NOTICE: This post references card features that have changed, expired, or are not currently available

Today there will be yet another new coin being released for sale by the US Mint. Over the past couple of years, we have seen quite a number of opportunities to buy and flip US Mint coins for points and profit. The easy route to points and profit is usually to buy from the Mint and sell to a buyers club, but that comes with its own risks (see: Is a buyers club a good idea for you?). I have sold most of my coins to a buyers club over the past several years, but I have also struck out on my own a couple of times — and I mean that in both senses of the phrase.

Today’s deal for those interested

The US Mint will release the following coin for sale at 12pm Eastern time today (8/12/21):

The coin will cost $73 with a limit of 3 per household. Ordering the maximum of 3 will come to $219 for the coins + $4.95 for budget shipping = $223.95.

Several entities are buying these coins. These are the ones of which I am aware:

- PFS Buyers Club is offering a total payout of $285 for a 3-coin order which means a net commission of $61.05 on a 3-coin order. I have a lot of experience with PFS. The have always honored my deals with them and paid promptly in my experience. Here is our referral link to PFS for more information.

- DCB Buying Group is offering a total payout of

$345$375 for a 3-coin order ($125 for each coin) which means a net commission of $151.05 on a 3-coin order. I have opted in with DCB a couple of times but have not yet completed a deal with them. Rapid Travel Chai has been writing about DCB. The email address for for more information and to reserve a spot is coinsfor.dcb@gmail.com. - Miles Per Day advertises a buyer offering a total payout of $384 for a 3-coin order which means a net commission of $160.05 on a 3-coin order. I don’t have direct experience selling through Miles Per Day but Vinh has long written about resale opportunities. For more information, see his blog post.

As noted above and is worth repeating, do your own due diligence and understand the risks and rewards.

One of the pieces of advice you’ll often find in the comments of posts about Mint coins is that you can do better by selling these high-demand Mint releases on your own and apart from a buying group. That’s reasonable. I totally expect these US Mint coins to increase in value any time there is an immediate resale opportunity like the ones above — the buyers clubs wouldn’t be offering to lock in a profitable price if they didn’t expect to sell for even more money. Nobody should be surprised that the market is higher than whatever they are offering.

The point of the rest of this post is to share some of my experience doing just that — breaking away from the buying groups in search of more reward.

Here are several of my experiences:

A big win: the American Eagle 2019-S 1oz Silver Enhanced Reverse Proof

Late in 2019, there was an opportunity to buy a Mint coin that immediately exploded in value. It was an American Eagle 2019-S 1oz Silver Enhanced Reverse Proof coin. This one originally sold for about $70 plus shipping and it went up in value fast. PFS initially offered $100 on top of the Mint price. As the market exploded very quickly, they ended up agreeing to match a slightly higher payout for those who asked. Still, the secondary market quickly climbed higher yet.

I had committed to PFS, so I sold the two that I purchased to PFS. However, I also helped two different family members get one each under the premise that I’d help sell the coins on the open market.

Readers have frequently commented over the years saying that you can do better with a local dealer, so I started with a local coin shop when the first family member coin arrived. The first shop wasn’t interested at all. They didn’t even ask how much I wanted for the coin. I was kind of surprised, but they said that they see these things all the time where a limited item comes out and the price jumps up but then a week later it falls back down to normal and they had no interest getting involved in it. The arbitrage-hunter in me was surprised they didn’t even want to make an offer and see where I stood, but they clearly weren’t interested.

I called another local shop owner and we came to an agreed price of $450. He asked to meet at a a shop he owns that is about 30 miles from my home. I had something going on that day, so my wife packed our son in the car and drove the 30 miles to meet at the agreed-upon time of 3:30pm. She got there a few minutes early and the coin shop was closed. The owner never showed up and never called me. She called the number on the shop door and nobody answered. My wife is normally a good sport about this kind of thing, but she was annoyed that day…..until she got home and I listed it on eBay for $840 and the coin sold in less than 5 minutes. Thank you for ghosting us, local coin dealer!

A week later, when the next coin arrived, I didn’t bother calling the local coin dealers again. I listed that next coin on eBay and it sold for $1150 exactly 42 minutes after listing. I am perplexed that my nearest coin dealers had no interest in buying these — but their lack of interest in a coin that hot has dissuaded me from reaching out on subsequent deals.

In both cases, the sales on eBay went through without a hitch. I had prepared the family that there could be a PayPal “not as described” claim as late as 6 months later, but thankfully we had no problems. The win here of doing in “on your own” was much higher than the locked-in profit, though there was the risk of an eBay buyer claiming they didn’t receive it, etc. The reward here would have outweighed the risk and if I had it to do over again of course I’d not have opted in to sell mine to the buyers club. C’est la vie. In the end, the two coins I sold privately cost about $156 (paid for overnight shipping on one) and they sold for about $1700 after fees for a net profit of almost $1550. This was a big win.

The Pride of Two Nations….and scourge of my existence

In 2019, the US Mint also released a limited-edition two coin set with the Royal Canadian Mint called The Pride of Two Nations. The short story is that buyers clubs were offering a payout on this and the value of the coins immediately tanked (I think maybe the Mint announced a second run of them shortly after they offered these for sale or something?). This time around, I had locked in the sale with APMEX rather than a buyers club. APMEX is a major precious metals dealer and they were offering a higher payout than the buyers clubs. I have both bought and sold to APMEX before, though only regular random year gold and silver American Eagles, not collector-edition stuff. I thought they seemed leaps and bounds safer than a buyers club because they are very large player in the precious metals market.

I was wrong.

I followed their instructions and slapped labels on the US Mint boxes and sent them to APMEX just before leaving home for an extended trip. A couple days later, after the resale market on these had already tanked, I got an email from APMEX saying that the packaging had been damaged and they would need to return the coins but reminding me that I could request a return with the US Mint within 7 days of receipt. Unfortunately, I wouldn’t be home in time to receive them and ship them back to the Mint fast enough and I figured that the resale market would eventually recover a bit.

I was once again wrong; the price never really recovered on that set. I was also wrong about the safety of selling to APMEX. While the exterior boxes looked like they had been shipped across the country, there certainly wasn’t any indication from the outside that the coins would be damaged — and sure enough, everything was in mint condition (see what I did there?) inside the shipping boxes. It sure seemed like a stretch to have claimed shipping damage. Of course, by the time I was home, it was too late. I was stuck with these coin sets that have been in my filing cabinet for a couple of years now taking up space. I roll my eyes at them every month or two while I wait for silver to increase in price enough to make them sellable without losing (much). These are a constant $700 reminder of the fact that “just sell them on your own for more money” doesn’t always work out. If I sold these myself on eBay today I’d be lucky to see about $600 based on today’s prices.

End of World War II 75th anniversary American Eagle silver 1oz proof

This coin was originally $83.00 from the Mint when they offered it for sale late last year. At the time it was released, PFS was offering to buy the silver coin for a commission of $62.05 (for a total payout of $150). I opted in with PFS to sell them the Gold version of this coin but figured I’d take a flyer on the silver coin. It was a low investment and low profit, so I was willing to put in my $83 and see what happened.

Truthfully, I had completely forgotten about this coin until I recently went through inventory of stuff that needed to get listed and sold. I ended up selling this one on eBay for $340. Unfortunately, I did so before remembering to upgrade my account to an eBay store. I knew that store subscribers could get a discount on final value fees but forgot to upgrade until after I’d sold this coin (I haven’t used eBay much in a long time).

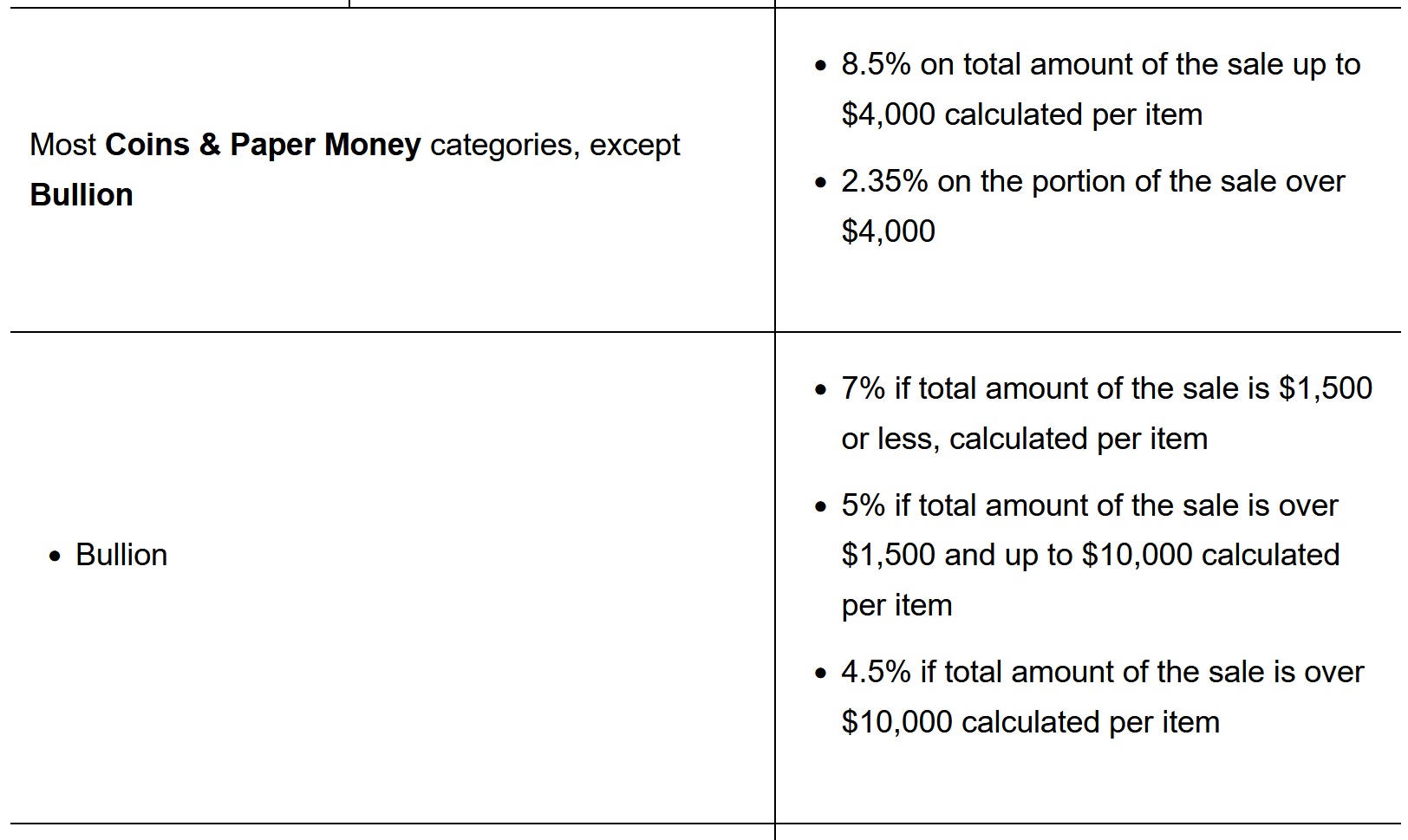

For those not “in the know”, if you subscribe to an eBay store, even just for a month when you’re ready to make a sale, you get a discount on final value fees in many categories including Coins & Paper Money (assuming you choose the monthly subscription, you can just cancel your store subscription after you’ve sold your stuff and before next renewal). The very cheapest store doesn’t get a discount on coins, but Basic, Premium, Anchor, and Enterprise Store subscribers get the following final value fees on Coins & Paper Money:

Since this coin falls under bullion, I would have paid 7% of $340 ($23.80). Instead, I paid 12.35% + $0.30 ($42.29). The cost of a 1-month subscription to a “basic” store is $27.95. The $18.49 difference in fees on this one coin wouldn’t have been enough to justify paying twenty-eight bucks for a store, but I’d be ahead after selling anything similar.

Thankfully, I remembered to make that change before selling anything else.

Note that I think eBay may have recently changed the final value fees. I could have sworn coins & paper money were 6.35% with any store subscription when I had looked recently.

Still, at the end of the day, even with the higher final value fee and my shipping cost, I came out $200 ahead on this coin. That’s significantly better than the $62.05 I would have gotten from PFS and I only held this thing for 9 or 10 months. Selling this one on my own was a win.

Low-balled by APMEX on my other coins

I still have several coins left from limited-edition runs including:

- 2020 American Eagle 1oz gold coin uncirculated with low mintage. This was the last of the gold coins minted at West Point with the old reverse design and it was minted in a small batch. This originally cost $2620.

- 2021 American Eagle Gold Proof 4-coin set (21EF, Type 1). This is the same set that went on sale just recently but I had bought the previous release back in March without opting in anywhere. The initial price on this one was $4410. At the time, PFS offered a commission of $200, but I decided to buy and hold to see if I could do better on my own.

- 2019 Pride of Two Nations sets

I reached out to APMEX before selling the End of World War II silver coin to see if they were interested in buying any of the above or that silver coin before I listed it on eBay. Their quote for the Pride of Two Nations sets actually wasn’t terrible (I’d lose money, but not much more than I would if I tried to sell them on my own). They offered me $260 for the silver coin above that sold for $340 on eBay. Again, that’s not awful considering that I’m only ending up with a bit over twenty bucks more by selling it on eBay and I am accepting the risk of it getting lost in shipping or a scammy buyer — the APMEX offer really wasn’t bad through that lens.

However, on the limited-edition Gold coins, APMEX made their offers based on the spot price of gold and that just didn’t accurately reflect the market for those coins. They were way below market value on them, so I politely passed.

Striking out with Pinehurst

A reader in our Facebook group had recommended Pinehurst Coins to someone who inquired about where to sell Mint purchases. I reached out to Pinehurst about all of the coins above and they wrote back to say that they weren’t buying any of them at this time – they didn’t make an offer on any of them. Swing and a miss.

At this point, I’m still stuck with both the single 2020 American Eagle gold uncirculated coin from the last round of the original reverse design and the 4-coin 2021 gold proof set. I’m sure I’ll eventually sell both for a profit and haven’t put much effort into doing so yet, but selling them on my own hasn’t been an instant win.

Would I sell on my own or to a buyers club on future deals?

The bottom line is that US Mint coin sales can present good opportunities to earn both points and profit. Just the coins mentioned in this post add up to about eight thousand dollars in legitimate spend that helped me / family members earn rewards / meet bonuses. I’ve bought many more coins over the years and sold plenty to buyers clubs for locked-in profit. In the cases listed here, I tried striking out on my own — and if you’re doing the math at home, it kind of looks like I’ve indeed struck out by some measure.

On the eight thousand dollars in purchase prices for the coins in this post that I’ve tried to sell on my own, I’ve only received about $2K back so far. I’m still holding coins with purchase prices totaling about $7700. I expect that I’ll end up selling those for $8.6K after fees, so I should come out handsomely ahead. However, it will have involved floating the cost for a while and some level of effort in taking pictures / writing descriptions / answering questions / cancelling a mistaken order / shipping items out. Is it worth the money I can make? Maybe. It certainly was on that first silver coin deal. I’m less sure on some of the others. Locking in a “guaranteed” profit with a buyers club certainly makes some sense even if it pays less cents. I could have had $200 in profit on that 4-coin set back in March and been done with it. I’ll probably eventually sell for a significantly higher profit, but I’ll have floated the money for a while and taken on all of the risk. That’s not for everyone.

I used the quotation marks around the word guaranteed above because there is clearly no guarantee when you’re shipping out thousands of dollars worth of gold or silver to a buyers club waiting for them to pay you sometime after they receive it. Plenty of people wouldn’t be comfortable with that (I’m sure you’ll find a few in the comments below) and that is a completely reasonable position. There are risks in this resale game (and again I recommend reading this post before you dive in). When I use the word guaranteed, I mean a profitable resale price that you have locked in before buying. That’s the advantage of a buyers club and it is an advantage I have been willing to pay for many times in terms of reduced profit.

In the future, I think I’d be more likely to lock in buyers clubs on more expensive coin sets and take a chance selling on my own with coins that are less than a hundred bucks unless the locked-in profit margin is pretty high. I’m willing to take a gamble on a $100 coin. However, I don’t really want to hold a $5,000 coin set for months on end waiting for a buyer and then have to sweat whether or not the buyer is legit. I think I’d rather lock in a $200 or $300 in pajama profit and points than accept time commitment and risk to make a couple hundred more. I certainly won’t argue with someone who is willing to accept the time and effort to make hundreds more; I respect the hustle and envy those with an easy opportunity to resell for a higher price. But with other stuff on my plate, I’m willing to sacrifice to some extent for the sake of an easy win.

I should also note that there are limits as to how much I’m willing to extend to a single buyers club at once. There has been a deluge of coin deals lately and that’s a good reminder to be careful. A reader once likened a buyers club to extending your credit line to a stranger on the street. I’d be cautious about how much to extend to one buyer at a time. Similarly, it might not be wise to go after every single coin deal if you want to sell on your own and don’t have the tolerance for infinite float.

Still, with a few of these relatively cheap coin opportunities lately, we’ve seen chances to pick up a few hundred bucks here or there in easy spend and a decent profit while you’re at it. I’m likely to continue going after these opportunities. As of the time of writing this post, I haven’t yet opted in to a resale group on today’s $73 coins. At that price, I’m somewhat tempted to test the market myself. On the other hand, with silver at a spot price of $23 an ounce, the chance to lock in the sale of 3 ounces of silver for $285-$385 seems like a no-brainer — especially when I glance back over at those Pride of Two Nations sets. Yeah, I’ll probably opt in for pajama points and profit after all.

Nick, I also have the “pride of the two nations set” x5. I was out of town when the coins arrived and had to drive to the ups regional center to pick them up by the time they arrived at the buyers club, it was too late and they returned them back to me. It’s been more than two years that I’ve had them. I know that price of silver went up like 40%+ since I got these but I guess the pricing doesn’t follow the metal directly.

I’m planning to get rid of these? What are my options besides ebay and local coin stores?

What about tomorrows Mint Release “Limited Edition 2021 Silver Proof Set – American Eagle Collection” 21RCN Do you know Any offer for it?

“I opted in with PFS to sell them the Gold version of this coin” – the WW2 AGE really was the one to keep. What was the PFS commission on that coin?

I recently used Pointsmaker for the 4 gold coin set recently released. It was kind of nerve wracking sending that kind of investment, but all went well and it was a quick $500. I’ll register with DCB buying group on your referral to see what they offer. If anything it will help me squeeze more out of pointsmaker.

Any update on your experience with DCB?

Yes! Paid out promptly via ACH on the 3rd business day after they received the coin as expected. Smooth.

Great to hear! Thanks a lot for the update!

Where are you getting $600 for The Pride of Two Nations set? You can find plenty on Ebay for under $200 for the set in original packaging.

Sales on eBay on these sets are in the 150-160 range and OP has 5 with a cost of 140 each. so after taking fees out its closer to 600. At any rate, the price the OP is getting is below his cost.

Did the author update the article? I don’t see any reference to him having purchased 5 sets.

his cost on pride of two nations was $700 and household limit was 5. The cost from the mint was 139.95 and all the groups buying asked ppl to buy 5 sets. Just some personal knowledge i remember from this deal as i sold mine to buying groups.

I’ve been doing the same as you with these coins. I have sold these on eBay a few times, but only under certain circumstances. I recently bought a couple of coins for $4500 and $3000 that I listed. The buyer of the $4500 coin had thousands of positive reviews and looked to be a reseller and so I had no problems selling to him. The other buyer had zero history. I felt it was too risky selling a $3K coin to a first time buyer so I canceled the transaction and ended up selling to PFS.

I usually only buy coins if PFS or someone like Pinehurst emails me beforehand. I did buy a few coins a couple of months ago where I didn’t get any pre-offers just to see how I could do. The first batch cost $250 each and I sold them for 100% profit on eBay. The next batch was also $250 each. I sold the first coin within minutes for $300 but only managed to break even on the next coin.

The only dealing I had with Pinehurst was on that 2019 $79 coin that exploded. Pinehurst offered me $700 and sent me a purchase order. I never actually committed to selling to them and ended up selling to another dealer for $1000. Pinehurst sent a few threatening emails but I ignored them.

I am currently doing my first transaction with Pinehurst. I sent them a coin last week with their purchase order and am waiting to hear back. I am also locked into a few other deals with PFS.

I have not gotten stuck hold any coins and have made a nice profit overall. But in the future I will only sell on eBay if the buyer has a high enough rating. There’s just too much risk of someone claiming the item wasn’t what they expected and eBay will always side with the buyer.

I’ve never encountered Pinehurst sending a PO unless you give them the order number, name address etc. But their PO’s are binding now, i dont want to go digging for old PO’s as they might not be binding or include the mint order numbers.

I called Pinehurst and they gave me their offer. This was the first coin I ever bought and I didn’t know what I was doing. I gave them my name, address and email and they sent me a PO and an email with lots of legalese saying I was now bound to an agreement. My wife is an attorney and said it wasn’t valid as I had never explicitly committed to anything. Just giving them my info does not mean I agreed to a binding contract. Pinehurst sent me a few emails asking for the coin, which I ignored. Eventually they stopped. They don’t seem too upset as they recently started emailing me with offers to buy coins. I have dealt with other dealers who also send PO’s, but none with the threatening legalese that you are now bound to their agreement.

I have learned since that time to not give my name and address until I’m ready to commit.

Just a follow up on completing my first Pinehurst deal. I shipped the coin to them last Wednesday and received the check in the mail a week later.

[…] Striking out on my own with US Mint coins by FM. Interesting look at sticking with buyers clubs vs going out on your own. […]

This may be a naive question, but is there no insurance product that would deal with this issue?

great question….also curious how this relates to shipping risk (lost package claim, etc.) what risks can we cover?

The similarities are stunning – I’m staring at both the Pride of Nations sets and the 2021 4 coin gold proof set as well. If nothing else, I’ll put them in the safe deposit box and hope that my children can profit from them in the future.

Nick, great article, as usual! Quick question: with all the changes this year to credit card terms of service, especially with regard to purchasing coins, what are good cards to use (besides the one you are trying to complete a SUB), and what card issuers should you absolutely avoid? TIA!

Good question. When I write a post about mint coins I usually include that info but didn’t think to do so here. US Bank and Elan Financial cards (like the Fidelity Visa) won’t earn any rewards on US Mint purchases. Despite Amex and Chase both adding terms that caused worry about coin purchases, I’ve not yet heard a story of anyone ever having been charged a cash advance fee on a Mint purchase nor have I heard of any other issues getting rewards from Mint purchases. I recently used Amex cards for $5K purchases from the Mint and those coded as purchases with rewards pending as expected. I probably wouldn’t recommend using an Amex while working on the welcome bonus only because you don’t want to be sweating weather or not they are going to claw it back.

In terms of good cards to use, I guess the best option would be the Bank of America Premium Rewards or Unlimited Cash Rewards if you have Platinum Honors (for 2.625% cash back). Next best would be Alliant (2.5% back). After that, I guess I’d go Double Cash, Blue Business Plus, maybe Venture and Freedom Unlimited. Some card that gets a decent return “everywhere else”. I’ve used cards from all of the above issuers without a problem, though my most recent purchases that have shipped (vs these preorders) were on Amex and Bank of America.

Glad I read to the end – I was going to do my next Mint purchase on a new US Bank card. Well written article Nick.

Just a thought, the BOA Cash Rewards Mastercard lists online purchases as a category option. This has worked on Plastiq payments so no doubt it would work for this. As a Platinum Honors member, I get 5.25% back on $2500 in spend per quarter. Not bad for a card with no annual fee…

US Mint charges don’t work for the online shopping category. I had read that recently and also just checked my statement where I had made a mint purchase before reading that it doesn’t work, and in fact it doesn’t. No category bonus. In the transaction category it codes as Cash, Checks, etc.

My online insurance and cable purchases didn’t work either. It is not just online, it looks like the transaction category needs to be Shopping & Entertainment …

Thanks for the heads up! Odd then it works on my Plastiq mortgage payments. I’ll have to check the transaction category.

Great read! I’ve always had great luck with PFS and they always pay promptly without any issues for the past couple years. I’ve opted in and got the three coins today. Interesting thought though about future coin purchases…. It’s sort of like collecting old comic books and Pokémon cards… hold out for the far future (like stocks).

Nick: Thank you for the insight on mint coin deals. I’ve had relatively good success by sellling on eBay. But what I find extremely difficult is buying from the US mint on high demand coins. For example today I was not able to buy any coins. The 2021 American Eagle proof coin sold out in 9 minutes. Oh well….

Any DP on how much these coins are worth over a longer period of time? I don’t mean 1 or 2 years, but over 10, 15, or even more years. Just curious if these coins actually are worth holding as investments of some sort.

A large percentage of the difference in value over time is just going to be the difference in the value of gold/silver. Some people will tell you to invest all of your money in gold/silver because it is going to be valuable in the long run and others will tell you that it has more or less tracked inflation historically. Most of these coins are going to be held by collectors, so I don’t see them becoming much more scarce (though the ones available for sale might be more scarce over time…but will they also have fewer people looking to buy them?). I probably wouldn’t buy these hoping for a huge increase over that kind of period of time. If I were going to keep them for 10 or 15 years or more, it would be because I enjoyed collecting them for the hobby aspect rather than for the investment prospects. After all, these coins are each just 1oz of gold or silver, so whatever they are “worth” above that is just what someone is willing to pay.

I tried selling a $5K coin on my own, via eBay, They take 10%, so thats all your profit. Higher risk with some random buyer on eBay than one of these vetted buying groups.

While I feel comfortable with some buying groups (obviously), I think it’s worth being careful with semantics when you say “vetted buying groups”. I’ll say that I’ve done some amount of research into who the people behind these things are, but not so much that I’d feel comfortable presenting them to anyone else as “vetted”. The truth is that there isn’t a ton of info readily available about who you’re dealing with and even when you do know who you’re dealing with there is still some risk. Take that $5,000 coin for instance. If one of these groups buys 100 of those, that’s $500,000 worth of coins being shipped to one person / entity. In reality, it could easily be a million dollars worth of gold or more. It’s worth recognizing that this creates a situation where there is also risk. Again, I’m not saying that eBay is safer or that these groups are unsafe, just to go in with your eyes open and a full understanding of the risk you’re taking.

I’d argue that regardless of what vetting has been done, these silver coin deals are pretty safe. Suppose TPM got back into the biz and reemerged as TCM (thecoinmerchant). He would use all the silver coins to build up a huge base, then pull the rug out from under us after a gold coin deal. So even if you’re really paranoid, by my logic, you’re safe on almost any silver coin deal. If you’re being really cautious, you’d skip silver coins immediately after a gold release also.

Just my two (silver) dollars.