NOTICE: This post references card features that have changed, expired, or are not currently available

Yesterday a Reddit user posted a live link to signup for the new Chase Sapphire Reserve card:

You may remember from other posts that this card was expected to go live on August 21st. The link released on Reddit was nearly a week early. We quickly posted a Quick Deal to let readers know about this unexpected link: Chase Sapphire Reserve Live Application Link Available & 5/24 Data Points. Later the same day, the application link died. Clearly it had been prematurely released into the wild.

You may remember from other posts that this card was expected to go live on August 21st. The link released on Reddit was nearly a week early. We quickly posted a Quick Deal to let readers know about this unexpected link: Chase Sapphire Reserve Live Application Link Available & 5/24 Data Points. Later the same day, the application link died. Clearly it had been prematurely released into the wild.

While it was available, the application landing page didn’t show a signup bonus, but many people applied anyway. They took a risk that the expected 100,000 point signup bonus would apply automatically or that Chase would match them to the bonus once the official offer was public.

While it was available, the application landing page didn’t show a signup bonus, but many people applied anyway. They took a risk that the expected 100,000 point signup bonus would apply automatically or that Chase would match them to the bonus once the official offer was public.

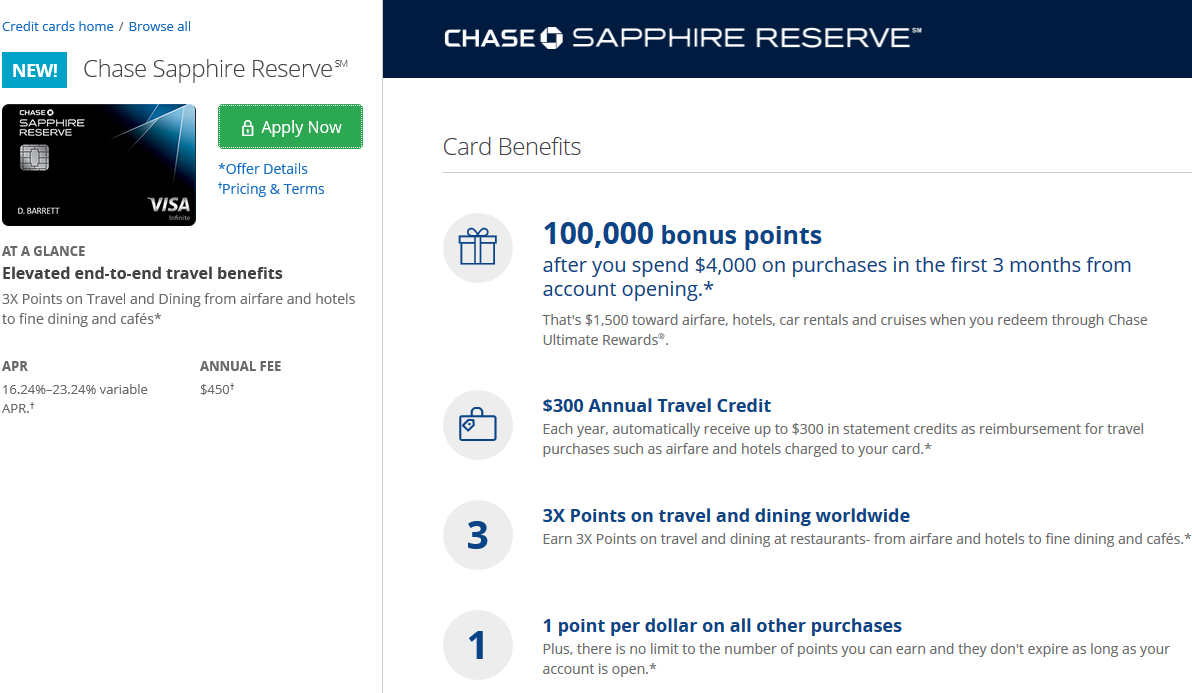

Then, someone else posted a link to a landing page that did show the expected 100,000 point signup bonus and many other details. The URL was clearly to a “dev” server (a site used for development of a web site and not meant for wide release). But, when people clicked “Apply” from this page, they were directed to the same link that was originally posted.

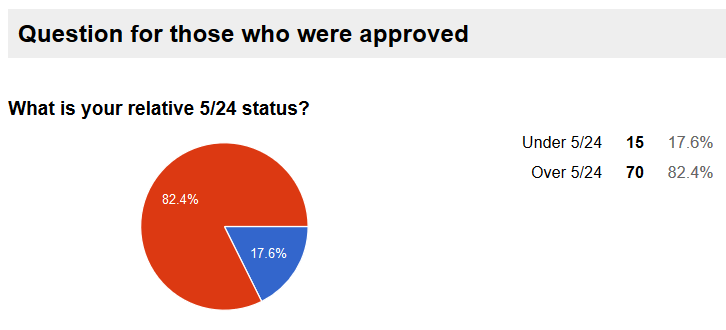

While the two links were alive, many people applied for the card. Interestingly, many were approved even if they were far over “5/24”. That is, even if they had opened 5 or more accounts in the past 24 months, they were approved. On Reddit, someone began collecting data about the approvals. Results can be found here. At the time of this writing, just under half of applicants reported that their application was approved (most of the rest went pending). Of those who were approved, more than 80% indicated that they were over 5/24!

Does this mean that the 5/24 rule doesn’t apply to the Chase Sapphire Reserve?

The information from this accidental application launch is intriguing but it doesn’t really prove anything. Clearly the 5/24 Rule was not in place yesterday for this card, but that does not mean that it won’t be applied later.

When the Chase Freedom Unlimited card was first unveiled, the 5/24 Rule was not initially applied to it, but Chase quickly corrected that oversight. If you are eager to get the Sapphire Reserve card, but you’ve opened 5 or more cards in the past 24 months, consider signing up for the Sapphire Reserve as soon as it becomes available for real (expected August 21, but it may appear sooner).

Also read my advice here:Get approved for the Sapphire Reserve 100K offer despite 5/24.

Answers to the $1200 question and other key questions revealed

Assuming the “dev” landing page (shown above) along with the linked offer terms was legitimate, we now have answers to a number of questions about the Chase Sapphire Reserve…

- The $300 Annual Travel Credit really is for any travel purchases. This means that car rentals, hotel charges, award booking fees, taxis, trains, etc. should all be reimbursed up to $300 per year!

- The $300 Annual Travel Credit is applied per calendar year. That means that those who signup soon could get $300 in travel credits this calendar year (2016) and another $300 next calendar year before having to pay a second annual fee.

- Authorized users do not get their own travel credits. Travel purchases made on authorized user cards do get reimbursed but it comes out of the same $300 per year bucket as the primary card. This was the $1200 question. We now know that the $300 travel credit is limited to $300.

- The card offers Primary car rental collision damage waiver

We also now have confirmation regarding a number of things we already knew:

We also now have confirmation regarding a number of things we already knew:

- 100K Ultimate Rewards Signup Bonus after $4K spend in 3 months

- 3X Travel & Dining

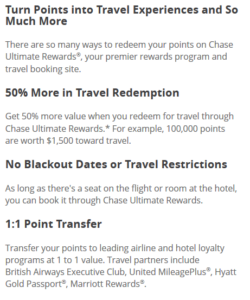

- Point Value: Use points for travel at 1.5 cents per point value.

- $300 in annual travel credits automatically applied to account for travel purchases charged to card

- Airport Lounge Access = Priority Pass Select

- Global Entry or TSA Pre Fee Credit

- No foreign transaction fee

- Points transferable 1 to 1 to selected airline and hotel programs

- Annual Fee: $450

- Authorized User Fee: $75 per year

- Issued as Visa Infinite

A lot of the new and confirmed information was found in the Offer Terms on the dev application site. Here are the terms, as found yesterday, in their entirety:

AT A GLANCE Elevated end-to-end travel benefits 3X Points on Travel and Dining from airfare and hotels to fine dining and cafés*

APR 16.24%–23.24% variable APR.†

ANNUAL FEE $450†

Card Benefits

100,000 bonus points

after you spend $4,000 on purchases in the first 3 months from account opening.*

That’s $1,500 toward airfare, hotels, car rentals and cruises when you redeem through Chase Ultimate Rewards®.

$300 Annual Travel Credit

Each year, automatically receive up to $300 in statement credits as reimbursement for travel purchases such as airfare and hotels charged to your card.*

3X Points on travel and dining worldwide

Earn 3X Points on travel and dining at restaurants- from airfare and hotels to fine dining and cafés.*

1 point per dollar on all other purchases

Plus, there is no limit to the number of points you can earn and they don’t expire as long as your account is open.*

100,000 Bonus Points after you spend $4,000 on purchases in the first 3 months from account opening

This product is not available to either (i) current cardmembers of this credit card, or (ii) previous cardmembers of this credit card who received a new cardmember bonus for this credit card within the last 24 months. To qualify and receive your bonus, you must make Purchases totaling $4,000 or more during the first 3 months from account opening. (“Purchases” do not include balance transfers, cash advances, cash-like charges such as travelers checks, foreign currency, and money orders, any checks that access your account, overdraft advances, interest, unauthorized or fraudulent charges, or fees of any kind, including an annual fee, if applicable.) After qualifying, please allow 6 to 8 weeks for bonus points to post to your account. To be eligible for this bonus offer, account must be open and not in default at the time of fulfillment.Earning Points

How you can earn points: You’ll earn points when you, or an authorized user, use a Chase Sapphire ReserveSM credit card to make purchases of products and services, minus returns or refunds. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won’t count and won’t earn points: balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, overdraft advances, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. 3 points: You’ll earn 3 points for each $1 spent when your card is used for purchases in the travel category or the dining at restaurants category. You may see “3X” in marketing materials to refer to the 3 points you earn for each dollar you spend in these categories. 1 point: You’ll earn 1 point for each $1 spent on all other purchases. You may see “1X” in marketing materials to refer to the 1 point you earn for each dollar spent on all other purchases. We may offer you ways to earn bonus points through the program. You’ll find out more about the number of bonus points you can earn and any other terms at the time of the offer. How you can use your points: You can use your points to redeem for cash starting at 2,000 points through an account statement credit or electronic deposit into an eligible checking or savings account held by a financial institution located in the United States. Other redemption options include gift cards and travel. When you use points to redeem for cash and gift cards, each point is worth $.01 (one cent), which means that 100 points equals $1 in redemption value. When you use points to redeem for travel, each point is worth $.0150 (one and a half cents), which means that 100 points is worth $1.50 in redemption value. You may see “Points are worth 50% more” in marketing materials to refer to the redemption value for travel when you redeem through Chase Ultimate Rewards. Redemption values for other reward options may be worth more or less than that. Points expiration/losing points: Your points don’t expire as long as your account remains open, however, you will immediately lose all your points if your account status changes, or your account is closed for program misuse, fraudulent activities, failure to pay, bankruptcy, or other reasons described in the terms of the Rewards Program Agreement. Rewards Categories: Merchants who accept Visa/MasterCard credit cards are assigned a merchant code, which is determined by the merchant or its processor in accordance with Visa/MasterCard procedures based on the kinds of products and services they primarily sell. We group similar merchant codes into categories for purposes of making rewards offers to you. Please note: We make every effort to include all relevant merchant codes in our rewards categories. However, even though a merchant or some of the items that it sells may appear to fit within a rewards category, the merchant may not have a merchant code in that category. When this occurs, purchases with that merchant won’t qualify for rewards offers on purchases in that category. Purchases submitted by you, an authorized user, or the merchant through third-party payment accounts, mobile or wireless card readers, online or mobile digital wallets, or similar technology will not qualify in a rewards category if the technology is not set up to process the purchase in that rewards category. For more information about Chase rewards categories, see www.Chase.com/RewardsCategoryFAQs. Rewards Program Agreement: We will mail you a Rewards Program Agreement containing additional rewards program terms once your account is established. If you become a Chase Online customer, your Rewards Program Agreement will be available online as well.50% More in Travel Redemption

When you use points to redeem for cash, each point is worth $.01 (one cent), which means that 100 points equals $1 in redemption value. Each point you redeem for travel booked through Chase Ultimate Rewards is worth $.0150 (one and a half cents), which means that 100 points equals $1.50 in redemption value, and points are worth 50% more than if redeemed for cash. For example, 100,000 points are worth $1,500 towards travel, or $1,000 when redeemed for cash. The cost of travel is based on the rates and fares available through the Ultimate Rewards website and travel center, and may not reflect all rates and fares that are available through other sales channels.$300 Annual Travel Credit

A statement credit will automatically be applied to your account when your card is used for purchases in the travel category, up to $300 in statement credits annually (“annually” means the year beginning with your account open date through the first December statement date of that same year, and each 12 billing cycles starting after your December statement date through the following December statement date). Purchases are when you, or an authorized user, use a card to make purchases of products and services, minus returns or refunds. Buying products and services with your card, in most cases, will count as a purchase; however, the following types of transactions won’t count: balance transfers, cash advances, travelers checks, foreign currency, money orders, wire transfers or similar cash-like transactions, lottery tickets, casino gaming chips, race track wagers or similar betting transactions, any checks that access your account, overdraft advances, interest, unauthorized or fraudulent charges, and fees of any kind, including an annual fee, if applicable. We do not determine whether merchants correctly identify and bill transactions as being of a certain type. For more information about Chase rewards categories, see www.Chase.com/RewardsCategoryFAQs. Statement credit(s) will post to your account the same day your travel category purchase posts to your account and will appear on your monthly credit card billing statement within 1-2 billing cycles. Qualifying purchases made by authorized users on your account will be included in the $300 Annual Travel Credit. Maximum statement credit accumulation for the Annual Travel Credit is $300 annually. The Annual Travel Credit will be issued for the year in which the transaction posts to your account, through your December statement date. For example, if you pay for baggage fees, but the airline does not post the transaction until after your December statement date, the cost of the baggage fees will be allocated towards the following year’s Annual Travel Credit maximum of $300.Complimentary Priority Pass™ Select Membership

One time activation required. There is no additional cost to activate your membership and certain terms, conditions and exclusions apply. Priority Pass Select membership includes access to airport lounges participating in the Priority Pass Select network. Participating lounges are owned and operated by independent third parties and their participation and/or facilities may change. To access a lounge, member must show his/her valid Priority Pass Select membership card. Priority Pass Select membership is subject to the Priority Pass Select Terms and Conditions. Account must be open and not in default to maintain membership. For complete Priority Pass Select Terms and Conditions and a listing of participating lounges, please visit www.prioritypass.com/select Opens Overlay .Global Entry or TSA Pre ✓® Application Fee Statement Credit

To be eligible for this statement credit you must use your Chase Sapphire ReserveSM card to either complete the Global Entry application and pay the $100 application fee, or complete the TSA Pre ✓® application and pay the $85 application fee. A statement credit will be processed after the Global Entry program application fee OR TSA Pre ✓® application fee (whichever program is applied for first) is charged to your Chase Sapphire ReserveSM card. You are entitled to either: one (1) $100 statement credit per account, OR one (1) $85 statement credit per account, every 4 years in connection with the Global Entry or TSA Pre ✓® program application fee. The statement credit will be posted to your account within 24 hours of the Global Entry or TSA Pre ✓® program application fee being charged to your card. You are responsible for payment of all charges until the statement credit posts to the account. Global Entry is a U.S. Government program, operated by U.S. Customs and Border Protection (CBP). TSA Pre ✓® is a U.S. Government program, operated by the U.S. Transportation Security Administration (TSA). Chase has no control over either program including, but not limited to, applications, approval process or enrollment, or fees charged by CBP or TSA, and no liability regarding the Global Entry or TSA Pre ✓® programs. For complete details on the Global Entry program, including full terms and conditions, go to globalentry.gov. For complete details on the TSA Pre ✓® program, including full terms and conditions, go to tsa.gov. Websites and other information provided by government agencies are not within Chase’s control and may not be available in Spanish. To be eligible for this benefit, your account must be open and not in default at the time of statement credit fulfillment.National Terms and Conditions

Discount applies to base rate only at participating locations. Discount varies by rental date, location and vehicle type. Taxes, other governmentally-authorized or imposed surcharges, license and concession recoupment fees, airport and airport facility fees, fuels, additional driver fee, one-way rental charge and optional items such as Loss Damage Waiver (LDW) up to $30 per day are extra. In the U.S., check your insurance and/or credit card for rental vehicle coverage. Renter must meet standard age, driver and credit requirements. 24-hour advance reservation required. May not be combined with other discounts. Availability is limited. Subject to change without notice. Blackout dates may apply.Visa Terms & Conditions

Offer subject to change, and is based on the individual merchant’s terms and conditions. Void where prohibited or restricted by law. Any taxes are the sole responsibility of the purchaser.Avis Terms & Conditions

Discount applies to base rate only at participating locations. Discount varies by rental date, location and vehicle type. Taxes, other governmentally-authorized or imposed surcharges, license and concession recoupment fees, airport and airport facility fees, fuels, additional drive fee, one-way rental charge and optional terms such as Loss Damage Waiver (LDW) up to $30 per day are extra. Renter must meet standard age, driver and credit requirements. 24-hour advance reservation required. May not be combined with other discounts. Availability is limited. Subject to change without notice. Blackout dates may apply.Visa Terms & Conditions

Offer subject to change, and is based on the individual merchant’s terms and conditions. Void where prohibited or restricted by law. Any taxes are the sole responsibility of the purchaser.Silvercar Terms and Conditions

No blackout dates. Reservations must be 2 days or longer. Offer not valid with any other offer unless stated otherwise. Discount applies to base rental rate before surcharges and taxes.Visa Terms & Conditions

Offer subject to change, and is based on the individual merchant’s terms and conditions. Void where prohibited or restricted by law. Any taxes are the sole responsibility of the purchaser.Many of the stated benefits and services of this product are provided by third parties who are solely responsible for their provision or fulfillment.

The Luxury Hotel & Resort CollectionSM

The Luxury Hotel & Resort Collection program benefits and Guest Privileges are available exclusively on select Chase credit cards. To receive the Guest Privileges, reservations must be made through a Luxury Hotel & Resort Collection Travel Specialist or on the website, LHRCollection.com. All exclusive amenities and Guest Privileges are provided per room and are based on double occupancy. Some amenities may only apply to select rates, may be subject to availability at check-in, and are not redeemable for cash. Amenities may not be combined with other offers, including tour operator or wholesaler rates and packages. Program benefits, participating properties, and Guest Privileges are valid through the current calendar year, but may become unavailable due to circumstances outside of Chase’s control. All efforts have been made to ensure the accuracy of the information contained. We reserve the right to correct any mistakes. Certain blackout dates and other restrictions may apply. This program is brought to you by Chase through an agreement with Signature Travel Network.Travel & Purchase Coverage

These benefits are available when you use your card. Restrictions, limitations and exclusions apply. Most benefits are underwritten by unaffiliated insurance companies who are solely responsible for the administration and claims. There are specific time limits and documentation requirements. Once your account is opened we will send you a Guide to Benefits, which includes a full explanation of coverages.Chase Sapphire is a registered mark of JPMorgan Chase & Co.

The TSA Pre ✓® trademark is used with the permission of the U.S. Department of Homeland Security.

[…] How much do I like the card? My wife and I both applied for the card when the application site was briefly available last week. Why? Because we’re both way beyond 5 new accounts in 24 months, which may or may not trigger […]

Any DPs on reported income levels and approvals?

From one I’ve seen so far, income levels don’t seem to be a major driving factor, but I don’t have much data to go on yet.

Will travel include cruise ships. both for the $300 credit and also for the 3pointsper doolar on spend?

Yes

Do you know if Authorized User is eligible for Global Entry benefit?

No, they only allow one Global Entry credit per account every 4 years. You CAN use the AU card to pay for the Global Entry application and you’ll get reimbursed, but then you won’t be able to get reimbursed if you do the same with the primary card.

I am at 5/24 including CSP, Amex Platinum, Citi Prestige, United Mileage Plus & Chase Ink Plus all within 2 years. Now, CSR looks incredible. I am planning to cancel Citi Prestige next year after using the $300 airline credit. When I applied for Chase Ink Plus ( my latest card), it went for review and i had to confirm my small Business before they approved for a small credit limit. The reason they said was: You have applied for a lot of cards recently. That being the case, should I apply for CSR on the 21st?

Chase has been tougher with Ink approvals recently. I wouldn’t expect that your experience there will have any bearing on your experience with applying for the CSR. 5/24 might be an issue or might not. We won’t know for a while. Personally, if I were you I’d risk it. The “cost” of a single hard inquiry if you are denied is minimal.

Awesome! Will wait for the first day to apply! Thanks a Ton!

Is there any indication whether the 1.5cents per point value for use in the Ultimate Rewards Travel portal will extend to those points eared via other cards the same way having Sapphire Preferred makes Freedom UR points more valuable?

Yes ^

Can I transfer the UR points earned on my INK to the CSR account and use those points at 1.5x instead of their 1.2x rate to book travel?

Yes, definitely. There’s no reason to expect that they’ll change the way Ultimate Rewards work. You should be able to just “combine points” from other cards to the CSR card and then redeem the points from there.

FM,

I was under the assumption that this card will be available only at branches. So now, those like me who don’t have Chase branch in my state can relax that this app will be available online to apply?

Everything I’ve seen online indicates that you can apply for this online similar to most of their cards. 🙂

Yep, relax 🙂

Thanks for the post. Do you know if the fee is waived the first year? I didn’t see anything about it? Is that what makes it more lucrative to get at the end of a calendar year, b/c you can get 2x $300 credits before your 2nd fee comes up?

The fee is not waived the first year. Yes, if you don’t plan to keep the card long term, you can get back 2 x $300 in your first 12 months of card ownership and then cancel or downgrade.

Thank you.

Hello-

My wife and I recently joined CPC. Do you think there is an advantage to apply in person rather than online? Also, my wife is a permanent resident but has a short credit history in the US. Should being part of CPC enable her to get this card as well?

Thanks!

Yes, I expect CPC will help her, but there’s no guarantee. If it isn’t too out of the way, I do think that applying in-branch has an advantage in that the banker who helps you will be very motivated to help you get approved. So, if she is denied, your CPC banker will happily fill out a Special Consideration form.

if Authorized User Fee is $75 – should we assume that the user will also have access to lounges and also get $100 for Global Entry?

I don’t think we know yet about Priority Pass Select. I think it is likely that AUs will get it. I think that the Global Entry credit does not apply to AUs because the terms state: “$100 statement credit per account” (AUs are on the same account as the primary cardholder)

Thanks for all the info on this new card. I will likely apply 8/21 when it is released.

Lingering Q : Are we sure that the Sapphire Reserve is a “new product” and not an upgrade of the Sapphire Preferred (possibly rendering it ineligible for bonus reward points?). Did not see specific language on that in the last day or so . . .

Yes I’m sure. The Sapphire Reserve is aimed at a higher end market with its $450 annual fee. The Sapphire Preferred will (I assume) stay with its $95 annual fee.

Thnx, Greg.

If this card has $100 airfare discount for visa infinite, why doesn’t chase advertise it as a benefit of card like Ritz card?

It’s possible that this card doesn’t have the $100 companion discount. We don’t know for sure yet.

I hope it has the same or better $10K travel cancellation/interruption insurance as the CSP.

I have a question. I had the regular Chase Sapphire Preferred card, which I cancelled some time back. It is less than 24 months since I got the bonus. Will I get the bonus for this card if it gets approved?

Yes because it is a different product.

Would it be a good strategy (assuming i’m approved for the new CSR), to downgrade my Sapphire Preferred to a Freedom Unlimited? It seems like all the perks of the Sapphire Preferred are on the CSR.

Yes, definitely. If you don’t already have a regular Freedom card that might be a good downgrade option too (for it’s rotating 5X categories)

IF you are going to keep the CSR long term. If you are going to cancel it before the 2nd year fee hits AND the only other premium UR card you’ve got is a CSP AND you won’t be able to apply for a new one (say an Ink Plus) due to 5/24 before you need to use your UR, then you might want to keep the CSP around.