NOTICE: This post references card features that have changed, expired, or are not currently available

A family member received a good targeted offer on the Capital One Quicksilver card. While this card isn’t a terribly exciting card to have and hold, it could be worthwhile for the bonus, particularly for those newly dipping their toes in the Capital One ecosystem given the way you can move rewards from one card to another.

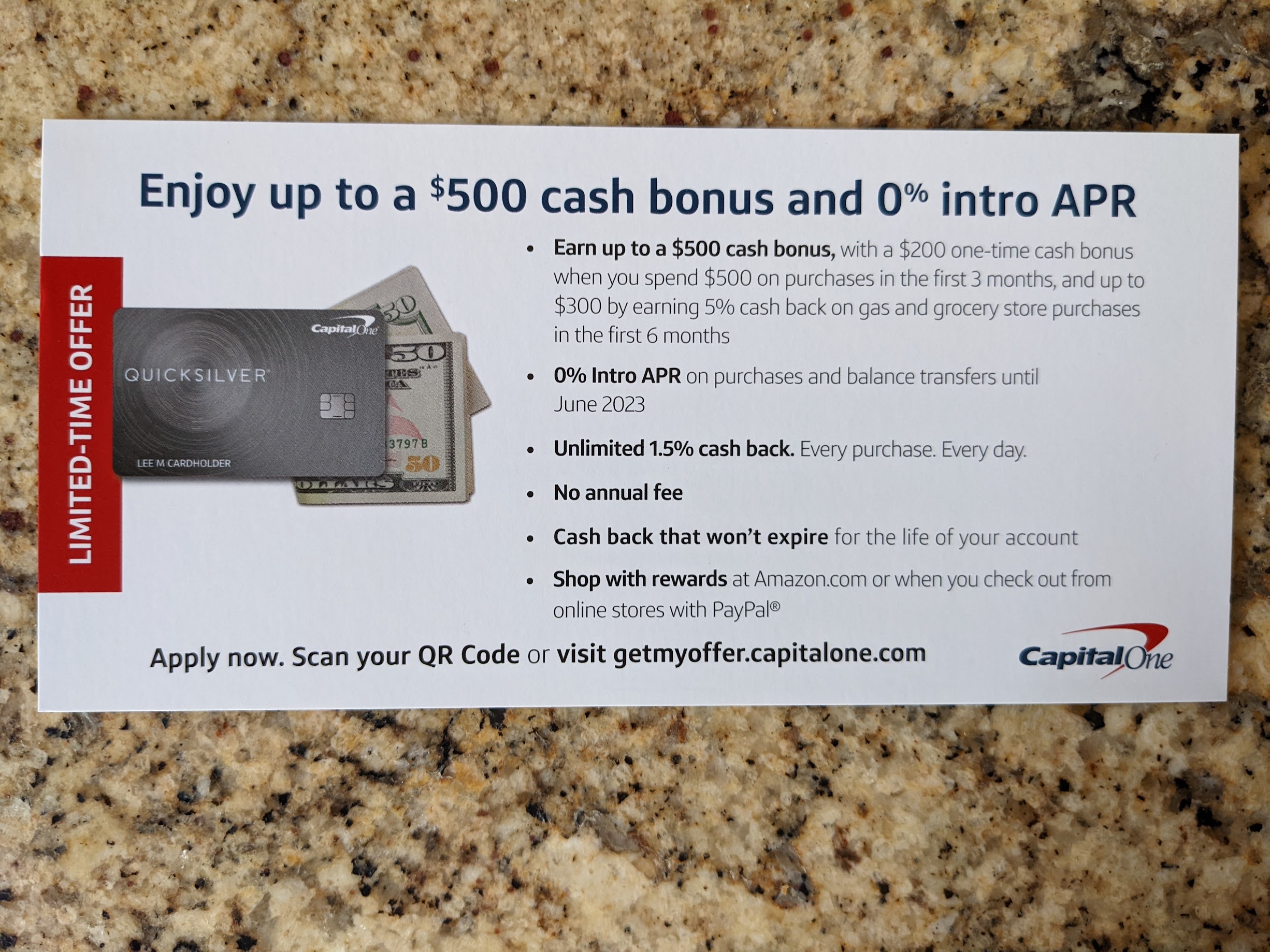

The Deal

- There is a targeted mailer offer going out to some customers to earn up to $500 cash back with a Quicksilver card as follows:

- Get $200 back after $500 in purchases in the first 3 months

- Get 5% back on gas and grocery store purchases for the first 6 months up to $300 back

Key Terms

- Targeted offer that requires a QR code or invitaiton code

Quick Thoughts

This is a targeted offer that a friend received via direct mailer. Interestingly, the back of the pictured insert indicated that being targeted indicated high likelihood of approval (no idea how accurate that is). The family member who received it previously had a GM card with Capital One and Goldman Sachs just recently took over that portfolio, so maybe this has been sent to good customers who no longer have Capital One cards.

The Capital One Quicksilver card has no annual fee, but it only offers 1.5% cash back on all purchases. That’s a relatively poor return; there are plenty of cards on the market that offer a flat 2% back everywhere with no annual fee. It just wouldn’t make sense to make this card a regular feature in your wallet.

That said, this targeted bonus might make it quite appealing for those looking to gather Capital One miles. While the Quicksilver is a cash back card and thus the rewards it offers are in cash back, Capital One allows rewards to be moved from a cash back card to a miles card at a rate of $0.01 = 1 mile. In other words, the $500 welcome bonus here could be converted to 50,000 miles by moving the rewards to a card that earns miles.

In my household, my wife has moved cash back from her Capital One Spark Cash card to her Venture and Venture X cards and also to my Venture card. Moving rewards between your own cards can be done online, but if you want to move your rewards to another cardholder you need to call the number on the back of your card to do so.

Even for those who aren’t interested in converting this bonus to miles but rather are more interested in cash back, this is a decent intro bonus, though it’s not quite as good as it sounds. The 5% bonus categories really only represent a bonus of 3.5% since you would otherwise ordinarily earn 1.5% cash back on all purchases with the Quicksilver.

In other words, you’ll earn the initial $200 bonus with $500 in purchases. Separately, you earn 5% back on gas and grocery on up to $6K in purchases. That maxes out at $300 back on $6K in the bonus categories. However, you’d ordinarily earn $90 in cash back on $6K in purchases with the Quicksilver card (at 1.5% back), so you’re really earning a “bonus” of $210 on that spend (and if you have a 2% back card from some other issuer, the “win” drops to $180 additional cash back on the $6K in purchases. That’s still a win and it may be appealing, I just think it is important to consider the comparison points.

Capital One does sometimes allow product changes (they call them “upgrades” even when changing to another card with no annual fee), so you may be able to convert this card to something else down the road if you don’t want to be stuck with a Quicksilver card forever, but keep in mind that Capital One’s criteria for product changing is not at all clear. There’s no way to know for sure whether you’ll be able to product change.

I’d probably skip this offer myself, but I could see it being appealing in the right circumstances.

I’m getting a $39 annual fee and NO SOB from their pre-approval website.

Looking to keep my points without paying the AF next month on my Venture card. They don’t have a retention depatrtmant(!?) and the 3 different agents I spoke to all couldn’t say whether they could waive the AF until it posts- and they can’t offer me a card on the phone, I was told to use that tool only and figured it would take awhile to get/set up to transfer the points over.

Any suggestions guys?

THANKS

I don’t put much stock in the pre-approval tool. In this post about the Venture X card, I noted that several people who were “pre-approved” for the Venture card got denied for the Venture X and my wife, whose only offer via the pre-approval tool was for a *secured* card, got instant approval for the Venture X. I’ve seen DPs from others who have seen a pre-approval for a card only to be denied for it. Again, I just don’t have much faith in the tool as a useful indicator of anything.

https://frequentmiler.com/everything-you-want-to-know-about-capital-one-and-the-venture-x/#Is_the_Capital_One_preapproval_tool_a_useful_indicator_of_likelihood_of_approval

Thanks, Nick!

I was able to tell the tool that I didn’t like their offers and that link took me to all there cards where I found a no AF, $200 SOB for SAVORONE card and applied. Was denied, letter to follow.

Capital One is a shit show if you ask me.

There’s an upgrade link that allows you to login in and upgrade your card, if there’s upgrade is available for that card. I recently upgraded a QuicksilverOne to a VentureOne using that link. Unfortunately you can’t upgrade to the Savor or SavorOne using that link. I spoke to customer service you have to apply for the Savor Cards. Upgrades to them are rarely if ever available. I found that link on various websites and a few YouTubers have done videos on it with the link available in their bio.

Any recent data points on converting a Quicksilver to another card? I’ve had one for years and would love to convert it to something useable. (Particularly now that I have the Venture X).

I got a $300 with $500 spend offer, that’s probably better..