NOTICE: This post references card features that have changed, expired, or are not currently available

| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

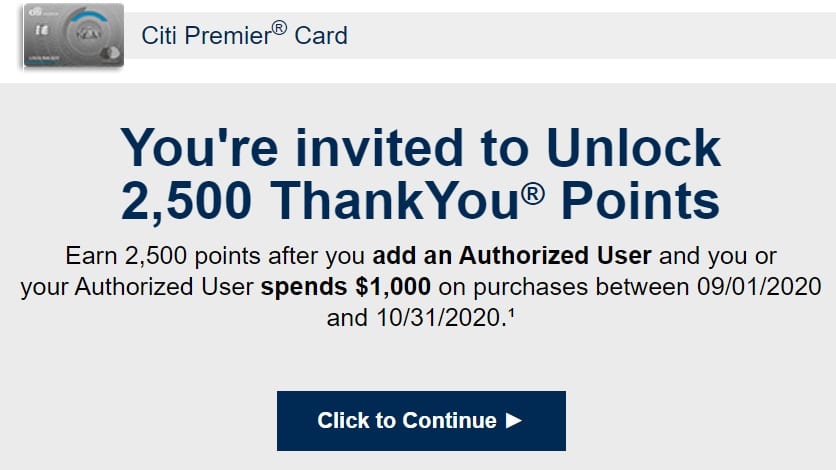

Citi has been sending out targeted emails to some cardholders offering bonus points when adding an authorized user and meeting a spend requirement. Unlike usual authorized user bonuses though, this one doesn’t require the AU to be the one to actually complete the spending.

The Deal

- Add an authorized user to a Citi credit card & get 2,500 bonus points when you or the authorized user spends $1,000 on purchases.

- The same number of bonus points are on offer for spending $1,500 or $2,000 based on additional data points in the comments below.

Key Terms

- Activation required.

- Expires October 31, 2020.

- Balance transfers, cash advances, checks that access your Card Account, items returned for credit, unauthorized charges, interest and account fees, traveler’s checks, foreign currency purchases, money orders, wire transfers (and similar cash-like transactions), lottery tickets, gaming chips (and similar betting transactions), Citi Flex Loans and the creation of Citi Flex Pays, are not purchases.

- All purchases must be made during the promotional period.

- ThankYou Points earned will be posted to the primary cardmember’s account in 1-2 billing cycles.

- This offer may overlap with other special offers in which you are currently enrolled.

- Offer is limited to one bonus points award of 2,500 ThankYou Points after conditions are met.

- In order to qualify for this offer, the account must be open and current at all times. If your account is closed for any reason, including if you convert to another card product, you may no longer be eligible for this offer.

Quick Thoughts

As mentioned earlier, one of the great things about this offer if you’re targeted for it is that the authorized user doesn’t have to be the one who completes the $1,000 in spend. You could therefore add an authorized user and spend $1,000 on your own card to trigger the 2,500 bonus point offer. That could be far more convenient if you’d be putting spend on your own card anyway.

That can be stacked with other bonus categories to make it even more rewarding. For example, I received this offer on my Citi Premier card. That now earns 3x at grocery stores, so this AU offer makes that a total of 5.5x on $1,000 of spend.

I seem to be in Citi’s good graces because they also recently targeted me for a 5x offer on up to $625 of spend on certain store categories including consumer electronic and home improvement stores. Other people were targeted for a similar offer but for grocery stores and drugstores (among others), so that $625 of spend can help contribute towards this bonus requiring $1,000 of spend.

Seeing as Citi sent out targeted offers of at least two varieties for that 5x deal, they might have done something similar with this AU bonus. Let us know in the comments below if you received a different version of this $1,000/2,500 ThankYou points offer.

[…] (Targeted) Citi: Add Authorized User & Get 2,500 Bonus Points When Spending $1,000 (Expires 10/31/20) […]

2,500 Typ’s for $1500 spend for me. No thanks, would rather work on a real sub

Thank you for the additional DP 🙂

My offer on the Premier was: Earn 2,500 points after you add an Authorized User and you or your Authorized User spends $2,000 on purchases between 09/01/2020 and 10/31/2020.¹

As I’m currently working on a SUB, I’ll miss out on this.

Thanks for the DP – I’ve added that to the post.

Stephen, do you happen to know what date Chase sees when you add an AU to a Citi card for purposes of 5/24? Is it the date the AU is added or the account open? I know you can talk Chase out of AUs for 5/24 but it is a bit of a hassle and puts eyes on the application So application date would be nice.

I’m afraid I’m not sure – I have the same dilemma with deciding if I want the hassle in the future as my wife is under 5/24 too.