NOTICE: This post references card features that have changed, expired, or are not currently available

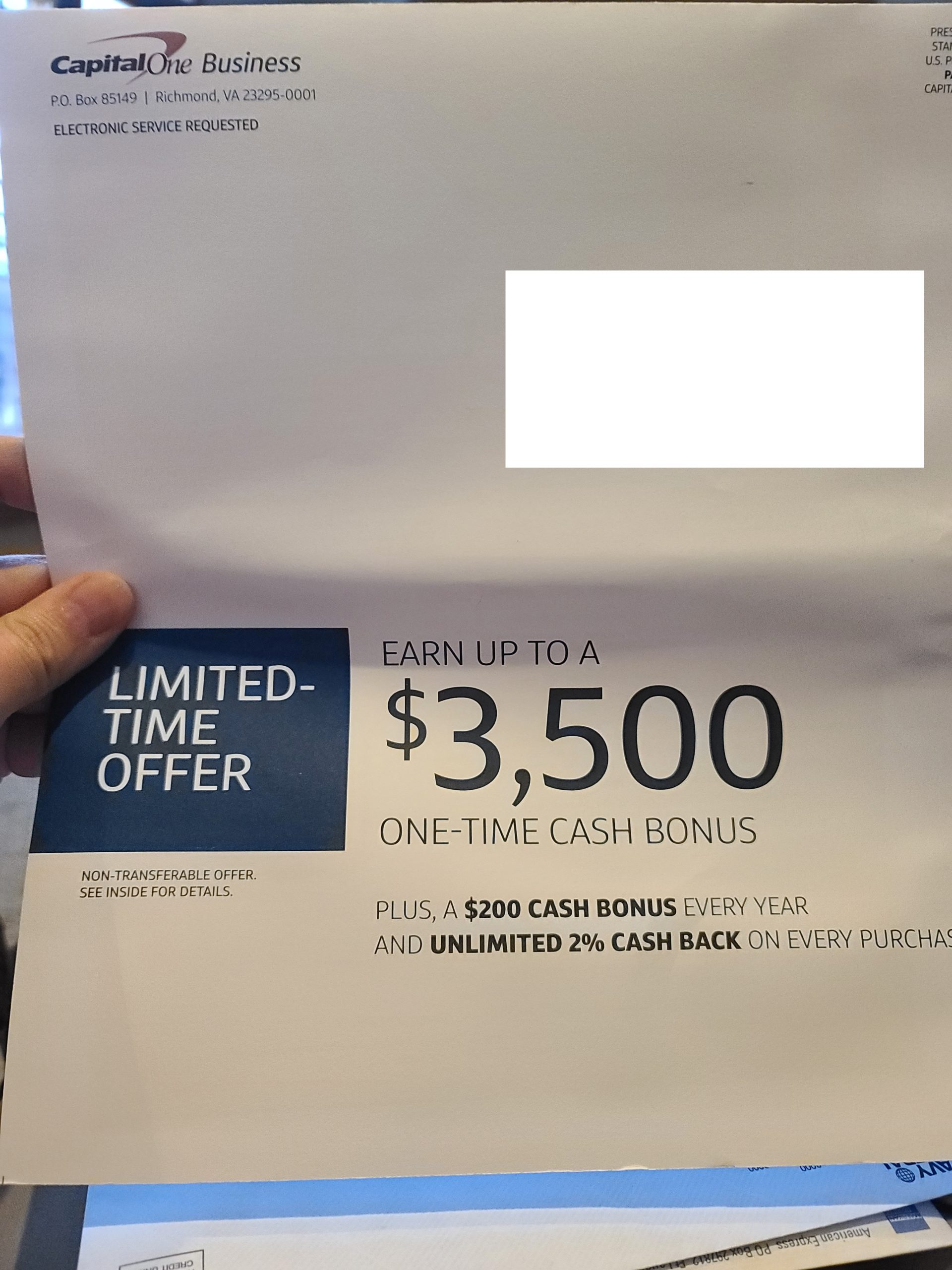

A few readers have reported receiving a targeted mail offer for the Capital One Spark Cash Plus card that is even better than the current public offer (which we wrote about here): Earn $3,500 in total cash back bonus: $500 cash bonus after $5,000 in purchases in the first 3 months and $3,000 additional cash bonus after $50,000 in purchases in the first six months.

The current public offer on this card is for a still-huge $3,000 total cash back after the same total spending requirement (read more about that current offer here), but this offer kicks it up another five hundred bucks. That’s awesome for those who receive the mailer and can meet the spend.

Remember that this card earns 2% back everywhere, so this is a total of $4,500 back after $50K in total purchases. Since you should be able to transfer that cash back to miles on a Capital One Miles card, it could alternatively become 450,000 airline miles. That’s a pretty fantastic bonus for a single card.

As we noted in the post about the public offer, this offer won’t make any sense for those without large expenses and/or for those who are otherwise willing to open five or six different credit cards, but for someone with high expenses and a desire to open just one card right now, this could be a great option.

I assume this mailer isn’t very widely targeted, but it’s worth keeping an eye on your mailbox if you have this card in mind.

H/T: THEsocalledfan

Any tips to getting targeted?

I have a good long-standing relationship with Capital One – have Quicksilver and Spark Cash for 8 years or so. I haven’t been using either of them actively in a while though.

Lately I have not had much luck with Capital One. They rejected my application for Savor a couple of years ago. They rejected my Venture X a couple of months ago.

I’m happy to keep trying once in a while for offers like this one. I just wonder if it would make it better if I closed my existing Spark Cash. Any suggestions?

I’m not sure it’ll make a difference, so I probably wouldn’t close it unless you want to close it anyway. On the flip side, I have heard of people getting approved for a second Spark Cash. Still, if Capital One doesn’t like you, they may just not like you. While it’s possible that closing would free up room if they feel like they’ve got you at the max exposure they want to extend, I am far from confident that it will make any difference.

So, that is my thumb in the photo; I shared this with Nick. Note, I applied and was approved for Venture X about 2 weeks before I applied and was approved for this card. Key with Capitol One appears to be saying you will run balances, and I even said I regularly do cash advances for this one…..

Thanks, I forgot to hat tip you!

Do you have an existing business card with Capital One? I’m wondering whether or not that’s a requirement of getting an offer of this sort.

I’d love to hold out hope of getting this offer, but since I don’t have a business card with C1 already I’m not sure if there’s any chance.

No. I did have a spark card in the past to get a measly $500 for but long closed; seems kind of foolish now!

Thanks! I’ll keep my fingers crossed for a bit that I get a mailer.

I got the Venture X card a couple of months ago. Doesn’t that mean I need to wait for 6 months or so before I can apply for this?

And like AB asks, can one meet spendig by paying taxes @ 2% to 2.34% or do you get your greedy fingers chopped off?

I cannot naturally spend $50K in so short a time but I did just refer someone for the Venture X and he spends more than that every month in his business.

Is there any technique to being targeted by Cap One?

Also interested in the answer to this.

I’ve seen one person claim that they were approved even though they had recently gotten the Venture X, and another person claim that they were rejected for the 6 month rule.

I’ve seen several reports of people getting approved for the Venture X and Spark Cash Plus in close proximity, so it seems that the 6-month rule is more spongy than set in stone.

Paying taxes certainly shouldn’t be a problem. That’s a totally legitimate expense. We’ve paid taxes plenty of times with our Spark Cash card.

That’s worth trying my hand at MS. How does Capital One feel about gift card purchases?

Tough question to answer. Some people get shut down, others don’t. I’ve bought plenty of them with my Capital One cards, but that doesn’t necessarily mean that you can or should. As always, your best bet is to ramp up slowly.