Update 2/23/24: We’ve now received word that this increased offer will be ending on March 11th, 2024.

~~~

The Capital One Spark Cash Plus Business card is out with a new welcome offer worth up to $3,000 in cash back. While the spending requirement is high, this could make for a good return for someone who has a high capacity for spend and/or low tolerance for many new cards. We’ve reported in the past that Capital One cash back can unofficially be transferred to miles cards at a rate of $0.01 per mile (indeed my wife has converted cash from her Spark Cash card to miles on both her Capital One Venture Rewards card and mine), so you may alternatively be able to get even more value out of the cash back as transferable miles.

The Offer & Key Card Details

| Card Offer and Details |

|---|

$1200 Cash Back ⓘ Affiliate Earn a one-time cash bonus of $1,200 after $30K spend in the first 3 months. (Rates & Fees)$150 Annual Fee Recent better offer: Expired 3/14/22: $3K after $50K spend in 6 months FM Mini Review: This may be a good option for business owners who prefer simple cash back rewards. Note that this is a pay-in-full card, so your balance is due in full every month. Earning rate: 2% everywhere ✦ 5% on hotels and rental cars booked via Capital One Travel Base: 2% Card Info: Mastercard issued by CapOne. This card has no foreign currency conversion fees. Big spend bonus: Get $150 annual fee refunded every year you spend at least $150,000 Noteworthy perks: No foreign transaction fees ✦ No preset spending limit |

Quick Thoughts

Given the huge spending requirement, this bonus won’t make sense for those with limited spending capacity. Obviously $100,000 in spend could alternatively be used to trigger many, many new card welcome bonuses.

Even the first-tier spend will be a non-starter for many…$20K is a big number. With the Amex Business Platinum still hanging out at 150K Membership Rewards points for 25% less minimum spend, it’s certainly worth comparison shopping to make sure that the Spark Cash Plus is the best fit for your situation.

However, if you have a business with high expenses and you either have plenty of capacity for all of the spending that you need to do or you don’t want to juggle multiple new credit cards, this bonus certainly could be attractive. Between the $3,000 total bonus and the 2% base earnings on that spend, you’d have a total of $5,000 in cash back after $100K in purchases. A return of 5% on that quantity of spend with a single card certainly isn’t bad.

That said, I’d personally be a bit hesitant about dedicating $100K spend on a Capital One card after the way they handled Greg’s Venture card account. They approved him, allowed him to earn the welcome bonus offer, and then closed his account and redeemed all of his miles at half a cent each. While I think the risk of that happening to any individual person is very low, Capital One’s complete unwillingness to discuss the matter with him or give him an opportunity to transfer miles rather than get only half a cent per Capital One “mile” reduces my enthusiasm about spending serious bling on a Capital One card in a short time span. On the other hand, since you would be earning cash back on the Spark Cash Plus card, you don’t run the risk of getting rewards redeemed at suboptimal value.

Keep in mind that the Spark Cash Plus is a charge card. That means there is no preset spending limit. It also means that the balance is due in full each month. The annual fee on this card makes it a poor value proposition long-term unless you need to spend a lot of money each month. There are a number of 2% cash back (or 2x transferable points) cards on the market with no annual fee if your expenses are not so high as to need the additional spending capacity of a charge card.

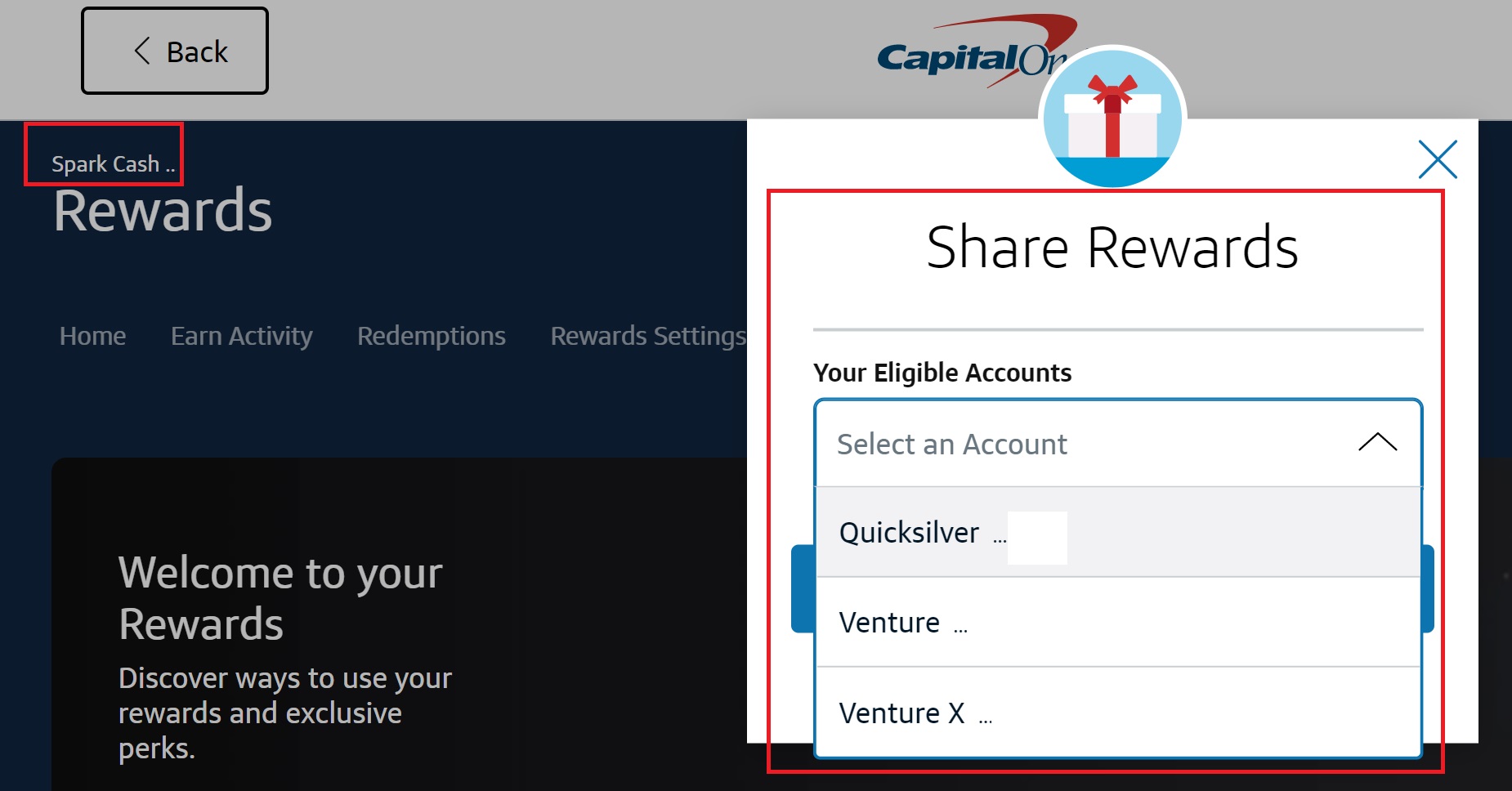

As noted at the top, it may be possible to convert the cash back earned on this card to miles. That isn’t a published Capital One program benefit. However, we reported couple of years ago that cards that earn cash back can transfer that cash to cards that earn Capital One miles at a rate of $0.01 per mile. For instance, my wife has a Spark Cash card (the old credit card version) and within her online account, she can easily move cash back earned on that card to miles on her Venture or Venture X cards.

My wife has even called the number on the back of her card and transferred that cash to miles on my Venture card. Again, there is no guarantee that this capability will be available for all cardholders nor that it will last forever, but thus far it has been working. YMMV.

Overall, the spending requirement on this new bonus makes it a tall order for most, but for some the big influx of cash (or potentially miles) could make it worthwhile.

![[Aug / Sept ’24 added!] Baseball fans: Capital One once again has great seats for 5,000 miles each a man taking a selfie in a baseball stadium](https://frequentmiler.com/wp-content/uploads/2022/07/NY-Mets-seat-location-for-Capital-One-cardholder-seats-218x150.jpg)

Imagine if a card offered 15,000 points for $5,000 spend as a sign up bonus. Multiplying by 20 doesn’t make it more tempting.

I think there’s probably a fair amount of folks out there that would be tempted by the first half – 190K points after $20K in spend (including the 40K that you earn from the spend itself). That’s not terribly different from the Business Platinum 150K after $15K (or 165K if you add the points from spending), which is very popular…but with the Spark you pay $545 less in annual fee. From my POV, the current Venture X Business offer is better, but I can see why this does appeal to some.

How often does Cap1 bring this offer back?

worth applying given Capital One’s 1/6 rule? I got the venture X 3 months ago.

How about an article on how much more in cashback or miles one could make with multiple signup bonuses for a total of $50,000 pending across all the selected new cards you choose which primarily rewards in cashback like this one. Even if the timeframe is shorter for some cards (3 months instead of 6 months) we could stagger when we apply. I wonder how much better it would be to get multiple card offers for cashback and percentage of net gain (this bonus being 8% while others could be 10%, 12% and so on. And, don’t use anything like Amex Membership reward cards since I and others have had bad experiences with AMEX (I’ve written them off after their RAT team took away over 200,000 points from us).

And, Amex could even see we were using all the points for months toward charity through their own charity program, and were about to give the rest of the 200,000+ MR points to charity again. I think someone didn’t like the charity I had chosen which was one of many choices their own program gave people. Someone must have had a biased against the charity and didn’t care that people were being helped. They clearly saw, as I pointed it out to Amex, our history of where all our previous points went. Such scrooges.

[…] high minimum spend. Could fit someone with a business that spends a lot. If interested, here is a post with more analysis of the offer. If this card is a fit for you, please use my Credit Card links to apply, thank you. […]

Love this card and offer. My wife got a total of 6 spark cards several years ago when they had the same sign up bonus.

Seeing as this is a Cap One Business Card, would this be able to be used at plastiq for daycare and auto loan purchases. Based on the chart you have, it seems like it would?

Scratch that. It looks like this would not work with auto loans, only tuition/daycare

Does the question mark in the title mean you think there’s a real chance that you won’t be able to convert the cashback to C1 miles?

Or are you just hedging against a minute chance that they change their minds, but don’t really believe it would ever happen?

The $3000 will be taxable.

Why would you think that? I’m not a tax advisor, so consult with yours, but the precedent cited by most is that credit card rewards, including welcome bonuses, are considered rebates and as such are not considered income and therefore are not taxable. I’ve never heard anyone claim otherwise.

Oh, my mistake then. I thought it was non taxable if it wS miles or points.

I think what he has in mind is that either the $3000 will count as profit for the business and be taxed, or the business won’t be able to write off the full $50k in expenses (minus the usual 2% cash back), which is another form of tax. I know businesses that only spend on cards that earn points/miles instead of cash back for this reason. This is different than the bonus on a personal card, which is a rebate on a personal expense and has no tax consequences.

Nick, was Greg using creative techniques on his spend when he got shut down? I know you talked about it on the pod, but don’t remember…… I just got venture x before this opportunity, and trying to figure the best way to do my 10 k there then potentially 50k on this, and yes, I will need to be creative….. 🙂 trying to gage my risk.

Not. At. All. Only legit spend. If Greg had done anything even marginally questionable, I wouldn’t still be mentioning it in posts — it would have been a blip on the radar noting that if you play with fire you might get burnt. Instead, all he did was legit spend on the card, which is what made it all the more frustrating that they stonewalled him on it.

IF you can convert the cash back to miles, fine. But, you have to redirect $50k of spend from other sign-up bonus opportunities. With only $35k or so in spend, one could obtain (if eligible) roughly 500k on Amex. Capital One continues to un-impress.

See the commenter below you. Some people don’t prefer to open the number of cards required to do that. I’m obviously not arguing that you’re wrong, just that some people have different goals and desires and that’s OK, too.

Indeed. For some, their favorite color is red. For others, it’s blue. Absolutely. I have a TON of points at airlines and cash back is my objective. So, in a way, I’m in this camp. But, for me, I’ve tried and tried and tried to give Capital One a chance — kind of like Southwest as an airline — ha — there always seems to be better opportunities. For James — below — excellent and congratulations.

how earn 500k MR?

Amex Platinum, 150k plus 10X on restaurants, $6k spend

Amex Business Platinum, 150k points, $15k spend

Amex Gold, 60k, $4k spend

Amex Business Gold, 70k, $10k spend

Amex Green, 45k, $2k spend

Not close to $50k spend yet and one is at a (regular) bonus of 475k points. Valued at 2 cents if transferred. We’re talking almost $10k in value. Throw in the restaurant pop on the Platinum and one is easily there.

For reference, the Platinum restaurant pop is 10X on $25k spend = 250k on top of the 150k sign-up bonus. So, we’re looking at over 750k points for $56k in spend.

YMMV

Real, legit spend. Never MS. Over the past 18 months, Amex offered huge opportunities, including referral bonuses. The Resy Platinum offer was 500k alone if maxed out. Then, there was the uncapped 3X bonus at the end of 2020. Those who were able to capture it added that 3X to the Green Card’s 3X on travel and dining for a total of 6X. Or, to the EDP’s 1.5X for all other spend, they were getting 4.5X. If one is a legit high-spend family, one cleaned up. Opportunities are always coming along.

Just applied and was instantly approved. It’s a lot to spend/churn, but I strongly prefer bigger bonuses on fewer signups (from 5/24, just general card maintenance). I also plan to get the Venture X later on, so 500K+ points from two SUB is worthwhile to me.

Did exactly the same with Venture itself to boot. While I recall Greg’s unfortunate experience, I have to wonder whether part of it is/was based on who Greg is (I DONT CONDONE CAP1 AT ALL IF THEY DID).

how picky is cap1 on churn/gift card buying?