Update: Apparently past performance is indicative of future results after all considering the shenanigans they pulled last year.

Right on cue, a rep from The Motley Fool reached out to advise the following:

I just wanted to let you know that Airline rewards offer terms and conditions state that their offer cannot be combined with other offers, like the Amex.

Obviously, we’re thrilled with anyone who wants to join our services and learn about The Motley Fool approach to investing, and we want to incentivize folks to give us a try. But for those interested in stacking offers, best to look elsewhere now, as there is not a double dipping opportunity and they won’t receive the airline miles.

It therefore looks like they’re on the lookout for anyone stacking the deal, so it’s likely that you’ll only receive the $50 statement credit from the Amex Offer or Citi Offer, but nothing from a portal or card-linked program.

I’m not sure how they’re planning on enforcing this. I guess they could ensure their affiliate program doesn’t pay out for anyone who pays for a $99+ subscription with an Amex card, but that could affect people who don’t have the Amex Offer loaded. If you have access to the Citi Offer, that could be a safer option because they’ll hopefully have a harder time identifying new subscribers who take advantage of that offer after clicking through from a shopping portal. (Update 2: It’s since occurred to me that The Motley Fool presumably gets passed some kind of payment information by Amex and Citi, so that might help them identify corresponding transactions through affiliate networks in order to decline the bonus miles.)

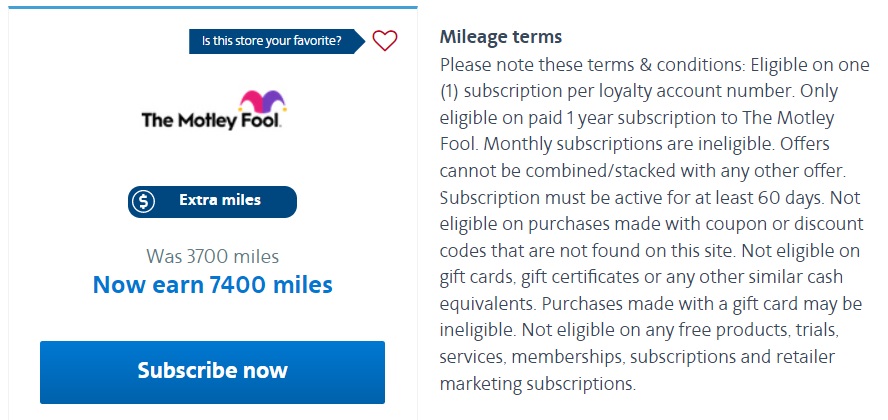

An alternative option would be to use the link on the American Airlines shopping portal which only charges $79 for Stock Advisor rather than $99. To find that option, look on the portal for the description for ‘A Full Year Of Recommended Stock Picks Now 60% Off. Valid through Mar 1, 2022’. You’d be getting 7,400 American Airlines AAdvantage miles for that along with 7,400 Loyalty Points, so just over 1cpp combined. While that’s not as good as the previous stacks would’ve ended up, those aren’t going to be an option. Thanks to Aaron for reaching out to highlight that option.

(Motley) fool me once, shame on you. (Motley) fool me twice, shame on me, but also shame on you again as well.

Here’s the original post.

~

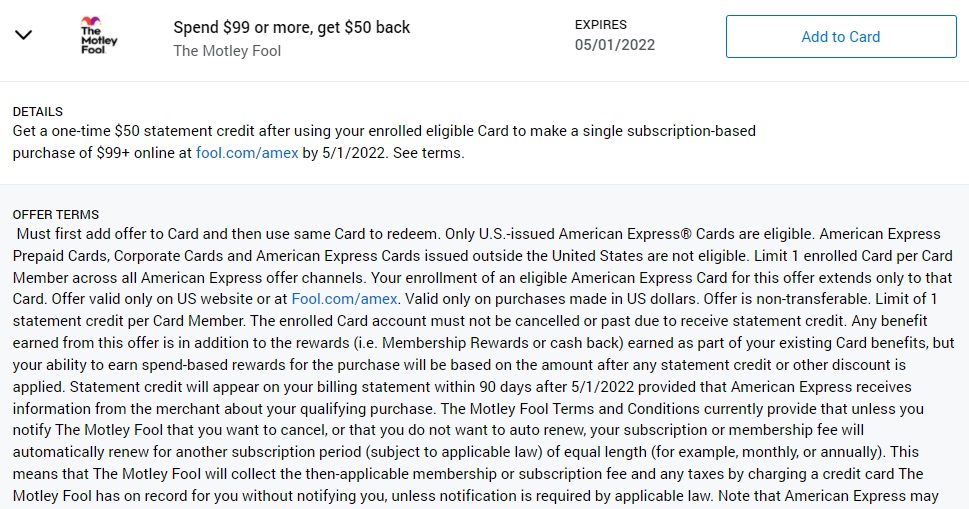

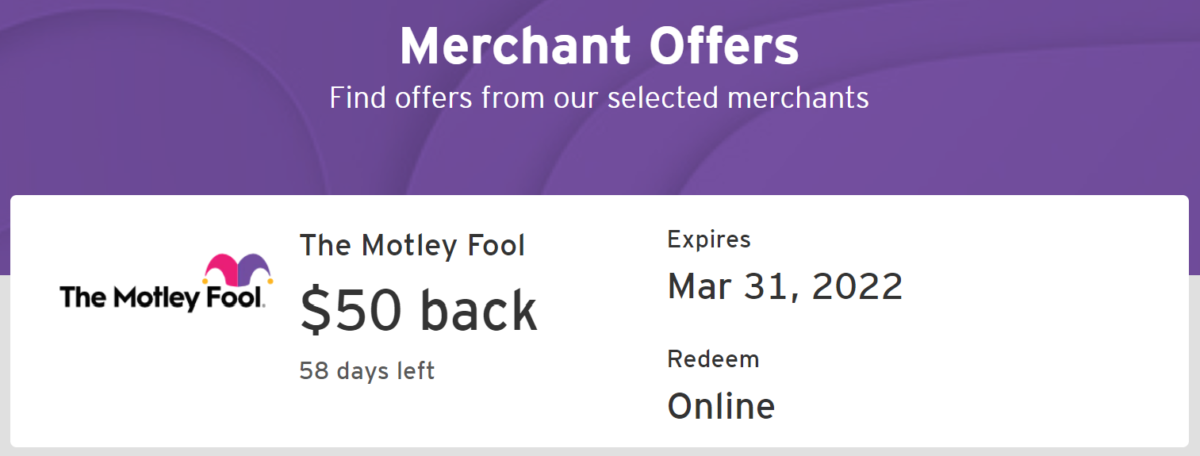

A new targeted Amex Offer for The Motley Fool showed up for some cardholders today which can save you 50% on an annual subscription. There’s also a similar offer for some Citi cardholders.

While those aren’t great deals in and of themselves unless you were planning on paying for a subscription anyway, the value received from shopping portal earnings can make this a profitable deal. It’s even better if you’re trying to earn American Airlines Loyalty Points as there’s a boosted rate through their shopping portal right now, but use caution with this offer.

The Deal

- Spend $99+ on a single subscription-based purchase for The Motley Fool & get $50 back with an Amex Offer or Citi Offer.

Key Terms

(Terms below are for the Amex Offer)

- Expires May 1, 2022.

- Offer valid only on US website or at Fool.com/amex.

- Valid only on purchases made in US dollars.

- Offer is non-transferable.

- Limit of 1 statement credit per Card Member.

- Statement credit will appear on your billing statement within 90 days after 5/1/2022 provided that American Express receives information from the merchant about your qualifying purchase.

- The Motley Fool Terms and Conditions currently provide that unless you notify The Motley Fool that you want to cancel, or that you do not want to auto renew, your subscription or membership fee will automatically renew for another subscription period (subject to applicable law) of equal length (for example, monthly, or annually). This means that The Motley Fool will collect the then-applicable membership or subscription fee and any taxes by charging a credit card The Motley Fool has on record for you without notifying you, unless notification is required by applicable law.

Quick Thoughts

Before going any further, a word of warning. The Motley Fool played stupid games with an Amex Offer last year.

As a quick recap, that Amex Offer gave $99 back when spending $99. That meant a subscription was free for the first year which was worth taking out when taking into account the high shopping portal payouts that were available when that offer first appeared. It was possible to make almost $100 profit which, needless to say, many readers jumped on.

Well, it was a great deal until The Motley Fool had buyer’s subscriber’s remorse from the other side. They decided that having all these new subscribers was wonderful, but they didn’t want to pay out for the portal earnings. They initially paused their affiliate program for shopping portals to prevent a double dip. Then, when it returned to portals, they quietly added terms that stated only plans more expensive than $99 would earn rewards through shopping portals.

There’s therefore a danger that they could try playing us for (Motley) fools for a second year, but we wanted to highlight this potential deal anyway because shopping portals don’t currently exclude the ability to stack the Amex Offer with earnings from their sites.

With that major caveat out of the way, for anyone currently seeking status with American Airlines the Amex Offer or Citi Offer could be a particularly great opportunity to also earn AAdvantage miles and Loyalty Points. Their shopping portal normally offers 3,700 bonus miles when subscribing to The Motley Fool which had been boosted to 6,200 miles recently. That’s now been increased further to 7,400 bonus miles which means you’ll earn 7,400 Loyalty Points too.

Provided the portal earns as it should (which is no guarantee given the issues with last year’s offer), the $49 net cost after the Amex or Citi Offer is more than offset by the 7,400 redeemable miles you’ll earn. The 7,400 Loyalty Points are therefore the cherry on top.

Note that the American Airlines shopping portal isn’t the only portal currently offering a higher payout on The Motley Fool subscriptions. Check Cashback Monitor in case there are points/miles/cashback that you value more highly than 7,400 AAdvantage miles + 7,400 Loyalty Points.

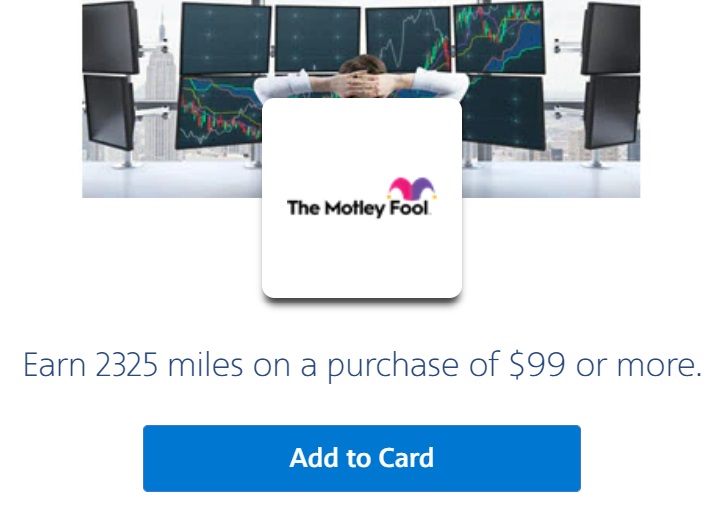

That’s not all though. If you have the Citi Offer, keep an eye out for a targeted SimplyMiles offer for The Motley Fool giving 2,325 bonus miles – and corresponding Loyalty Points – when paying for a $99+ subscription. This particular part of the stack is only available if you have the Citi Offer because the card-linked offers for SimplyMiles are only eligible when paying with a linked Mastercard, so Amex cards can’t be enrolled.

There’s an additional stack available thanks to the handful of shopping portals that use Collinson’s tracking network. There’s an offer for The Motley Fool on those portals that’ll earn you bonus points/miles on your subscription purchase which won’t conflict with regular portal earnings because Collinson’s offer is card-linked rather than tracked via cookies.

That means you can earn bonus points or miles with Caesars Rewards, Choice Privileges, Emirates Skywards or JetBlue TrueBlue by linking your Amex card to one of those portals. You can find the current rates for those card-linked offers here.

If you do take advantage of this Amex Offer, be sure to take screenshots of the shopping portal terms before clicking through so that you can make a claim in case The Motley Fool decides to pull their shenanigans again.

I’m guessing they’ll screw with me, but I tried a double dip, Amex and aa. So far miles seem to be pending and got email from Amex. Hopefully if they take back miles will be within 30 days.

Alive again

Can anyone post back if the 7,400 + SimplyMiles or the 7,400 + Amex payback have worked and STUCK?! We should know via others, what works and what does not. Hopefully. I have stayed away from the Motley Fool offer as many people have been FOOLED! Thanks.

Have you seen anywhere that it was clawed back?

Because there are plenty of people who got the triple stack

I received my 7,400 miles last week and it now says it is Confirmed within my AA Shopping account. I also used the $50 Amex offer and received the credit in my American Express account. Is there a chance the miles are clawed back even though it says Confirmed? I really do not want to have a situation where I get past the 30-day cancellation period for Fool and then lose the miles…

Given the fact that The Motley Fool is clearly on the lookout for people trying to stack these deals, it wouldn’t surprise me if they decided to claw back the 7,400 miles 31 days after people signed up, thereby meaning they couldn’t cancel for free. I don’t know if that’ll definitely happen, but it’s certainly a risk.

Interesting. I’m in the same situation as JoshP: Have the miles, got the Amex Offer credit. Trying to think this one through…

The advantage for play 2) is that there is an upside, while with play 1), once you make the call, the Expected Value is basically your loss. Tempted to let it ride here, unless some people think that Motley Fool can somehow compel or cajole Amex to take back the Offer, too.

Help wanted here.

Sorry, Comments renumbered my complicated Bullets path. Read 9) as a Summary of everything else; 2) 3) 4) as a) b) c) under option 1) ; 5) as option 2) ; and 6) 7) 8) as a) b) c) under option 2).

None of this will be on the test.

Where are we at with this? Worth trying the Shopping Portal/SM/CMO stack?

I can confirm the triple stack is working! Still waiting on Caesars card-linked points to pend, but so far for my Feb 1 order:

7400 AA Portal miles tracked same-day and posted 2 days after ordering

2325 SimplyMiles tracked in SM portal 5 days after ordering (not yet posted to AA)

$50 Citi Merchant Offer tracked 5 days after ordering (not yet credited but shows under ‘redeemed’ tab with yesterday’s date)

Still nothing on Caesars card-linked program, but I’m hopeful.

$50 Citi MO has credited to my card.

Caesars card-linked it showing as pending now for 2160.

Just waiting on SM to credit to AA and for Caesars to post to confirm the quadruple stack.

I’m really curious to try the AA Portal + SimplyMiles stack for 7400 + 2325. Please do report back if this works (and that Motley doesn’t claw it back for violating stacking rules). Thank you!!

Simplymiles posted to my AAdvantage account today. So I have been auto-credited my 7400 AA portal + $50 Citi merchant offer + 2325 Simply Miles. My Caesars points are still pending, but it tracked at least.

I am also waiting for the 2325 SM offer to post to AA. It is taking suspiciously long.

Did the 7400 for $79 offer on Wednesday and points just posted. Like others commented, I didn’t stack due to risk, but still a reasonable point/$ rate. But this helped me bring in just shy of 10k loyalty points in the first month of the year for under $100 spent.

Edit: My original comment mentioned it was difficult to call and cancel, apparently now it’s easier – you can just turn off autorenew.

7,400 miles starts posting, pending…

So far so good…didn’t stack due to risk but used only the portal offer. Interesting thing, though…the offer was $79 on mobile but $99 on desktop so I did the former and it’s now posted,

[…] Miler wrote about a potentially lucrative offer with Motley Fool through the AAdvantage shopping portal. What made it […]

I am curious which one would track if someone did a 2-, 3-, or 4-deep stack. I used Amex with the AA portal and the Caesars card-linked program. If Citi would ever give me offers, I would have done that instead of Amex and added SimplyMiles.

I assume at least one will (should) pay out, but does anyone know which one(s)? Did anyone last year let it ride to see what happened?

I did the 4 deep stack, and so far have my AA portal miles posted. Will update on the rest if they materialize.

Heads up – Simply Miles – ” View full terms & conditions

Offers may not be stacked or combined with other promotions. Only valid on the $99 Motley Fool Stock Advisor service.”

How does this work if you’ve previously gotten the miles from them over a year ago? Can I get them again (No amex offer). ?? Or is it a 1 time per AA account deal?

I think it’s one time per AA account. You could use a different portal instead, but that wouldn’t help with loyalty points.

I received 7,400 miles through the AA portal in Oct 2020, then didn’t renew the subscription and re-subcribed a few weeks ago (received another 7,400 miles). YMMV? Maybe once per year?

Did you happen to use the same email? I wonder if it’s AA tracking that via AAdvantage number or Motley Fool tracking if previous accounts sign back up.

Same email.

i got an email from AA about transaction pending. how about we reach out to AA if it doesn’t post within few weeks.

So we think this is a good idea to try or nah? I’m gonna do the portal/SM/CMO stack- Currently 0 for 1 on that (thanks Byte)

We have a 30 day moneyback on this. If it doesnt post by then, Ill just refund everything.

W.R.T. the warning from Motley Fool, I wonder if it will still stack with SimplyMiles.

wondering the same

Yes, I also want to know this!