limit in a cycle even if you pay the charge immediately

You say “best in person card” with the Altitude Reserve. If you have a Mac or iPhone, often you can use “Apple Pay” to check out at certain stores (if you’re using Safari), so it could be beneficial for online orders too!

I have the Altitude Connect and can’t find a way to access the Shopping Deals portal. The link in Nick’s post doesn’t take me there. I even called cardmember service and they didn’t know what I was talking about.

In the past, to get a US Bank card you needed to be in the US Bank footprint (or perhaps open a bank account first and then apply). Is this still the case?

no

You forgot the best card offered by US Bank: Cash+ Card.

It’s the only credit card in US offering 5% on home utilities. Even your utility companies do not accept credit card. You can add Cash+ to PayPal then BillPay utilities to earn 5%.

Barclays Business Earner Plus earns 5$ on home utiltiies.

That is business card, not consumer card.

Nick, several folks have commented on the Cash+ card. Could you comment on that?

@Nick Reyes I believe my US Bank Business Altitude Connect Priority Pass membership only comes with 4 free visits per Priority Pass membership year. The terms seem to say that guests are free, but that each guest entry will use up 1 of the 4 free visits. Also, the membership is a digital membership, so I don’t think there’s any physical card that comes with it.

I think the AR is the best daily driver card on the market. Primary rental coverage, no foreign currency fee, it is fantastic in Europe or anywhere with a modern POS system. No brainer to get 4.5 percent back on virtually anything if you travel enough.

Thanks for the wakeup call. I punted and applied for the Altitude Reserve yesterday afternoon after reading this article in the morning, and was not instantly approved. However, approval came by the time I left work! I was so surprised, since US Bank recently rejected me for the Triple Cash Business card because I had “too many inquires/accounts”. Either way, I’m in the late game, and can’t get anything else from Amex/Chase/BofA/Citi/Capital1/Barclays for awhile, so this was the last girl at the dance. This card had zero opportunity cost, since it didn’t affect my 5/24 count (Cards 5 & 6 are dropping at the same time, so it didn’t push the date to the right)

This is a good card to complement my Sapphire Preferred, Hilton Surpass, and Bilt MC, and will be replacing my Amex Green (I’d already snagged the Platinum, Gold, & Green before that door closed). A solid 4.5% back at Costco/BJ’s, Visa Infinite perks, a second GE credit for P2, and now a total of 18 PP annual visits without companion restrictions is worth the effective $50 AF ($400 AF – $325 credit – $100 ÷ 4 [[essentially $25]] Global Entry credit). I don’t need/want limited guest privileges like the other Tier 1 cards, as I’ve wife + four kids, and need to use 6 PP visits in one shot.

Excellent writeup, Nick, and I’m excited for this win!

Similar to Nick this card had been in my radar for awhile but never was ready to go for it. With 30+ cards, close to a 1M URs (which made a other Ink feel a bit silly), Amex 5/5 and just generally not a lot of cards peaking my interest, I went for it. I also wouldn’t necessarily champion it for someone just getting started but it’s a sweet card for those of us who have full points cups.

I should also note I am out of footprint for US Bank but have a Biz Triple Cash due to a Radisson Business conversion. Because of that was able to be approved for both the business and personal US Bank accounts with their nice bonuses last spring and figured maybe my approval odds would be helped by having two bank accounts.

I timed my application before a last minute trip to Europe which meant I was pretty much guaranteed to be able to do mobile payment for everything (get with it US!) while hitting SUB.

I really like the card more than expected. I love being able to use Square terminals with tap to pay at breweries/wineries/coffee shops and know I have 3x guaranteed earn. I am not the biggest Costco shopper (NYC) though definitely see the use case. Atleast for now, it’s my default card when tap to pay is an option even when I do have other cards that bonus the specific spend.

In the past, U.S. Bank had some significant sign up bonuses related to how many medals the U.S. wins at the Olympics. Not sure if they will do it with the next Olympics or not. It was significant before!!

Even as a frequent Costco shopper, I just cannot get that excited about the Altitude Reserve. Yes, it is probably the best single card to use there. But with a little effort, you can definitely get a higher return when shopping there. A few examples:

Most of my shopping at Costco is for food, pet supplies, cleaning supplies, etc. Stuff I do not need extended warranty coverage, so using gift cards are fine. When I do buy something electronic, I tend to buy it online & use my ATTA Citi card for the extended warranty protection.

I’ve been a long-term U.S. Bank customer. The card offerings have improved a lot in the last few years, and I’ve never had an issue getting either consumer or business cards (I have an LLC). I prefer cash back as my leisure travel is mostly domestic, and I tend to stay at independent hotels that only except cash. Another card that is worth a mention is the Cash+ card. There is a modest SUB, but getting five percent in certain categories that I can choose is pretty good for no AF. I have mine set to streaming services and cell phones. Now, if I could only get the cash back offers to show up on my app or the website….

I have other US Bank cards and I have kept my eye on the Reserve, but I find that 5X in rotating categories on Chase Freedom and Discover more than makes up for the extra 1 point earned with mobile wallet.

US Bank Cash Plus has 5% on utilities which they define as gas, electric, water (TV and Internet are another category). I don’t know of other cards that have this as a bonus category.

Wyndham Earner Biz (5x), but you’re right that it’s not common.

I think it’s great for home utilities alone. 5% on those for a no-fee card is a pretty good deal in my book!

Forgive me if i missed this Nick. Can you churn these card bonus’?

Seems like Altitude reserve is hands down the best card for P2, P3, etc because it’s so straightforward and no AU fee? Have that and BOA 2.62%. Or for us poors 2.22pts on double cash.

That would be true if I could get P2 to tap with her phone. For some reason, that’s just a bridge too far.

Bummer 🙁