| Sorry, this deal is no longer available. Do you want to be alerted about new deals as they’re published? Click here to subscribe to Frequent Miler's Instant Posts by email. |

|---|

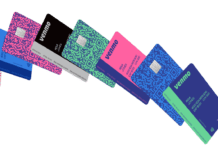

Some Venmo users are receiving a targeted email offer to get double cash back for six months. That turns the Venmo card into a potentially compelling offer for those targeted.

The Deal

- Venmo is targeting some users to get double cash back for the first six months when opening a Venmo credit card. Targeted users have received an email with the subject line, “You’ve been selected for a double cash back offer” valid through 12/31/25. It may also be possible to find the offer within the Venmo app.

Key Card Details

Note that if you click the card details below, you will go to our card page with current public offer information, not the targeted bonus outlined in this post.

| Card Name w Details No Review (no offer) |

|---|

No Annual Fee Earning rate: 3% on your eligible top spend category ✦ 2% on your second top category ✦ 1% everywhere else ✦ Eligible cateories include Dining & Nightlift, Travel, Bills & Utilities, Health & Beauty, Grocery / Warehouse Stores, Gas, Transportation, Entertainment Base: 1% Card Info: Visa issued by Synchrony. This card has no foreign currency conversion fees. |

Quick Thoughts

The Venmo card ordinarily offers 3% back on your top eligible spend category each billing cycle and 2% back on your second highest spend category out of the following categories: Dining & Nightlife, Travel, Bills & Utilities, Health & Beauty, Grocery / Warehouse Stores, Gas, Transportation, Entertainment. All other purchases earn 1% back.

Those targeted for the double cash back offer would earn 6% back on their top category from that list and 4% back from their second-highest category along with 2% back everywhere else. That’s a really solid offer for six months if you have a lot of spend to do in one or two of the qualifying categories. The inclusion of Warehouse Stores is of particular interest for many since it represents the best return for those purchases, though getting 6% back on utilities, gas, and dining could all be compelling choices for those who spend a lot in those categories.

You should obviously weigh the return here versus what you might earn by putting the same spend toward other welcome offers, but even without the bonus this card is worth it for some for the chance to earn 3% back at warehouse clubs. Getting 6% back for six months is as good as it gets in terms of a welcome bonus on this card as far as I recall. Keep in mind that the offer is targeted and may come via email or within the Venmo app.

I don’t see listed the % for using the card on actual Venmo spend in the app. Would that fall into the 3% category?

Nope. The potential categories for 3% are listed in the post:

Do we know how sensitive Synchrony is to manufactured spending?