I’ve long advocated against over-emphasizing the 5/24 rule and thereby missing out on easy opportunities now for the sake of a shot at a future welcome offer (See: Stop over-valuing 5/24 slots). That’s particularly true when you’re missing out on a more valuable welcome offer now in order to become eligible for a lesser welcome offer later. Despite all that, I’m currently really struggling with a desire to get under 5/24 — and the temptation to go over.

The 5/24 rule

Some banks will not approve you for a new credit card if you have opened too many new accounts within the past 24 months.

Chase is anecdotally known to deny applicants who have 5 or more new credit card accounts with any issuer in the previous 24 months. Most business credit cards are not included in this count (even Chase ones), but you’ll need to have 4 or fewer new credit card accounts within the past 24 months if you want to get approved.

To determine your 5/24 status, see: Easy Ways to Count Your 5/24 Status. The easiest option is to track all of your cards for free with Travel Freely.

I really want a Southwest Companion Pass

My wife and I have had a Southwest Companion Pass in our household for more than a decade. While we love fancy international business or first class award tickets as much as anyone, my family almost exclusively flies Southwest when we travel domestically as a family (for a variety of reasons),

In the beginning, our first couple of Companion Passes came via the Southwest Rapid Rewards Shopping portal. Back in those days, I was buying and reselling products. I think I may have lost a little bit of money on the resale of the products I bought to earn my first companion pass, but I earned enough points for the Companion Pass in one fell swoop, which more than negated the small loss.

In the years since, the Rapid Rewards shopping portal just hasn’t been very interesting. I can’t remember the last time that the Rapid Rewards shopping portal was offering the best rate of return for an item I wanted to purchase, so we have turned to earning points via credit card.

Eventually, my wife got both a Southwest consumer credit card and a Southwest business credit card, earning a Companion Pass from the welcome bonuses. In subsequent years, she’s been able to pick up enough referrals for the card to re-earn the Companion Pass every other year, so we’ve had that one Companion Pass in our household year after year for a long time.

However, now that we have two kids, two Companion Passes would be ideal so that we could be getting not one but two free seats every time our family of four flies Southwest.

Unfortunately, I do not have a Southwest credit card of my own. I’d love to be able to get a Southwest consumer card and a Southwest business card, but I need to get under 5/24 if I’m to do it.

Currently at 6/24 and would go under 5/24 in August

I’m currently sitting at 6/24. The following are when my oldest “new” accounts will drop off the count:

- August 1, 2025

- August 1, 2025

- October 5, 2025

- December 12th, 2025

In other words, if I didn’t open another card between now and July, I’d end up at 4/24 by August 1st. I’ll drop one further to 3/24 at the beginning of October, which is historically a great time for Southwest cards.

Cards I want right now (Should I keep waiting?)

While I want a Southwest Companion Pass, I’m struggling with the idea of waiting 5 more months to be eligible. That is in large part because of several current “wants”.

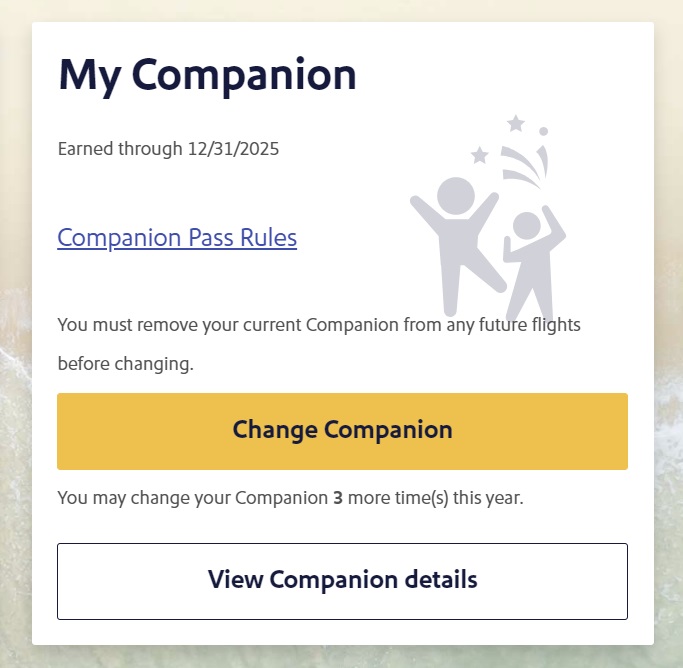

Hawaiian Airlines Mastercard

| Card Offer and Details |

|---|

ⓘ $-99 1st Yr Value EstimateClick to learn about first year value estimates None Non-Affiliate This card is no longer available$99 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 80K points after $2.5K spend in first 90 days (ended 11/4/25) Earning rate: 3X Hawaiian Airlines ✦ 2x gas, dining, and grocery stores ✦ 1x everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Noteworthy perks: Two free checked bags on Alaska and Hawaiian when flight is booked through Hawaiian Airlines or Alaska ✦ One time 50% off companion ticket for roundtrip coach travel between Hawaii and North America on Hawaiian Airlines and on Alaska Airlines North America routes ✦ $100 off a companion ticket for roundtrip coach travel between Hawaii and North America on Hawaiian Airlines and on Alaska Airlines North America routes at each account anniversary ✦ Atmos™ Silver, Gold, Platinum, or Titanium status get a $100 annual statement credit toward inflight purchases ($10 maximum per day) on Hawaiian Airlines and Alaska Airlines flights. |

I really want a Hawaiian Airlines Mastercard because my family has a stash of Alaska/Hawaiian miles spread across several family member accounts. We flew a “paid” British Airways business class fare a couple of years ago (we used the Amex Business Platinum’s pay-with-points rebate to book), so my wife and one of my sons earned a bunch of Alaska miles from that. Then we similarly flew a “paid” Hawaiian Airlines business class fare (using Business Platinum points) last year and all four of us earned over 13,000 Hawaiian miles on that flight.

The Hawaiian Airlines Mastercard allows the cardholder to combine miles with others for free. If I got this card, I could move miles from all of our family accounts to Hawaiian (from Alaska to Hawaiian first as necessary) and then as a cardholder we could move the all of the Hawaiian miles in my wife’s account and both sons’ accounts into my Hawaiian account and then on to my Alaska account. The end result being around 400,000 Alaska miles in a single account, which is far more useful than having 13,200 Hawaiian miles in one son’s account and around 50K between Alaska and Hawaiian in another son’s account, etc.

Note that I could accomplish this with either the Hawaiian consumer card or the Hawaiian Business card. A notable perk of the business card is that it wouldn’t add to my 5/24 count — it would essentially fly under the radar.

However, the intro bonus is 20,000 miles better on the consumer card, the spending requirement is lower, and Barclays can be weird on approvals for their business cards. I could try for the business card, but if I weren’t concerned about 5/24, I’d be going after the consumer card. I somewhat regret not getting the consumer card when it offered 70,000 miles after first purchase (you now need to spend $1,000 in the first 3 months to trigger the bonus).

Finally, of key importance here is the fact that we don’t expect the Hawaiian cards to be available forever, Current speculation is that Barclays will probably stop taking applications for the Hawaiian cards by the time the programs merge, which is expected to happen around the middle of this year. Will they stop taking applications sooner than that? Will the card continue to be offered beyond summer 2025? We don’t know. But I believe that my window of opportunity on this card is going to be measured in months at best.

Capital One Venture Rewards credit card

| Card Offer and Details |

|---|

ⓘ $1205 1st Yr Value Estimate$250 travel credit valued at $220 Click to learn about first year value estimates 75K Miles + $250 Capital One Travel credit 75k miles after $4k spend within first 3 months + $250 to use on Capital One Travel in your first cardholder year$95 Annual Fee Alternate Offer: Alternate offer for 75k miles + $300 travel credit available for some via referral pre-approval Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75k miles after $4k spend within first 3 months + a one-time $250 Capital One Travel credit to use in your first cardholder year FM Mini Review: This card earns 2 miles per dollar, which are worth exactly 1 cent each toward travel. This makes the return on spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their miles to airline miles & hotel points. Click here for our complete card review Earning rate: 2X miles everywhere ✦ 5X miles on hotels, vacations rentals and rental cars booked via Capital One Travel ✦ 5X miles on Capital One Entertainment Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: Receive up to $120 application fee credit for Global Entry or TSA PreCheck® ✦ Redeem miles for travel at value of 1 cent per mile ✦ Convert miles to airline miles & hotel points ✦ No foreign transaction fees |

This pick will surprise some, but it will make sense: I want to open a new Capital One Venture (or maybe Venture X?) card. My wife already has a Venture X card and I have an old VentureOne card, either of which allows for transfers to partners. Since there is no fee to add an authorized user on a Venture X card, it wouldn’t ordinarily make much sense to have a second Venture or Venture X card in a single household.

However, for starters, there’s the welcome bonus, which is decent on either card at 75,000 transferrable miles after $4K in purchases. But that’s not the whole story. We’re currently collecting reader referral links for the Venture card here and using them on our Best Offers page. Cardholders can earn up to 100,000 Capital One miles per year for referring others (I believe it’s 20K miles per referral on the Venture or 25K per referral on the Venture X, so this maxes out after 4 or 5 referrals). I imagine that I could probably end up with 100,000 extra miles from referrals, making this feel more like a 175K bonus (and it would give me capacity for referrals in future years as well). That obviously changes the math significantly.

It’s worth noting that the Venture X is the better deal mathematically, but we need another $395 annual fee like we need a hole in the head, so I’m leaning toward wanting the Venture just to keep things simple.

Amex Green Card

| Card Offer and Details |

|---|

ⓘ $424 1st Yr Value EstimateClick to learn about first year value estimates 40K points ⓘFriend-ReferralThis is a friend-referral offer. A member of the Frequent Miler community may earn a referral bonus if you are approved for this offer 40K after $3K spend in first 6 months. Terms apply. See Rates & Fees$150 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 60K after $3K spend in first 6 months + 20% off travel and transit purchases for first 6 months. [Expired 8/21/23] FM Mini Review: This card is worth considering as your go-to travel card, but only if you value its CLEAR credit. Also note that Amex cards continue to have limited acceptance in many international destinations. Click here for our complete card review Earning rate: ✦ 3X on travel & transit (including flights, hotels, taxis, and rideshares) ✦ 3X dining ✦ 1X points on other purchases. Terms apply. See Card Info: Amex Pay Over Time Card issued by Amex. This card has no foreign currency conversion fees. Noteworthy perks: Up to $209 CLEAR® credit annually Terms Apply. |

I also want to get an Amex Green card. That doesn’t make much sense on the surface given the fact that it features a comparatively weak welcome bonus and a relatively weak set of benefits for its annual fee.

Here’s my situation: I have a consumer American Express Platinum Card® that I failed to cancel within 30 days of the annual fee posting. I’ve now used my various 2025 fee credits on the Platinum card. Since more than 30 days have passed since the annual fee was billed, if I cancel the card now, I won’t receive any refund of the annual fee. However, if I downgrade the Platinum Card®, I’ll get a prorated refund of the annual fee that will correspond with the number of months left in my cardmember year (~10 months, so I’ll get about $579 back). Then, I’ll pay a prorated fee on the card to which I downgrade.

From the Platinum Card®, my only downgrade path options are to downgrade to an Amex Gold card (which I currently have) or an Amex consumer Gold card. Since the Green card has the lower annual fee, it makes more sense to downgrade to a Green card. I’d be charged the prorated fee for 10 months of the Green card (about $125). In the end, I’d net about $454 back if I downgrade rather than cancelling (again, if I simply cancel my Platinum card, I won’t get anything back).

My problem is that I’ve never had the Amex Green card before. Amex application terms typically say that you are not eligible for the welcome bonus if you have or have had the card before. If I downgrade to the Green card, the application terms would mean that I may never be eligible for the welcome bonus on the Green card in the future since I will have had the card if I downgrade to it.

It might therefore make sense for me to apply for a Green card first, before downgrading my Platinum Card®. That way, I could be eligible for the welcome bonus on the Green card.

What I think I should do is open an Amex Green card now. Then, in a few days, I could downgrade my Platinum Card® to a second Green card. I’d end up with two (largely useless) Green cards, but I’d earn the 40,000-point welcome bonus (at the time of writing) on the new one and get a net $454 back on the downgraded one.

Essentially, if I don’t apply for the Green card now without first applying for it, I’m costing myself a shot at 40,000 points.

Other cards

I should note that the above cards aren’t the only ones I want. I’d also like to get a Hilton Honors Surpass card in our household (we haven’t had one in many years) and I’m really interested in the U.S. Bank Smartly card as I think we could meet requirements to make that a 3%-everywhere cash back card. Those aren’t the only other cards I want — my point here is that I’ve been waiting on other opportunities as well.

Do I push off falling under 5/24 for a few months? Do I give up on it entirely for 2025?

This all brings me to a dilemma: do I hold the line and try to avoid opening any consumer cards until I fall below 5/24 in July, or do I move forward and open a couple of new cards now?

Since the best time to open Southwest credit cards tends to be late in the year, I would have envisioned waiting until October to try to open Southwest cards, looking to earn the welcome bonuses for one Southwest consumer card and one Southwest business card in January 2026 so that I could have a Companion Pass for almost two full years (the rest of 2026 and until December 31, 2027). Since I wouldn’t be under 5/24 until about August 1st, I likely couldn’t earn the Companion Pass in time for our summertime domestic travel this year (since I’m not eligible to apply now under the current referral offer). In short, I guess it makes sense that I don’t need to be under 5/24 until October.

With that decided, I could afford to open one new card now. That would put me at 7/24 for now, but around August 1st, I would drop back to 5/24 when the two oldest accounts fall off of my 5/24 count. Then, in October, the next oldest account would drop off, knocking me down to 4/24 — at which point I could apply for Southwest cards. That seems like it could work.

My next oldest card after the one that falls off in October comes off in December. If I can wait until December to get my Southwest credit cards, I could add one more new account now, bumping myself up to 8/24 right now, dropping to 6/24 in August, 5/24 in October, and back down to 4/24 in December.

I’m a little bit hesitant to wait until December since the welcome offer sometimes changes in early December, but since I could probably pick up some referrals even if the welcome offer is unideal, I think that’s not a bad bet. I think that opening two consumer cards right now seems reasonable enough.

But which two?

Narrowing down the field

As you can see above, the question comes down to which card to eliminate from the trio of cards I want right now if I want to earn a Companion Pass.

I think that based on the number of total transferable points I can earn, I should probably try for a Venture card first. The combination of welcome bonus and potential referral points, both this year and in the future, is worth so much more than the other bonuses I’m considering. In fact, if I got this card and happened to get the 4 or 5 referrals necessary to max out the bonus, I could have enough miles to erase $1,750 in travel, or I could get far more value transferring to airline partners. This bonus might be more valuable to me than a Companion Pass. I think it should be the first card I try for now. (Note that I’m not recommending that others make this card a top priority — my situation here is fairly unique).

Capital One is known to be very fickle with folks who already have a lot of cards. I think there’s certainly a chance that I won’t get approved for a card with Capital One based on the fact that I have so many accounts open with other banks. If I don’t get approved for a Venture card, then I could go after the other two cards I’m considering. If I get approved for a Venture card, I have to decide whether to get a Hawaiian card or a Green card now.

To be clear, I’ll also still consider business cards between now and when I fall under 5/24 since most business cards do not add to one’s 5/24 count, but I’ll try to hold off on being tempted by other consumer cards until I fall back under 5/24 in December.

The card I need to chop from my strategy is the Amex Green card. The current welcome offer on the green card is significantly less valuable than the welcome offer on the Hawaiian card. And while I might not be eligible for the bonus on a Green card in the future after I downgrade my Platinum Card®, Amex sometimes allows people top earn a welcome offer on a card they’ve had before even though terms state that they may not. That means there’s a chance I could possibly still get the welcome bonus on a Green card “someday”. I think that the Hawaiian card will likely go away forever at some point this year. It’s a much more time-limited opportunity in my opinion.

Final decision

I think I’ve convinced myself to go ahead and go for a Venture card and a Hawaiian card now as that will only push back my Southwest card eligibility by a couple of months, likely to the time of year when I would have been considering applying anyway. I’ll potentially forgo my shot at an Amex Green card bonus, but I continue to earn a lot of Membership Rewards points from business card bonuses as well as category bonuses on my existing Amex cards, Rakuten, referrals, etc. I do want to become eligible for a Southwest Companion Pass and I’m willing to sacrifice a shot at 40,000 Amex points to open up the possibility of being eligible for Southwest cards later this year, but I don’t think I should sacrifice the opportunity to get the other cards I want now even if it means pushing the Southwest cards down the line a few months.

Nick I don’t envy your position considering whether to keep both players under 5/24! We are a three person household and when it looked useful I’ve been able to get a Companion Pass myself first, then have P2 get it when I blew past 5/24. Haven’t had it for a few years as we did less Southwest flying but it’s looking like it would be beneficial again so I’m eyeing going for it after I drop under 5/24 later this year while P2 is well past 5/24. Similar situation to you I am at 6/24 but will drop to 3/24 by July.

I’m going to echo the many comments here and say forget the Green card. You’re unlikely to be eligible for the SUB because of AMEX family rules anyway and the bonus is just not that great.

With Hawaiian Personal back up to 70K on 1 purchase I would grab that and apply for a Hawaiian Business card immediately after. Hard pulls combine for the personal and business card if you apply same day – just did it a few months ago with successful approval on both at 6/24. Neither was instant but Barclays made two separate calls a few days later and let me shift around credit lines to get approved for both. Since the hard pulls combine and the business card won’t count against 5/24 I viewed it as going after a 120K SUB with a $4000 + $1 minimum spend.

Since you’ll drop under 5/24 in October after opening the Hawaiian card, I would hold off on the Venture for now. Once you are under 5/24 the Southwest cards should hopefully be back around with their annual end of year elevated offers. When they are apply for the Venture first so that you can try to get that while having as few recent inquiries and new accounts on your report as possible. Then immediately apply for your Southwest cards since Chase doesn’t seem to be as inquiry sensitive as other banks (and a hopefully approved Venture card won’t show up on your credit report yet).

Doing this you have a shot at getting the Venture card with a few months still left in 2025 to try to max out referral bonuses, and it won’t push back getting under 5/24 for the Southwest cards to December. You may even luck out and land on an elevated Venture offer at that time.

One other thought to give you another slot for staying under 5/24 – do you need to get both the personal and business Southwest cards? The Performance business regularly gives 80K bonus points and requires $5K of spend. Added to the 10K companion pass bonus points for cardholders you will already be at 95K Southwest points, 40K short of a Companion pass. At the current rates that is only 2 Chase Southwest card referrals you would need to earn the pass. Alternatively it’s not a ton of shopping portal or Southwest Hotels shenanigans to earn that last bit. I know the ideal is having it for a full two years, but unless you have a ton of domestic flights planned for January – February next year you have a couple months to meet that before you hit Spring Break and the busier summer travel season. Leaving out the personal Southwest card would mean you’d be right back to 4/24 in December while picking up both the Venture and Hawaiian personal card along the way, and leave you some room for considering other personal cards in 2026. Just please not the AMEX Green!

Please let us know if you’re able to get a Venture card! I’m at 5/24, a month away from 4/24. Cap1’s pre-approval for VX denied me this morning. 🙁

Nick, I read on reddit that a backdoor way to get the max refund on an Amex card more than 30 days after the annual fee is to PC to another annual fee card to get the prorated refund, pay the new prorated AF on the new card, and then cancel the new card within 30 days of paying the said prorated AF. I heard that gives you a full refund on your new prorated AF. So for your case, you can just downgrade to Gold and not take away Green’s potential SUB in the future. It doesn’t matter which card you downgrade to as long as you cancel within 30 days of the prorated AF, you will get the full refund back on the new prorated AF.

That sounds like a great way to land in pop-up prison with Amex.

Hmm. I thought once you have had the gold or platinum card you are no longer eligible for the Green signup bonus. That’s why they tell you to apply for amex personal cards in order, green, gold, platinum. Has that rule changed?

Sometimes I wonder if CP is worth it considering the opportunity cost, having to stay under 5/24 and prioritizing SE cards versus other Chase cards.

Wow thanks Marta super insightful post

Hey Nick, you don’t need a Hawaiian Airlines Credit Card in your family. If you have a friend / relative / FM team mate that has the HA CC, you can transfer the HA miles from your wife / son 1 / son 2 into the HA CC holder’s account for free, then transfer from the HA CC holder to your HA account for free. This way you can move the miles around without having a HA CC in your name.

Now that’s really smart. I can’t believe that none of us have thought of that! Well done.

Happy to help. I was thinking way out of the box and it worked 🙂

Hi Nick! Great post.

Why not downgrade the Amex Platinum to another gold? If you can use at least some of the “coupons” like the resy credits and some of the dunkin/restaurant/uber credits, then the cost of another gold isn’t that different than the cost of the green.

That’s a great point. In my case, without actually looking at my spreadsheet, I’d guestimate that we spend more than $8,000 a year in annual fees right now. Obviously part of that is that I’m writing about a wide range of cards and it helps to have them, some of it is cards I opened for a welcome bonus and won’t keep, etc. I don’t really want to sink more into the same Resy/Dunkin/Uber credits we already get if I can help it — but you’re right that the cost may not effectively be much different!

TLDR, 2 companion passes for a family of 4 is well well well worth foregoing some desirable cards for the open 5/24 slot to make it happen.

My wife and I both have companion pass which we use to have our two kids travel with us and (as you already know) it is a godsend and something I think is definitely worth staying under 5/24 for.

I know this will be a controversial take, but I think having 2 companion passes and 2 kids makes transferring incredibly easy to earn UR points to Southwest a very good deal in terms of value per point. I know, I know I KNOW! Having companion pass doesn’t change the cpp value because you *could* buy those flights with cash for less now. But I’m defining value as miles flown per point, and in that respect you absolutely do get double the miles flown per point that you otherwise would. We are currently in our third “round” of getting companion pass for ~18 months, waiting a few months to get to 24 months since last bonus, and then rinsing and repeating. I can’t imagine what we would do without it.

I have been working through the same process!! I’m glad I’m not the only one! Also having issues with Chase denials so being extra cautious and wondering if 5/24 goal is really worth it. Thanks for sharing your path forward.

Nick, thanks for sharing your thought process! I suggest you get the Hawaiian business card. The marginal benefit for the HA personal card is an extra 20k points (value $260) and $3,000 less spend requirement (assuming MS rate of 3% = cost of $90). So you’re trading a 5/25 slot for $350. Given your situation, seems like a absolutely terrible value proposition. Get the HA business card!

I’ve been struggling with this same question. At 4/24 and thinking about how my Chase strategy will change now that they are not approving business card like they used to. Is it worth staying under 5/24 if I can’t even get more Chase cards? Then again, how would I accrue transferrable points in this ecosystem? Other than SW, I haven’t gotten brand focused cards since I don’t have loyalty to any specific programs. Still not sure of my strategy moving forward on this one.

Melissa I am in the same situation. Now that the Ink train is harder to ride I think I’ll just grab the Chase personal cards that I consider keepers and move on.

Can someone have both, the Venture one and the Venture 1 X?

Yes.

Yes, both me and P2 have had VX and VOne at the same time, before downgrading VOne to Venture (no annual fee version).

As others have said, yes, you can have multiple versions of the Venture card.

This article reminded me to consolidate me 2 children’s Alaska miles into my account. However when attempting to do so I get a message saying that “sharing miles for free” has been unavailable since April of 2023. I’m a Hawaiian primary card holder.

You need to move to move the miles to Hawaiian, consolidate them all there, then move them back to Alaska.

I am sure you have done this, but here is a thought – Since you have had a SW companion pass on your wife’s account, calculate the true savings you achieved last year or the year before that, when accounting for opportunity cost of flying southwest vs. other preferred (in terms of price/routing/class of service/# of stops, etc.) airlines. You can’t go back in time, but you can potentially recreate those itineraries for this year, and calculate your savings. Assuming you’d do one r/t using southwest per month (this will be a stretch given you have 2 small kids, but let’s assume this will be average) over 2 years of companion pass, and each time, your companion pass saves you $200 worth of cash or points translates to $4800 in savings. So, the real question is – can you generate enough cash/points equivalent from someplace else without worrying about 5/24?