NOTICE: This post references card features that have changed, expired, or are not currently available

The value you get from airline miles depends upon how you use them

Most airline loyalty programs only loosely tie the cost for airline awards to the price of paid tickets. Many have zone based award charts in which they offer flights from one region to another for a fixed number of miles. And, often, the charts are broken down into variations on “saver” vs. “standard” award pricing. When people talk about trying to find award space, they usually mean that they’re looking for those few “saver” awards that are made available on many flights. For example, many airlines charge 25,000 miles round-trip for flights within the continental United States. That’s their “saver” award pricing. If the flight you need is very expensive, then a 25,000 mile award can offer great value. For example, if your flight would have cost $1,000 (maybe it was a last minute flight, for example), those 25,000 miles offer 4 cents per mile value. On the other hand, if you use 25,000 miles to book a flight that would have cost $125, then you get just half a cent per mile value.

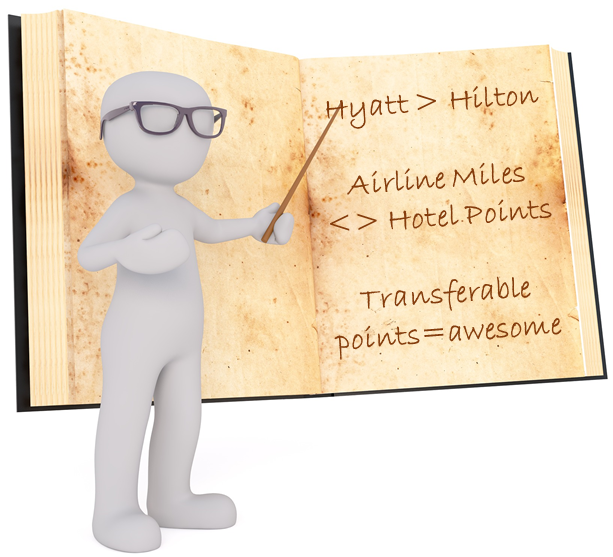

Comparing loyalty program points is like comparing dimes to dollars

If a Hilton hotel charges 50,000 points per night and a Hyatt charges 25,000 points, which is the better deal? The answer isn’t as obvious at it seems. All else being equal, I’d much rather pay 50,000 Hilton points than 25,000 Hyatt points. On our Reasonable Redemption Values (RRVs) page, we show how much value one can reasonably expect to get from a wide range of airline and hotel loyalty programs. There you’ll find that Hyatt points are usually worth more than 3 times as much as Hilton points (1.5 cents per point vs. 0.45 cents per point at the time of this writing). So, 25,000 Hyatt points can be expected to be worth far more than 50,000 Hilton points. This doesn’t make Hyatt points good and Hilton points bad. It’s simply important to understand that they run on different scales.

Travel isn’t the best way to earn miles and points

When airline miles were first invented the only way to earn them was to fly. That’s no longer remotely close to true. Today, the single best way to earn miles and points quickly is through credit card signup bonuses. Via our Best Credit Card Offers page millions of points and miles are available. Beyond credit card signup bonuses, miles and points can be earned through credit card spend, online shopping portals, and countless miscellaneous promotions.

Opening many credit card accounts doesn’t hurt your credit score

A common myth is that having multiple credit card accounts open will hurt your credit score. In reality, the opposite is true. People often find that their score increases as they open more accounts. The reason is that a significant portion of your score is your credit utilization ratio. The less you spend as a percentage of the credit you have available, the better your score. So, when you open new accounts, you’re normally given more credit to work with and therefore (unless your spending has increased too), your score improves. To be clear, even though your credit score is unlikely to be hurt, there can be negative outcomes to opening lots of credit cards: acquiring a mortgage can be harder, car insurance rates may go up (weird, but true in a few cases), and getting approved for certain new credit cards may become more difficult. And, of course, if you don’t pay your credit bills on time every month, your score will go down.

You can often get a better credit card offer

When you’re presented a nice looking credit card offer in the mail, or by a flight attendant, or through a blog, chances are pretty good that there’s a better signup offer out there somewhere. On our Best Credit Card Offers we work hard to present the best publicly available offers, but even then there are times where better targeted offers exist. Pay attention to offers through mail, email, and even when going through the steps of booking a flight or hotel. Compare those offers to the best public offers found on our Best Credit Card Offers page to see if you were targeted for a better offer.

When given the opportunity to earn points for free, take it

Many people fly, stay in hotels, and rent cars without joining the loyalty programs associated with those travel providers. That’s a mistake. Even if you don’t think you’ll have use for a particular brand’s rewards program, you may be surprised. Take a minute to sign up. Then add the your new account to Award Wallet in order to keep track of your points.

Points and Miles regularly devalue

Airline and hotel loyalty programs regularly change their award schemes in ways that make their points less valuable than before. This can happen in many different ways:

- Airlines often increase the cost of saver level awards

- Airlines sometimes make saver level awards harder to get on the most valuable routes

- Hotels chains sometimes add new higher level (more expensive) categories to their award charts

- Hotel chains often move hotels to higher categories in order to charge more points for those hotels

- Airline and hotel programs move towards revenue based award schemes where they tie the price of an award to the paid price for a flight or hotel night. This can be both bad and good: On the negative side, the top value you can get from your points goes down. On the plus side, the least value you can get from your points generally goes up.

Transferable points programs are the best

Amex, Capital One, Chase, and Citibank offer their own rewards programs. These are the best programs for accumulating points. All four offer the ability to use points to book travel or to transfer points to various airline mileage programs. Transferable points give you many options for redeeming points towards great value, they help protect you from devaluations, and they can often be used for decent value by using points to book travel directly when there are no good transfer options. For more about transferring points from each of these programs, see:

- Amex Membership Rewards Complete Guide

- Capital One “Miles” Complete Guide

- Chase Ultimate Rewards Complete Guide

- Citi ThankYou Rewards Complete Guide

[…] Top 9 things to know about Points & Miles before you get started […]

[…] me a better blog for beginners and great affiliate linking practices? I am waiting…Will likely be back in this list […]

Not sure if it should be in the very first post, but explaining that you don’t always have to run away from an AF (like IHG $49 = 1 nite) would be useful. Also, some reference point to the relationship between credit score and application success (how to check score, monitor, which cards to start with). Could just be a brief mention with link to further details. Great idea!

Thanks. Good suggestion. I actually came close to putting that into the first draft (and with the same IHG example!)

Thanks everyone! Great input!

There seems to be general agreement that beginners need to start with goals/strategy. Plus we need more emphasis on the need to pay your credit card bill in full every month (i.e. you can’t win this game if the bank is winning). There were also several specific suggestions that I’ll chew on. I appreciate it!

I’m thinking that this will become a number of connected lessons. The idea for this one was primarily to dispel misconceptions and convey a few core concepts before starting with lessons regarding earning points, spending points, etc. I feel like it’s necessary to understand some of these things before a person can understand the rest.

As someone that is first starting out I’ve been doing a lot of reading over the last few weeks trying to get up to speed.

One thing I haven’t seen much discussion on is a comparison of the different rewards programs(Chase vs AMEX vs Citi vs SPG, etc). The closest thing you can really find is the point valuations where UR is worth 2.1, MR worth 1.9, etc. What does that actually mean and why are they worth different amounts?

I know most of the answers there will come down to personal preference, but some past experiences, andecdotal stories, etc always help. Which program has the best redemption options? Which is the easiest to redeem points with? Which has the best transfer partners?

I read several bloggers regularly and I believe that The Points Guy covers this pretty well. I use the rack rate of a hotel vs the number of points it requires to determine whether to pay cash or points or a combo. Compare the transfer partners against each other to see which program makes the most sense for your spending.

I read multiple blogs as well, including TPG. He seems to be a bit of a shill for Chase, and hasn’t done a comparison breakdown that I’ve seen.

It seems the general consensus is Chase UR is the best program, but I’m just having a hard time understanding why. AMEX offers more cards, with better signup bonuses, their premium cards have better perks, they have more transfer partners, and the rewards earning potential with an AMEX lineup of Platinum, Everyday Preferred, and Blue Business Plus seems to be at least as good, if not better than the optimal Chase lineup. Additionally you don’t have to worry bout 5/24 with AMEX, and most of their MR cards are charge cards so you don’t worry about the 5 credit card limit with them.

And with transfer partners, yea anyone can look up a list and see which company partners with which bank. But it can go much deeper than that, especially with airlines. For example, AMEX doesn’t partner with AA. But they do partner with British Airways, so a roundabout way does exist to redeem MR points towards AA flights, correct?

For most, and certainly beginners, Chase UR is best because of transfers to United, Hyatt, and to a lesser extent Southwest. None of those are partners with Amex. For your first redemptions, it’s likely those are going to be your best bet. I just got 10 cents per point value on an Amex transfer but that’s not likely an itinerary a beginner would go for. This is probably my 15th flights from points redemption

Greg did a comparison called “Membership Rewards vs. Ultimate Rewards vs. ThankYou Rewards. Which is best?” You can find it under the tab “Resources.” Hope it helps.

Timeshares: Rule #1 – Never buy them from the Developer. However, they are a great way to travel (especially with kids – full kitchen, washer/dryer, 5* service). Either buy them Resale (several websites) or Rent them from an owner (several websites).

Timeshares? What is the relevance to points & miles?

I think, overall, the most important thing to someone starting on this wonderful game is to pay your credit card statements in full every month. You can collect all kinds of thrilling bonus points and miles … but you don’t want to incur interest charges on unpaid balances, it’s counter-productive. Next, it’s important to make a pledge to yourself to read every single thing about your loyalty program(s). Stay on top of it all so you never forfeit or miss extra points because you ‘didn’t know’.

I agree with everybody else in that it’s important for people to set goals and develop a strategy and plan to achieve those goals.

Writing up an introduction to points and miles is really hard. I tried to write one up myself in my own blog. If you have the time, let me know what you think…

https://www.drmcfrugal.com/travel-hacking/

Two mistakes I made were signing up for a card then putting my spouse as an AU (or vice versa if he got the targeted offer). We should have each been opening our own cards to get the bonus. My other big mistake was not knowing about the Chase 5/24 rule. That combined with putting my husband as an AU meant neither of us were able to get a couple of cards with great bonuses that we would have used (Southwest and Marriott). Definitely stress having a goal so folks don’t just open random cards.

Agree with some others,

2 starting points are:

– This is not for you until you can prove to yourself you can not carry a balance on your cards

– The goal comes first. Once you know where you want to go it is much easier to decide the “best path” to get there. Don’t know? Focus on really flexible currencies like Chase UR

Hope I am not repeating other advice, or running on too much, but I would consider adding:

1. Figure out your goals first. For example, say you want to go to Belgium and drink the best beer in the world for a week and take your GF so she can try all that incredible chocolate she’s so much heard about. And you like Hyatt hotels and can conveniently stay in them for work. So you get the Hyatt card and start accumulating.

A year later, you go to reserve for your dream trip and find out THERE ARE NO Hyatts in Belgium.

Now you get to start over. D’oh!

2. Bloggers often IMO excessively push the “aspirational travel” angle. But say you are a 29-y.o. consultant traveling 4 days a week for work and have a wife and two little kids aged 4 and 5 at home. You have points and miles and status coming out of your ears, but maybe little cash on hand because you have student loans and lots of household expenses and such.

You ain’t going F to the Maldives to stay in an overwater bungalow any time soon.

But you have always wanted to take the kids to Disney and they are the perfect age. And you want to take your parents along before they get too much older.

Go ahead and head to Orlando. Do it as efficiently as possible, but do it. Now. So what if you didn’t get the maximum conceivable value from your SPG points or whatever? So what if some supposedly “knowledgeable” people make fun of you for being silly and wasteful. Screw that; do what you want to do. You can always make more money/points. You cannot make more time or go back to a younger age.

3. Do not be seduced by the retail value of a flight you are considering and think you are getting 10+ cents a point on some F trip somewhere. If you wouldn’t pay $15000 for that ticket, it ain’t worth $15000. Instead think about how much cash out-of-pocket you’d actually pay. That’s essentially what you are actually getting.

4. I have discovered there are two basic ways of looking at this hobby. Trying to get something really nice/expensive for a moderate price (e.g. F to the Maldives), vs. trying to get something moderate for cheap or free (e.g. Southwest Companion Pass). Figure out which kind of traveler you are, because the strategies can be completely different.

I think that’s enough for now.

Great perspective, as awesome as it would be to get 10 cents per point on a flight and hotel in an exotic location it’s much more likely that I will redeem points to reduce the cost of a family vacation in a less glamorous destination.

I like your site a lot, and as someone who helps his beginner friends a lot I think this is an excellent idea.

I like the Cap One idea as one of your “main points” but I’d make it *much* more broad. Something like understanding the difference between cash, cash points, and miles.

I also second the primacy of a strategy before even starting. If someone doesn’t know what they plan to do with points, they’ll be very inefficient when they begin. Should be it’s own post.

I don’t pay attention to whether you have affiliate links (I have my own CC strategy so I really don’t notice on any of the blogs), but the two credit card posts should be part of a primer on CC strategy. They are too specific for a beginner, IMHO.

I’d move the Award Wallet link to a separate post about great tools (AW, Award Hacker, SeatGuru, ExpertFlyer, etc). Maybe add top info sites as well that don’t really compete as blogs (FlyerTalk, Secret Flying, etc).

This note in your post may be the most important:

“And, of course, if you don’t pay your credit bills on time every month, your score will go down.”

We all understand this, but credit card debt is a big problem for over 1/3 of the US. A newcomer shouldn’t read any of the post or online tutorial if they can’t pay off their statement each month.

Agreed. But I think it’s really important to note the primacy of paying off your balance in full every month. Everyone already here knows interest outweighs rewards, but newbies may not get it, and start down the CC path without thinking it through completely.

I’d add Marriott as a quasi-transferable currency, so long as travel packages exist, though that is probably an intermediate or advanced concept.

When I have friends who wonder how I can take these trips the one bit of information that seems to open their eyes the most is that mikes do not need to be used in the program in which they are earned. I think this is becoming a bit more understood now that more and more search engines on airline websites show partner availability.

Still, the first time you tell someone, “your American miles don’t need to be used on American flights,” it tends to come as a surprise. It makes it easier to justify using chase or citi for crummy redemptions too — “what does the ability to transfer to Korean or Avianca have to do with me”?

I really want to send something like this to my newbie friends but it’s still too high level. I would not lead with Capitol One although it’s good to include.

A strategy section at the beginning would be really helpful. Friends need to form a plan then collect the correct miles to reach their goals. I find this is what my friends need to understand first.

Plan which miles you collect based on where you want to go. Explain partner airlines a bit more.

When people ask me about the hobby I always ask Where do you want to go? They always pause and say I don’t know. That seems critical to me.

Mention Google Flights as a starting point and the map feature to figure out a destination.

I second this. I started about a year ago and where I missed the mark was with a cohesive strategy to make my points the most valuable. I think this section, in conjunction with the transferable points options is most important.

I agree as well. Somewhere along the line — and I think it needs to go in the front — you have to tell people that this is not an especially rewarding activity if you have limited objectives and limited time. Unless you are rich, or have a high-volume small business, squeezing a couple of percent in cash out of annual spending will not get anyone to an aspirational place at a particular time of the year. Maybe once in a lifetime. The percentage in the “game” comes when you have some flexibility, in both what you do and when you do it. (At least one of the two.) Then you can take advantage of the opportunities that arise.

People need to be aware of where they are in life, in terms of both time and aspirations. When people we know can’t figure out how we travel as much and as well as we do, they think they are using the wrong card. Usually it is the mindset that is missing.