Many credit cards offer bonuses when booking hotels through the credit card portal, and some credit cards offer hotel credits. However, I don’t highly value the 8x or 10x or 12x offered by various credit card portals, and I don’t value credit card hotel credits at face value. A large part of the reason for both of those things is that it is often possible to earn better rewards by clicking through a shopping portal to make a hotel booking directly with the chain, earning both hotel points/elite credit and shopping portal rewards.

However, a common question is , “How does this work for a future hotel stay? If I click through a shopping portal today and book a hotel stay far in the future, will the rewards rate stick based on my booking date even if my travel date is far in the future? And what about Capital One Shopping, which often displays “ineligible” on travel bookings before travel is completed — will it ultimately track at the correct rate?”

I can’t guarantee that things will always go according to plan, but I wanted to share my recent (positive) experience with this on a Best Western booking made through Capital One Shopping as an example of how it can work, even far in advance.

Stacking a shopping portal with hotel rewards

While stacking veterans surely understand the basics here, many newcomers to the hobby are surprised to learn that it is possible to click through from a shopping portal to a hotel chain and stack rewards from both the shopping portal and the hotel program (and your credit card and any card-linked offers as well).

As an example, at the time of writing, shopping portal Top Cash Back is offering 12% back on stays at IHG hotels and resorts (note that this maybe different by the time the post publishes as rates change all the time).

If you log in to Top Cash Back and click through their link to the IHG website, you could book a stay at an IHG property (like a Holiday Inn, Crowne Plaza, InterContinental, etc) and earn both IHG One Rewards points and the 12% back from Top Cash Back. You do not need to book a prepaid rate to stack rewards, and you can also stack with rewards earned on your credit card and any card-linked offers on your card of choice. To be clear, you’re not booking through the portal (Top Cash Back in this case), you’re just clicking through Top Cash Back to get to the IHG website.

All of the above is second-nature for some readers, but I am frequently reminded that this is a new concept for some readers.

In some cases, the stacking can work out really well. It isn’t uncommon to be able to stack something like 12% back from a portal, 10x from the hotel chain (plus any elite bonuses), 5-10x from the credit card (if you’re using the hotel credit card), and maybe even another 10% back from a card-linked offer.

Portal rates vary from day to day and portal to portal. Some portals offer flexible points, like Rakuten (which can be set to earn Amex Membership Rewards points or Bilt points as alternatives to cash back).

A common question: are rewards earned based on the rate when I click through the shopping portal or the rate offered when I complete my stay?

Newcomers to booking hotels via shopping portals often ask whether they can expect the advertised shopping portal rate even if their stay is completed months in the future, since a shopping portal’s advertised rate could change many times between the date of booking and the date of the stay.

The answer is that your rewards should be based on the rate that was available when you clicked through and made your booking. It doesn’t matter that the advertised rate will change many times between booking and completing the stay; the rate that matters is the one in effect at the time when you click through and make your booking. That’s the rate that should track attached to the purchase.

That said, keep in mind that you generally will not earn rewards from travel bookings until after your stay is completed. In other words, if you clicked through the example button above for 12% back at IHG in January and you complete your stay in June, you shouldn’t expect rewards until sometime after the stay is completed in June (it may take a month or two after the stay is completed, depending on the portal, chain, and various processing time factors).

My recent experience with a Best Western stay booked via Capital One Shopping, far in advance

In December, I spent a few nights at the Best Western Monopole Métropole in Strasbourg, France.

I booked that hotel because of a combination of factors:

- It was very close to the main train station (less than a 5-minute walk)

- It was very close to the main plaza/Christmas market (closer than most other chain hotels in the city!)

- I had been targeted for a Capital One Shopping offer of 25% back (up to $250 back)

That last bit was the key for me. Strasbourg crowns itself as the “Capital of Christmas”, and it is hard to argue. As we were booking in March for a December stay (more than 8 months in advance), cash rates were more reasonable than they would have been later in the game. We needed two rooms. One room came to a total of about €1,000, and the other was a bit over €800. In our case, the stay was actually prepaid but fully refundable until close to the stay. Given the (better) exchange rate in effect at the time when we booked, we paid just a bit over $1,982. As noted above, prepaying is not necessary to earn portal rewards, but given the high-season timing of our stay, the hotel charged a deposit of the full amount (minus a tiny bit for taxes that were paid at the hotel).

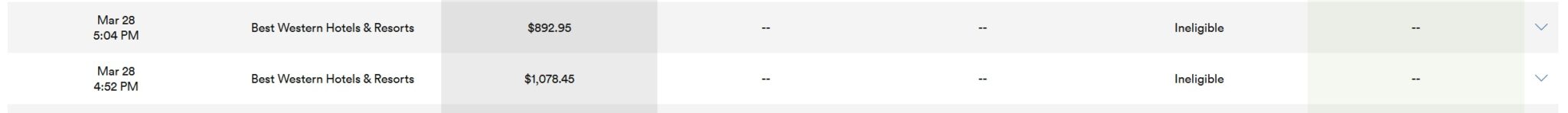

Unfortunately, despite having clicked through from Capital One Shopping and booking a public rate, the reservations showed up as “ineligible” in my Capital One Shopping account. The “purchase amount” was listed, but no rewards were shown.

That actually didn’t shock me: Capital One Shopping terms indicate that travel rewards may show up as “ineligible” until after travel is completed. I’ve written before about the process and my experience with travel-related rewards posting after travel was completed.

Still, it was a little disconcerting since we had prepaid for the booking. I would have felt better if the transaction showed a pending rewards amount, even if that pending rewards amount did not become payable until after travel was completed. Several times, we contemplated cancelling the reservation and either rebooking or booking with a different chain.

However, the deal we got on the rate turned out to be the best thing we could find, with or without the Capital One Shopping Rewards. We decided to let it ride.

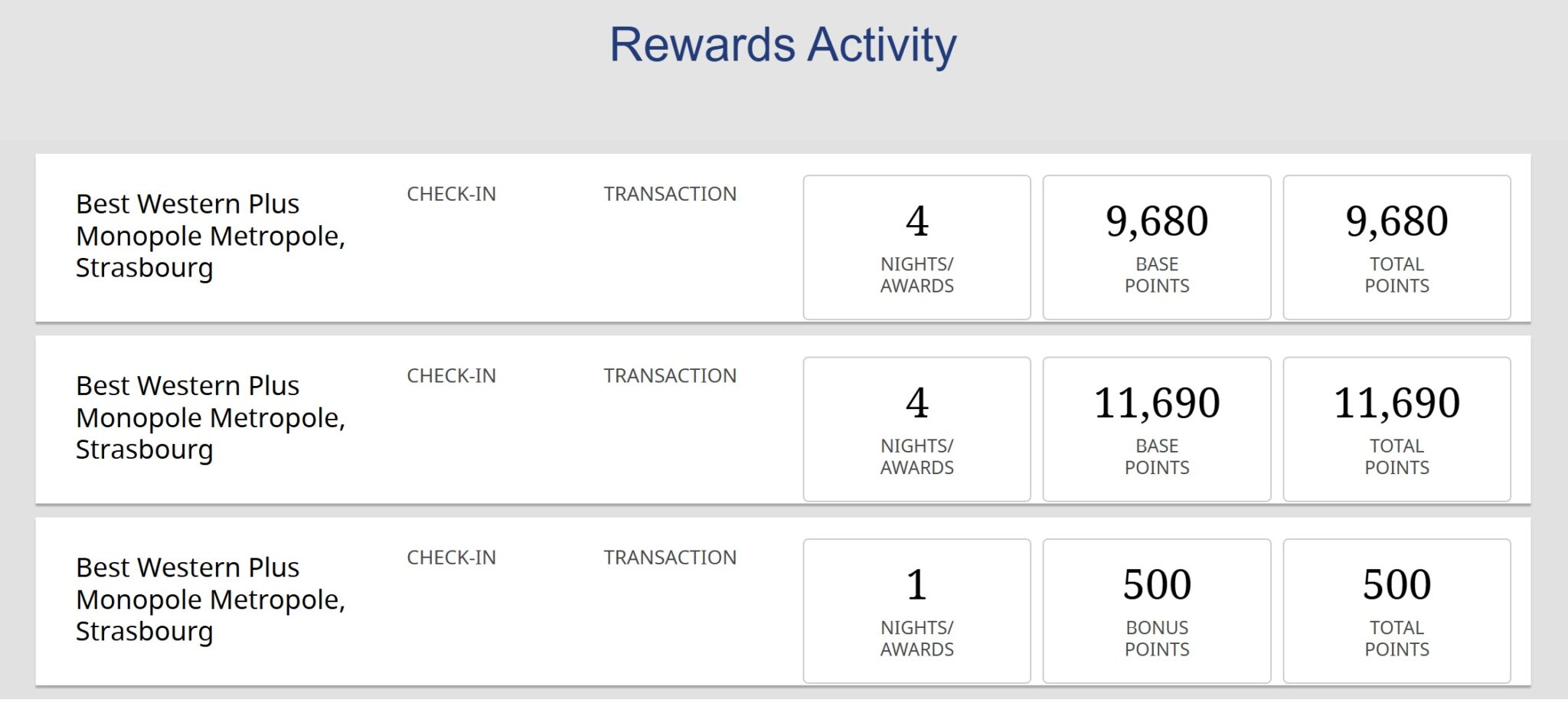

The stay came and went. Best Western allows a member to earn points on up to 3 rooms at a time, so I earned more than 21,000 Best Western points for the two rooms.

Based on our Reasonable Redemption Value of Best Western Rewards points (0.61c per point), the total points I earned are worth about $133.

Based on our Reasonable Redemption Value of Best Western Rewards points (0.61c per point), the total points I earned are worth about $133.

The stay came and went in December, but I checked daily in December, and my Capital One Shopping account still showed the bookings as “ineligible”.

I intended to eventually follow up with customer service, but I got busy with our travels and the holidays, and I put that off until the new year.

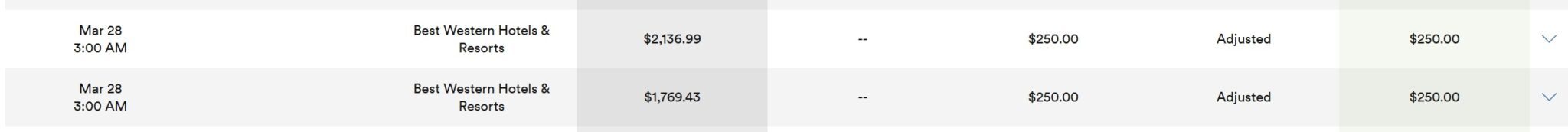

Then, last week, to my surprise, the reservations were credited to my Capital One Shopping account after all.

Eagle-eyed readers will notice that it says “adjusted” above (rather than ineligible) and that the purchase amounts for both hotels are roughly (though not exactly) doubled. I noted in a previous post about targeted elevated rates that I’ve noticed the purchase amounts are often increased after the purchase is credited. I suppose maybe this is how Capital One Shopping accounts for the elevated rewards on the back end.

You may note that the offer had a cap of $250 in rewards. In my experience, even when an offer has a limit, that limit has applied per transaction rather than per merchant. I clicked through separately to make each of the two room reservations, so I was not surprised to be able to earn $250 two separate times.

However, I was a little surprised that both reservations hit the $250 cap. I should reiterate that rewards aren’t always capped at $250 back; I have earned hundreds more back from single transactions on some deals. However, the specific offer I used listed a maximum of $250 back per transaction.

However, my two bookings were not of equal cost. One booking was about $1,084 (tracked at $1,078 originally) and the other was just under $900 based on the exchange rate at the time of booking (tracked at $892 originally). For my purposes, I assumed that the exchange rate in effect at the time of booking was what mattered since I prepaid (based on the March exchange rate). At 25% back, I wouldn’t have expected to earn $250 back on that second reservation (and even with the better exchange rate at the time the stay was completed, I think it should have been a little bit less than $250). If Capital One Shopping made a rounding error here, it was close enough to be relatively inconsequential. Still, I found it interesting.

More importantly, that $500 in rewards did indeed credit to my Capital One Shopping account about a month after the stay (about 9.5 months after booking). Even if I only valued that $500 in rewards at about 80% of face value (since they can only be redeemed for gift cards to select third-party merchants), that’s still a return value of ~$400. Added together with the ~$133 worth of Best Western points from this stay, the combined total made for a really nice rebate that made this our best option in Strasbourg by a wide margin. I put the original $1,982 on my U.S. Bank Altitude Reserve for 3x, which I later redeemed at a value of 1.5c per point (no longer available!), meaning that I got about another $89 worth of rewards out of using that credit card for the purchase.

It also explains why I can’t value a credit card hotel credit that must be used through the credit card booking system at full face value: if I booked this same stay via a credit card issuer in order to earn 8x-12x and/or use a $200 or $300 hotel credit card credit, it wouldn’t have felt like nearly as good a deal.

Will your Capital One Shopping purchases track?

While my positive experience with a Best Western stay made ~8-months in advance and paying out a month after the stay is nice, the more relevant question for most readers will be, “Is this replicable?”

In most cases, I think that it is. By following the usual shopping portal best practices, I’ve had a high rate of success with Capital One Shopping. By contrast, many readers haven’t been so lucky. Personally, I have earned 5-figures worth of rewards from Capital One Shopping, mostly without issue (and in cases like this, if I had jumped the gun, I might have thought that I had a problem getting paid out that required intervention if I hadn’t been patient enough to trust the process and wait….or busy enough to procratinate long enough, anyway). In other words, if I had assumed the worst (that it was never going to track) last month after the stay, I might have wasted time, effort, and frustration following up with customer service.

Of course, the flip side of that is that I may have forgotten about it and never gotten the rewards. You might count me lucky for having gotten them. The truth is, I did plan to eventually follow up if the rewards did not follow (after all, I was checking on this regularly). But, past experience with travel bookings has been that they take a while after travel is completed to track, so I gave this one some time.

I was particularly glad in this case to know that a travel booking made so far in advance could work exactly as I expected it would. That’s not to say that it was intuitive — I still think that Capital One Shopping has a major flaw in tracking travel purchases as “ineligible” rather than showing proper pending rewards that simply confirm with final payouts after check out.

The good news is that other portals do a better job in that regard. My stays booked through portals like Rakuten and Top Cash Back usually show up within a day of booking, so I know exactly what to expect. And we often see elevated offers through other portals. Earlier this week, we reported on some elevated lodging offers through Rakuten (and yesterday, I saw that expand to include IHG as well). I definitely prefer that, but it can be hard to resist Capital One Shopping offers that sometimes reach totals of 25, 30, or even 40% back or more. I’ll probably continue to put up with the quirks for payouts like those.

Bottom line

I recently had a hotel stay where I clicked through from a targeted Capital One Shopping offer and made my booking more than 8 months in advance of the stay. Sure enough, the rewards did post to my account after the stay was completed. That’s exactly how shopping portal rewards for hotel stays generally work, though I wish Capital One Shopping would add the expected rewards after booking rather than showing an “ineligible purchase” until after travel is completed. Still, whether you use Capital One Shopping or another site, you should definitely be looking to stack paid hotel bookings by stacking those easy rewards — and accounting for hotel credits tied to specific rewards program booking engines as being worth less than face value, even if not worthless.

Will these hotel offers work properly when the only option is to prepay a deposit and pay the rest in full at the hotel? I have received lucrative offers that were for HostelWorld.com. However, Hostel World only gave me the option to prepay a portion. That portion has now tracked, but not the full amount that will be due upon check-in. Will Capital One see the full charge later or is it done differently when hotels charge the rest at check-in?

Thanks for the info. I’ve been using capital one shopping a lot the last 9 months some of their offers are just amazing.. Like 33% back at Hilton or $70 back at Crocs… Teaching had mostly been ok but several hotel stays had issues. My support tickets have always gone my easy and credited. I would agree unlike top cash back sometimes the transactions don’t appear or you’re unsure if the actor did track. I wish they would fix that part.

Really useful data point. Thank you. I’ll add one myself and amend some of my previous comments. I have complained in comments (for a long time) about emailed rate offers not working or even displaying correctly in teh browser plugin after clicking an offer from an email. However, I stopped using that browser and set up a new browser profile (in Edge, fwiw, vs. previously in Firefox) and voila! Everything has been as smooth for me as for Nick. So for people having trouble I recommend you set up a fresh browser profile, install the C1 Shopping extension there, and see if you have better success.

Did anyone do VRBO yesterday? Is it tracking as pending or ineligible? Mine is the latter. I hate rolling the dice until after the stay.

I did the VRBO offer the night of January 20. It hasn’t tracked yet. How long did yours take to even show as ineligible? At the same time I booked the Trip.com $50 off $50+ and it is now showing as tracked but as ineligible.

You left about $60 of Best Western points on the table! They are an EASY (and quick) status match to Diamond Select which earns a 50% bonus. Also the status “sticks” for years — a decade for me despite only one stay.

Yeah, you’re right. I had Diamond for years on one of those matches and never used it. Didn’t have it anymore and didn’t even think about it until I was checking out. A miss for sure!

I think Rakuten->MR (and through 5/15 Bilt) negates the importance of the 8-12x premium credit card portal bonus, because as you note you can often find Agoda etc. on Rakuten for ~10x. The difference is the time value of points – receiving the points within a month versus playing the waiting game on stays that may not be for 6 months out and then waiting another 1-2 months for the points to post. Not for the faint of heart perhaps, but still, excellent value can be had with Rakuten, COS, etc.

(I put AA Hotels / AA Exec Card in a different category because you get 10x from the card but then the AA Hotels offer can be another 15k – so while you always have to run the math you can get outsized value there and actually get miles not gift cards).

Thanks for sharing your experience, Nick. Hope you had a fun time in Strasbourg at the Christmas markets. Would you go back to Strasbourg a different time of year if there were no Christmas markets to visit?

These scheduled posts make you look like a shill, “by the time this post is published”, all the time….. just hit publish when you are done!

Not sure what that has to do with being “a shill”, but we publish on a regular schedule so that the headline at the top of the daily newsletter isn’t a quick deal about a promo to earn 1,000 Hilton points or something, but rather a longer, more in-depth post like this.

Glad this worked out for you….I no longer use Top Cash Back after a very negative experience attempting to receive the cash back for a Marriott stay.

I clicked through on the promotion, I followed all the rules, it tracked properly and then one day, a few months later, the status was “denied”.

Opened a trouble ticket with TCB and the best answer I could get boiled down to: you didn’t do anything wrong, Marriott just decided to not pay out” Marriott? or TCB????? I wonder. We already remember the one that did us wrong.

Very lame.

“I have earned more than 5-figures worth of rewards from Capital One Shopping”

Does this mean you’ve earned 6-figures of COS cash back??